Is Someone Secretly Smashing the Stock Market at Night?

Stock-Markets / Stock Markets 2019 May 16, 2019 - 10:43 AM GMTBy: Troy_Bombardia

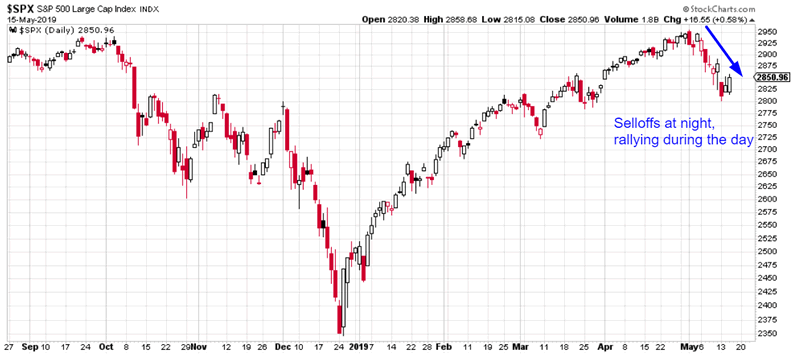

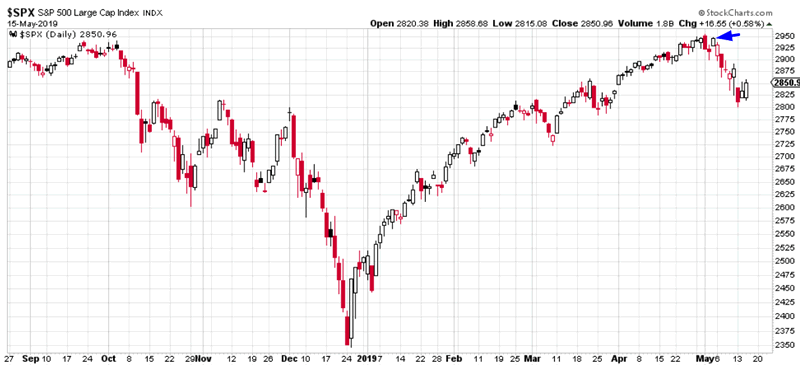

The stock market has been rallying throughout the day and selling off at night throughout the recent stock market decline. Is this the sign of something more sinister that’s going on in the stock market. Meanwhile, interest rates are falling.

Go here to understand our fundamentals-driven long term outlook.

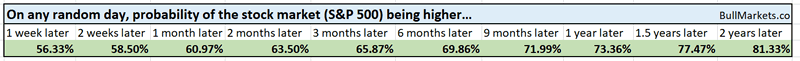

Let’s determine the stock market’s most probable medium term direction by objectively quantifying technical analysis. For reference, here’s the random probability of the U.S. stock market going up on any given day.

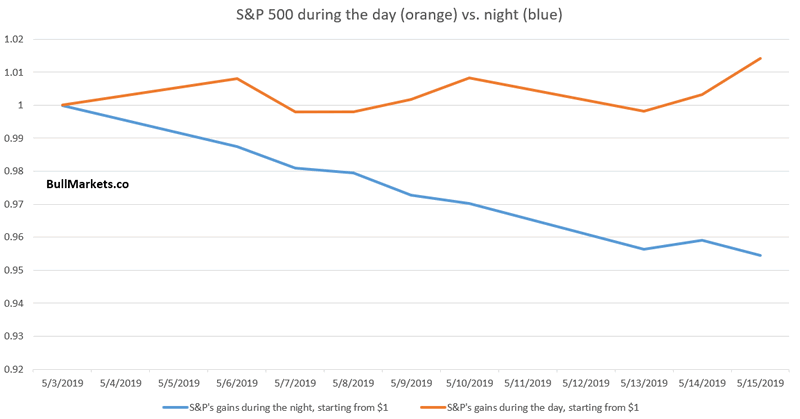

Night vs Day

Over the past 8 days, the S&P has rallied more than 1% during the day and fallen more than -4% at night. From 1962 – present, this is the first time this has happened.

