Should We Declare Emergency for Gold?

Commodities / Gold & Silver 2019 Feb 19, 2019 - 02:06 PM GMTBy: Arkadiusz_Sieron

Sixteen states sue Trump over border wall emergency. Is it good or bad for the yellow metal?

Sixteen states sue Trump over border wall emergency. Is it good or bad for the yellow metal?

Trump’s National Emergency and Gold

On Friday, President Trump declared a national emergency to obtain funds for building a wall along the U.S.-Mexico border, which was his key promise during a campaign. According to the President’s proclamation :

the current situation at the southern border presents a border security and humanitarian crisis that threatens core national security interests and constitutes a national emergency. The southern border is a major entry point for criminals, gang members, and illicit narcotics.

Trump declared emergency despite the fact that Congress allocated nearly $1.4 billion toward border fencing. However, the order would give him an additional $6.7 billion. The national emergency is nothing unprecedented. Every U.S. president since 1976, when the National Emergencies Act was signed off, has declared at least one national emergency.

What is new is that Trump admitted that there is actually no emergency. As he said on Friday, “I could do the wall over a longer period of time, I didn’t need to do this, but I'd rather do it much faster.” When we checked the dictionary last time, ‘emergency’ meant “a serious, unexpected, and often dangerous situation requiring immediate action”. And what does data say?

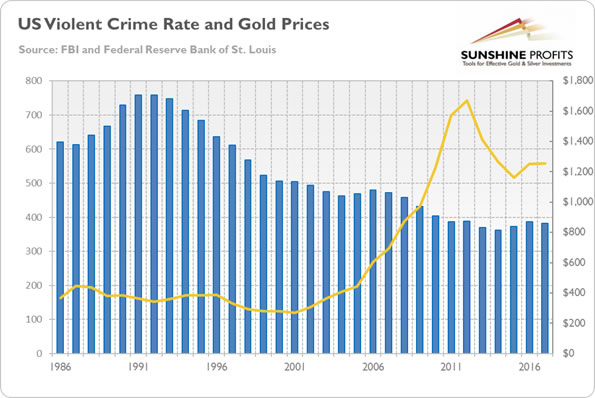

Let’s look at the chart below. It displays the US violent crime rate, i.e. the number of violent crimes (which is composed of four offenses: murder and non-negligent manslaughter, rape, robbery, and aggravated assault) per 100,000 inhabitants. Although there is indeed an increase since 2014, the rate remains historically at a very low level. This rate declined from 758.2 in 1991 to 382.9 in 2017. Our chronicler’s duty is to note that we do not see any correlation between the violent crime rate and the gold prices.

Chart 1: US violent crime rate (blue bars, left axis, number of crimes per 100,000 inhabitants) and gold prices (yellow line, right axis, London P.M. Fix, in $) from 1986 to 2017.

The ironic part here is that Trump’s comment could undercut the government’s legal argument, and the legal challenges could actually slow the whole process of building the wall. The coalition of 16 U.S. states led by California has already sued President’ declaration arguing that it was a misuse of presidential power. And it is not the only lawsuit – three Texas landowners and an environmental group also sued Trump, saying that building the wall would violate the Constitution and would infringe on their property rights.

What does it mean for the gold market? The political perturbations between the Congress and the White House could potentially increase the safe-haven demand for gold, especially if it causes a constitutional crisis. But the recent government shutdown, which did not boost gold prices, clearly shows that people overestimate the impact of geopolitics on the gold market. After all, politics is mainly a theatre. We are not saying that it is not irrelevant, but investors should not overestimate its significance.

Is There Emergency for Gold?

No matter what you think about the national emergency concerning the southern border of the United States, gold is far from being under threat. Although the US economy remains solid, industrial production fell by 0.6 percent in January (the forecasters expected 0.3-percent gain), for the first time in eight months. And retail sales declined 1.2 percent in December, according to the delayed government report, the biggest decline in nine years. Moreover, inflationary pressure has recently moderated. The monthly CPI index was flat in January, while the increase in the cost of living over the past 12 months slowed from 1.9 to 1.6 percent, the smallest increase since the period ending in June 2017. The recent economic data makes the Fed’s recent dovish turn look like the right move. Hence, the US central bank should remain reluctant to tighten its monetary policy aggressively. The resulting downward recalibration in interest rates should be a benefit for gold.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.