Gold & Global Financial Crisis Redux

Stock-Markets / Financial Markets 2018 Dec 12, 2018 - 05:12 AM GMTBy: Jim_Willie_CB

The Global Financial Crisis, a broader deeper more powerful systemic crisis than the Lehman Event was, has finally arrived in a great redux. It is seen in numerous areas. We have finally arrived at the ten-year anniversary of the Lehman event, a killjob whereby JPMorgan and Goldman Sachs bought a few $billion in mortgage bonds and never paid Lehman Brothers. The firm died, called a financial failure, but was actually a strangulation. Goldman went on to capture AIG, in order to claim 100 cents per dollar on insured mortgage bonds, a second crime. The Wall Street banks, under the leader Henry Paulsen as the managing USTreasury Secretary, completed the third crime, by pitching the $700 billion TARP Fund. They stole it, using the fund for enriching themselves with redeemed preferred stock, instead of making the funds available for lending purposes. Here ten years later, nothing has been fixed. In fact, all the abuses heaped upon the mortgage finance sector have been repeated in sovereign bonds. The USTreasury Bond has become a subprime bond, financed by pure monetization, almost no actual bonds buyers, $trillion annual deficits, auctions rigged, with hidden demand from the derivative machinery. It qualifies as a Third World debt security. The corporate bonds were routinely abused in stock buybacks, hardly ever ploughed back into the business. High yield bonds are the norm now, along with the wrecked Emerging Market bonds. There are many analysts who call the current situation the Everything Bond Bubble.

The Global Financial Crisis, a broader deeper more powerful systemic crisis than the Lehman Event was, has finally arrived in a great redux. It is seen in numerous areas. We have finally arrived at the ten-year anniversary of the Lehman event, a killjob whereby JPMorgan and Goldman Sachs bought a few $billion in mortgage bonds and never paid Lehman Brothers. The firm died, called a financial failure, but was actually a strangulation. Goldman went on to capture AIG, in order to claim 100 cents per dollar on insured mortgage bonds, a second crime. The Wall Street banks, under the leader Henry Paulsen as the managing USTreasury Secretary, completed the third crime, by pitching the $700 billion TARP Fund. They stole it, using the fund for enriching themselves with redeemed preferred stock, instead of making the funds available for lending purposes. Here ten years later, nothing has been fixed. In fact, all the abuses heaped upon the mortgage finance sector have been repeated in sovereign bonds. The USTreasury Bond has become a subprime bond, financed by pure monetization, almost no actual bonds buyers, $trillion annual deficits, auctions rigged, with hidden demand from the derivative machinery. It qualifies as a Third World debt security. The corporate bonds were routinely abused in stock buybacks, hardly ever ploughed back into the business. High yield bonds are the norm now, along with the wrecked Emerging Market bonds. There are many analysts who call the current situation the Everything Bond Bubble.

The Jackass prefers the name of Systemic Lehman Event, since it is part 2 with the exact same monetary abuse, bond fraud in underwriting, with a QE chaser. The Quantitative Easing is old fashioned hyper monetary inflation of the worst kind, unsterilized, meaning huge volume of funds added to the financial system with no extractions. The global financial crisis is upon us, having entered an intermediate level of debt saturation, of bond issuance deep abuse, of market rigging corruption, of banking system insolvency at acute levels, and of economic rot setting in. The outcome of the unfolding crisis will be three to five times more magnificent that what was witnessed in 2008 and 2009. Expect the current crisis to wreck a few big Western SIFI banks, collapse at least one national banking system, destroy at least five major Western corporations, and result in open discussion of the USGovt debt restructure, technically a default. The systemically important financial institutions (SIFI) cannot not be saved, since too many are insolvent, gigantic hollow reeds, dependent upon bond carry trade easy profits and narco money laundering fees. They rely upon hidden central bank welfare, to cover their $trillion exposure to derivatives. As the Petro-Dollar dissolves, these derivatives become unmanageable.

