Why Every Investor Should Own Hazardous Waste Stocks

Companies / Sector Analysis Dec 16, 2019 - 06:27 PM GMTBy: Robert_Ross

There’s only one guy in history who’s built three Fortune 500 companies.

His name was Wayne Huizenga.

Wayne founded automotive retailer AutoNation. He was also instrumental in Blockbuster Video’s growth. He wisely sold his stake for $8.4 billion in 1994.

But Wayne’s crown jewel was Waste Management, Inc. (WM).

Waste Management is the largest trash collection, disposal, and recycling company in North America. It runs a very dirty but very profitable business.

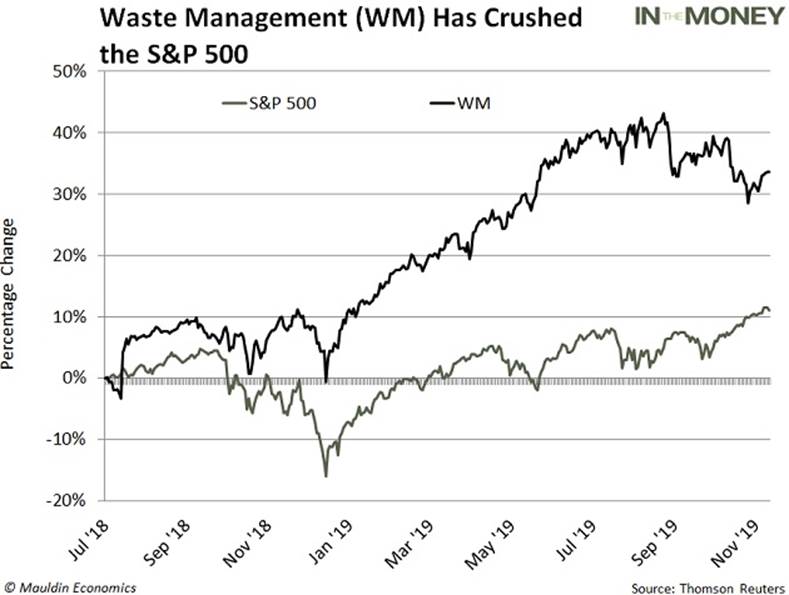

I recommended shares of Waste Management back in July 2018. The stock has surged 36% since, crushing the 11.6% return for the S&P 500 over the same period:

Waste Management has been on an incredible run. It’s climbed an average of 22% per year over the last five years. But it’s getting expensive. So I wouldn’t buy it right now.

The good news is it’s not the only player in the highly profitable trash industry.

Today I’ll explain why trash is such a great business—and share a small, overlooked trash niche that’s poised for big profits.

Recycling Services Will Almost Double in the Next 5 Years

There are lots of reasons to hold trash stocks right now.

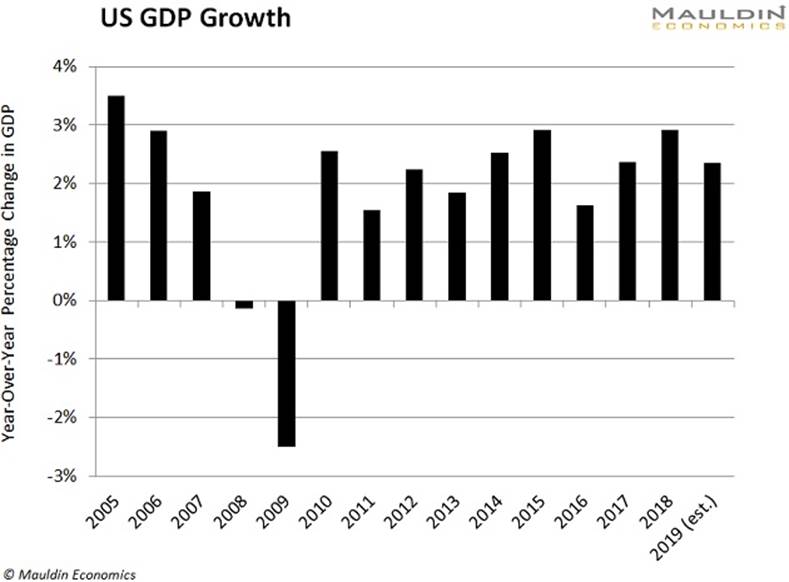

First, the economy is growing. Gross domestic product (GDP) measures economic growth. When GDP growth rises, it means people and businesses are buying more stuff. It also means they’re throwing old stuff away… which creates more trash.

US GDP has been growing for 10 straight years:

People have thrown away a lot of stuff during this period. And there’s no sign of that slowing down. According to the World Bank, US trash production will increase 25% by 2050.

