Gold And U.S. Dollar, Buffett, Trump, – Nothing Has Changed

Commodities / Gold and Silver 2018 Aug 28, 2018 - 06:35 AM GMTBy: Kelsey_Williams

“Even in the U.S., where the wish for a stable currency is strong, the dollar has fallen a staggering 86% in value since 1965, when I took over management of Berkshire…” — Warren Buffett Feb2012

“Even in the U.S., where the wish for a stable currency is strong, the dollar has fallen a staggering 86% in value since 1965, when I took over management of Berkshire…” — Warren Buffett Feb2012

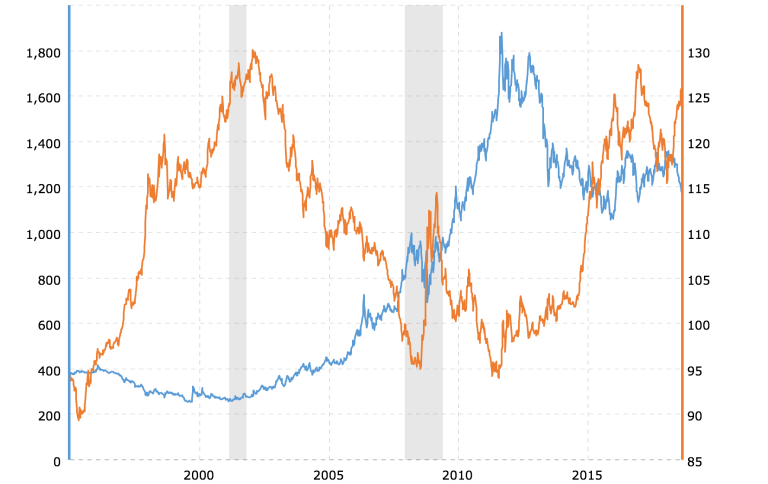

During that same period (1965 – 2012) the price of gold increased from $35.00 per ounce to more than $1800.00 per ounce – a whopping 5000%. Seven years ago this month (August 2011), the price of gold peaked at $1879.00 per ounce, and has since fallen 30% to approximately $1200.00 per ounce currently. That drop in price is the inverse reflection of the U.S dollar’s temporary strength and stability, which is up by 30%. You can see that on the chart GOLD PRICES AND US DOLLAR CORRELATION below…

(This interactive chart compares the daily LBMA fix gold price with the daily closing price for the broad trade-weighted U.S. dollar index over the last 10 years.) source

Looking at the most recent activity, the U.S. dollar is currently up 10% from its low point earlier this year in January, whereas the price of gold has declined 14% from its corresponding high point that same month.

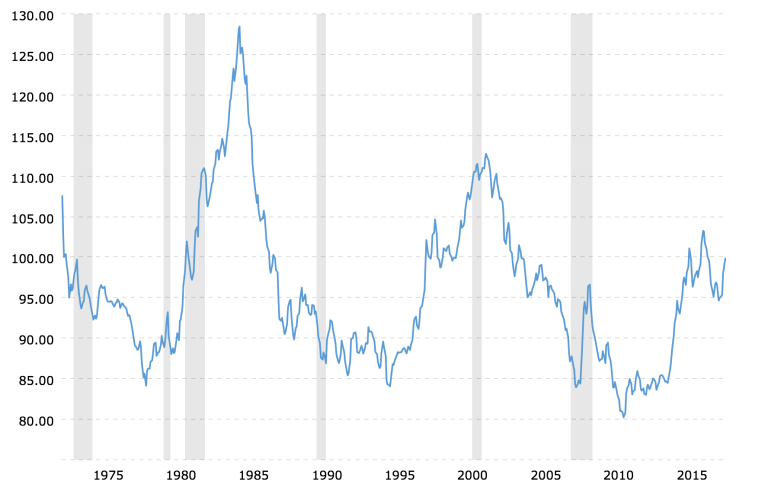

Here is another chart US DOLLAR INDEX HISTORICAL CHART…

(This chart of historical data shows the broad price-adjusted U.S. dollar index over the past 43 years as published by the Federal Reserve.) source

When gold peaked in January 1980 at $850.00 per ounce, the U.S. dollar had just begun to move upwards from its decade-long decline, eventually reaching its ultimate high of 128 five years later. A secondary peak at 113 in February 2002 occurred just after the price of gold reached its nadir at $250.00 per ounce. The subsequent decline of 30% in the U.S. dollar resulted in a seven-fold increase in gold’s price.

Again we see the same pattern over and over. And while some may get tired of hearing it, they apparently haven’t gotten the message: “the price of gold is an inverse reflection of the fluctuating value of the U.S. dollar – nothing more, nothing less, nothing else” …Kelsey Williams

On January 20th, 2017 Donald Trump was inaugurated as the 45th President of The United States of America. The price of gold was $1209.00 per ounce.

Today, August 27th, 2018, the price of gold is $1209.00 per ounce. And the U.S. dollar index stands currently at 125; exactly where it was on January 30th, 2017 – ten short days after President Trump’s inauguration.

With all that has happened in the past two years, and with all that was supposed to send gold infinitely higher, nothing has changed.

Those who were insisting that “President Trump’s election is good for gold” are now telling us that his trade war is good for gold. And that his calls for a weaker U.S. dollar will lead to an impending collapse of the U.S. dollar; which will lead to much higher gold prices.

Calls for gold’s price to ‘soar’ to $5,000, $6,000, $10,000 per ounce abound. And the adamancy of these predictions is even stronger after gold’s most recent drop.

And, too, “fundamentals for the miners have greatly improved and the gap between them and the price of gold will soon narrow significantly”. It has to, right?

If you consider yourself bullish on gold (for most people, this means only one thing – they expect the price of gold to go higher; a lot higher), there is no shortage of fundamentals to get you excited.

Anything that someone suggests or implies will cause gold’s price to rise, is now a fundamental for gold. These include: interest rates, the economy, the Euro or Yuan or Yen, Brexit, trade wars, conspiracies, social unrest, terrorism, etc.

Analysis of gold,as it is proffered by most of those associated with the yellow metal, is misleading and harmful; and it generates unrealistic expectations.

Gold’s value is not determined by world events, political turmoil, or industrial demand. If you have in mind a particular scenario or series of events that you think are critical or important with respect to gold, then you need to reconsider them carefully as to what specifically would be the effect on the U.S. dollar. Nothing else matters.

The U.S. dollar is the world’s reserve currency and gold is priced in U.S. dollars. If the U.S. dollar continues to strengthen, then gold prices in US dollars will continue to decline. If the US dollar weakens, then gold’s price in US dollars will go up. It can’t be any other way.

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2018 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.