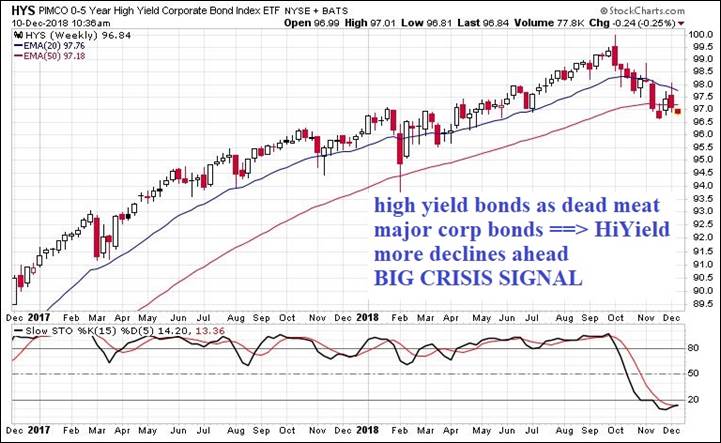

The signals are numerous for the unfolding erupting cascading financial crisis. Witness the early tipoff in the FANG tech darling stocks. Then the Italian banking system recurring disaster. Then the Deutsche Bank saga, better known as the Bush Narco Bank. Then the entire US big bank takedowns, evident in the BKX bank stock decline. Then the crude oil decline, down 30% in two months, a sign of the vacated Petro-Dollar. Now finally, see the declines in the major stock indexes, like the SPX (S&P500 index), the QQQ (Nasdaq index). The pain meter will be the high yield bonds and the Emerging Market bonds. In fact, the Western banks have kept the EM nations afloat by lending them funds in the last two years, just to maintain and to float the loans owed to the same Western banks. This is lending good money after bad. The Wall Street banks are soon to decline sharply from the crude oil price, as the energy sector deals out tremendous pain. The ballyhooed shale sector will collapse in a massive thud.

GOLD AS SAFE HAVEN

The USTreasury Bond is the gigantic subprime global bond. It will face a major global challenge by the Eastern superpowers, as they work steadily toward implementing the Gold Standard. The weaponized USDollar and the nuclear threats do not deter global players in the East. The rogue nation has become the United States, both financially and in global behavior. The USGovt tax revenue in total does not cover the USGovt borrowing costs any longer. The entire USGovt function is currently in deficit, the entire shebang. The insolvency of the situation is utterly obvious, except to Americans.

The subprime bond is the USGovt debt security. It bears Third World fundamentals, and will be treated as such. The lit fuse will be Western bank declines and Emerging Market debt default. The winner will be Gold during the next global financial crisis. Many are its signals, and the BKX bank stock index is only one of several such signals. In 2008 and 2009, the safe haven during the crisis was clearly the USTreasury Bond. Not this time, as Gold will take the safe haven mantle, or share the mantle. The entire global bond market will be shaken to its core. Gold will hit the scene with trade payment, then with bank reserves management. The fact that Gold has such lousy sentiment is the final confirmation, a contrary indicator. The Jackass has two key clients who just threw in the towel, each involved in a gold trade line of business. They might be the last sellers, since so dedicated and devoted in the past.

Thanks to Gab for a fine historical chart of the Gold price. The multi-year correction appears to be ending. Long-term trendlines offer support. The intermediate downtrend over the last three years has been broken. The bottoming process has been completed. The low from January 2016 has been retested, without matching those low levels. The massive global crisis, with all bonds in bubble formation, and many banking systems in insolvency, has contributed to an environment where Gold reigns. GOLD HAS BEEN THE BEST PERFORMING ASSET IN THE ENTIRE 2018 YEAR !! Gold feeds off crisis.

As the global crisis, Lehman Part 2 emerges with more a blossoming multi-faceted unfixable magnificent crisis, Gold will become headline news. The hidden battles by the Globalist fascist elite banker cabal, against the Eastern nations who hold vast gold troves, is coming to a conclusion. These battles will make for excellent movies in the future, with downed aircraft, murdered attorneys, legacy bonds captured, stolen gold located, mine rights sacked (e.g. Grasberg), where the site of the concentrated conflicts tend to be Malaysia and Indonesia.

The Gold price will approach the $1300 level, toy with the $1350 level, and eventually move to multi-year highs. The Gold price could possibly in the next couple years, work toward the 2011 and 2012 highs. The time for Gold has come, giving great impetus by the massive global historically unprecedented financial crisis which has finally begun. It is the second phase of the same problem from 2008, except it has gone global.

