Gold: Learn from the Actions of the "Smartest on Wall Street"

Commodities / Gold & Silver 2020 Mar 05, 2020 - 03:52 PM GMTBy: EWI

Deep-pocketed speculators miss the big turns -- but you don't have to

Hedge fund managers are considered to be among the smartest people on Wall Street.

Ironically, as a group, they're notorious for consistently being on the wrong side of major turns in the markets they trade. By contrast, a group of insiders called Commercials are generally on the right side of major market turns.

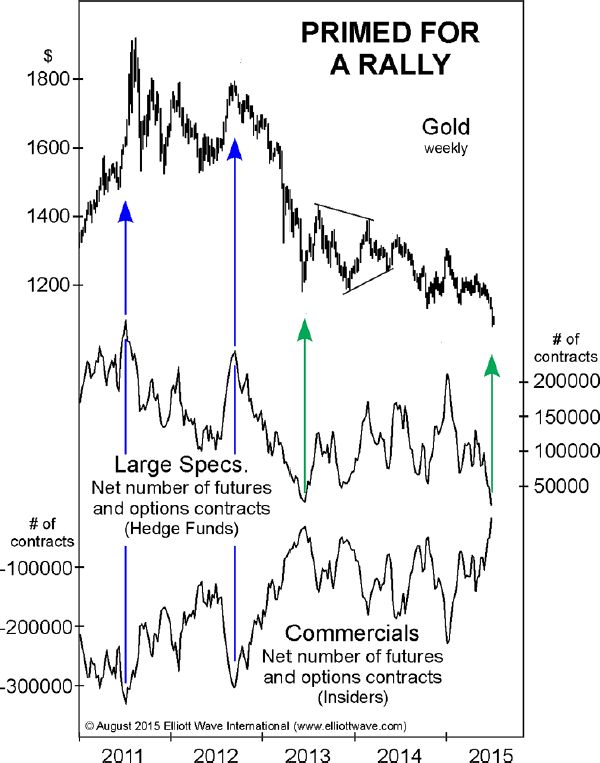

With that in mind, consider this commentary from the August 2015 Elliott Wave Financial Forecast, and note on the chart that hedge managers are synonymous with the term Large Speculators:

Large Speculators and Commercials hold a net-position size that is a multi-year extreme, and it is opposite to the position size held several weeks prior to gold's all-time high at $1921.50 in September 2011 and at gold's peak in October 2012 ... a sentiment that is consistent with a gold rally. Despite the possibility of near-term base-building, we still anticipate that the advance, when it starts, will last several months.

Indeed, in December 2015, gold hit a low of $1046.20 and then rallied to $1375.53 on July 6, 2016, a 31% increase.

A reversal followed which sent the price of gold to a Dec. 15, 2016 low of $1122.98.

At that time, as you might have guessed, sentiment had again turned decidedly bearish.

Here's a Dec. 29, 2016 Marketwatch headline:

2017 is the year gold drops below $1,000

Instead, however, gold started another climb. By Jan. 25, 2018, the price hit $1366.38, and the Daily Sentiment reading from trade-futures.com registered 91% bullish.

But, yet again, most big players were on the wrong side as gold began another slide.

By Aug. 16, 2018, gold hit a low of $1160.24. After the market closed on that date, our U.S. Short Term Update said:

Large Specs currently [hold] their second smallest net-long positions in 16 years at 3.5%.

In other words, 96.5% of deep-pocketed speculators were betting that gold's price would continue to decline.

But, if you've been an observer of the gold market, you know that the price of gold has not looked back since then.

Instead of trend following, Elliott Wave International's analysts use the Wave Principle to forecast the price behavior of widely traded markets, like gold.

The Elliott wave method not only helps traders to identify the main price trend, it also provides market participants with a high level of confidence in determining the maturity of a price trend.

Get important insights in the free report, "Learn How the Wave Principle Can Improve Your Trading."

This article was syndicated by Elliott Wave International and was originally published under the headline Gold: Learn from the Actions of the "Smartest on Wall Street". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.