Home Equity Release Interest Rates Are on the Rise

Housing-Market / UK Housing Nov 08, 2018 - 02:47 PM GMTBy: MoneyFacts

The equity release market has continued to evolve, not only by allowing customers to release more equity from their homes, but also in terms of providers offering more flexibility, such as the inclusion of drawdown options.

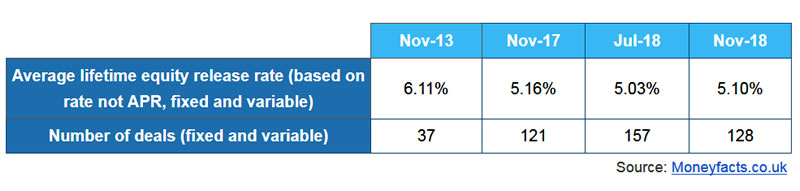

While the equity release market is nowhere near as volatile as the residential mortgage market in terms of interest rate changes, it has not been left unscathed by recent cost increases. The latest analysis by Moneyfacts.co.uk reveals that over the last quarter, more than half of the 11 lenders in the lifetime mortgage market have increased interest rates within their range (Aviva, Hodge Lifetime, Just, LV=, Legal & General, Vernon Building Society).

Rachel Springall, Finance Expert at Moneyfacts.co.uk, said:

“The equity release market has listened to the consumer demand for more flexibility, and, as a result, lifetime mortgages are becoming more popular, so much so, that record amounts are being unlocked through equity release*.

“This year has also seen an influx of competitive rates, with the average lifetime mortgage recording its lowest ever level in July (5.03%). However, lenders are now starting to factor in interest rate rises, with six out of 11 providers upping their rates over the last quarter, some more than once, meaning the average rate now stands at 5.10%. In fact, the average rate for mortgages ranging up to 50% loan-to-value has risen from 4.67% to 4.83% over the same period.

“Beyond the rates, lifetime mortgages may well be attractive to those who had considered downsizing, but are looking to avoid the hassle of moving and the costs involved, such as paying stamp duty. It is little wonder then that 82% of the lifetime mortgage market provide a free valuation. There are now more deals without a product fee too, however these deals still account for less than half the market share (41%).

“It is a misconception that equity release is aimed solely at the cash-poor or for those looking to plug the gap of their later life care costs. For instance, some consumers may be considering these products for gifting reasons. It’s little wonder then that our own independent study revealed that two-thirds of consumers believe they have a clear understanding of equity release.**

“It’s encouraging to see the market adapt to create more flexible products, such as those that provide a drawdown option to suit those looking to draw cash as and when they need it rather than take a large upfront lump sum. It’s easy to see why this option would be popular, as more traditionally, any remainder of a lump sum could well have been stashed in a basic savings account for later withdrawal.

“Whilst consumers need to seek advice from an independent financial adviser that specialises in equity release, it can be beneficial to find one who also advises on mortgages, so they can work out the best point of action by going through all the latest options to hit the market – including retirement interest-only mortgages, for example.

“Choosing the right equity release deal will typically come down to a combination of different factors. Independent product ratings, such as the Moneyfacts Star Ratings, can help highlight the best plans available at a glance, which could then be considered in conjunction with cost.”

Our Moneyfacts Star Ratings criteria for equity release products is based on the weightings of specific features and benefits offered, outside of rates, that could be of most relevance to the consumer considering a product.

*According to the Equity Release Council, £1.02 billion was released in the third quarter of 2018.

moneyfacts.co.uk is a financial product price comparison site, launched in 2000, which helps consumers compare thousands of financial products, including credit cards, savings, mortgages and many more. Unlike other comparison sites, there is no commercial influence on the way moneyfacts.co.uk ranks products, showing consumers a true picture of the best products based on the criteria they select. The site also provides informative guides and covers the latest consumer finance news, as well as offering a weekly newsletter.

MoneyFacts Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.