What Gold Is Not

Commodities / Gold and Silver 2018 Aug 17, 2018 - 03:17 PM GMTBy: Gary_Tanashian

I was reading a post by Martin Armstrong called…

Gold and the Changing Fundamentals

…and in it he published a question from an email sent by a reader:

“Mr. Armstrong; You are obviously the person worth listening to when it comes to gold. Every fundamental these people have argued to support gold has proven completely false. Confusion in gold is really very high. You have to be really stupid at this point to listen to this nonsense. Can you express any opinion on gold?”

“These people” the emailer is talking about are obviously the gold “community” at large and the “gold analyst” (ha ha ha, gold analyst; hi, I am a gold analyst; I analyze a piece of rock that does nothing whatsoever) community in particular. First of all, anyone who belongs to a community is already implicitly sworn in as biased. Secondly, a gold analyst is just another term for gold-obsessed idealist who really wants you to be obsessed with it too.

Don’t get me wrong. There are a lot of market and gold mining analysts very much worth their salt. Within a market analyst’s analysis there is gold analysis, just as there is tin, hogs, corn and global equities analysis. Within a mining analyst’s work is the ability to help us pick real companies in which to invest and avoid the plentiful scams out there. I have two who I trust through our long-term relationships; Inca Kola News (IKN) and a personal contact who is not public (although I think he should be). You should either do intensive fundamental work or have access to reputable sources for it.

But the surest way to spot one of the promoters that Marty often rails about is their singular, dogmatic focus on a piece of metal that pays no dividend, is no one’s liability and basically does nothing. There is literally a world of other assets and markets orbiting around the shiny rock in the middle, which does nothing other than get marked up in times of monetary and systemic anxiety and marked down when all’s seemingly just swell.

Armstrong goes on to talk about how the younger generation is going to go digital and kick gold to the curb (that’s debatable, Marty) and that gold will go opposite the US dollar (most often yes, but not always). He then talks about the real question surrounding gold…

The real issue is not whether gold is money, silver, copper, bronze, seashells, sheepskins or cattle. The real question is will money be COMMODITY based (Tangible) with its roots in barter or will it be simply a representative of economic output that can be electronic? That is the real question. Are we headed into a future as in Star Trek where physical money is obsolete?

Well, I am not ready to board the Starship Enterprise just yet, but I will say that over the years (even well before gold entered its bear market) I have either poked fun at or aimed bile at those promoting…

- Gold as a war and terror safe haven: When gold spikes due to war or terror knee jerk reactions, buying it at that time is the surest way to incur a short-term loss on your position when the hype dies down in a day or two.

- Gold as real money: It is not; paper currency is real money because governments – faulty and debt addled as they are – say it is. Gold is a long-term hedge against these ill-fated monetary regimes.

- Gold as the best hedge against inflation during times when an inflated economy is growing and seems healthy to a majority: Ah, no. When the public perceives there to be a problem with the inflation, then sure. But since 2011 inflation by monetary policy has gone right to stocks and more recently, inflation by fiscal policy has helped the US economy. And so I ask you, where’s gold currently trading again?

- Demand from India and China will overwhelm the efforts of manipulative western entities to suppress the gold price: I ask you again, where is gold currently trading? For every eastern buyer there is a seller, whether western or otherwise. A buy/sell transaction is a zero sum game and would have little effect on the price from a supply/demand standpoint in and of itself. Demand has obviously not been there relative to supply.

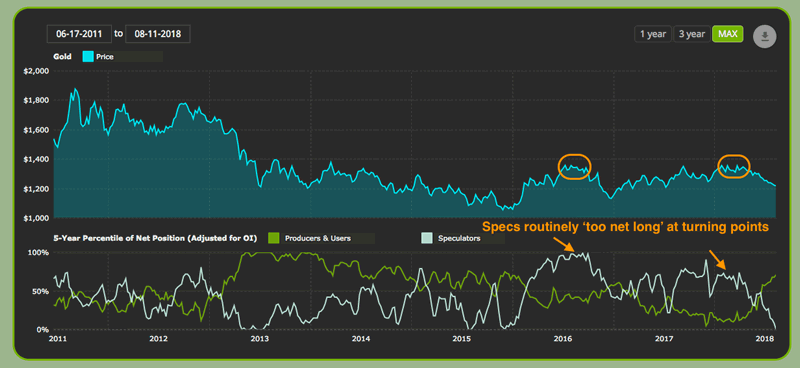

- People obsessing upon the Commitments of Traders data looking for evil and manipulative intent with regard to gold and silver: Cue the well-followed technology and gold “expert” (as he was first introduced to me a few years ago), on Twitter recently railing against “short attacks” on gold by large speculators. What is actually happening is that the Specs were too net long and those “attacks” he sees are actually redemptions and mass pukage by these not so evil Specs (click chart for source).

The gold “community” always wants you to have a solid reason for events other than ‘well, looks like we screwed up… again’.

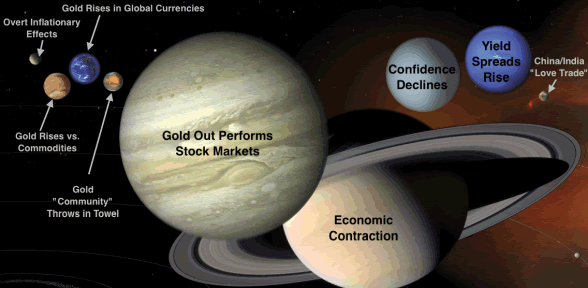

The way to start not screwing up is to drop all the wrong headed stuff that has not worked for basically ever, and start using what does work. That would be something along the lines of say… I know, the Macrocosm. The big 4 are right there. Gold vs. the stock market, economic contraction, Yield Spreads (i.e. Yield Curve stops flattening and/or begins to steepen) and by extension, declining confidence.

It’s not rocket science (nor the Starship Enterprise for that matter), but so many people have been pre-programmed by other people who have pretended for too long to be experts on something so simple it appears complex to the average person.

Gold is an anchor. That anchor digs into a sea bed of stability as the tides go in and out. But if you’re playing gold as a play in the casino, well you get what you deserve. The average gold-obsessed analyst assists casino patrons as they throw the dice and hope that whatever rationale comes up will be the winner. But it ain’t “Chindia Love” or inflationary economic growth that are going to do it, especially for the gold miners, which would leverage gold’s standing vs. cyclical assets.

So with the gold sector in some stage of capitulation and approaching NFTRH‘s current downside targets, it’s best to remember why you may or may not be interested in buying. It’s already been proven, time and again, that it is not for the standard reasons that the “community” * pitches to you. We are setting up for a potentially epic opportunity… but only if the right analytical parameters come into play would it be an intense and extended affair.

* I put that word in quotes because it was actually used repeatedly by Mr. Gold when writing to his CIGA (comrades in golden arms). I mean, they even nickname themselves as some sort of team or unit. What better giveaway to bias could you imagine?

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas. You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2018 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.