Paulson Bailout of Freddie, Fannie and PIMCO Translated

Stock-Markets / Government Intervention Sep 08, 2008 - 06:24 PM GMTBy: Mike_Shedlock

Financial Institutions Must Be Allowed To Fail

Financial Institutions Must Be Allowed To Fail

Paulson: "Homeowners should not anticipate a government bail-out. Banks should not expect to be bailed-out by government, despite intervention by the Federal Reserve in the near-collapse of Bear Stearns in March."

Translation: Critical banks and GSEs must not be allowed to fail.

Paulson: "For market discipline to be effective, market participants must not expect that lending from the Fed, or any other government support, is readily available. For market discipline to effectively constrain risk, financial institutions must be allowed to fail."

Translation: Expect the mother of all bailouts at taxpayer expense.

July 10 2008

Fannie, Freddie 'Insolvent' After Losses

Former Fed Governor William Poole: "Congress ought to recognize that these firms are insolvent, that it is allowing these firms to continue to exist as bastions of privilege, financed by the taxpayer"

Translation: "Congress ought to recognize that these firms are insolvent, that it is allowing these firms to continue to exist as bastions of privilege, financed by the taxpayer"

July 11 2008

Paulson Backs Fannie, Freddie in Their 'Current Form'

Paulson: "Today our primary focus is supporting Fannie Mae and Freddie Mac in their current form as they carry out their important mission"

Translation: We are working behind the scenes to address the inevitable failure of Fannie Mae and Freddie Mac. There is no conceivable way that Fannie and Freddie stay in their current form.

July 11 2008

Fed Says No Talks With Fannie, Freddie About Loans

Fed spokeswoman Michelle Smith: "There have been no discussions with the GSEs about access to the discount window"

Translation: We have plans to discuss the discount window with the GSEs as early as Monday, July 14.

July 13 2008

Paulson Statement on Freddie Mac, Fannie Mae

Paulson: "Fannie Mae and Freddie Mac play a central role in our housing finance system and must continue to do so in their current form as shareholder-owned companies."

Translation: There is not a snowball's chance in hell that Fannie and Freddie survive in their current form. We are working on contingency plans right now.

July 17 2008

Merrill Lynch: Don't forget the salt

Merrill Lynch CEO John Thain: “Right now we believe that we are in a very comfortable spot in terms of our capital.” (July 17, 2008 — Thain on a conference call after posting Merrill's second-quarter results)

Translation: We have nowhere near enough capital. If you believe we do, then you are a complete fool. After all, I have stated Merrill has no need to raise capital 8 times this year only to immediately raise capital. (See above link).

July 20 2008

Banks sound but economy to take time

Paulson: "Our banking system is a safe and a sound one."

Translation: Our banking system is on the verge of collapse. (Please see You Know The Banking System Is Unsound When.... for more on this theme)

July 23 2008

Death Spiral Financing at WaMu, Merrill Lynch, Citigroup

Washington Mutual CEO Kerry Killinger: "The capital that we have in place is sufficient to manage through this period. We have no plans at this point to raise additional capital."

Translation: We desperately need to raise capital. Unfortunately, death spiral financing and low share price prevents us from doing so.

August 19 2008

Freddie and Fannie fix under market pressure

Treasury Department: The Treasury has no intention of using its newly authorized power to invest in either the debt or equity of Fannie and Freddie.

Translation: We have every intention to invest in the GSEs, and far sooner than anyone thinks. We never would have asked for a blank check if we did not think we needed it. Boy do we need it.

August 22 2008

Buffett Says Fannie Mae, Freddie Mac 'Game Is Over'

Warren Buffet: "Fannie Mae and Freddie Mac, the two largest mortgage finance companies, don't have any net worth. The game is over as independent companies."

Translation: "Fannie Mae and Freddie Mac, the two largest mortgage finance companies, don't have any net worth. The game is over as independent companies."

September 4 2008

Bill Gross Wants Treasury To Buy Assets To Prevent Tsunami

Bill Gross: "Unchecked, it can turn a campfire into a forest fire, a mild asset bear market into a destructive financial tsunami. If we are to prevent a continuing asset and debt liquidation of near historic proportions, we will require policies that open up the balance sheet of the U.S. Treasury."

Translation: Please rescue PIMCO. I bet the farm on a bailout.

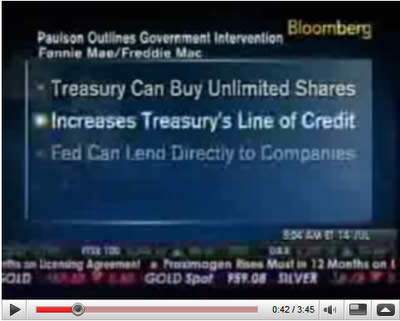

Take A Load Off Fannie

click here to play video

The video is very enjoyable with a great song throughout.

My analysis of what's at stake for the taxpayer can be found in Paulson Rolls The Dice At Taxpayer Expense .

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.