WaMu America's Biggest Bank Failure

Stock-Markets / Financial Markets Sep 27, 2008 - 11:28 AM GMT In what is by far the largest bank failure in U.S. history, federal regulators seized Washington Mutual Inc. and struck a deal to sell the bulk of its operations to J.P. Morgan Chase & Co.

In what is by far the largest bank failure in U.S. history, federal regulators seized Washington Mutual Inc. and struck a deal to sell the bulk of its operations to J.P. Morgan Chase & Co.

The collapse of the Seattle thrift, which was triggered by a wave of deposit withdrawals, marks a new low point in the country's financial crisis. But the deal, as constructed by the Federal Deposit Insurance Corp., could hold some glimmers of hope for the beleaguered banking system because it averts any hit to the bank-insurance fund.

Instead, J.P. Morgan agreed to pay $1.9 billion to the government for WaMu's banking operations and will assume the loan portfolio of the thrift, which has $307 billion in assets. The full cost to J.P. Morgan will be much higher, because it plans to write down about $31 billion of the bad loans and raise $8 billion in new capital. All WaMu depositors will have access to their cash, but holders of more than $30 billion in debt and preferred stock will likely see little if any recovery. (Source: Wall Street Journal)

A bit more precisely, J.P. Morgan paid $1.9 billion for WaMu's deposits and real estate. It got the questionable $307 billion portfolio at no cost. In addition, it received $31 billion in tax losses for which it paid nothing. What a deal! At a corporate tax rate of 35%, JPM instantly made $10.85 billion in tax write-offs alone. Economically, J.P. Morgan expects the takeover to add earnings of 50 cents per share in 2009.

A free ride.

What we are seeing here is the healthy institutions taking a free ride on the fears of the general public and the administrators at the FDIC. The FDIC wants to have a “seamless” takeover of failed banks, to keep the general public from panicking. However, the healthy banks are holding out for the best deal they can get in this situation. By staying away from the auction being held last week for Washington Mutual, J.P. Morgan was able to cut a very profitable deal for itself.

Pelosi says, “Bailout has to happen.”

U.S. House Speaker Nancy Pelosi said Friday that she expects lawmakers to reach agreement on a $700 billion Wall Street bailout package because “it has to happen.” In an interview with ABC's “Good Morning America,” the California Democrat said she hoped lawmakers would reach final agreement within the next 24 hours so that the House and Senate could act on legislation this weekend.

U.S. House Speaker Nancy Pelosi said Friday that she expects lawmakers to reach agreement on a $700 billion Wall Street bailout package because “it has to happen.” In an interview with ABC's “Good Morning America,” the California Democrat said she hoped lawmakers would reach final agreement within the next 24 hours so that the House and Senate could act on legislation this weekend.

Expect an explosive rally to follow, but it won't last.

Bonds rise as bailout hopes stall.

Government bonds around the world rose after talks on a $700 billion rescue package for the U.S. financial system stalled and Washington Mutual Inc. was taken over in the biggest U.S. bank failure in history.

Government bonds around the world rose after talks on a $700 billion rescue package for the U.S. financial system stalled and Washington Mutual Inc. was taken over in the biggest U.S. bank failure in history.

Investors are piling in to the safest assets on concern delays to the bailout plan will cause more banks to fail. At the same time, the short-term debt markets that provide financing for the global economy are seizing up. This is not a pretty sight.

Be careful!

Gold rose above $900 an ounce, heading for the second straight weekly gain, as talks on the $700 billion U.S. plan to ease the credit crunch stalled. Silver also gained. Investment in the SPDR Gold Trust , the biggest exchange- traded fund backed by bullion, has jumped 18 percent in two weeks. The surge followed the collapse of Lehman Brothers Holdings Inc. and the U.S. takeover of American International Group Inc., Fannie Mae and Freddie Mac. The issue at hand, though, is that gold is overbought and needs another pullback before launching its next advance. Better positioning is advised.

Gold rose above $900 an ounce, heading for the second straight weekly gain, as talks on the $700 billion U.S. plan to ease the credit crunch stalled. Silver also gained. Investment in the SPDR Gold Trust , the biggest exchange- traded fund backed by bullion, has jumped 18 percent in two weeks. The surge followed the collapse of Lehman Brothers Holdings Inc. and the U.S. takeover of American International Group Inc., Fannie Mae and Freddie Mac. The issue at hand, though, is that gold is overbought and needs another pullback before launching its next advance. Better positioning is advised.

No confidence here in Japan.

The Nikkei 225 Stock Average fell 113.37, or 0.9 percent, to close at 11,893.16 in Tokyo, after earlier rising as much as 0.6 percent. The broader Topix index slipped 6.06, or 0.5 percent, to 1,147.89. Almost four shares dropped for each that climbed on the Topix, which recorded a 0.1 percent weekly drop. ``The assumption is that the bailout will take longer than expected, which is negative,'' said Tsuyoshi Shimizu , a senior fund manager at Mizuho Asset Management Co., which oversees $26 billion. ``As with Washington Mutual, the longer it takes to pass something, the more victims we're going to see.''

