Stock Market Fundamentals are Weakening: 3000 on SPX Means Nothing

Stock-Markets / Stock Markets 2019 Jul 11, 2019 - 04:14 PM GMTBy: QUANTO

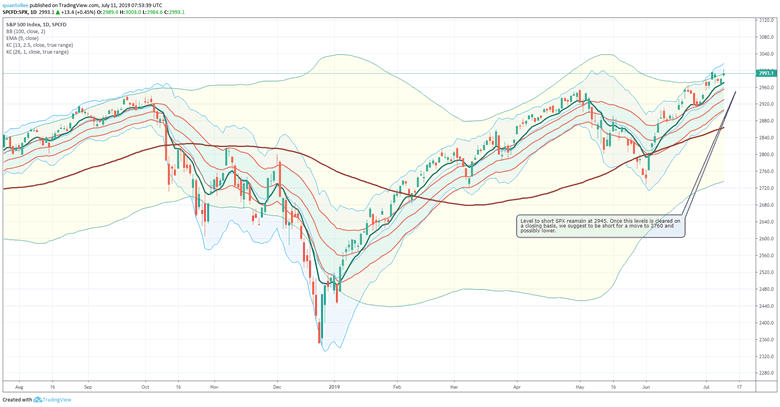

Even as markets climbed above to 3000 on SPX, we are fairly bearish on equities for the forseeable future. Algo continue to trip the stops higher. The levels to watch are mentioned below on where you could position your stops.

Level to short SPX reamsin at 2945. Once this levels is cleared on a closing basis, we suggest to be short for a move to 2760 and possibly lower.

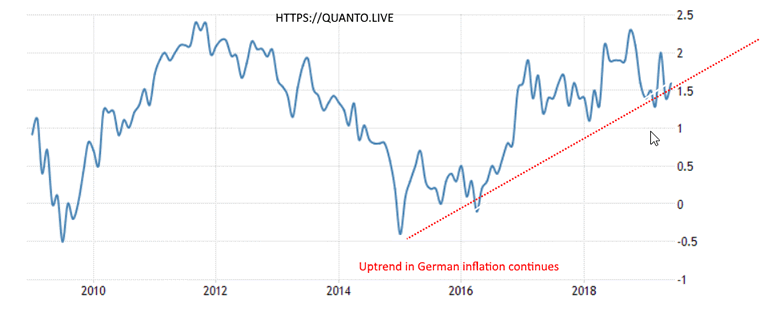

Inflation: Globally is on rising path Germany: Trend is higher

The inflation rate in Germany was confirmed at 1.6 percent year-on-year in June 2019, up from 1.4 percent in the previous month, as both services and food prices rose at a faster pace while energy inflation eased. Inflation Rate in Germany averaged 2.37 percent from 1950 until 2019, reaching an all time high of 11.54 percent in October of 1951 and a record low of -7.62 percent in June of 1950.

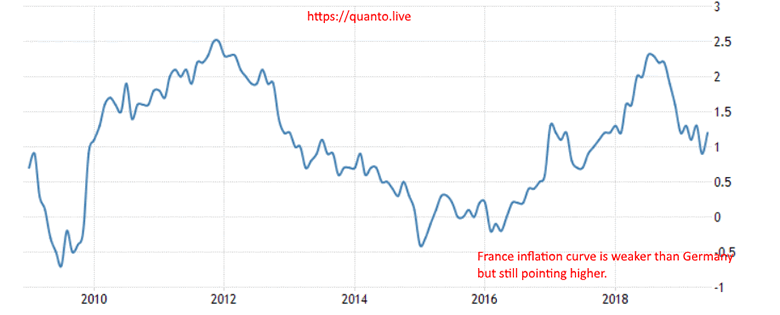

France: Trend is picking up

The inflation rate in France was confirmed at 1.2 percent year-on-year in June 2019, up from a near two-year low of 0.9 percent in the previous month, as services and food prices rose at a faster pace while energy inflation eased and manufactured products prices continued to fall.

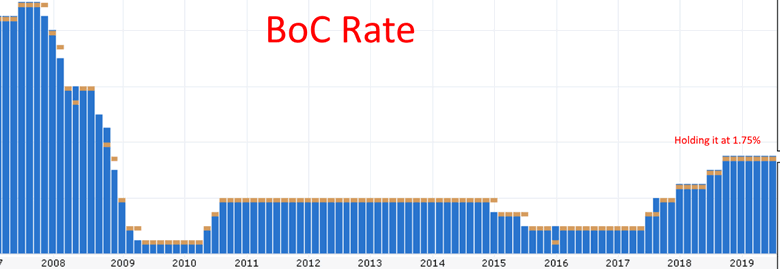

Bank of Canada : Held rates at 1.75%.