One could argue “in the midst of a trade war, foreign investors are selling U.S. futures (overnight) while domestic investors are buying (daytime).” A more conspiracy driven explanation would be “China is selling U.S. stocks to hit back at the U.S. during this trade war”.

We don’t guess or create random theories to explain why the stock market is doing what it is doing. Most of those guesses are no better than 50/50 bets. Instead, we just look at the data.

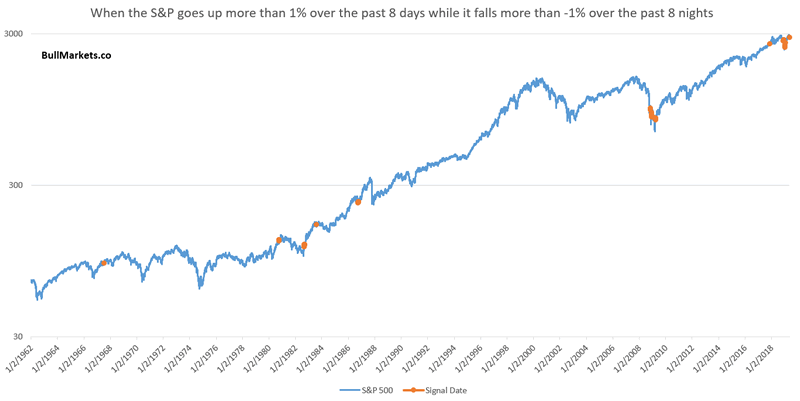

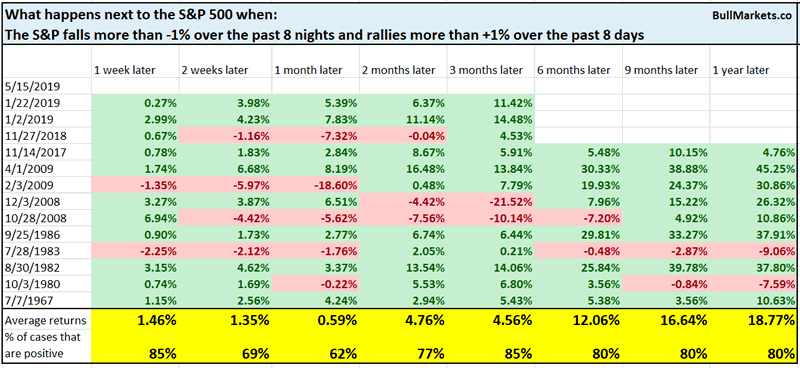

To increase the sample size, we can look at all the cases in which the S&P rallied more than 1% over the past 8 days while it fell more than -1% over the past 8 nights.

There’s a bullish lean over the next 1 week, although I’m not sure why this is.

Industrial Production

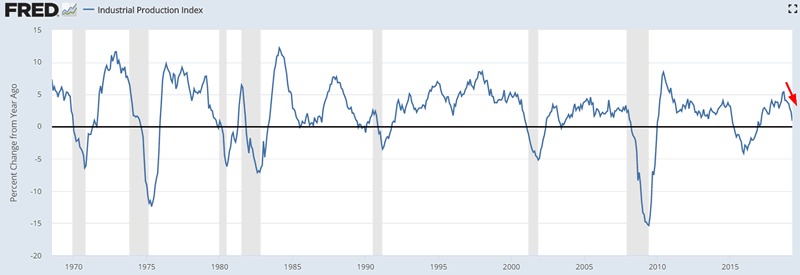

The media has been all over falling Industrial Production growth today.

Industrial Production is broken down into 3 groups:

- Manufacturing. This is the largest group, and is most important.

- Mining.

- Utilities.