The Nikkei 225 Stock Average fell 113.37, or 0.9 percent, to close at 11,893.16 in Tokyo, after earlier rising as much as 0.6 percent. The broader Topix index slipped 6.06, or 0.5 percent, to 1,147.89. Almost four shares dropped for each that climbed on the Topix, which recorded a 0.1 percent weekly drop. ``The assumption is that the bailout will take longer than expected, which is negative,'' said Tsuyoshi Shimizu , a senior fund manager at Mizuho Asset Management Co., which oversees $26 billion. ``As with Washington Mutual, the longer it takes to pass something, the more victims we're going to see.''

Did China's stimulus package work?

China's stocks rose, with the benchmark index advancing for the first week in nine, after the government stepped up support for the world's second-worst performing market this year. The problem is, which came first, the chicken or the egg? Did the market bounce because the government lowered taxes or was the market so oversold that it was due to bounce whether the government did anything or not?

China's stocks rose, with the benchmark index advancing for the first week in nine, after the government stepped up support for the world's second-worst performing market this year. The problem is, which came first, the chicken or the egg? Did the market bounce because the government lowered taxes or was the market so oversold that it was due to bounce whether the government did anything or not?

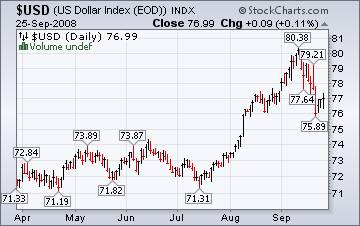

The “scorned dollar” is is ready for more gains.

The overseas markets have scorned the dollar due to the onerous conditions of the bailout package. However, many of them are in the same position or worse when it comes to needing a bailout. The point is, the dollar is due for another rally. It may coincide with the bailout being passed, or it may not.

The overseas markets have scorned the dollar due to the onerous conditions of the bailout package. However, many of them are in the same position or worse when it comes to needing a bailout. The point is, the dollar is due for another rally. It may coincide with the bailout being passed, or it may not.

Dear Congressmen…is anyone listening?

The director of the Congressional Budget Office said yesterday that the proposed Wall Street bailout could actually worsen the current financial crisis.

The director of the Congressional Budget Office said yesterday that the proposed Wall Street bailout could actually worsen the current financial crisis.

During testimony before the House Budget Committee , Peter R. Orszag -- Congress's top bookkeeper -- said the bailout could expose the way companies are stowing toxic assets on their books, leading to greater problems. "Ironically, the intervention could even trigger additional failures of large institutions, because some institutions may be carrying troubled assets on their books at inflated values," Orszag said in his testimony. "Establishing clearer prices might reveal those institutions to be insolvent."

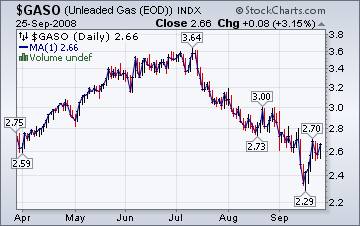

Not much damage to gasoline prices.

The Energy Information Administration reports that, “ While Hurricanes Gustav and Ike did not cause the degree of damage to refineries and other petroleum infrastructure sustained during Katrina and Rita, refineries have been slow to return to operation due to lack of power. With refineries unable to fill pipelines that move product into the Midwest and East Coast, inventories have been dropping, and spot shortages, mainly of gasoline, are occurring, even with increasing imports arriving to help fill the gap.”

The Energy Information Administration reports that, “ While Hurricanes Gustav and Ike did not cause the degree of damage to refineries and other petroleum infrastructure sustained during Katrina and Rita, refineries have been slow to return to operation due to lack of power. With refineries unable to fill pipelines that move product into the Midwest and East Coast, inventories have been dropping, and spot shortages, mainly of gasoline, are occurring, even with increasing imports arriving to help fill the gap.”

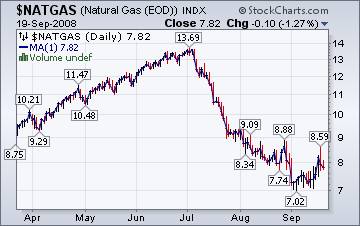

Energy prices going lower.

The Energy Information Agency's Natural Gas Weekly Update tells. “ Natural gas prices rose since last Wednesday, September 17, as natural gas production shut-ins and rising crude oil prices contributed to upward price pressure. Natural gas production has been slow to recover from the impact of Hurricanes Gustav and Ike, with the Minerals and Management Service reporting that 4.2 Bcf per day—57 percent—of offshore natural gas production in the Federal offshore Gulf of Mexico remained shut-in as of September 24.”

Fellow citizens, take back your country!

Mish says, “It is time to take back America from Wall Street and return it to Main Street USA.”

Mish says, “It is time to take back America from Wall Street and return it to Main Street USA.”

Treasury Secretary Paulson is attempting to ram down the throats of US taxpayers, a $700 billion bailout of Goldman Sachs (GS), JPMorgan (JPM), Citigroup (C), Morgan Stanley (MS) and other many other banks that participated in questionable if not fraudulent mortgage lending schemes.

Those corporations have padded their own pocketbooks and handed out billions of dollars in bonuses and stock options over the past few years, all based on mythical profits.

Now those same corporations are asking U.S. taxpayers to bail out their bad lending practices to the tune of $700 billion. No Deal!

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week we debate what the market is telling us, near-term. It should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.