The Bank of Canada held its benchmark interest rate at 1.75 percent on July 10th 2019, as widely expected. It remained the highest rate since December 2008. However they made mention of weakening trade and tangible effects on economy from trade wars. This will be considered a dovish hint

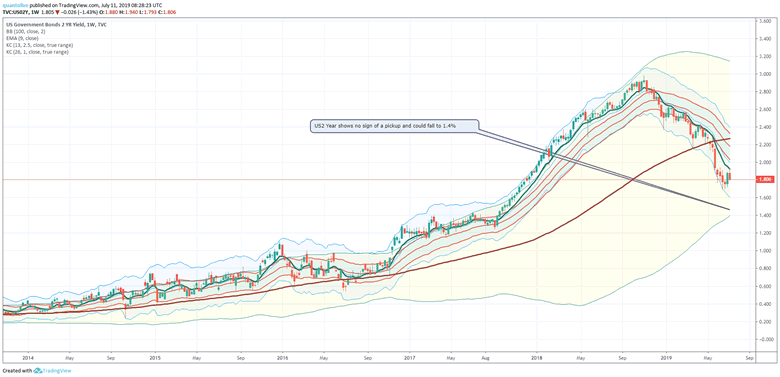

US 2 year yield

US2 Year shows no sign of a pickup and could fall to 1.4% US10Year Yield

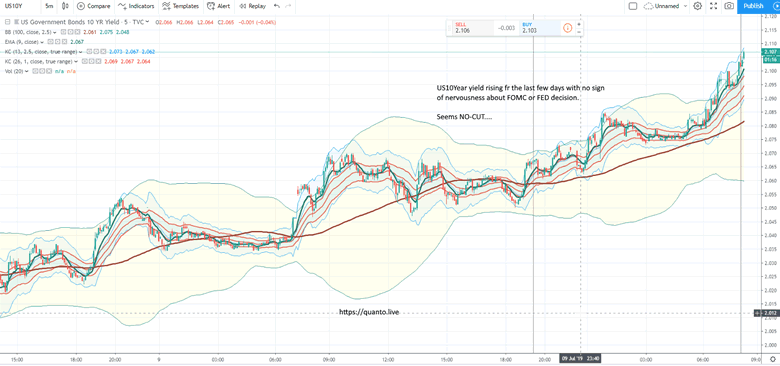

The US 10 year yield has stabolised at 2.05%. Current FED rate at 2.5%. FED probablity tool suggests 94% chance of a 25 bps rate cut on 31 July. But Morgan Stanley believes there could be a 50 bps cut.

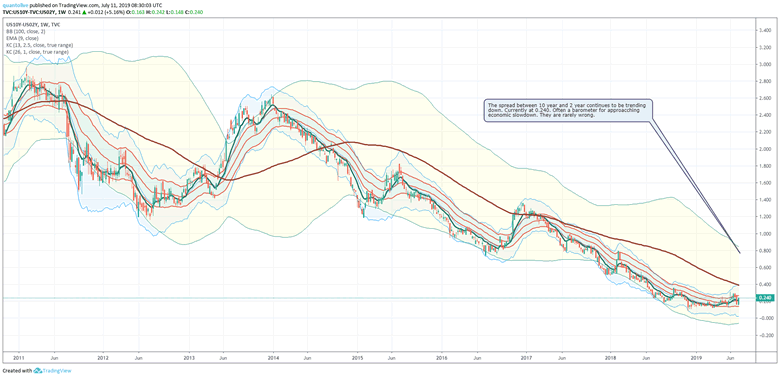

10 Year - 2Year spread

The spread between 10 year and 2 year continues to be trending down. Currently at 0.240. Often a barometer for approacching economic slowdown. They are rarely wrong.

German Bunds

Hint of profit taking in Bunds. DB structuring plans seem to be finding good market reaction. It could have a bearing on EURUSD.

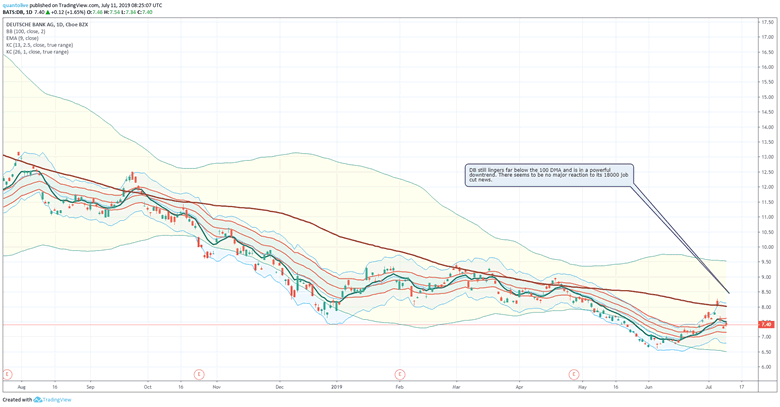

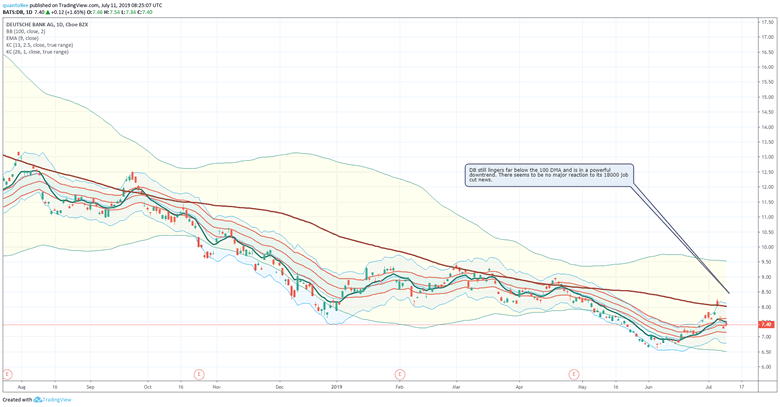

DB

DB still lingers far below the 100 DMA and is in a powerful downtrend. There seems to be no major reaction to its 18000 job cut news. This suggests that investors will expect further bad news to pour of banking system. The financial economy has been shrinking and we expect more poison out of UK and US banks as well.

