How Chinese Trade Issues Will Drive Stock Market Trends

Stock-Markets / Stock Markets 2019 May 13, 2019 - 01:50 PM GMTBy: Chris_Vermeulen

It is becoming evident that the US/Chinese trade issues are going to become a point of contention for the markets going forward. We’ve been review as much news as possible in an attempt to build a consensus for the future of the US markets and global markets. As of last week, it appears any potential trade deal with China has reset back to square one. The news we are reading suggests that China wants to reset their commitments with the US, remove all tariffs and wants the US to commit to buying certain levels of Chinese goods in the future. Additionally, China has yet to commit to stopping the IP/Technology theft from US companies – which is a very big contention for the US.

It is becoming evident that the US/Chinese trade issues are going to become a point of contention for the markets going forward. We’ve been review as much news as possible in an attempt to build a consensus for the future of the US markets and global markets. As of last week, it appears any potential trade deal with China has reset back to square one. The news we are reading suggests that China wants to reset their commitments with the US, remove all tariffs and wants the US to commit to buying certain levels of Chinese goods in the future. Additionally, China has yet to commit to stopping the IP/Technology theft from US companies – which is a very big contention for the US.

This suggests the past 6+ months of trade talks have completely broken down and that this trade issue will likely become a market driver over the next 12+ months. The global markets had anticipated a deal to be reached by the end of March 2019. At that time, Trump announced that he was extending talks with China without installing any new tariffs. The intent was to show commitment with China to reach a deal at that time – quickly.

It appears that China had different plans – the intention to delay and ignore US requests. It is very likely that China has worked to secure some type of “plan B” type of scenario over the past 6+ months and they may feel they are negotiating from a position of power at this time. Our assumption is that both the US and China feel their interests are best served by holding their cards close to their chests while pushing the other side to breakdown through prolonged negotiations.

Our observations are that an economic shift is continuing to take place throughout the globe that may see these US/China trade issues become the forefront issue over the next 12 to 24 months – possibly lasting well past the November 2020 US Presidential election cycle. It seems obvious that China is digging in for a prolonged negotiation process while attempting to hold off another round of tariffs from the US. Additionally, China is dealing with an internal process of trying to shift away from “shadow banking” to eliminate the risks associated with unreported corporate and private debt issues.

The limited, yet still valid, resources we have from within China are suggesting that layoffs are very common right now and that companies are not hiring as they were just a few months ago. One of our friends/sources suggested the company he worked for has been laying off employees for over 30 days now and he just found out he was laid-off last week. He works in the financial field.

We believe the long term complications resulting from a prolonged US/China trade war may create a foundational shift within the global markets over the next 16 to 24+ months headed into the November 2020 US Elections. We’ve already authored articles about how the prior 24 months headed into major US elections tend to be filled with price rotation while an initial downside price move is common within about 16+ months of a major US election event. This year may turn out to prompt an even bigger price rotation.

US Stock Market volatility just spiked to levels well above 20 – levels not seen since October/November 2018, when the markets fell nearly 20% before the end of 2018. The potential for increased price volatility over the next 12+ months seems rather high with all of the foreign positioning and expectations that are milling around. It seems like the next 16+ months could be filled with incredibly high volatility, price rotation and opportunity for skilled traders.

Our primary concern is that the continued trade war between the US and China spills over into other global markets as a constricted price range based trading environment. Most of the rest of the world is still trying to spark some increased levels of economic growth after the 2008-09 market crisis. The current market environment does not settle well for investor confidence, growth, and future success. The combination of a highly contested US Presidential election, US/China trade issues, a struggling general foreign market, currency fluctuations attempting to mitigate capital risks and other issues, it seems the global stock markets are poised for a very big increase in volatility and price rotation over the next 2 years or so.