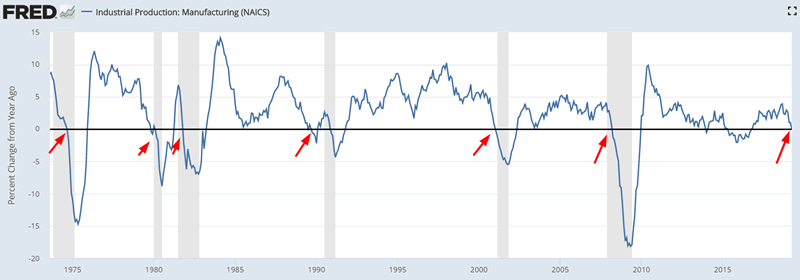

Industrial Production Manufacturing growth has already turned negative. This has often occurred during recessions, although there are some false signals (see 2014, 2015).

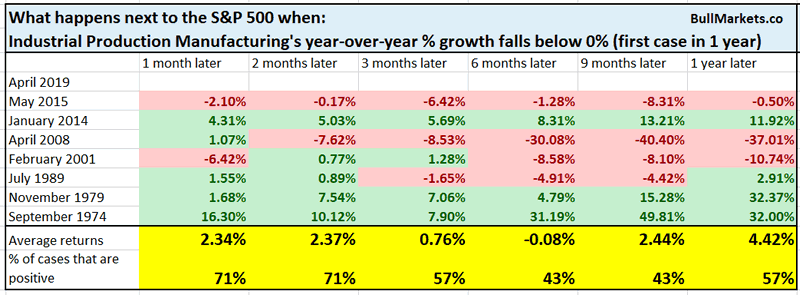

Here’s what happens next to the S&P when Industrial Production Manufacturing’s year-over-year % growth falls below 0%

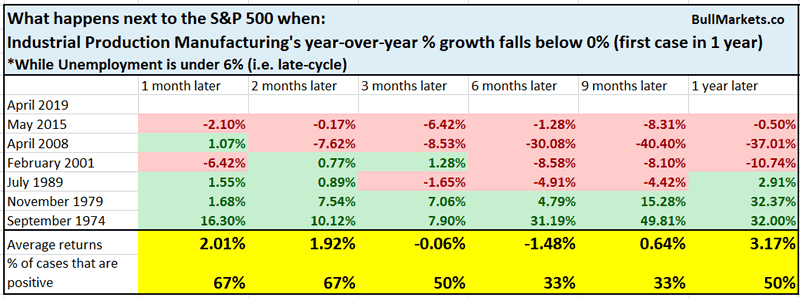

If we only look at the late-cycle cases (when unemployment is under 6%), it becomes a little more ominous:

Industrial Production is a weak point in macro right now. However, this is not one of the best leading indicators for the U.S. economy and stock market

Housing is improving?

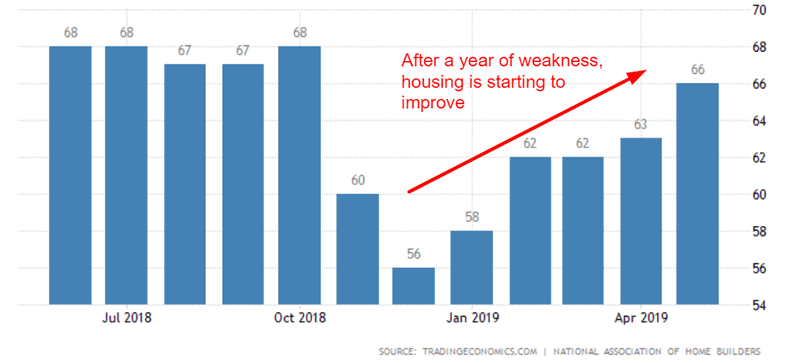

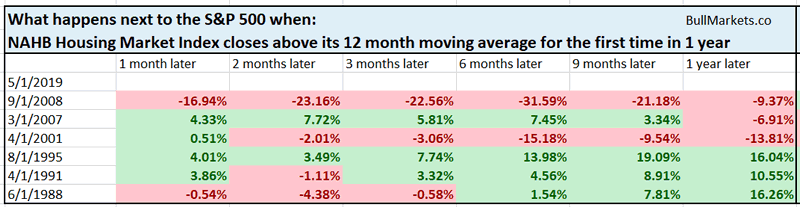

After sustained weakness in 2018, housing seems to be improving. Here’s the NAHB Housing Market Index.