NUMEROUS CRISIS SIGNALS

The major stock indexes have raised alarm in recent weeks. The attention is inescapable. Consider the signal given by the S&P500 stock index. This is a death star, akin to severe heart palpitations in the EKG readings, leading to a heart attack. Nothing can stop this decline, as the recession is being recognized. Next come the parade of margin calls, huge quarterly losses, negative outlooks, calls for powerful recession, corporate debt defaults, official debt rating downgrades, rising unemployment, rising price inflation, and growing scattered talk of a USGovt debt restructure (default).

Consider the QQQ stock index, for the NASDAQ. This is another death star, which will have a matching heart attack on the tech side, led by the majors and joined by the darling FANG stocks. These nearly worthless stocks like FaceBook and NetFlix,must come down to earth, upon recognition of their absent value and pumped support by funny money. They provide a hilarious echo to the DotCom worthless stocks such as Groupon. Nothing can stop this decline, as the recession is being recognized. The gloomy stories will become a massive procession of negativity and a lost generation.

Consider the crude oil price, whose massive 30% decline in just two months should be interpreted as a loud gong for the Petro-Dollar death. The East is not using it like in past years, and maybe not even the Gulf Arabs. Qatar and the United Arab Emirates just both discarded their devoted usage of the USDollar in oil trade. The oil producing nations will seek a new protector in the East, like Russia and China. They will seek a new standard for trade payment, based upon the Gold Trade Note. It is overdue in the launch. The Wall Street banks are extremely exposed to the declining oil price. They cannot hold off the deep energy portfolio losses.

Revisit the major bank stock index. It was featured several weeks ago, and its continued death spiral is clear for all to see. Last week an important reversal decline occurred. The October lows have been taken out, as new lower lows are seen in a near catastrophic week last to finish off November. Look for two years of gains to be wiped out quickly, as the 2016 levels will return. The crude oil price declines, of historic magnitude in recent months, will take down a couple big banks. The Wall Street banks desperately propped up the crude oil price, with the collusion of the USFed itself. Next it all unwinds, and massive losses to Wall Street banks threaten to expose tremendous losses in the $billions for these hollow pillars posing as banks, whose main activity is market rigging and bond carry trade. The Roaring 2010s (like the Roaring 1920s) are coming to an end, fueled by the same medicine, excess debt and its horrendous abuse.

Consider the High Yield Debt, those funky bonds which cannot be held in mutual funds or bond funds, due to downgrade and toxic ratings. Its two year rise in fabricated legitimacy will come to an end, with all the gains erased quickly and thoroughly. The Emerging Market debt matches this sector, except with a much worse stench and a $9 trillion tab of defaulted debt.

Consider Deutsche Bank, whose stock was once well over $100 per share. It serves as the Western bank toilet lever. The DB share price is heading to 50 cents in one of the greatest tragedies in the modern financial era. Hundreds of $billions in market capitalization are being vaporized. Little known to the sheeple and even to many financial mavens is that DBank is the Bush Narco Bank, which has moved $billions in narco money for three decades, under the aegis of the US-UK-EU regulators with watchful eyes, complete with profitable fees.

Consider General Electric, once the bellwether industrial & financial stock. Its products have one of the widest ranges in the entire Western world. Hundreds of $billions in its market capitalization are being vaporized. GE is the poster boy of abused bond issuance, putting the funds to work in executive compensation furry lined pockets, executive stock options, and stock buybacks (which reinforce the options). The GE debt downgrade two weeks ago shocked the world, moving it to the lowest level above junk status. It will eventually find itself junk. As GE goes, so goes the entire upper echelon US-based bond market. Dozens of big US corporations will suffer additional debt downgrades. Expect at least 1$trillion in bond losses.

Consider the preppy tech darling stock FaceBook. It had absolutely no right being placed in the S&P500 exclusive list. It lacked two primary requirements: an established track record of a decade or more, and a tangible product. But Zuckerberg is a Rockefeller grandson, probably a bastard along the bloodline path. On a single day in July, its stock lost $165 billion in market capitalization, for one of the biggest losses in modern history. It is actually a $5 stock, posing as a $140 stock, nothing more than just a glorified rack of disk drives with a Langley gift of clever software. FaceBook will lead the FANG stock down 80% to their proper level. A key internet major stock might be declared a public utility and broken, certain to produce a gurgle sound as it circles the drain rendered contaminated by censorship.