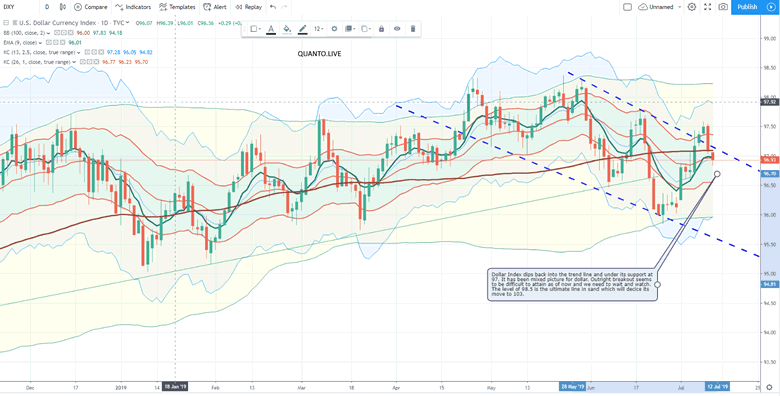

Dollar Index: looking to mmove higher Dollar Index dips back into the trend line and under its support at 97. It has been mixed picture for dollar. Outright breakout seems to be difficult to attain as of now and we need to wait and watch. The level of 98.5 is the ultimate line in sand which will decice its move to 103.

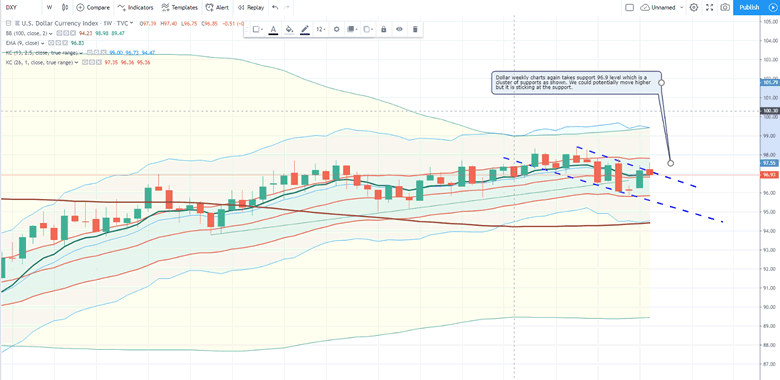

Dollar Weekly

Dollar weekly charts again takes support 96.9 level which is a cluster of supports as shown. We could potentially move higher but it is sticking at the support.

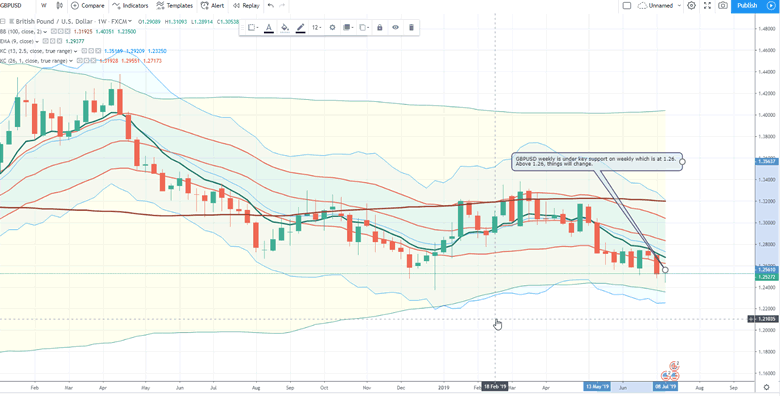

GBPUSD Weekly

GBPUSD weekly has broken key weekly support at 1.26. It is enroute to 1.2410 and 1.2370.

Trade Copier performance

The QUANT trade copier is zipping higher in July. The returns stand at 8.1%.

QUANTO is a advanced Investment Management firm for internet trading clients. We specialise in providing superior trading performance via algorithms and via premium research. We adhere to a high standard of professional risk management and alpha generating trading performance. If you are interested in automated trade copier, please contact us

Source: https://quanto.live/2019/07/11/markets-fundamentals-are-weakening-3000-on-spx-means-nothing/

By Quanto

Quanto.live is a Investment Management firm with active Trading for clients including Forex, Crypto. We send our trades via trade copiers which are copied to clients trading terminals. Top notch fundamental analysis and trading analysis help our clients to generate superior returns. Reach out to us: http://quanto.live/reach-us/

© 2019 Copyright Quanto - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.