Stock Market Up 9 Weeks in a Row. What’s Next

Stock-Markets / Stock Markets 2019 Feb 24, 2019 - 06:43 PM GMTBy: Troy_Bombardia

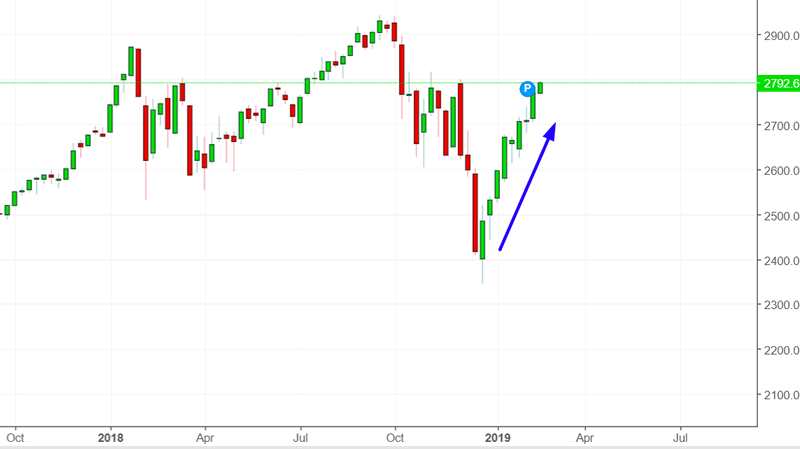

The Dow and NASDAQ are up 9 weeks in a row when you compare this week’s CLOSE to the previous week’s CLOSE, while the S&P is up 9 weeks in a row when you compare this week’s CLOSE to this week’s OPEN.

The Dow and NASDAQ are up 9 weeks in a row when you compare this week’s CLOSE to the previous week’s CLOSE, while the S&P is up 9 weeks in a row when you compare this week’s CLOSE to this week’s OPEN.

The most likely path forward is a short term pullback, with more gains ahead for 2019. Above all else, remember that the short term is extremely hard to predict, no matter how much conviction you have in it.

The economy’s fundamentals determine the stock market’s medium-long term outlook. Technicals determine the stock market’s short-medium term outlook. Here’s why:

- The stock market’s long term risk:reward is no longer bullish.

- The stock market’s medium term is mostly neutral (i.e. next 6 months)

- The stock market’s short term has a slight bearish lean.

We focus on the long term and the medium term.

Long Term

While the bull market could keep going on, the long term risk:reward no longer favors bulls. Towards the end of a bull market, risk:reward is more important than the stock market’s most probable long term direction.

Some leading indicators are showing signs of deterioration. The usual chain of events looks like this:

- Housing – the earliest leading indicators – starts to deteriorate. This has occurred already

- The labor market starts to deteriorate. Meanwhile, the U.S. stock market is in a long term topping process. We are in the early stages of this process, but the deterioration is not significant.

- Other economic indicators start to deteriorate. The bull market is definitely over, and a recession has started. A U.S. recession is not imminent right now

Let’s look at the data besides our Macro Index

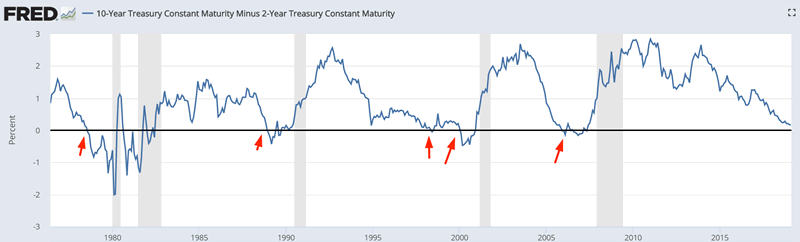

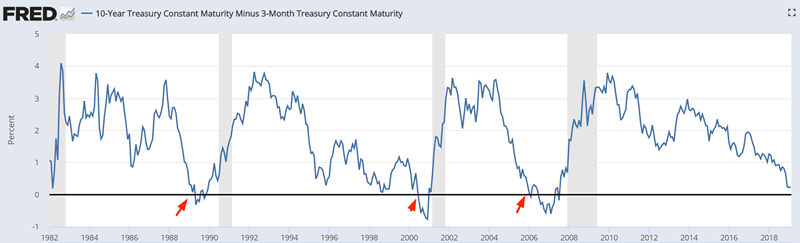

The yield curve remains stubbornly flat, even as the stock market rallies. This is to be expected, because an inverted yield curve typically precedes bear markets and recessions.

Source: FRED

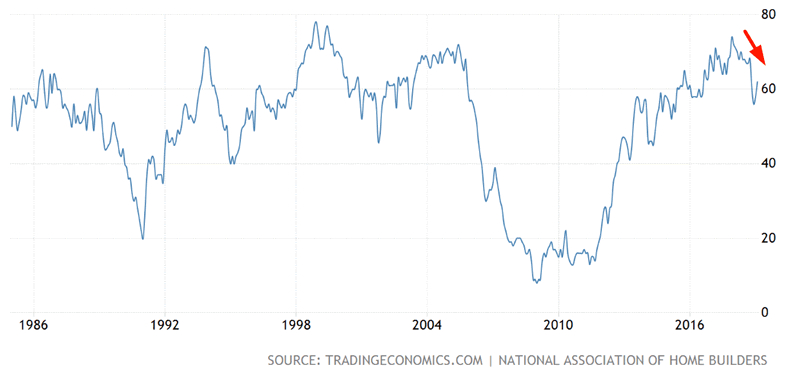

Recent readings for the housing market rebounded a little. However, the key point is that housing remains in a downtrend.

Here’s the main trend in the NAHB Housing Market Index.

