Global Debt Bubble Hits New All Time High – One Quadrillion Reasons To Buy Gold

Commodities / Gold and Silver 2018 Apr 16, 2018 - 03:39 PM GMTBy: GoldCore

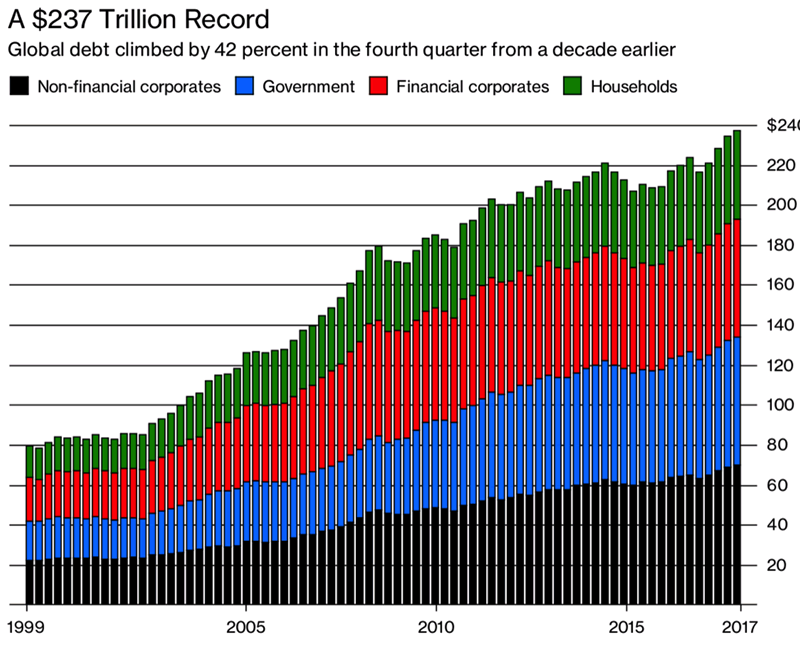

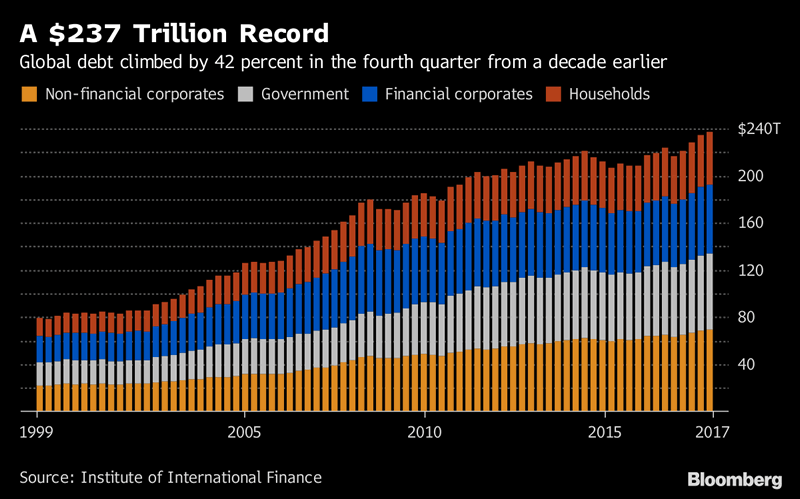

– Global debt bubble hits new all time high – over $237 trillion

– Global debt bubble hits new all time high – over $237 trillion

– Global debt increased 10% or $21 tn in 2017 to nearly a quarter quadrillion USD

– Increase in debt equivalent to United States’ ballooning national debt

– Global debt up $50 trillion in decade & over 327% of global GDP

– $750 trillion of bank derivatives means global debt over $1 quadrillion

– Gold will be ‘store of value’ in coming economic contraction

– Global debt is the mother of all bubbles

Source: Bloomberg

Global debt has now reached over 327% of global GDP, $237 trillion. Prior to the financial crisis it was less that $150 trillion. The amount by which it has surged in just one year is the same amount as the ballooning national debt of the United States.

The response of our leaders, central bankers and financial thinkers to this latest data?

It was good news as it showed that thanks to global growth the ratio of debt-to-gross domestic product fell for the fifth consecutive quarter. No irony in the fact that the economic growth is entirely funded by debt itself – adding another shaky layer to the house of cards.

Christine Lagarde said earlier this week:

The bottom line is that high debt burdens have left governments, companies, and households more vulnerable to a sudden tightening of financial conditions. This potential shift could prompt market corrections, debt sustainability concerns, and capital flow reversals in emerging markets.

A sudden tightening of financial conditions is inevitable. The latest FOMC minutes released yesterday showed that members plan to increase interest rates at a faster rate than previously expected. This was inevitable given the loose monetary policy that central banks have been enjoying for the last decade.

