China’s path from World’s Factory to World Market

Economics / China Economy Nov 07, 2019 - 12:15 PM GMTBy: Dan_Steinbock

The rise of the Shanghai Import Expo reflects China’s huge transformation from world producer and cheap prices to world consumer and innovator.

The rise of the Shanghai Import Expo reflects China’s huge transformation from world producer and cheap prices to world consumer and innovator.

Speaking at the second China International Import Expo (CIIE) in Shanghai, Chinese president Xi Jinping pledged China will stimulate increased imports, continue to broaden market access, foster a world-class business environment, explore new horizons of opening-up and promote international cooperation at multilateral and bilateral levels.

In order to safeguard and promote economic globalization, Xi said two years ago at the World Economic Forum in Davos, Switzerland that “efforts to reduce tariff barriers and open up wider will lead to inter-connectivity in economic cooperation and global trade.” In contrast, “the practices of beggaring thy neighbor, isolation and seclusion will only result in trade stagnation and an unhealthy world economy.”

Today, that message is critical. The World Bank has forecast only 2.6 percent global growth in 2019. That’s the lowest since the global financial crisis of 2008-9. And the collateral damage of trade protectionism is spreading worldwide.

China shifts from exports to imports

In the past, the best known trade event in China was the Canton Fair in the southern Guangdong province. In October, even amid the US tariff wars, it attracted more than 210 countries and regions, 25,000 companies and some 200,000 potential buyers, most of which were from Belt and Road countries.

China is now promoting the Shanghai CIIE as the world’s first international import expo. Its partners include the World Trade Organization and key United Nations trade organizations, which understand well that the CIIE reflects China’s structural rebalancing from investment and net exports toward innovation and consumption.

Shanghai, the most international Chinese megacity, is the natural host of the import expo. While the Canton Fair built its clout over decades, the Shanghai CIIE could develop its international influence in a matter of years.

Despite international tensions, it has attracted foreign leaders, such as French President Emmanuel Macron, diamonds from Belgium, Cambodian fragrant rice, and Kenyan farm products, along with US automaker Ford’s cutting-edge Ford and Lincoln brands. Despite the US tariff war against China, almost 200 US-based companies – from GE to Qualcomm – are participating in the CIIE and US companies have the largest exhibition space at the expo.

While the Canton Fair has morphed from traditional manufacturing exports to advanced technology, the Shanghai CIIE is focused on imports. It’s a massive shift in a country of more than 1.3 billion people. As China has prospered, Chinese companies have invested increasingly abroad, while Chinese consumers can afford foreign imports, thanks to reforms and opening-up policies, and Chinese innovation in ecommerce.

Middle-income consumers drive import growth

Recently, the European Union (EU) said that its firms had provided positive feedback on the CIIE last year, registered increased sales or met new potential buyers. Yet, EU wants more to do more vis-à-vis the EU-China investment agreement.

Obviously, the US, the EU and Japan would like to see China implementing the kind of reforms that support their exporters in the near term. But such reforms cannot happen disruptively. Even the advanced countries fought two world wars and were engaged in a Cold War before import growth truly picked up internationally.

While the middle class is shrinking in the West, China’s gradual reforms will ensure a rapidly expanding middle-income consumer base, the new precondition of international trade. As the world factory is morphing into the world’s largest market, rising numbers of consumers fuel import growth.

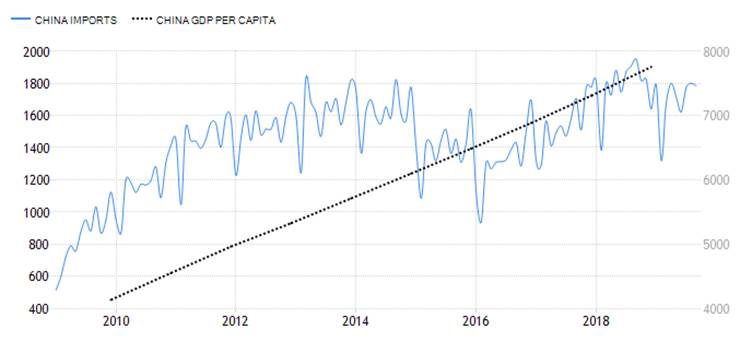

As China’s intensive industrialization shifts toward a post-industrial society, GDP growth is decelerating, but living standards, as measured by per capita income, are rising (Figure). That is vital for import growth over time and provides a blueprint for middle-income groups in other large emerging countries, such as India.

Figure Chinese Imports and GDP Per Capita, 2000-2019

As long as globalization advances in both rich and middle-income economies, imports to China increase. For instance, as the world economy was still recovering in early 2018, Chinese imports reached an all-time high. But after the US began imposing heavy tariffs on Chinese imports, businesses invested more cautiously and consumers became more cost-conscious. After all, China’s average per capita income remains only 15-25 percent of that in the US and Western Europe.

Long-term benefits require global cooperation

Some US research firms expect China to become the world’s top retail market this year, surpassing the US. The forecast may be optimistic, but the trend is clear. Today, China's imports of goods and services are estimated to be about 10 percent of the global total and, given international peace and stability, they will continue to expand.

China’s focus is on economic development that shuns trade protectionism and seeks to balance the needs of the global economy and its own economy. That’s why, instead of promoting “China First” nationalism and imposing excessive tariffs on imports, China is helping the Canton Fair to expand international trade and the Shanghai CIIE to supports import and that’s why President Xi promotes globalization.

Dr. Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Center (Singapore). For more, see http://www.differencegroup.net/

© 2019 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.