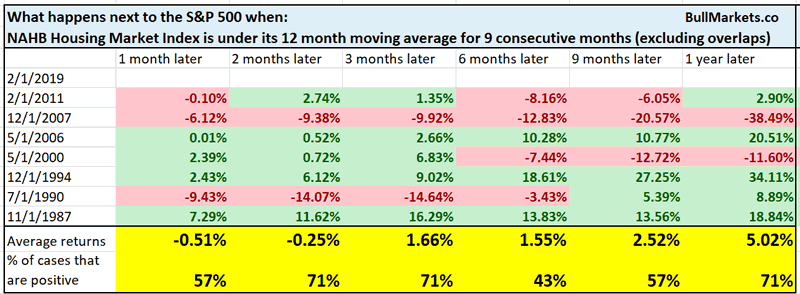

Here’s what happens next to the S&P when the NAHB Housing Market Index is under its 12 month moving average for 9 consecutive months.

This happens near a lot of problems in the stock market and U.S. economy.

- November 1987: this occurred after the October 1987 crash.

- July 1990: this occurred at the start of the 1990 recession and -20% stock market decline

- December 1994: this was a false signal. The economy deteriorated a little in early 1995, yet the stock market soared

- May 2000: this occurred at the top of the dot-com bubble. It was followed by a massive -50% bear market

- May 2006: this occurred 1.5 years before the 2007-2009 bear market

- December 2007: this occurred at the start of the 2007-2009 bear market

- February 2011: a -20% stock market decline began 5 months later

This generally isn’t a good sign for the stock market. It’s not immediately bearish, but it is something bulls should watch out for IF the downtrend in housing persists.

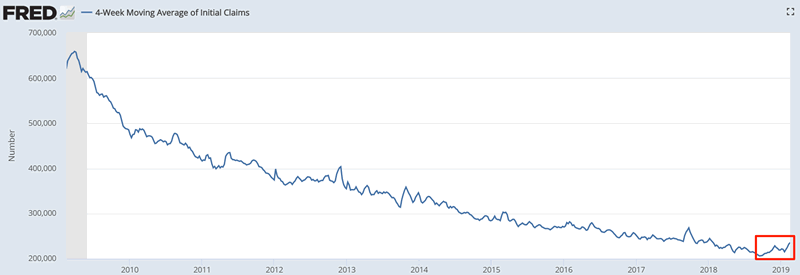

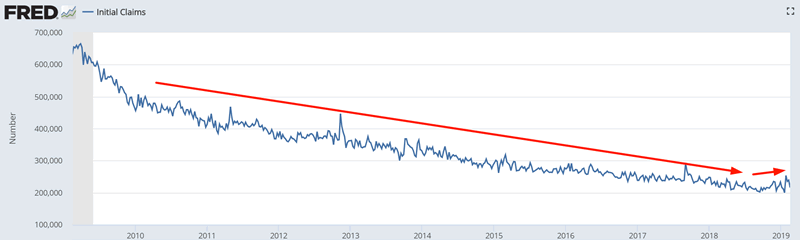

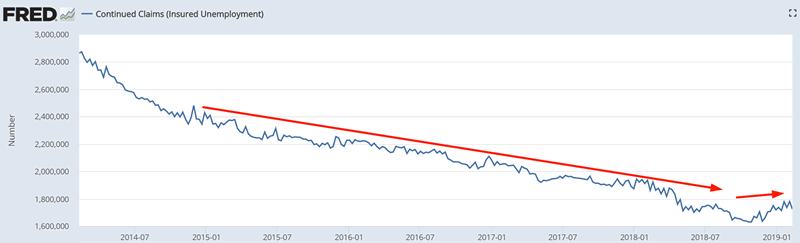

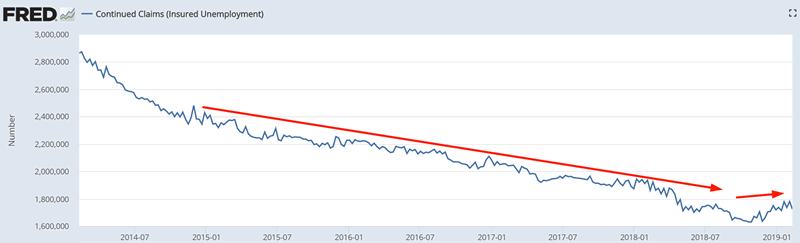

Meanwhile, Initial Claims’ 4 week average is ticking up.

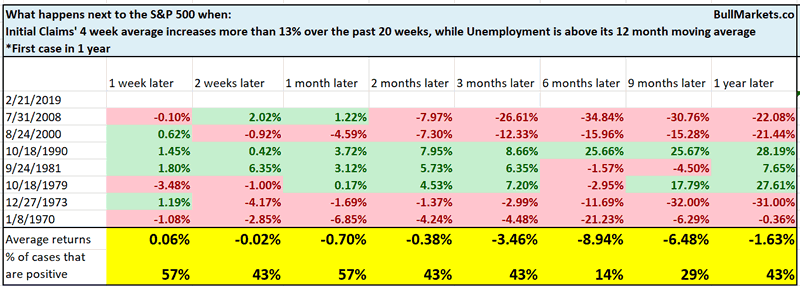

Here’s what happens next to the S&P when Initial Claims’ 4 week moving average rises more than 13% over the past 20 weeks, while the Unemploymnt Rate is above its 12 month moving average.

As you can see, this is quite bearish for stocks 6-9 months later.

The recent rise in Initial Claims and Unemployment may be attributed to the government shutdown. Hence, I would consider this to be a long term warning sign for stocks instead of a long term bearish sign. Bulls should watch out if this persists.

Initial Claims and Continued Claims are trending sideways. Historically, these 2 leading indicators trended upwards before bear markets and recessions began. This is something that bulls should watch out for IF Initial Claims and Continued Claims trend upwards significantly over the next few months.

