US Coronavirus Infections & Deaths Trend Trajectory - How Bad Will it Get?

Politics / Pandemic Apr 02, 2020 - 06:41 PM GMTBy: Nadeem_Walayat

The only adult in the White House Dr Fauci has started stating what sort of death toll to expect for the Untied States over the coming months of between 100,000 to 200,000 deaths as a consequence of the Coronavirus pandemic.

Trump implemented the Defence Production act mobilising US industry into producing tens of thousands of ventilators, which whilst good is however TOO LATE as the actions the US is taking today should have been taken a month ago!

How long is it going to take for these ventilators to appears? 1 month? 2 months? Probably 3 months! Where 1 Month is TOO LATE! The US needs tens of thousands of ventilators THIS WEEK! That and the medical staff to operate them.

On the plus side the US does have several floating hospitals that can house thousands of patients, and New York city and state governments appear to have gotten the message and are scrambling to bring their ballistic pandemic trend trajectory under control.

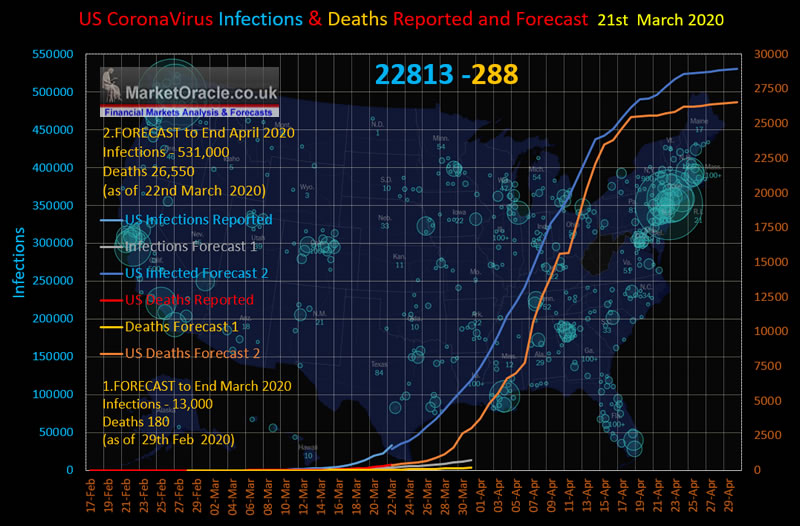

Which brings us to my trend forecast (US and UK Coronavirus Pandemic Projections and Trend Forecasts to End April 2020) that projected the US trending towards 531,000 tested as infected by the end of April, resulting in 26,550 deaths, as it was hoped that remaining valuable time would not be squandered on political bickering during this national emergency.

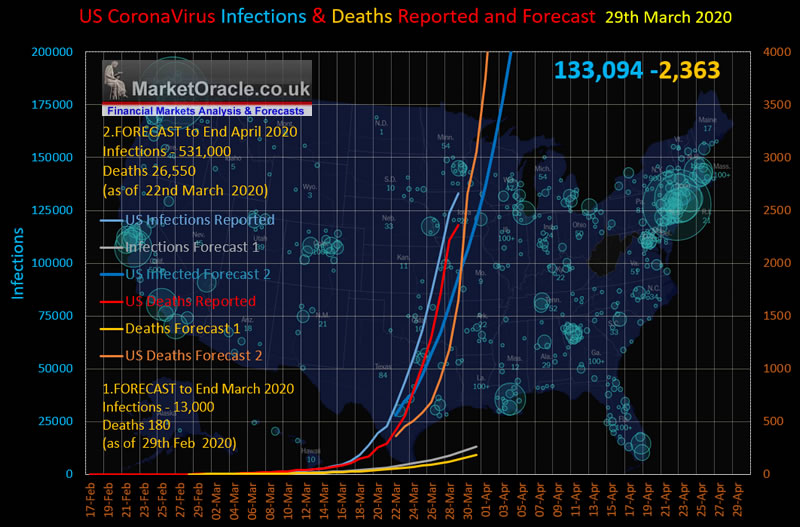

The latest data as of 29th March has the US infections going ballistic to 133,000 which is well beyond the forecast trend trajectory of 94,000, where if this deviation persists then would imply 750,000 testing positive by the end of April. Whilst the number of deaths is also running well ahead of forecast at 2363 vs 1646 that implies to expect 38,000 deaths by the end of April.

So the US has WASTED PRECIOUS TIME on political bickering, back and forth stupidity all whilst the virus has raged on. This is going to inflict even more economic damage and cost thousands more lives as it appears the US is slow to fully woke up yet to what is about to come to pass.

The rest of this extensive analysis has first been made available to Patrons who support my work - US and UK Coronavirus Trend Trajectories vs Bear Market and AI Stocks Sector

- Paying the Price for Acting Too Late

- UK Coronavirus Trend Trajectory - Deviation Against Forecast

- US Coronavirus Trend Trajectory - Deviation Against Forecast

- Coronavirus Stock Market Trend Implications

- Coronavirus Global Recession 2020

- Existing Stock Market Trend Expectations

- AI Stocks Q1 Buying Levels Current State

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.