Once Upon a Time There Was a Goldilocks Economy. Will This Story End Well for Gold?

Commodities / Gold & Silver 2019 Jun 30, 2019 - 06:15 PM GMTBy: Arkadiusz_Sieron

Once upon a time there was a Goldilocks (economy)… Would like to know the end of this story? So let’s read our today’s article – and find out whether it will have a happy end for gold!

Once upon a time there was a Goldilocks (economy)… Would like to know the end of this story? So let’s read our today’s article – and find out whether it will have a happy end for gold!

There was once a little girl whose hair was so bright and yellow that it glittered in the sun like spun-gold. For this reason she was called Goldilocks. One day she came to a house of Three Bears. They have gone out, but the girl saw the porridge through the window, so she went in.

She first tasted the porridge of the Great, Huge Bear, and that was too hot for her. And then she tasted the porridge of the Middle Bear, and that was too cold for her. And then she went to the porridge of the Little, Small Bear, and tasted that; and that was neither too hot nor too cold, but just right, and she liked it so well that she ate it all up.

We guess that you have heard this story. For sure, you have – Goldilocks and the Three Bears is one of the most popular fairy tales in the Western world. Now, you might wonder why we refer to the story for children in the report on the precious metals market. The reason is, of course, the Goldilocks economy we still have, to the despair of gold bulls.

What is the Goldilocks economy? It is the economy which combines a moderate economic growth and low inflation. So, just as in a fairy tale, it is the economy which is neither too hot, generating inflation, nor too cold, creating recession, but just right. At least right for the Wall Street. Stock market investors love the Goldilocks economy as it allows a market-friendly monetary policy, or it does not create reasons for the Fed to intervene and change its course. In such a macroeconomic environment, companies grow and generate positive earnings growth, so the stock market performs well.

No wonder that everyone asks the question whether the boom will continue. After all, the bull market has already became the longest in U.S. history, while the general economic expansion will break historic record in July. Will it last?

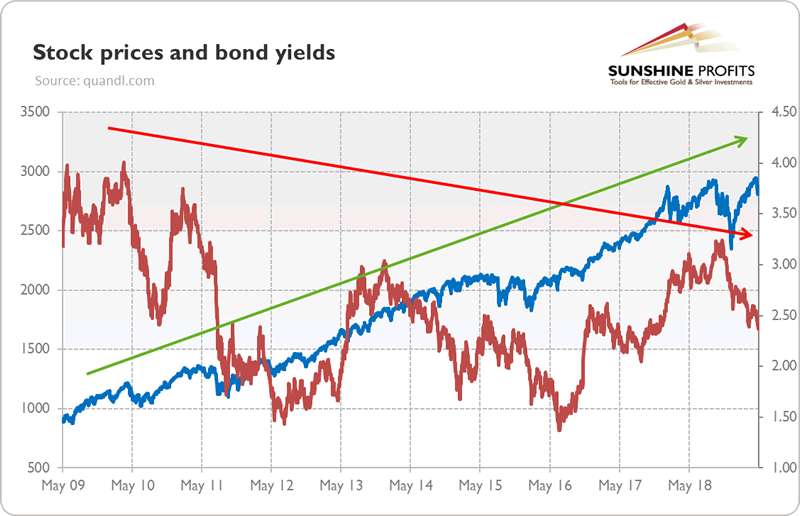

We all know that, unfortunately, all good things come to an end. It’s true that the stock prices are high, which indicates that investors continue to anticipate solid economic activity in the future. But bond yields are low, which seem to predict stagnation or global recession. The chart below shows the apparent divergence between the signals sent by the stock prices and bond yields. Who is right? Do bond markets know something that the stock markets do not realize?

Chart 1: S&P 500 Index (blue line, left axis, points) and the bond yields (red line, right axis, %, 10-Year Treasuries) from May 2009 to May 2019.

We cannot, of course, exclude such a scenario (but the opposite might be also true). However, the relatively optimistic stock markets and pessimistic bond markets do not necessarily mean a contradiction. You see, the equity and bonds prices are driven by different things. The former are shaped by the expected corporate profits which depend on the prospects for real economic activity. The latter are affected by the expected interest rates that depend on the forecasted inflation.

In the past, strong economic growth came together with higher inflation and higher interest rates. But the macroeconomic environment changed and we live now in a world of stubbornly low inflation. Economists say that the Philips curve has become flatter. In simple English it means that the link between the unemployment rate, or the pace of GDP growth, and the CPI rate has broken down (probably due to the globalization and new technologies, or the Amazon-Google-Uber effect).

Fair enough, but what does it all mean for the gold market? Well, we do not have good news for the goldbugs. The combination of steady growth and low inflation justifies both high stock prices and low bond yields. There is no contradiction here – and the latter do not have to signal the upcoming recession. It means that gold will remain in its sideways trend for a little more. After all, gold is a hedge against inflation and a safe-haven asset which shines the most during periods of either high inflation or deep recessions. Hence, the combination of low inflation and moderate growth is not particularly encouraging to invest in gold.

However, gold bulls should not forget that all fairy tales have a happy ending. One day some political or economic shock will happen, destroying the delicate balance of the Goldilocks economy. At some point, the bears return home, while the Goldilocks runs away. The girl’s hair might glitter like spun-gold, but it will never shine as brightly as gold.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.