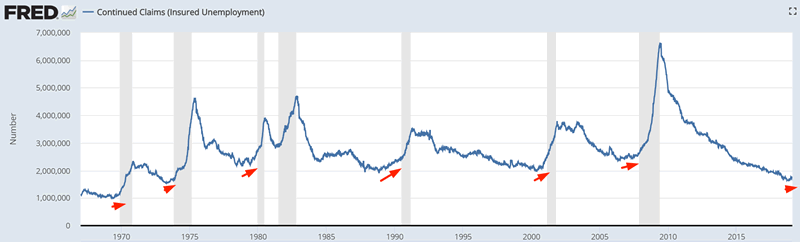

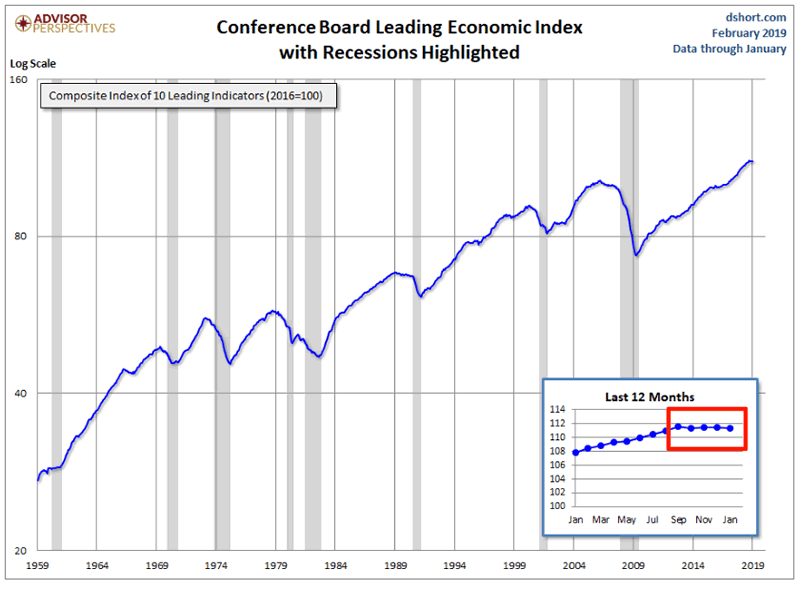

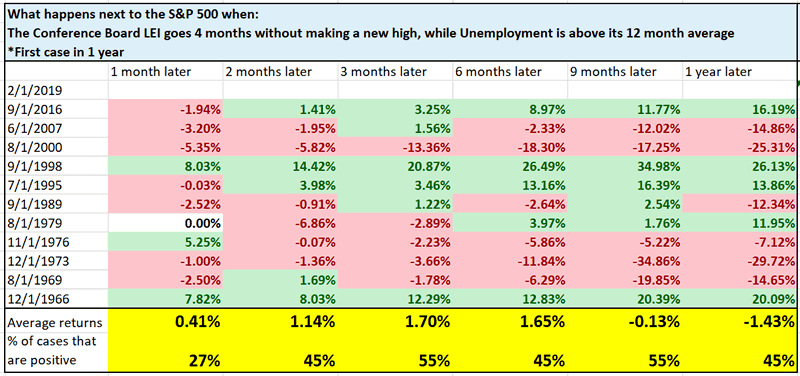

The Conference Board’s Leading Economic Index has gone 4 months without making a new high.

This is not worrisome on its own. But combined with other signs of macro slowdown, it is a problem.

Here’s what happens next to the S&P when the Conference Board LEI goes 4 months without making a new high, while Unemployment is above its 12 month moving average.

As you can see, the stock market’s forward returns are less bullish than random.

Once again, we treat this as a warning sign instead of a long term bearish sign because the recent weakness in the labor market may be attributed to the government shutdown. Watch out if this persists another few months, when the effects of the shutdown wear off.

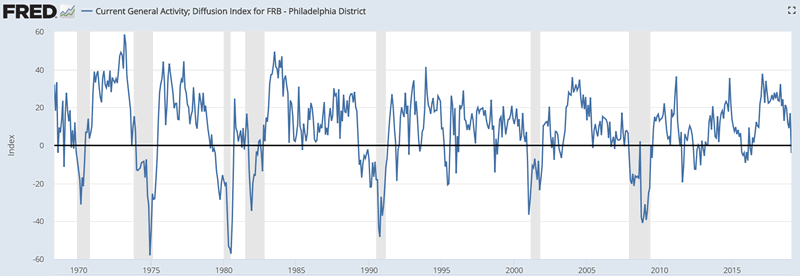

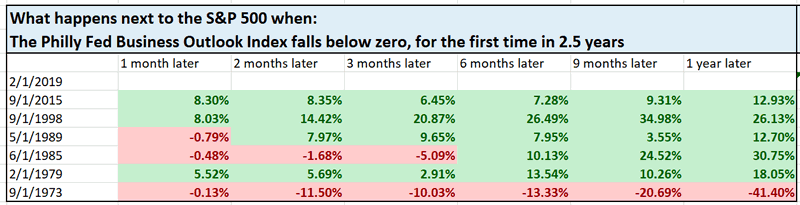

The Philadelphia Fed’s Business Outlook Index fell below zero for the first time since 2016. Surprisingly, this is more bullish than bearish for stocks.