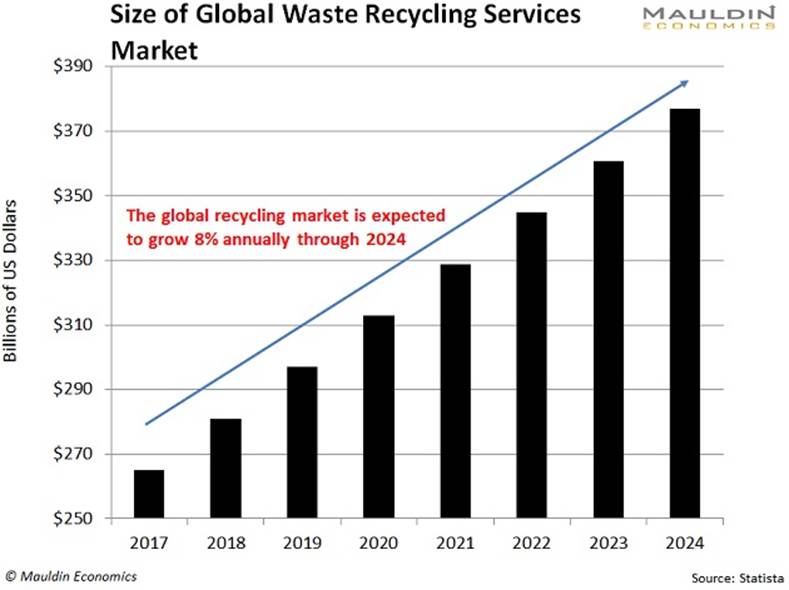

That’s steady growth. But trash companies are also in the recycling business. And that segment of the industry is growing much faster.

In fact, recycling services are set to surge 42% by 2024. That’s about 8% per year.

Trash Companies Often Have Zero Competition

Trash is a highly regulated business.

Waste Management, for example, is the only company allowed to remove trash in the city of Chicago. So it has zero competition. It literally has a government-granted monopoly.

At the same time, trash contracts can last up to 125 years. That means two things. First, the companies that win these contracts are well established. Second, it’s nearly impossible for new companies to break in.

In short, trash companies like Waste Management, Inc. (WM), Republic Services, Inc. (RSG) and Waste Connections, Inc. (WCN) don’t have a lot of competition.

Trash is also a “sticky” business. Once customers sign up, there’s almost zero chance of losing their business.

Think about it: When was the last time you heard of someone switching trash companies? Probably never. This isn’t good for companies looking to break into the business. But it’s great for the established players.

This all translates into steady, predictable returns for investors.

Trash Stocks Are Elite Dividend Payers

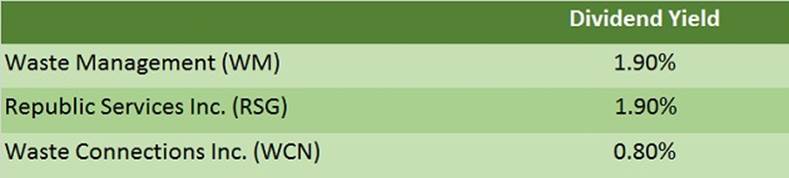

I’ve already mentioned the three non-hazardous trash titans: Waste Management, Republic Services and Waste Connections.

These companies have raised their dividends for 12 straight years, on average.

That’s great news for dividend investors. But all three stocks are pretty expensive right now. So I recommend keeping them on your watchlist and focusing on an overlooked niche in the trash industry: hazardous waste.

The Best Opportunities in Trash

Hazardous waste companies dispose of things like asbestos, chemical and medical waste, and highly flammable materials.

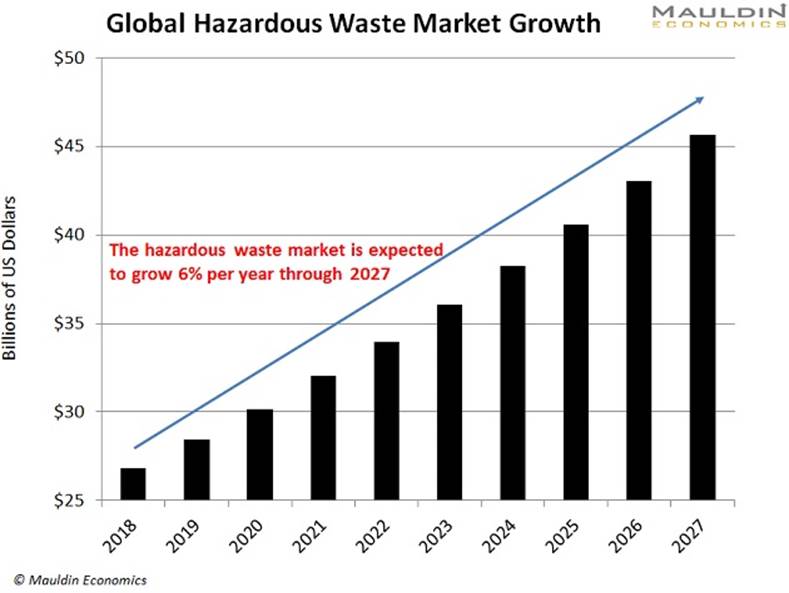

The global hazardous waste market is expected to grow 6% per year through 2027:

US Ecology, Inc. (ECOL) is the top dog here. The company treats, disposes, and recycles hazardous and radioactive waste. Unlike its non-hazardous peers, US Ecology’s customers are mostly governments and businesses.

The company pays a small but reliable 1.3% dividend yield, making it a great, low-risk stock for income investors.

There’s also a great, high-yield option across the pond: French waste management company Veolia Environnement SA (VEOEY).

Veolia focuses on water treatment, which is also one of my favorite investments. However, about one-third of the company’s revenue comes from hazardous waste management.

Veolia has a safe and reliable 4.1% dividend yield. So it’s a great addition to any income investor’s portfolio.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

By Robert Ross

© 2019 Copyright Robert Ross. - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.