Dow Stock Market Trend Forecast 2019 May Update

Stock-Markets / Stock Markets 2019 May 18, 2019 - 02:46 PM GMTBy: Nadeem_Walayat

My in-depth analysis first made avilable to patrons who support my work on the of 1st March 2019 Stock Market Trend Forecast March to September 2019 concluded in the trend forecast for the Dow to achieve at least 28,000 by Mid September 2019.

At the update of April 7th update (https://www.patreon.com/posts/stock-market-dow-25930920) the stock market was running ahead of the forecast by some 700 points.

When I warned to expect the stock market to converge towards my trend forecast rather than continue trending higher.

However, with stocks approaching resistance at previous all time highs I consider the most probable outcome is for the Dow is to converge towards my trend forecast during the remainder of April.

Which brings us to the present:

The stock market converged with the forecast trend by the end of April with SELL in MAY and GO AWAY kicking in a couple of weeks earlier than original anticipated it would a couple of months ago.

This analysis was first made available to Patrons who support my work: https://www.patreon.com/posts/stock-market-us-26752779

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Technical Analysis

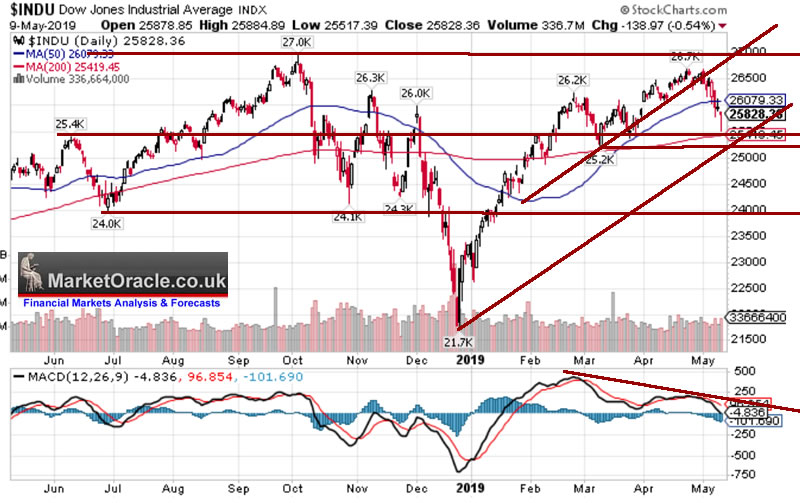

- The Dow put in a lower high before turning lower which targeted the previous lows of 25,200 to 25,400 which was achieved Thursday.

- The Dow put in a lower high than the forecast before turning lower, which implied to expect the Dow to trade lower to below the forecast low of 25,400.

- Support is at 25,200 and resistance at 26,700 and 27,000.

- Support trendline comes in at 25.000

- The immediate trend is down, towards support.

- MACD is bearish suggests more price weakness.

Sell in May and Go Away - Seasonal pattern is for a weak May into June.

The Dow is correcting in May as expected, the deviation from the forecast is that the correction kicked in a couple of weeks earlier than forecast. Coming off a lower high the trend is weaker than forecast which translates into a break of the 25,500 low to target 25,200. Since the Dow's not traded at 25,200 yet implies were not done on the downside and the market may spike lower still, so the market is going to be weak but not violently so i.e. the last close is 25828 so initial downside is limited to another 600 points or so.

Conclusion : The Dow is overall likely to trade within a tight trading range of 26,500 to 25,200 for the next month or so as the Dow converges towards the trend forecast by Mid June. In plain English, I expect the Dow to meet the forecast trend (RED line) by the Mid June low before resuming the bull market to new all time highs.

At the end of the day look for opportunities in this correction to accumulate into the machine intelligence mega-trend stocks, though be wary of those with significant exposure to China, Apple, Baidu etc as they will exhibit greater price volatility. Though will take a closer look at the prospects for the SSEC this month.

Top 10 AI Stocks - https://www.patreon.com/posts/top-10-ai-stocks-25779914

The bottom line is the bull market party isn't over, it's in a necessary correction off of the Dow hitting resistance after a strong March / April bull run.

May Analysis Schedule :

- Stock Market Trend Forecast Update

- Machine Intelligence Investing stocks sub sector analysis

- UK Housing market ongoing analysis.

- Gold / SIlver trend forecast update.

- China Stock Market SSEC

April Analysis:

- US House Prices Trend Forecast 2019 to 2021

- Bitcoin Price Trend Forecast 2019 Update

- Stock Market Dow Trend Forecast - April Update

- Top 10 AI Stocks for Investing to Profit from the Machine Intelligence Mega-trend

Your analyst, watching events through the prism of a multi-decade US - China WAR!

And ensure you are subscribed to my FREE Newsletter to get this analysis in your email in box (only requirement is an email address).

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.