Source: FRED

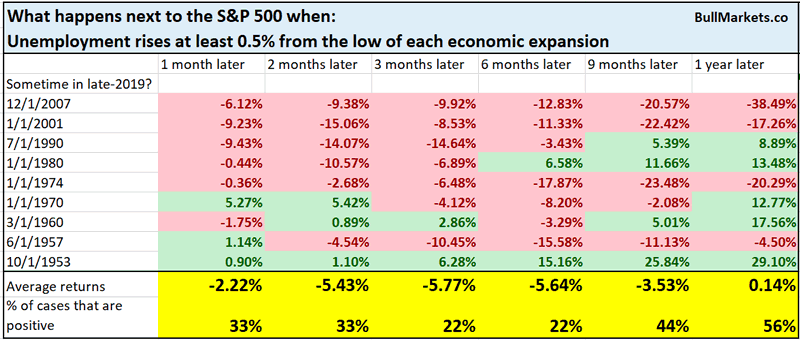

And lastly, the “Perfect Recession Indicator” (according to CNBC) has not yet been triggered, but is something to watch out for throughout the rest of 2019.

Historically, a 0.5% increase in Unemployment from the lowest reading in each economic expansion guaranteed that a recession had begun. Here’s what the S&P did next

As you can see, this is quite a bearish factor for the S&P. Perhaps this will trigger in the 2nd half of 2019, or in 2020. Who knows. Instead of guessing when unemployment will rise by 0.5%, we will let the data speak for itself and be ready when it does. Dont predict the data – react to it.

Conclusion: The stock market’s biggest long term problem right now is that as the economy reaches “as good as it gets” and stops improving, the long term risk is to the downside.

Economic deterioration is not significant yet, so the “bull market is over” case is not clear right now. We’re in a “wait and see the new data” mode. As long as the economic data doesn’t deteriorate significantly, the bull market could still last 1 more year.

Medium Term

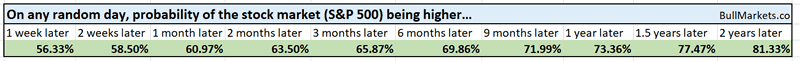

*For reference, here’s the random probability of the U.S. stock market going up on any given day, week, or month.

Macro has deteriorated a little, but the deterioration is not significant enough to warrant a full blown recession and bear market. Absent significant macro deterioration, this is a good sign for stocks in 2019.

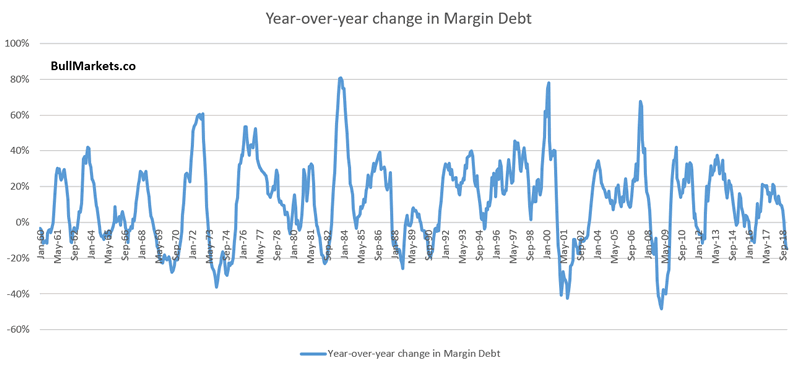

Margin debt in the stock market has fallen significantly over the past year

This was caused by the stock market’s poor performance in 2018, particularly in Q4 2018.

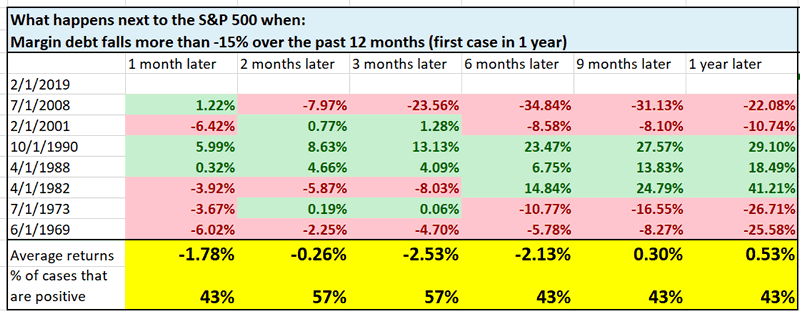

Here’s what happens next to the S&P when margin debt falls more than -15% over the past 12 months

We can see an interesting phenomenon. The stock market’s 6-12 month forward returns are either incredibly bullish, or incredibly bearish. There is no inbetween.

As we approach the end of a bull market, there’s always the possibility that the bull market will have 1 more leg higher, like in 1999. (Everyone thought 1998 would be the top, but it wasn’t).

This is what the market’s price action suggests.

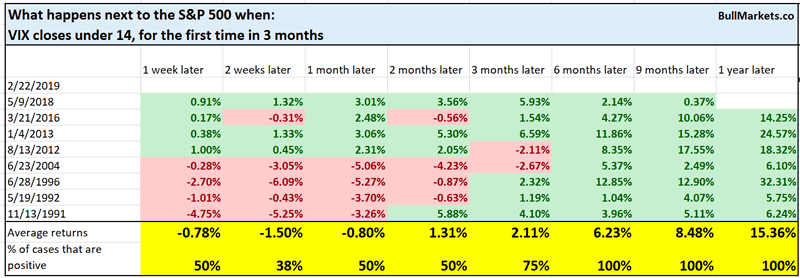

VIX has fallen below 14, for the first time in more than 3 months.

Source: Investing.com

Historically, this can be short term bearish for stocks, but is bullish 6-12 months later.

Why?

Because VIX (volatility) is typically more elevated in bear markets.