Housing is a key leading component of the U.S. economy. Since the U.S. economy and U.S. stock market move in the same direction in the long term, housing is also a key leading indicator for the stock market.

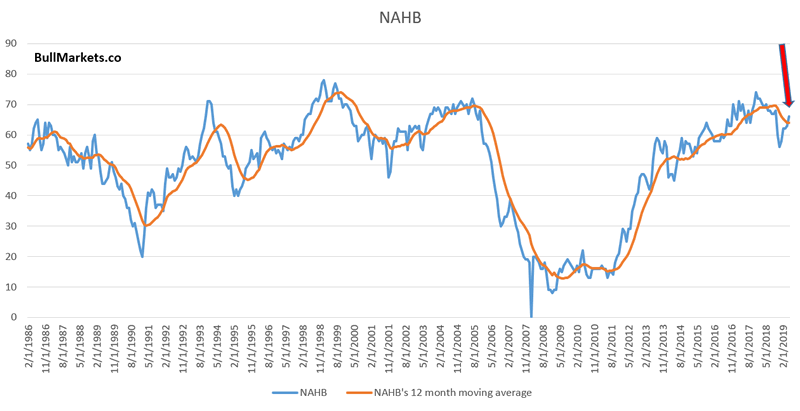

You can see that NAHB has cleared above its 12 month moving average for the first time in 1 year.

Here’s what happens next to the S&P when NAHB closes above its 12 month moving average for the first time in 1 year.

Not quite consistently bullish. It’s better to wait for a sustained housing breakout before turning optimistic on housing. You can see that there are plenty of 1 month false breakouts in 2001 and 2008.

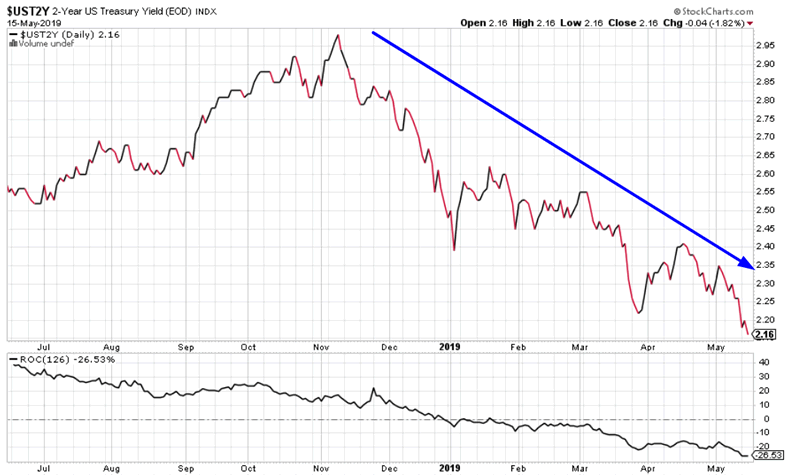

Treasury yields

Just last year everyone was “worried about rising interest rates”. This year, everyone is “worried about falling interest rates”. Reason?

The market is pricing in a rate cut. When the Fed cuts interest rates, it means that the economy is sliding into a recession.

*There is some validity to this theory. However, I think that guessing when the Fed will cut/hike interest rates is no better than a 50/50 coin toss. The Fed has not cut rates yet.