MONEY EXITS, GOES TO GOLD SAFE HAVEN

The money is exiting a growing long list of various sectors. Never in recent annals have so many sectors shown distress at the same time, ready for a parade of severe losses and waterfall declines. Expect the Wall Street managers to place very significant option puts in place for the S&P500 and the NASDAQ tech stocks. They will sabotage the main US stock market, in order to drive money into the USTreasury Bonds. But their initiative of sabotage will not succeed this time. The reason why is very solid and very understood. The funds will not find safe haven in the USTBonds since they are the new subprime bond. The tax revenue does not even cover the debt borrowing costs, a Third World indicator. The USGovt debt of $22 trillion will never be repaid, a newly forming consensus opinion. The USDollar is no longer considered the standard trade payment vehicle. The US-led sanctions have backfired. Alternative workarounds to the USDollar channels in SWIFT movements have been averted.

THE EXITING FUNDS TO GO TO GOLD !! This round in the Global Financial Crisis part 2, the emerging Systemic Lehman Event, the busted Everything Bond Bubble, the funds move to the safety of precious metals. The global battle to locate, to source, and to provide secure vaults for Gold has begun. The long ugly corrupted nasty Gold market correction since 2012 is ending. Finally! Look for an assault on the $1350 level in the next several months, or next several weeks. Look for a test (possible breach) of the $1900 levels from 2011 and 2012 to occur in the next year or two. The little known fact is that the Swiss with their Euro / Dollar / Gold machinations, brought down the Gold price from those previous highs. The publicity was given to the Swiss Franc & Euro peg. But the reality was their Dollar Swaps, Euro controls, and Gold suppression.

The game is over, featuring QE as debt monetization and big bank welfare. The crisis has begun, since nothing was fixed. All the abuse spread to render USTBonds the new subprime bond. It will erupt in numerous areas. IT CANNOT BE STOPPED, AND THE POWERFUL FORCES WILL BE DIRECTED TOWARD LIFTING THE GOLD PRICE. The Systemic Lehman Event has begun. The French riots add a social dash of salt to the table. The political and social ingredients are what the globalist banker cabal cannot control, and will result in major eruptions across the globe. Consider them to be backlash to the Color Revolutions. The beneficiary in the financial markets already is seen to be gold, Gold, GOLD !!

HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

“Jim Willie’s proprietary contacts in highly strategic positions around the world help him better predict the future with an accurately as high as 90%. That is astounding! The Hat Trick Letter is my secret sauce to better understand what is really happening, so I can make better financial decisions during this tumultuous period.”

(PaulK in Kentucky)

"I have continued my loyal patronage of your excellent commentaries not so much because of my total agreement with your viewpoints, but because you have proven yourself to be correct so often over the years. When you are wrong, you have publicly admitted it. You are, I suppose by nature, an outspoken and irreverent spokesman for TRUTH against power, which differentiates you from almost all other pundits on world affairs."

(PaulR in Hawaii)

"For over five years I have been eagerly assimilating any and all free information (articles, interviews, etc) that Jim Willie puts out there. Just recently I finally took the plunge and became a paid subscriber. I regret not doing this much sooner, as my expectations were blown away with the vast amount of sourced information, analysis tied together, and logical forecasts contained in each report."

(JosephM in South Carolina)

"Jim Willie is a gift to our age who is the only clear voice sounding the alarm of the extreme financial crisis facing the Western nations. He has unique skills of unbiased analysis with synthesis of information from his valuable sources. Since 2007, he has made over 17 correct forecast calls, each at least a year ahead of time. If you read his work or listen to his interviews, you will see what has been happening, know what to expect, and know what to do."

(Charles in New Mexico)

"A Paradigm change is occurring for sure. Your reports and analysis are historic documents, allowing future generations to have an accurate account of what and why things went wrong so badly. There is no other written account that strings things along on the timeline, as your writings do. I share them with a handful of incredibly influential people whose decisions are greatly impacted by having the information in the Jackass format. The system is coming apart on such a mega scale that it is difficult to wrap one's head around where all this will end. But then, the universe strives for equilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com. For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com, which includes a Squirrel Mail public email facility.

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.