Source: Investing.com

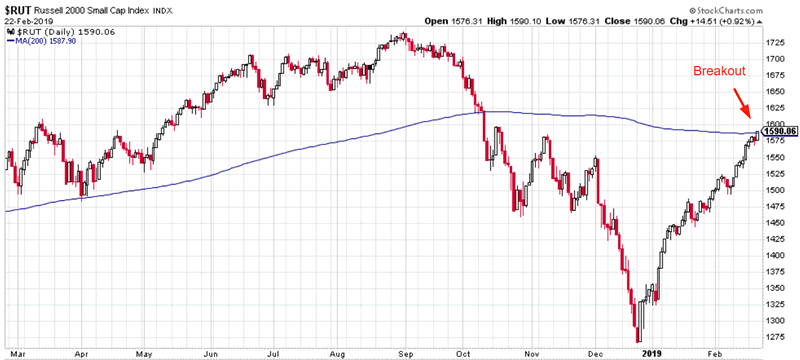

Meanwhile, the Russell 2000 (small caps index) has broken out above its 200 dma, after being deeply oversold.

Source: StockCharts

This is more bullish than bearish for stocks 2-12 months later.

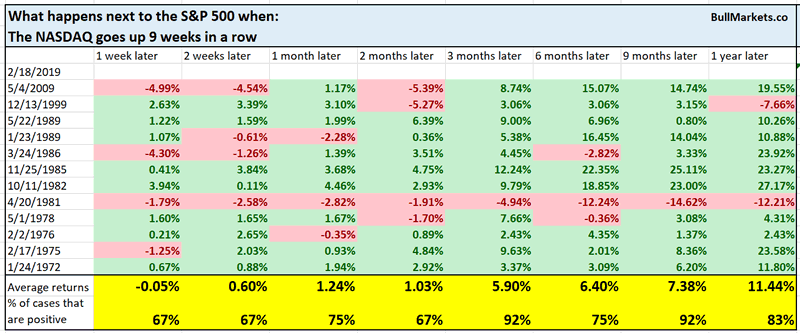

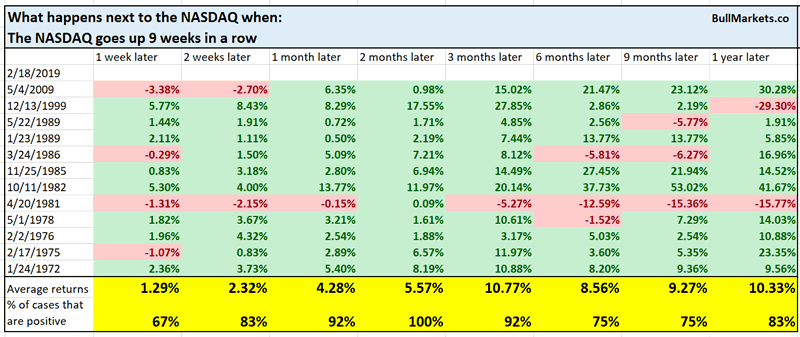

The NASDAQ is up 9 weeks in a row. This is more bullish than bearish for both the S&P and NASDAQ 3-12 months later

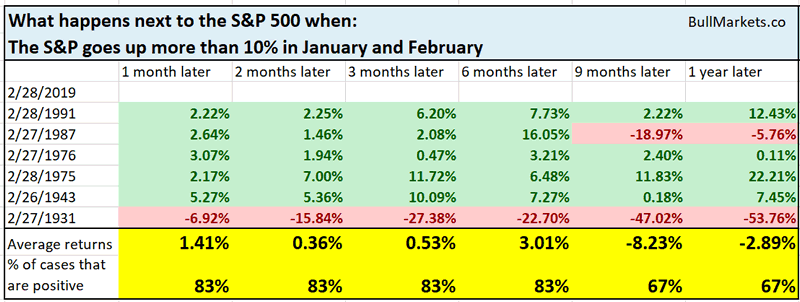

The S&P has gone up more than 11% in January and February so far. In terms of seasonality, this is a bullish start to the year

*Beware of seasonality factors, which can change on a dime. Seasonality should be of tertiary importance.

The stock market’s rally has been incessant. This has been one hell of a rally, with just 2 days in which the S&P lost more than -1%

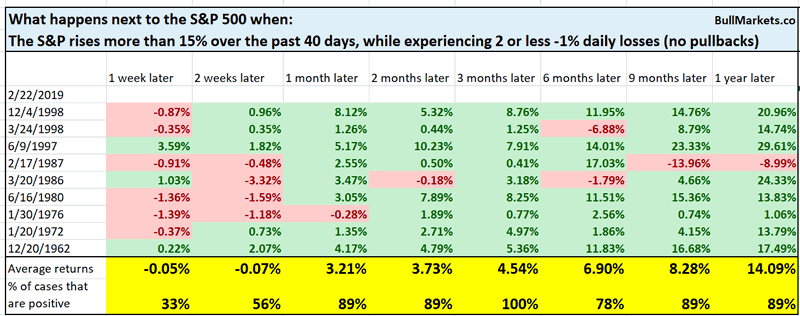

Here’s what happens next to the S&P when it rises more than 15% over the past 40 days, while experiencing 2 or less -1% daily losses.

While the stock market has a short term bearish lean, the 1-12 month forward returns are more bullish than random.

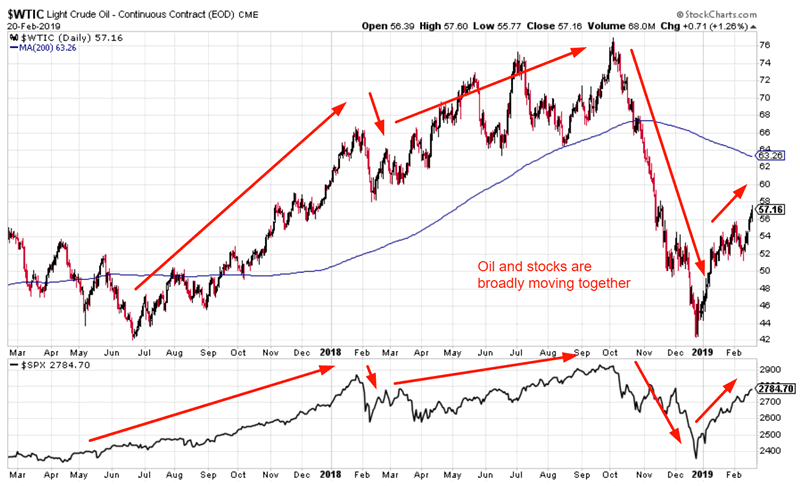

Oil has rallied along with the stock market, which is encouraging. Of all the global commodity markets, oil is most tied with global macroeconomic forces.