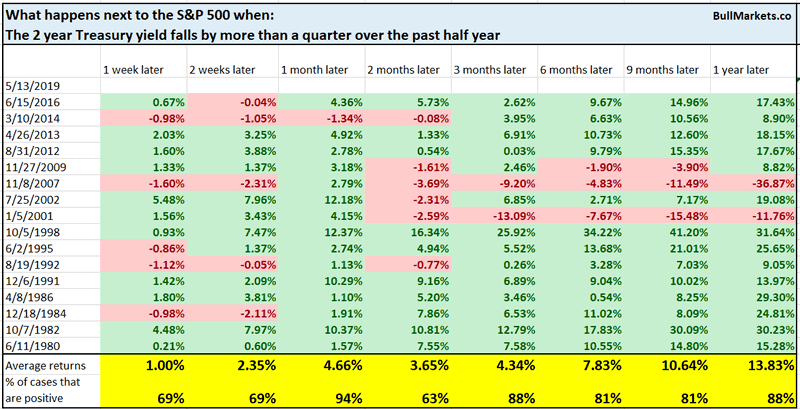

You can see that the 2 year Treasury yield has fallen by a quarter over the past half year. Contrary to popular belief, this is not a consistently bearish factor for the stock market.

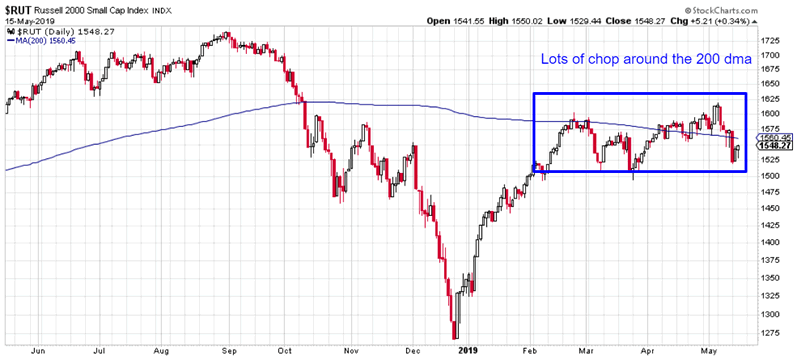

Russell’s continued indecision

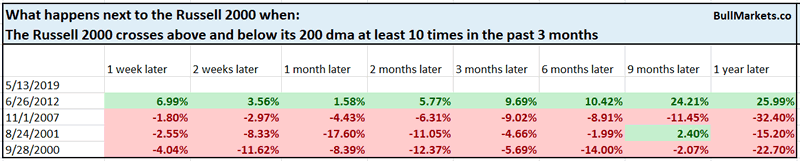

The Russell continues to be indecisive around its 200 day moving average. It has crossed above and below its 200 dma 10 times in the past 3 months.

Historically, this happened at bull market tops (2000 and 2007).

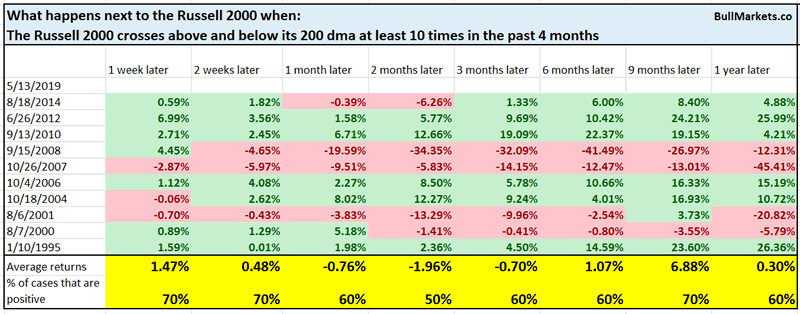

But the sample size is small. What if we increased the sample size by expanding the parameters? Here’s what happens next to the Russell when it crosses above and below its 200 dma at least 10 times in the past 4 months.

Not as ominous for stocks.

Breadth galore

Traders love breadth indicators. And right now, long term breadth indicators like the NYSE, Dow, and NASDAQ Summation Indices are falling.