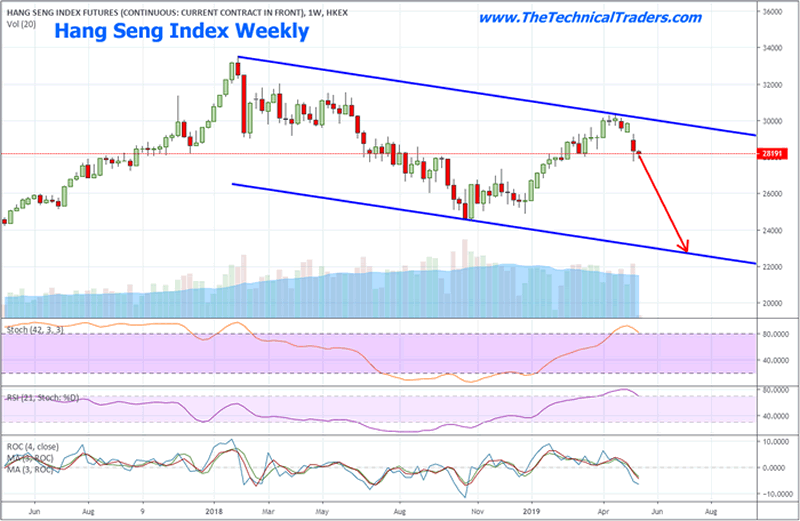

Our first focus is on the Hang Seng Index. This Weekly chart shows just how dramatic the current price rotation has been over the past few weeks and how a defined price channel could be setting up in the HSI to prompt a much larger downside objective. Should continue trade issues persist and should China, through the course of negotiating with the US, expose any element of risk perceived by the rest of the world, the potential for further price contraction is very real. China is walking a very fine line right now as Trump is pushing issues (trade issues and IP/Technology issues) to the forefront of the trade negotiations. In our opinion, the very last thing China wants is their dirty laundry, shady deals and political leadership strewn across the global news cycles over the next 24+ months.

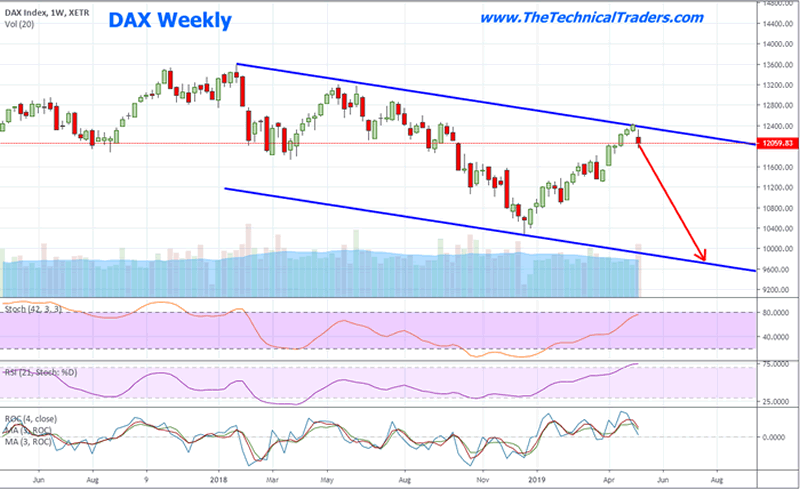

The DAX Weekly Index is showing a similar price pattern. A very clear upper price trend channel which translates into a very clear downside price objective is price continues lower. Although the DAX is not related directly to the US/China trade negotiations, the global markets are far more interconnected now than ever before. Any rotation lower in China will likely result in a moderate price decrease in many of the major global market indexes.

As we’ve suggested within our earlier research posts, US election cycles tend to prompt massive price rotations when the election cycles are intense. In our next post PART II of this report, we talk about what happened in the past election cycles reviewing the monthly charts and weekly SP500 index charts which are very telling in what could be about to happen next for the stock market from an investors standpoint.

For active swing traders, you are going to love our daily trading analysis. On May 1st we talked about the old saying goes, “Sell in May and Go Away!” and that is excactly what is happening now right on queue. In fact, we closed out our SDS position on Thursday for a quick 3.9% profit and our other new trade started Thursday is up 18% already.

Second, my birthday is only three days away and I think its time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

Right now I am going to give away and shipping out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. I only have 7 left as they are going fast so be sure to upgrade your membership to a longer-term subscription or if you are new, join one of these two plans, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE (Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE (Could be worth a lot in the future)

I only have 13 more silver rounds I’m giving away so upgrade or join now before its too late!

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Happy May Everyone!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.