Source: StockCharts

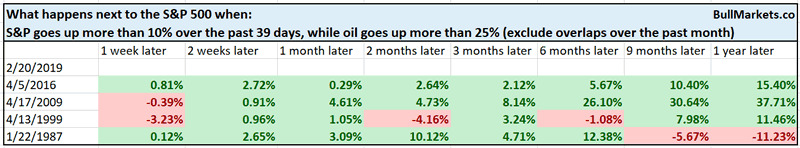

Here’s what happens next to the S&P when it goes up more than 10% over the past 39 days, while oil goes up more than 25%

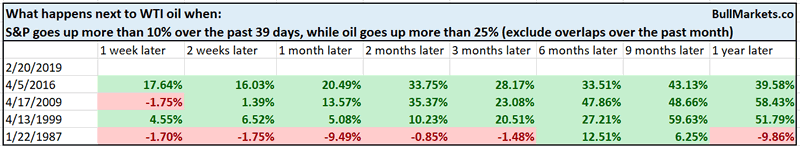

Here’s what happens next to oil

Mostly bullish for stocks and oil.

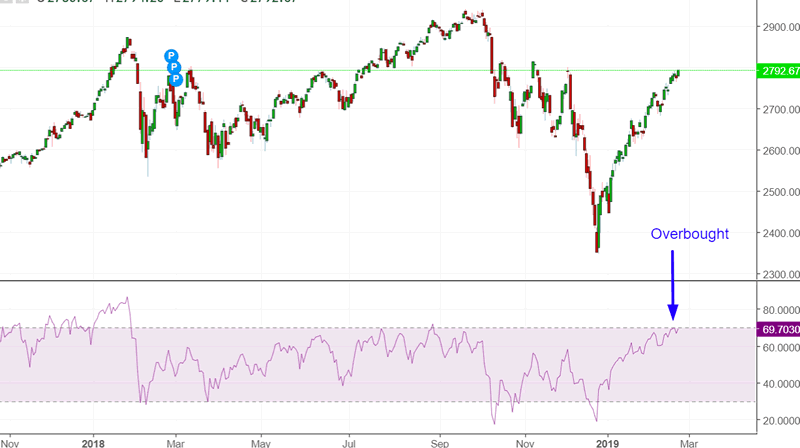

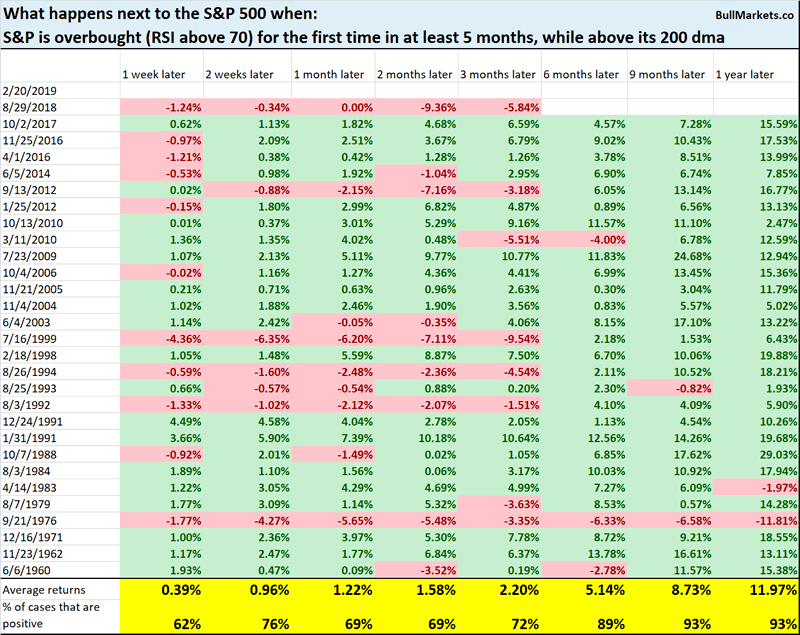

As of Wednesday, the S&P 500’s 14 day RSI became overbought for the first time in more than 5 months.

This is typically bullish for stocks 6-12 months later.

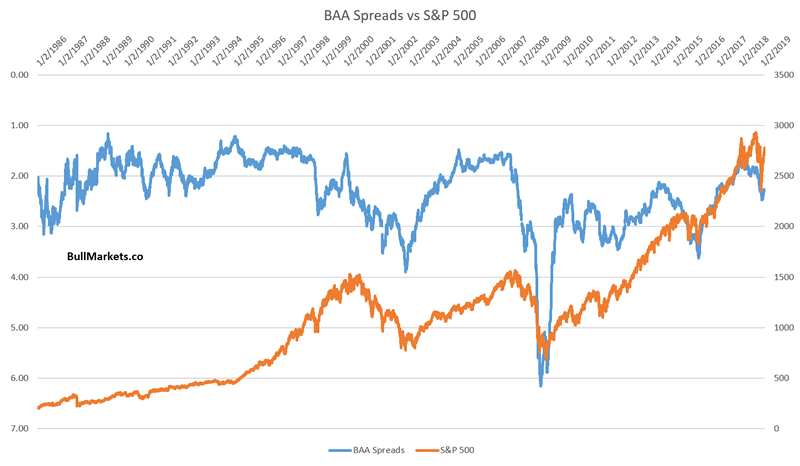

Baa corporate bond spreads widened when the stock market crashed in Q4 2018. Now that the stock market is rallying, corporate bond spreads are not narrowing significantly.

