Central Banklers Playing Taps For The Middle Class

Interest-Rates / Quantitative Easing Jan 14, 2020 - 07:38 AM GMTBy: Michael_Pento

It is not at all a mystery as to the cause of the wealth gap that exists between the very rich and the poor. Central bankers are the primary cause of this chasm that is eroding the foundation of the global middle class. The world’s poor are falling deeper into penury and at a faster pace, while the world's richest are accelerating further ahead. To this point, the 500 wealthiest billionaires on Earth added $1.2 trillion to their fortunes in 2019, boosting their collective net worth by 25%, to $5.9 trillion.

In fact, Jamie Dimon, CEO of JP Morgan, made a quarter of a billion dollars in stock-based compensation in 2019. As a reminder, shares of JPM were plunging at the end of 2018; that is before the Fed stepped in with a promise to stop normalizing interest rates. And then, soon after, began cutting them and launching a bank-saving QE 4 program and REPO facility on top of it in order to make sure Mr. Dimon’s stock price would soar. Slashing interest rates hurts savers and retirees that rely on an income stream to exist, just as the Fed’s QE pushes up the prices for the things which the middle class relies on the most to exist (food, energy, clothing, shelter, medical and educational expenses).

Therefore, what we have is a condition where those who own the greatest share of assets, such as stocks, bonds and real estate, are becoming more wealthy. Meanwhile, those that have to spend a greater percentage of their income on the basics of raising a family are falling further behind. The saddest part of this charade is that the Fed isn’t at all happy or content with the current pace of middle-class erosion. Instead, it actually wants to aggressively speed it up.

According to the Congressional Budget Office and Fortune.com, the incomes of the top 1% have increased by 242% since 1980, while the middle three quintiles have seen just 50% income growth in just under forty years. President Trump is correct; this is indeed the best economy ever--but unfortunately, only for the ultra-rich. Nearly 80% of Americans now live paycheck to paycheck. According to a survey done each year since 2014 by GOBankingRates, in 2019, 69% of respondents said they have less than $1,000 in a savings account, which compares with 58% in 2018.

According to the LA Times: Adjusted for inflation, wages for the top 5% of earners rose from $50.46 an hour in 2000 to $63.10 in 2018, an increase of 25%. The median worker’s hourly wage, meanwhile, rose by just 7% over that period, to $18.80.

According to economics professor Gabriel Zucman in a paper he submitted to the NBER, the wealthiest 0.1% of Americans now hold the largest share of total household net worth than at any time since 1929. This just happens to coincide with the period just before the historic Wall Street stock market crash and the start of the Great Depression.

A study done in 2015 showed that America’s top 10% of wealth holders averaged more than nine times as much income as the bottom 90%. And Americans in the top 1% averaged over 40 times more income than the bottom 90%.

The richest 1% of the world's population now holds over 50% of its wealth.

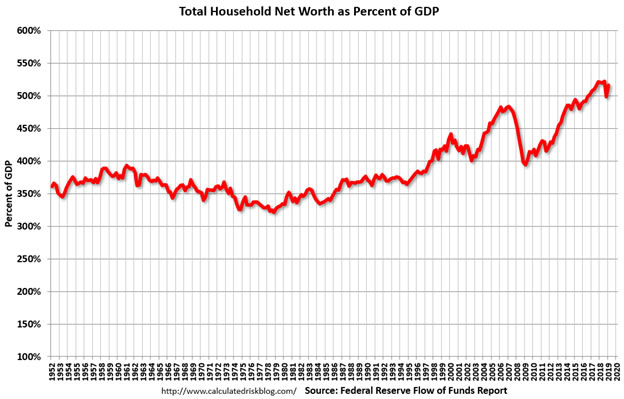

Perhaps it is not a coincidence either that the United States has lost 20% of its factory jobs since 2000. The chart below illustrates clearly how the Fed is pushing up asset prices far ahead of GDP…leaving the middles class in its wake.

Central banks are creating new money at an unprecedented pace and throwing it at the wealthiest part of the population—pushing asset bubbles ever higher and further away from economic reality. The Fed is turning a blind eye towards a middle class that is heading towards extinction.

Make no mistake about it…the level of fiscal and monetary insanity has jumped off the charts, along with the value of assets in relation to GDP. Global governments are now borrowing money at a record pace, which is adding more debt to the already insolvent and intractable existing pile. And, in order to keep all the bubbles afloat, central bankers have become trapped in a permanent condition of ZIRP and QE. What could possibly go wrong? Unfortunately, it will be nothing short of mass economic chaos when the bond market finally implodes. But this doesn’t have to be bad news for all investors. Having a process that navigates the crashes and booms will make all the difference in the world.

Michael Pento produces the weekly podcast “The Mid-week Reality Check”, is the President and Founder of Pento Portfolio Strategies and Author of the book “The Coming Bond Market Collapse.”

Respectfully,

Michael Pento

President

Pento Portfolio Strategies

www.pentoport.com

mpento@pentoport.com

(O) 732-203-1333

(M) 732- 213-1295

Michael Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services and research for individual and institutional clients.

Michael is a well-established specialist in markets and economics and a regular guest on CNBC, CNN, Bloomberg, FOX Business News and other international media outlets. His market analysis can also be read in most major financial publications, including the Wall Street Journal. He also acts as a Financial Columnist for Forbes, Contributor to thestreet.com and is a blogger at the Huffington Post.Prior to starting PPS, Michael served as a senior economist and vice president of the managed products division of Euro Pacific Capital. There, he also led an external sales division that marketed their managed products to outside broker-dealers and registered investment advisors.

Additionally, Michael has worked at an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career he spent two years on the floor of the New York Stock Exchange. He has carried series 7, 63, 65, 55 and Life and Health Insurance www.earthoflight.caLicenses. Michael Pento graduated from Rowan University in 1991.

© 2019 Copyright Michael Pento - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.