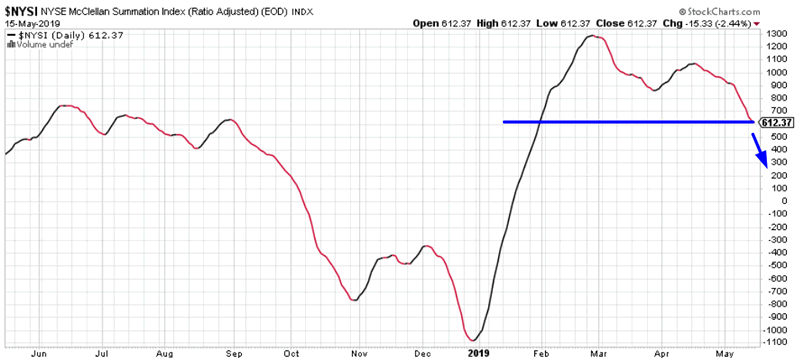

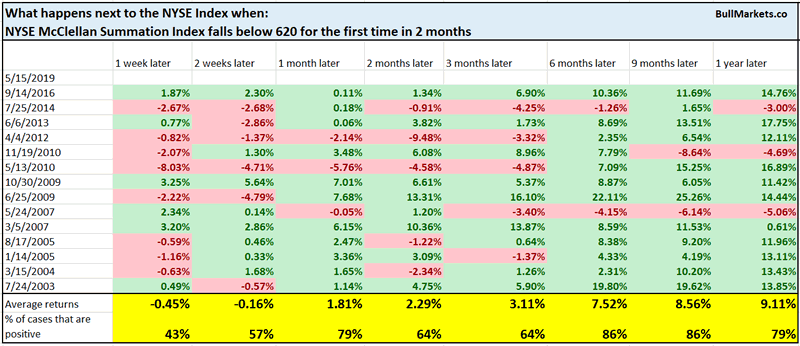

Here’s the NYSE McClellan Summation Index

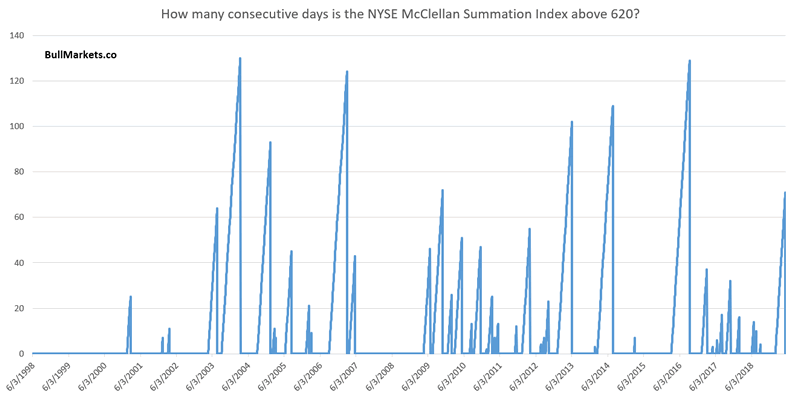

This marks the end of a long streak above 620

Here’s what happens next to the NYSE Index when the NYSE McClellan Summation Index falls below 620 for the first time in 2 months.

Short term bearish, mostly bullish 6-12 months later.

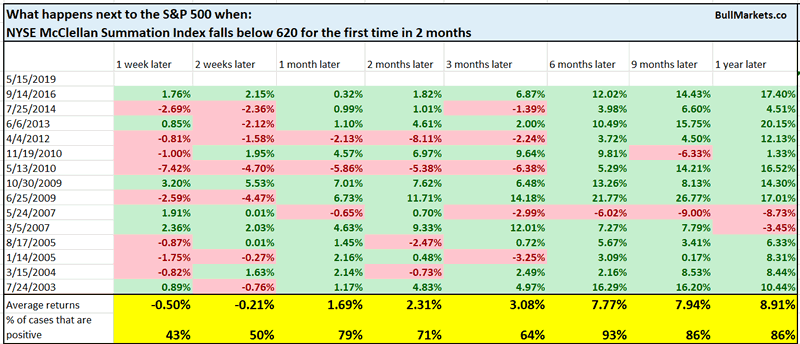

Here’s what happens next to the S&P.