As Jim Rickards summarises:

We hear that the U.S. is facing a debt crisis because budget deficits are out of control. We hear that China is facing a debt crisis because of wasted infrastructure investment, bank Ponzi schemes and bad loans to money-losing state-sponsored enterprises.

Next we hear that emerging markets are facing a separate debt crisis because of dollar-denominated debt that cannot be repaid if higher U.S. interest rates lead to a stronger dollar.

In short, the whole world seems to be facing a debt crisis in various forms.

Global debt is primarily made up of three groups: non financial corporates, governments and households. Each as indebted as the next, each as addicted as the next with no detox programme on offer.

Rickards reminds us that $237tn is only part of the story:

This debt is in addition to approximately $750 trillion of bank derivatives as reported by the Bank for International Settlements (BIS).

Adding the debt and derivatives together produces over $1 quadrillion of financial obligations of various kinds. This is far more that the amount of debt and derivatives outstanding before the last financial crisis in 2008.

So bad is the debt crisis that five leading economists recently felt compelled to write an op-ed in the Washington Post warning Americans of the impending debt crisis.

From this point forward, even if economic growth continues uninterrupted, current tax and spending patterns imply that annual deficits will steadily increase, approaching the $1 trillion mark in two years and steadily rising thereafter as far as the eye can see.

Unless Congress acts to reduce federal budget deficits, the outstanding public debt will reach $20 trillion a scant five years from now, up from its current level of $15 trillion. That amounts to almost a quarter of million dollars for a family of four, more than twice the median household wealth.

This string of perpetually rising trillion-dollar-plus deficits is unprecedented in U.S. history.

In recent months, we have seen an inevitable rise in interest rates from their low levels of recent years. Rising interest rates and increasing deficits threaten to build upon each other to send public debt spiraling upward even faster. When treasury debt holders start to doubt our government’s ability to repay, or to attract future lenders, they will demand higher interest rates to compensate for the risk. If current spending and tax policy continue unaltered, higher interest costs will have to be financed by even more debt. More borrowing puts more upward pressure on interest rates, and the spiral continues.

Household debt is not just a major problem in the US. In the latest release of figures Belgium, Canada, France, Luxembourg, Norway, Sweden and Switzerland each saw household debt as a percentage of GDP hit all-time highs. Only Italy and Ireland remain as the two mature market countries where household debt as a percentage of GDP is below 50%.

Things are even worse in emerging market South Korea where household debt to GDP is approaching parity, currently at 94.6%.

Imagine how much worse things will get as interest rates across the board begin to rise. Or, more likely, as central banks change their minds about interest rate rises and allow the period of easy money to carry on. Cue major inflation around the globe and ever-higher levels of debt.

Conclusion

The IIF, the group responsible for the data release, point to central banks as the culprits for these devastating figures.

“Still-low global rates continue to support unprecedented levels of debt accumulation.”

This is no surprise as they (as the puppets of governments and bankers) are the reason so many savers, households and investors have had to work hard to protect their assets in the last decade. Such little regard has been shown for the long term health of the economy or value of our hard won savings.

The global debt figures serve once again as a reminder that individuals and businesses must take responsibility for their own wealth and protect it from the ongoing currency debasement and gigantic monetary experiment of central banks.

Gold that is held in a segregated, allocated portfolio is a key way to protect your savings from counter-party risk in the financial system. Gold’s performance in 2017 into this year, along with low gold liquidations, increased demand for gold coins and bars and central bank purchases shows the prudent money is again diversifying into gold in anticipation of the next financial crisis.

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Gold Prices (LBMA AM)

13 Apr: USD 1,340.75, GBP 938.93 & EUR 1,087.35 per ounce

12 Apr: USD 1,345.90, GBP 951.01 & EUR 1,090.99 per ounce

11 Apr: USD 1,345.20, GBP 947.96 & EUR 1,087.86 per ounce

10 Apr: USD 1,335.95, GBP 942.25 & EUR 1,083.46 per ounce

09 Apr: USD 1,328.50, GBP 941.91 & EUR 1,082.33 per ounce

06 Apr: USD 1,325.60, GBP 946.08 & EUR 1,082.75 per ounce

05 Apr: USD 1,327.05, GBP 943.67 & EUR 1,080.75 per ounce

Silver Prices (LBMA)

13 Apr: USD 16.51, GBP 11.57 & EUR 13.40 per ounce

12 Apr: USD 16.66, GBP 11.74 & EUR 13.50 per ounce

11 Apr: USD 16.57, GBP 11.67 & EUR 13.39 per ounce

10 Apr: USD 16.49, GBP 11.65 & EUR 13.38 per ounce

09 Apr: USD 16.34, GBP 11.59 & EUR 13.32 per ounce

06 Apr: USD 16.28, GBP 11.61 & EUR 13.30 per ounce

05 Apr: USD 16.31, GBP 11.59 & EUR 13.28 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.