UK Easy Access Savings Accounts Not So Easy After All!

Personal_Finance / Savings Accounts Nov 07, 2018 - 03:33 PM GMTBy: MoneyFacts

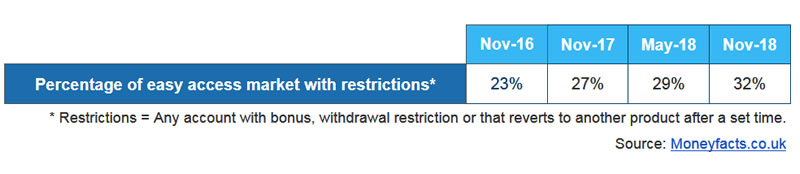

Competition in the easy access market is starting to boom, with providers increasing rates in an effort to enter the Best Buy charts. However, these great rates seem to come with a catch, as the latest research from Moneyfacts.co.uk shows that the number of easy access accounts with either a withdrawal restriction, a bonus or those that revert to a lower paid account after 12 months is growing – with 32% of the easy access market now having one of these restrictions.

Charlotte Nelson, Finance Expert at Moneyfacts.co.uk, said:

“Many savers would assume not only that easy access means unlimited access to their funds, but also that these accounts are no-frills and are simple to understand. However, this couldn’t be further from the case, with six of the top 10 highest rates having some kind of condition attached. Further than this, of the top five rates, only one is bonus and restriction-free.

“The trend of limiting the number of withdrawals on easy access accounts is worrying. In fact, two years ago just 14% of the easy access market had accounts that limited access, which has increased by 8% to stand at 22% today.

“These statistics show that providers are carefully thinking about how much money they can handle, and are choosing to put limitations in place so they don’t end up having to pay out too much over the long term. While there is nothing wrong with these accounts, the clauses they contain rely on savers being on top of their finances, either knowing when the bonus expires or how many times they require access to their cash.

“Although easy access accounts with restrictions often tend to pay higher rates, any saver considering them as an option would be wise to look at all the terms and conditions, so they know exactly what they are getting themselves into. Once the account is open, making a note of any bonus expiry dates in a calendar and how many withdrawals have been made will ensure you do not face a drop in rate or a penalty.

“When rates are low, finding a savings account can be hard enough without all the added complications, particularly when savers naturally assume these easy access accounts are straightforward. However, there are some deals that remain simple, so savers will need shop around to ensure they get the best deal for them.”

moneyfacts.co.uk is a financial product price comparison site, launched in 2000, which helps consumers compare thousands of financial products, including credit cards, savings, mortgages and many more. Unlike other comparison sites, there is no commercial influence on the way moneyfacts.co.uk ranks products, showing consumers a true picture of the best products based on the criteria they select. The site also provides informative guides and covers the latest consumer finance news, as well as offering a weekly newsletter.

MoneyFacts Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.