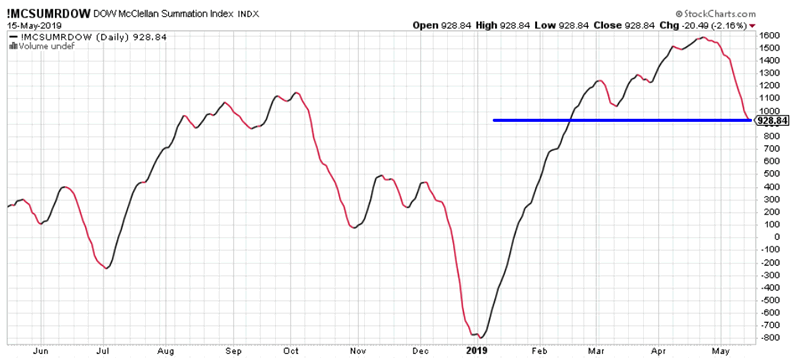

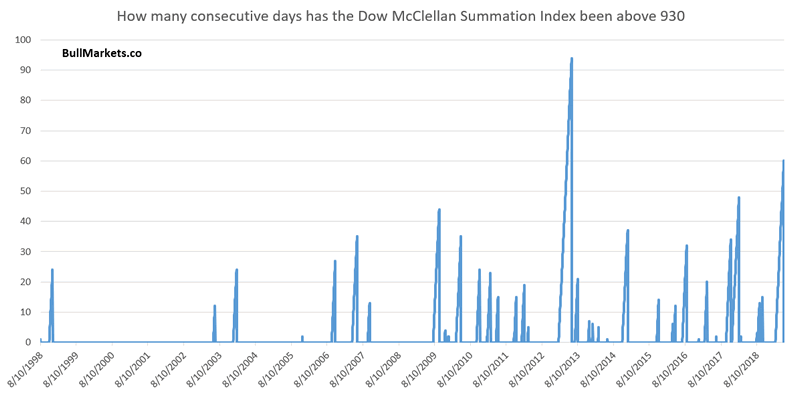

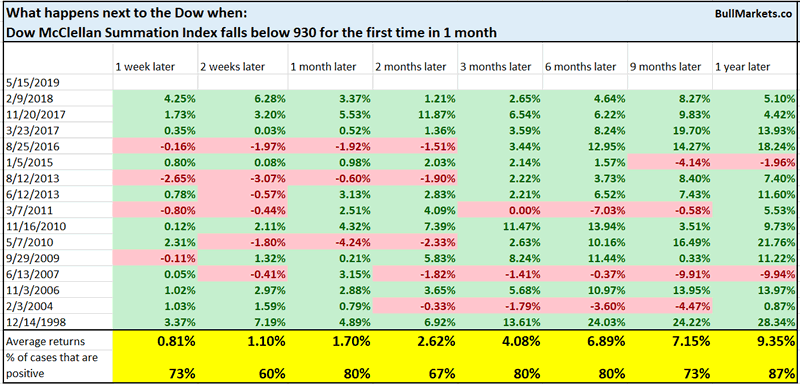

The Dow McClellan Summation Index is also falling.

This marks the end of a long streak above 930

Here’s what happens next to the Dow when the Dow McClellan Summation Index falls below 620 for the first time in 1 months.

