Gold as a Hedge Against Hyperinflation

Commodities / Gold and Silver 2018 Jan 25, 2018 - 06:08 PM GMT LETTER TO THE EDITOR

LETTER TO THE EDITOR

Dear Mr. Kosares,

I have read your articles with great interest and pleasure. I believe we are in a corner which is far from the mainstream. In reference to buying gold as protection, I also read stories like “sell-cryptos-buy-gold,” but it is never told what will happen when there is indeed hyperinflation.

It is said that the gold price can rise many fold. But if this happens, isn’t it so that food prices and prices of other necessities to keep living will increase also many fold or even more than gold? I mean the seller of food will abuse the situation and ask 2 pieces of gold instead of a half piece of gold for a certain quantity of food. In short how can a citizen even with gold survive such an event.

But I indeed think if there is no financial system and with trust gone and no financial transactions between all the participants in the society, there will be severe troubles because the present society is so intertwined (just in time supply chain for every aspect of live). For example as the truckers say “with no trucks transporting a few days everything stops.” And this is just one part of the economy. The collapse of the financial system will cause a shock wave through every part of society. Will gold protect against the retreat of the state?

But it is never told for example by gold analysts and others what happens then for gold owners in case of hyperinflation. Are gold owners also protected with the prices of necessities for living or survival also increase? Will these prices increase as fast as or faster as gold and other precious metals? This part is never explained. I also have never read what happened with the occasional gold owners during the Weimar hyperinflation.

Best regards,

RK

The Netherlands

You ask important, thoughtful questions, RK, that show you have given the hyperinflationary scenario a great deal of thought. Here are a few things to consider:

Gold will not only reflect the current rate of inflation, it will also anticipate future inflation. As millions of investors move capital out of the depreciating currency into appreciating gold and silver, its price velocity is likely to outstrip the rate of inflation by a wide margin.

Gold will not only reflect the current rate of inflation, it will also anticipate future inflation. As millions of investors move capital out of the depreciating currency into appreciating gold and silver, its price velocity is likely to outstrip the rate of inflation by a wide margin.- Wage and salary increases simply cannot be approved and implemented in most businesses quickly enough to keep pace with the rapid rate of inflation. At the height of the nightmare German inflation, for example, employees were paid several times a day and people ran to the store with a pile of paper money in order to beat price increases. It was impossible for business owners to keep up with the rapid decreases in currency value at a time when the money could not even hold its value in transit between the office and the store. It is difficult to see how this logistical problem could be overcome even in the modern digitized environment due to the decision-making process and prudential care most businesses would have to employ even in an emergency environment.

- As for the rate of return on savings or yield investments keeping pace with inflation, once again the problems revolve around timing. Let’s run through a quick simulation to illustrate what I mean. Let’s say that you wake up one fine morning to suddenly discover through a government announcement that the inflation rate had just jumped by 30%. The central bank board convenes an emergency rate-setting meeting and decides to raise interest rates to the 30% level. It, in turn, instructs banks to use that figure as the base rate to pay on depositor savings accounts. You visit your bank and buy a short-term time deposit that pays 30% interest. The problem, as you already may have recognized, is that you will not receive that 30% interest for a year. Interest accumulates over time and is not paid instantaneously. Meanwhile, the inflation rate is marching inexorably higher.

- The prices of gold and silver, on the other hand, are determined instantaneously on computerized trading venues all over the world. If, for example, the government announced a sudden 30% increase in the inflation rate, you can be certain gold and silver would respond immediately – probably with a gain of 30% or more if inflation expectations were high. Gold owners would in turn receive the benefit of that price increase instantaneously – no wait involved. In the case of dollar savings, on day one you have $100,000 and ultimately, in one year’s period of time, it will become $130,000. In the meantime, your $100,000 in gold has likely already appreciated in value to at least $130,000 on day one.

- Both scenarios outlined in #2 and #3 – individual income and savings – would get much more complex than the simplistic scenario outlined if inflation rates were running 50%, 100% and 1000% – not annually, but daily.

As the old saying goes, time is money and in no situation will that become more readily apparent than in the event of hyper or runaway inflation. Gold, in short, is the most suitable, most liquid and most responsive of the primary assets to an emergency situation like hyperinflation, even in the modern age, and that is why it is highly recommended.

Thanks for the good questions and good luck in the future, RK.

My best wishes,

Michael J. Kosares

USAGOLD

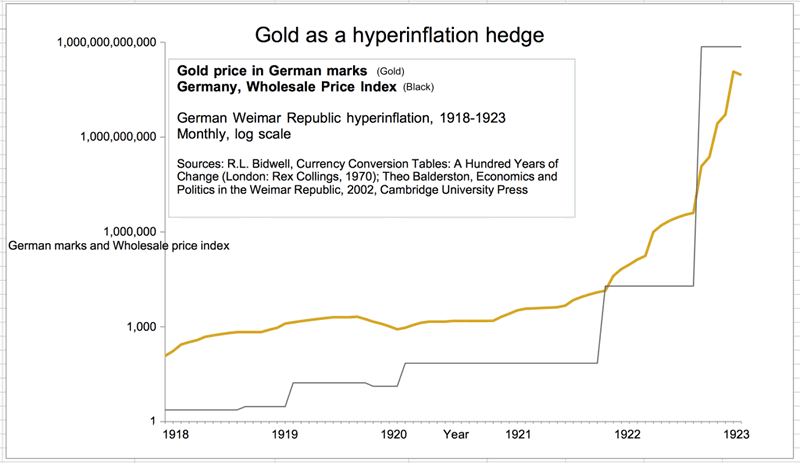

P.S. Interesting that you would ask specifically about gold’s role in the German hyperinflation. The chart below is a quick reference how gold performed during that time period in Germany. Also, we have an excellent report posted here at USAGOLD in our Gilded Opinion Library titled The Nightmare German Inflation. It offers a general look at what happened in Germany from 1918 to 1924 and how various markets and investments performed under those strained circumstances – including gold. Hopefully, this study will answer some of the questions you asked that I did not address above.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.