Gold Nuggets And Silver Bullets

Commodities / Gold and Silver 2018 Sep 12, 2018 - 04:15 PM GMTBy: Kelsey_Williams

It is very difficult to let go of someone – or something – when we have invested so much time and energy in it. It is even harder when we have invested so much of ourselves in it; when the outcome is not what we expected; when our reputation is at stake.

It is very difficult to let go of someone – or something – when we have invested so much time and energy in it. It is even harder when we have invested so much of ourselves in it; when the outcome is not what we expected; when our reputation is at stake.

In this particular case, that something is gold and silver.

The emotional proclamations just a few weeks ago seemed quite strong, almost being religious in their fervor. But after two thrusts of the dagger to the heart, the explanations afterwards seem a bit hollow.

To be sure, some of the prior adamancy is still there, but it seems more of a stubborn refusal to accept defeat, rather than a meaningful rallying cry.

It’s not as simple as being right or wrong, though. Morsels of truth find their way into various analyses of gold or silver. But the waters are still muddied for most of those with any interest in gold or silver. Lets see if we can bring some clarity to the “river of dreams”.

GOLD NUGGETS

- Gold is real money Money has three specific characteristics: medium of exchange, measure of value, store of value. A medium of exchange needs to be portable, which gold certainly is. And gold is and has been easily incorporated into recognizable forms and amounts for use within various standards of weight and measure. But what sets gold apart from every other item that has been used as money is its evidence as a store of value.

- Paper currencies are substitutes for gold/real money The first gold coins appeared around 560 B.C. Over time it became a practice to store larger amounts of gold in warehouses. Paper receipts were issued certifying that the gold was on deposit. These receipts were negotiable instruments of trade and commerce which could be signed over to others. They were not actual currency but are a presumed forerunner to our modern checking system.

- Gold is not an investment When gold is characterized as an investment, the incorrect assumption leads to unexpected results regardless of the logic. If the basic premise is incorrect, even the best, most technically perfect logic will not lead to results that are consistent.

Gold is stable. It is constant. And it is real money. Since gold is priced in U.S. dollars and since the U.S. dollar is in a state of perpetual decline, the U.S. dollar price of gold will continue to rise over time.

The U.S. dollar has lost ninety-eight percent of its purchasing power over the last one hundred years. And over that same one hundred years, what you can buy with an ounce of gold remains stable, or better. (See A Loaf Of Bread, A Gallon Of Gas, An Ounce Of Gold)

What might be just as important as understanding what gold is, is understanding what it is not. It is not a hedge against inflation, nor is it a safe-haven asset. Gold is not “driven” by or “correlated” with social unrest, political turmoil, wars, the economy, interest rates, etc.

Do people view gold as an investment? Absolutely. Which is why they are continually surprised and confused at their investment results. They buy gold – invest in it – because they expect the price to go up. Which is logical.

The problem is that the premise is wrong. When someone invests in gold, they are expecting the price to go up as a result of certain factors which they believe are ‘drivers’ of gold. In other words, they believe that gold responds to certain factors. These factors include interest rates, social unrest, political instability, government policies/actions, a weak economy, jewelry demand, and various ratios comparing gold to any number of other things.

But, again, that assumes that gold is an investment which is affected by the various things listed. It is not.

Have you ever “invested” in money? More specifically, when was the last time you called your financial advisor and placed an order for U.S. dollars?

Gold is quoted in U.S. dollars and the dollar is the world’s reserve currency. The ‘price’ of gold in U.S. dollars is an inverse reflection of the value of the U.S. dollar. The changes in price are continuous and ongoing. Confidence (or lack of it) and expectations (realistic or not) play a part. And yes, there are more extreme changes for shorter periods of time which don’t correlate exactly to changes in purchasing power of the U.S. dollar. But the most extreme changes occur after longer periods of time when the cumulative effects of inflation are recognized more fully by holders of the depreciating paper currency (i.e. U.S. dollar). And, since paper currencies and credit can be manipulated by government, expectations and reactions become more volatile.

Without a clear understanding of the above paragraph, we will continue to see unexpected results which defy our logic if we ‘invest’ in gold as a “hedge against the chaos and resulting breakdown of society”; unless that chaos results in a significant decline and/or breakdown of the U.S. dollar itself.

The only thing that you need to know in order to understand and appreciate gold for what it is, is to know and understand what is happening to the U.S. dollar.

SILVER BULLETS

- Silver is primarily an industrial commodity Silver is used in batteries, dentistry, solar energy (photovoltaic cells), medicine, semiconductors, nuclear reactors, etc.

- Silver has a secondary use as money Silver’s use as money is well-documented historically.

- Silver’s claim as ‘real money’ is tenuous Silver has failed substantially to offset the decline of the U.S. dollar.

For silver (or anything else) to be considered real money, it must be a store of value. According to Investopedia, a store of value is a “form of wealth that maintains its value without depreciating”. In this case, being a store of value means it must at least match inversely the decline in purchasing power of the US dollar. For this to be so, silver’s current value needs to be at least US$60.00/oz. It isn’t even reasonably close to that level.

Some would argue that silver is severely undervalued and its fundamentals will send its U.S. dollar price soaring higher and faster relative to gold from its current price level. It might. But when? And what are those fundamentals?

Most likely, they will point out a gap in consumption over production, the gold-to-silver ratio, and manipulation. The consumption/production gap and the gold-to-silver ratio were the same ‘fundamental’ arguments being made a half-century ago. How long should we wait? The ratio argument has no basis in fact and the manipulation argument is without merit. All three of these ‘fundamentals’ have been addressed and refuted here.

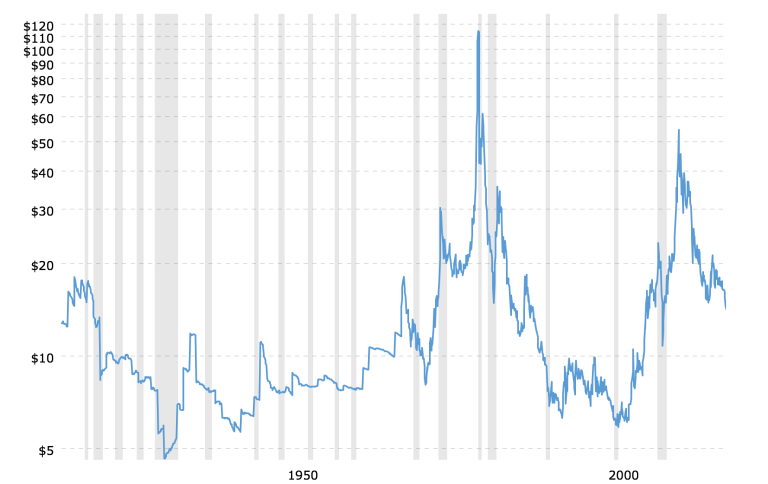

Silver Prices – 100 Year Historical Chart – Inflation Adjusted source

FACT: Since January 1980, silver has lost ninety percent of its value. To add insult to injury, silver is cheaper today than it was one hundred years ago. Whatever its attributes and however much people want to believe it is real money, SILVER IS NOT A STORE OF VALUE.

Most technical analysis of gold and silver boils down to “what the charts tell us about gold’s (silver’s) next move”. The next move – according to most seers of the trade – is “imminently bullish” and represents one, last chance for investorsto save their financial souls.

The problem is that more people have lost more money by ‘investing’ in gold or silver upon the advice of those who proffer it, than will likely ever be made up going forward.

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2018 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.