Vicious Trio Keeps Bitcoin in Chokehold

Currencies / Bitcoin Feb 23, 2018 - 05:12 PM GMTBy: Mike_McAra

The craziness of it. Bitcoin has been storming up and down, from $20,000 to $6,000 and back to $11,000 again. This volatility makes most traders’ stomachs churn, their faces go pale and their palms start to sweat. As if this action weren’t enough, an unknown trader has put their money where their mouth is – all $400 million of it. One can’t help but wonder what in the market justifies such an extreme move. On the Fortune website, we read:

The craziness of it. Bitcoin has been storming up and down, from $20,000 to $6,000 and back to $11,000 again. This volatility makes most traders’ stomachs churn, their faces go pale and their palms start to sweat. As if this action weren’t enough, an unknown trader has put their money where their mouth is – all $400 million of it. One can’t help but wonder what in the market justifies such an extreme move. On the Fortune website, we read:

An anonymous trader has sunk $400 million—enough to buy New York state’s most expensive home twice with change left over—into the cryptocurrency, raising his or her stake from 55,000 coins to more than 96,000 between Feb. 9 and Feb. 12. And that buy-in is already paying substantial returns.

The bulk of the purchases took place on Feb. 9, with another 9,000 or so on Feb 12, according to publicly available data tracked by digital wallet provider Blockchain. And even if the buyer bought at the day’s peak, he, she, or it is looking at total gains so far of roughly $83 million.

The current value of the buyer’s portfolio currently stands at nearly $1.1 billion.

Whoever the investor was, it wasn’t his or her first time plunking down a lot of cash on Bitcoin. Their account was largely dormant before Dec. 12, when it went from holdings of 0.246 coins to 48,627 by the morning of Dec. 13. (Bitcoin, at the time, was going for about $17,000—meaning a rough investment of $827 million.)

The sheer size of the position makes it highly unlikely that it’s just an individual trader behind the buy. An initial investment of $800 million followed by another one to the tune of $400 million would suggest an institutional buyer but let’s not forget that mutual funds, pension funds and similar institutions are constrained by law in their choice of investable assets. This leaves us with unconstrained entities, the most prominent of which are hedge funds and family offices. “Hedge funds” is an umbrella term for funds which take outside money from investors with substantial assets. They can invest without constraints imposed on mutual funds, which means they could potentially buy Bitcoin. Family offices are similar but they don’t take outside money but rather manage a portfolio of one individual or a whole family (hence the name). So, hedge funds and family offices are natural candidates for the mysterious buyer of Bitcoin.

The question whether there is anything happening right now which could explain such an enormous transaction in the market is perhaps an ill posed one. Time and time again, we have stressed the need to stay careful and cautious in light of the cruel Bitcoin volatility. It is our opinion that Bitcoin can be a great diversifier and has potentially a place in portfolios of many investors. We could easily put our rose-colored glasses and praise Bitcoin as the only asset worth investing, but this would be being reckless. And we care too much for you investment results to leave out the cautionary part of the story. The potential Bitcoin has needs to be balanced against the fact that digital currencies should only be a small part of one’s portfolio and only money one can absolutely afford to lose. With such volatility it’s downright crazy to put all your eggs in the Bitcoin basket. Granted, your eggs could turn out Fabergé but you could as easily end up with the messiest omelet in history. Make no mistake, we’re not saying that Bitcoin is bust but rather that it moves around like few other assets move. To be guarded against the downside, it might be best to keep Bitcoin positions small.

Three Barriers for Bitcoin

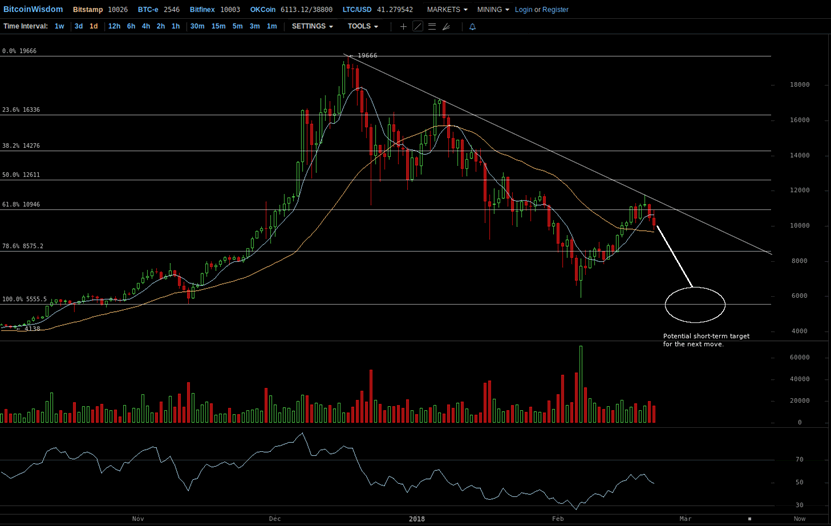

We are seeing a very interesting situation in Bitcoin (chart from Bitcoin Wisdom). To an extent, our comments today are a continuation of what we have written previously but we’re also seeing something which makes the current indications an extremely interesting triple. More on that in a couple of paragraphs.

The 78.6% level, which is not that important, is now broken to the upside but the 61.8% one isn’t and the much more important level 38.2% is very far. This means that, in our opinion, the current trend down remains in place. An earlier warning level around $12,000 based on the recent tops is also not that close. So, while the current rebound is to the upside and it might look worrying, we don’t think it really is as there are no market indications validating the rebound. No asset goes down in a straight line, which means that no matter how strong a decline is, you are bound to see corrective upswings along the way. Actually, it might be the case that the current rebound is setting up a situation in which Bitcoin is on a knife edge and the move down might accelerate shortly. The outlook remains bearish, in our view.

The recent appreciation has brought Bitcoin to the 61.8% retracement. Quite importantly, if you remember the 2013 top, you will see that the 61.8% retracement was an indicator of a strong rebound at the time. This is only partially comparable to the current situation as we are already in a bit of a rebound, however, we would like to give you all the information we think might be important for Bitcoin. This means that if we see a sustained move above the 61.8% retracement, we might consider adjusting our short-term outlook. This is not automatic. It might be the case that we see such a move but other market conditions will sustain the bearish outlook. Instead of going for the easy answer here, we would like to find the right one.

A short glance at the above chart reveals a few things, among them a very interesting trio. First of all, in the last couple of days Bitcoin has turned south again. The volume hasn’t been spectacular, but it hasn’t been particularly small either. It might be easy to dismiss a move down if there’s no substantial volume, but we wouldn’t take that path. Volume doesn’t quite work symmetrically – it is a move up on falling volume that is bearish, while a move down on volume which is not explosive is not necessarily bullish. Second, we see that Bitcoin is not only very far from the 38.2% Fibonacci retracement level but that the currency actually went back below the 61.8% level. The 61.8% level is less important, in our opinion, than the 38.2% one but it does serve as a weak bearish confirmation. Add a weak bearish confirmation to an already bearish situation and the implications are only strengthened. Third, if we draw a resistance line based on the all-time high from December 2017 and the local top from early January 2018, we see that it works uncannily well with the very recent reversal to the downside (Feb. 20, 2018). We currently have a trio three bearish indications of varying importance and the situation is quite far from oversold at the moment. Unsurprisingly, the combination of these factor yields a bearish rather than bullish suggestion, so even more substantial declines could follow.

If you have enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.