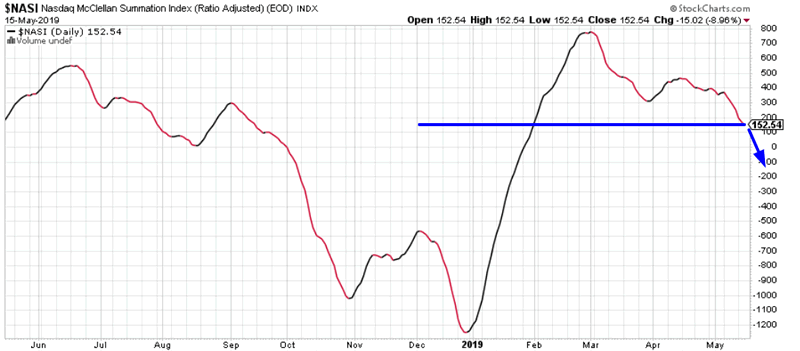

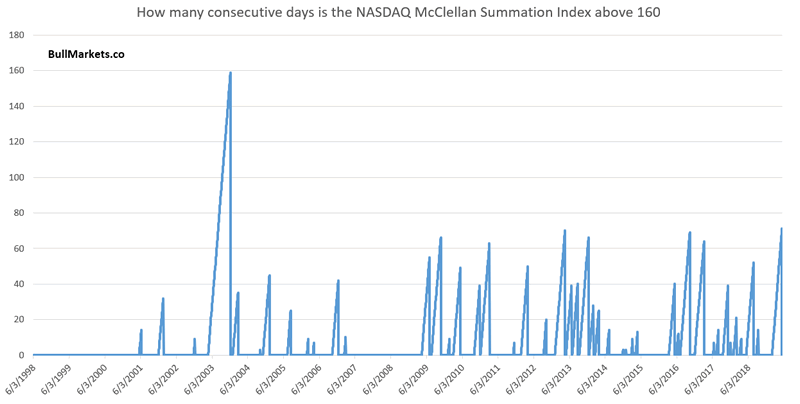

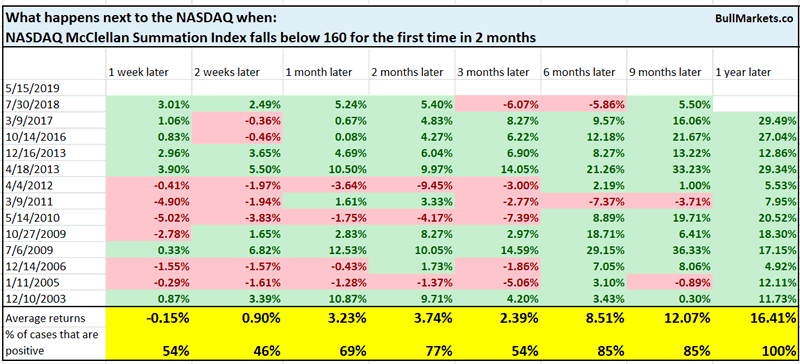

And lastly, the NASDAQ McClellan Summation Index is also falling.

Once again, this is slightly short term bearish and medium term bullish for the NASDAQ.

Read Is the economy about to tip in a recession? What this means for stocks

We don’t use our discretionary outlook for trading. We use our quantitative trading models because they are end-to-end systems that tell you how to trade ALL THE TIME, even when our discretionary outlook is mixed. Members can see our model’s latest trades here updated in real-time.

Conclusion

Here is our discretionary market outlook:

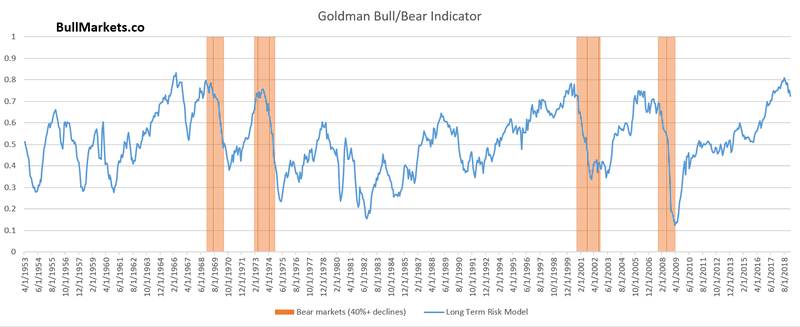

- The U.S. stock market’s long term risk:reward is no longer bullish. In a most optimistic scenario, the bull market probably has 1 year left. Long term risk:reward is more important than trying to predict exact tops and bottoms.

- The medium term direction (e.g. next 6-12 months) leans bullish

- The short term is very noisy right now. There is no clear risk:reward edge in either direction (bullish or bearish). Some short term market studies are bullish, and others are bearish. And with trade war news flying left and right, we have even less conviction for the short term than usual.

Goldman Sachs’ Bull/Bear Indicator demonstrates that risk:reward does favor long term bears.

Click here for more market analysis

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2019 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.