Stock Market Broad Sector Rotation Starts In 60+ Days – Part I

Stock-Markets / Stock Markets 2020 Feb 07, 2020 - 03:13 PM GMTBy: Chris_Vermeulen

We have been writing about the strong potential for a deeper market rotation in the US and global markets for well over 60+ days. In fact, our researchers predicted an August 2019 breakdown date based on Super-Cycle patterns that, eventually, pushed into 2020 as the US/China trade negotiations and other global news kept global markets in a low volatility bullish trend throughout the end of 2019.

We’ve highlighted some of our research posts over the past 30+ days to help illustrate the technical and price patterns that our research team has identified and shared.

December 20, 2019: WHO SAID TRADERS AND INVESTOR ARE EMOTIONAL RIGHT NOW?

December 16, 2019: CURRENT EQUITIES RALLY SIMILARITIES TO 1999

December 2, 2019: NEW PREDICTED TRENDS FOR SPX, GOLD, OIL NAT GAS

Technical Analysis is based on the premise that price reflects all news and expectations the instant that news or data is known. A common term in Technical Analysis is “Bias”. This is when the price trend is substantially more Bullish or Bearish by nature or expectation. Bias occurs when investing conditions mostly eliminate risk (for the Bullish side) and opportunity (for the Bearish side). When traders feel they can enter trades without any real risks (trading Long) or when they feel there is no opportunity for the markets to rally (trading Short), then a BIAS exists in the markets.

When the global markets rotate and volatility extends to much higher levels, the markets change from a “Biased Trend” to what Technical Analysts call “True Price Exploration”. When this happens, price begins to operate under the price principles of Gann, Fibonacci and Elliot Wave theories where price attempts to rotate to new lows or highs in an attempt to “seek out” clear support and resistance levels before establishing a new longer-term “Biased trend”.

We believe the global markets are about to enter a very volatile period of sector rotation. Certain sectors may see a much deeper price exploration than others. For example, consumer product manufacturers focused on US and European markets may see very limited risks compared to the Industrial Supply sector where a global economic slowdown could really hurt their future expectations.

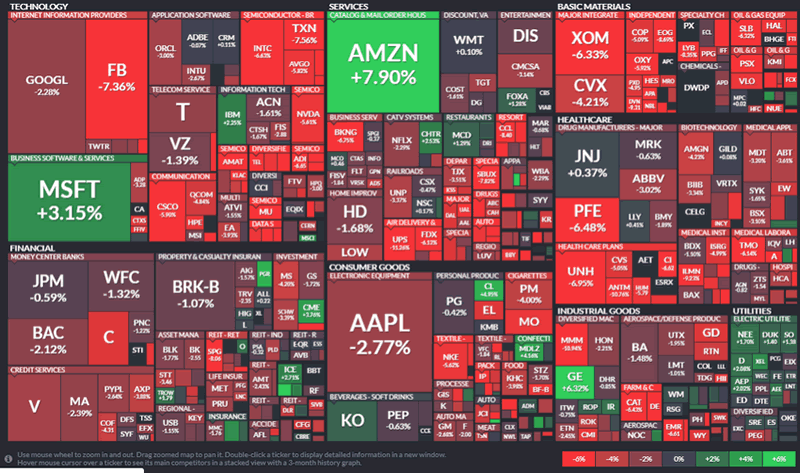

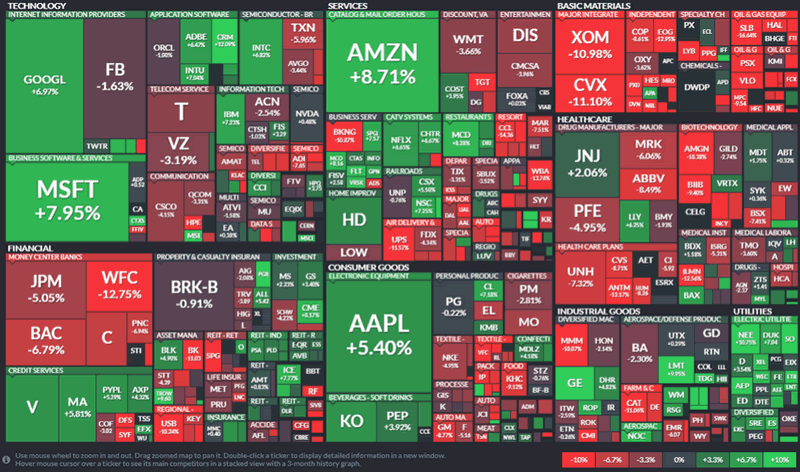

These two Market Sector Maps (source www.Finviz.com) highlight the change in the direction and scope of these changes over the past week and the past 30 days.

This first Sector Map is a 1 Week Sector Map

This second Sector Map is a 1 Month Sector Map

Pay very close attention to the sectors that were moderately or strongly weak in the 1-month chart and continue to weaken in the 1-week chart (Financial, Property, Telecommunications, Telecom Services, Healthcare, Biotech, Basic Materials, Industrial Goods, Lodging, Resorts, Travel, Hospitality, Food, Packaging, Textile. The list is rather impressive and it suggests this Coronavirus has somewhat panicked the markets and consumers. Yes, many of these consumers will continue to go out for food, entertainment, and other essentials – but what if 15% to 25% of them cut back on these activities and decide to stay home more often and watch movies or play games?

I remember in 1990 when Desert Storm started. Just before this war started, the US economy was clicking right along. I remember that within 10 days of the war starting, things started to change on the roadways and markets. I also noticed a change in consumer spending with a friend’s computer gaming distribution company. All of a sudden, consumers slowed their external purchasing activities and focused more on protectionist activities. We believe this same type of event is going to quickly unfold within the US and other nations as this Corona Virus extends over the next 30+ days.

This is why I believe the volatility of price and market sector rotation will continue for at least 60+ days as the globe attempts to contain and eliminate the risks associated with this virus. We understand the risks in the US and Canada are very small at the moment, but that has not stopped shoppers from emptying the shelves at the local hardware and pharmacy stores for “surgical masks” and supplies. Trust us, people are already well into the protectionist-mode and are preparing for what may happen over the next 30+ days.

This creates an opportunity for technical investors and traders. This potential for deeper price rotations and extended opportunities resulting from an end of bias volatile price exploration allows us to target very quick and exciting trades.

In part II of this research post, we’ll highlight three specific sectors we believe are poised for great trade setups as a result of the volatility and rotation in the global markets. Join us in our quest to create incredible profits from these bigger trends – visit www.TheTechnicalTraders.com today.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.