Source: FRED

Seeing that Baa spreads and the S&P have mostly had a positive correlation from 2016 – present, some prominent traders are seeing this divergence as a bearish sign of “non-confirmation”.

It isn’t.

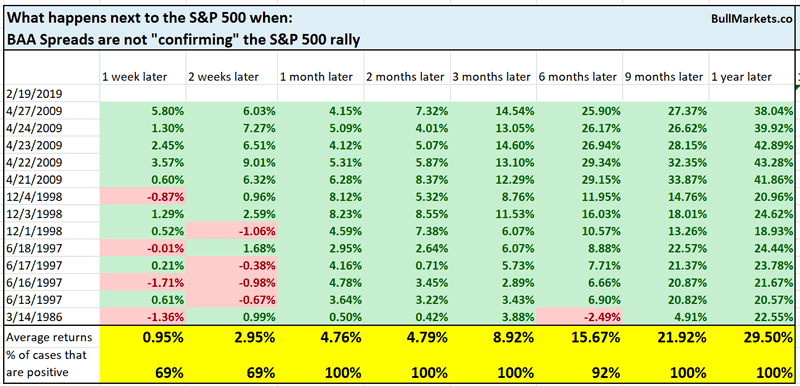

Here’s what happens next to the S&P when the S&P rallies more than 15% over the past 38 days, while Baa spreads narrow by less than -0.1

*Data from 1986 – present

Such “non-confirmations” are more bullish than bearish for stocks. Just because there’s a divergence or “non-confirmation” in the market, doesn’t make it useful.

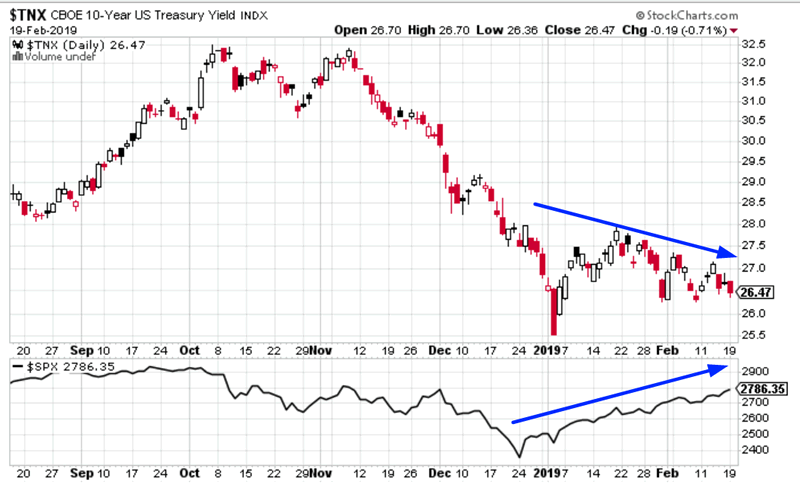

Bloomberg noted the “epic clash between stocks and bonds”. Bond yields are falling while stock prices are rallying.

Once again, this “divergence” and “non-confirmation” is not actually bearish for stocks

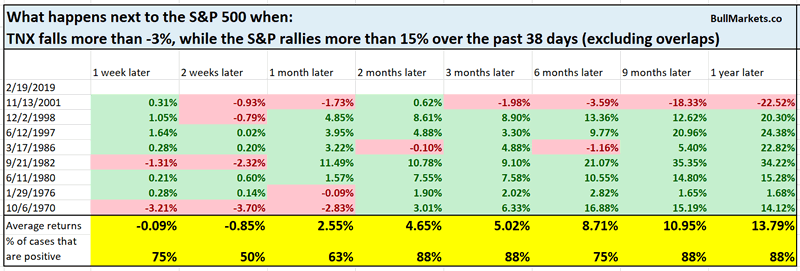

Here’s what happens next to the S&P when it rallies more than 15% over the past 38 days while TNX (the 10 year yield index) falls more than -3%

*Data from 1962 – present

Once again, more bullish than bearish for stocks 3-12 months later.

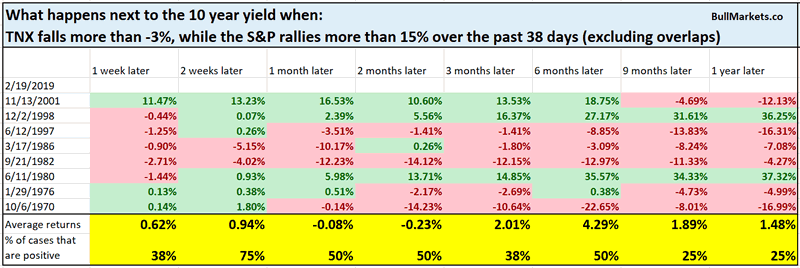

…And also more bearish than bullish for Treasury yields 9-12 months later

Short Term

The short term has a bearish lean, with the important caveat that the short term is extremely hard to predict, even when you think you have an edge. Many random and unpredictable factors impact the short term. That’s why we focus on the medium-long term and mostly ignore the short term.

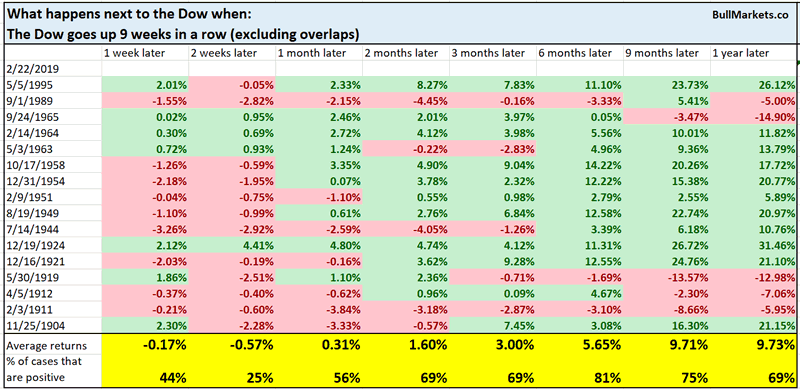

The Dow is up 9 weeks in a row. Historically, this is a bearish factor for the Dow 1-2 weeks later. All streaks eventually come to an end. (Emphasis on the “eventually”).

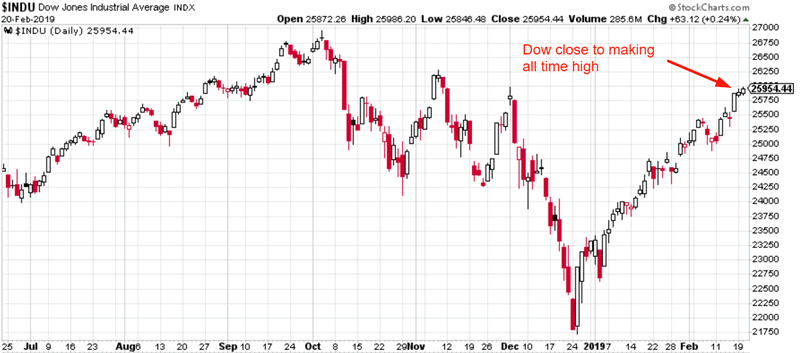

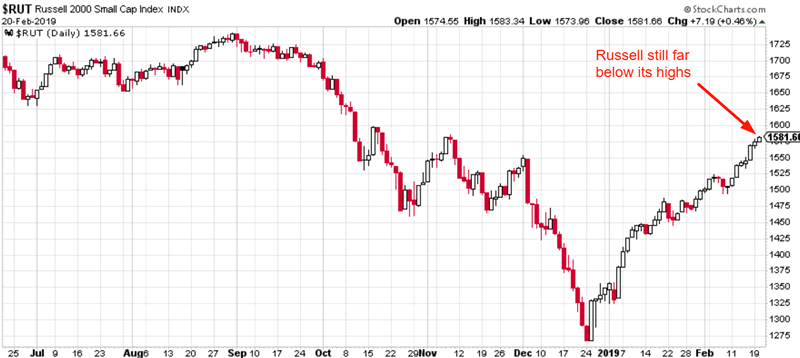

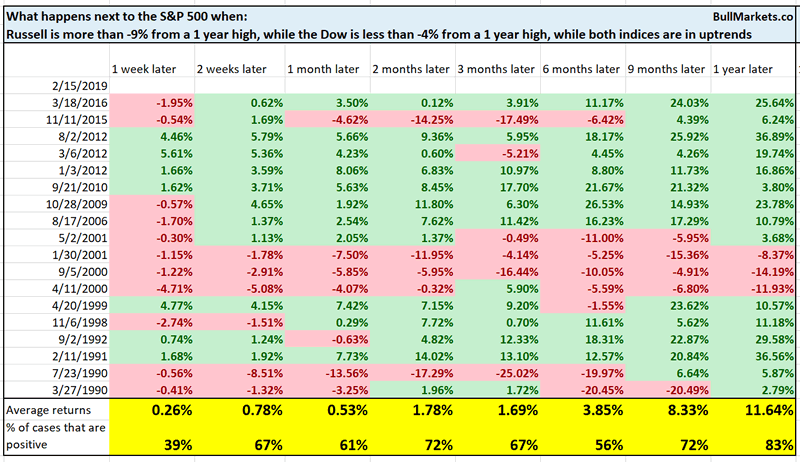

The Dow (large caps index) is much closer to making an all-time high than the Russell 2000 (small caps index).

Source: StockCharts

One would assume that this “divergence” is meaningful for determining the stock market’s long term direction.

It isn’t.

This is a short term bearish sign for the stock market, and nothing more.

Conclusion

Here is our discretionary market outlook:

- The U.S. stock market’s long term risk:reward is no longer bullish. In a most optimstic scenario, the bull market probably has 1 year left. Long term risk:reward is more important than trying to predict exact tops and bottoms.

- The medium term direction (i.e. next 6 months) is mostly neutral. There are a few more medium term bullish studies than medium term bearish studies

- The stock market’s short term has a bearish lean due to the large probability of a pullback/retest. Focus on the medium-long term because the short term is extremely hard to predict.

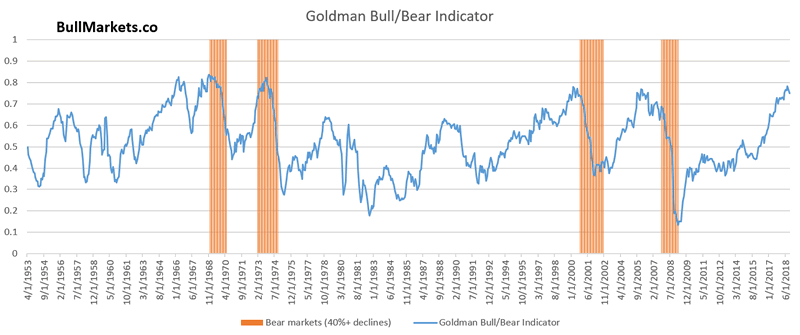

Goldman Sachs’ Bull/Bear Indicator demonstrates that while the bull market’s top isn’t necessarily in, risk:reward does favor long term bears.

Our discretionary outlook is not a reflection of how we’re trading the markets right now. We trade based on our quantitative trading models, such as the Medium-Long Term Model.

Members can see exactly how we’re trading the U.S. stock market right now based on our trading models.

Click here for more market studies

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.