Federal Reserve Funds 165% Of Record Pandemic Deficit Spending Through Monetary Creation

Interest-Rates / Quantitative Easing Apr 20, 2020 - 06:44 PM GMTBy: Dan_Amerman

Two extraordinary and unprecedented actions are being taken in the attempt to contain the economic damage from the national shutdown, and thereby attempt to prevent a depression. Each are on a scale we have never seen before, and each are almost certain to be very long lasting.

Even if the actions are "successful" - a depression is prevented and a severe recession is shortened - these radical actions occurring over a matter of months and years are not only likely to dominate our investments, savings and retirements throughout the rest of the 2020s, but they are likely to still be changing our lives decades from now, long after the COVID-19 pandemic has been forgotten by most.

Between the economic damage to the nation, the lost earnings and careers for individuals, and the costs of the containment of that damage, the shutdowns being used to "flatten the curve" are likely to be the single most expensive event in U.S. history. How the expenses of attempted containment are funded - will change everything, and the effects will stay with us for the rest of our lives.

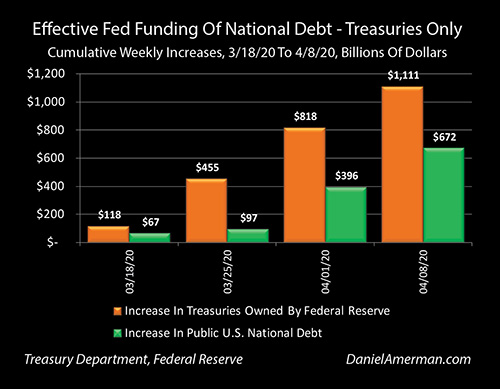

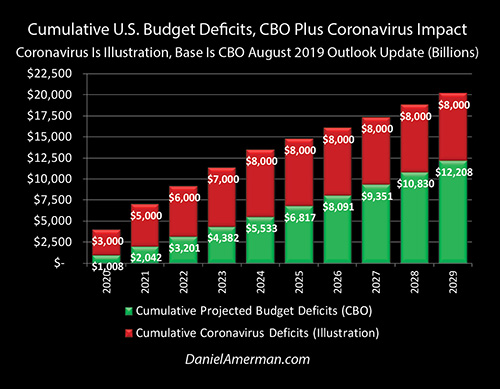

As can be seen in the graph above of the preceding weeks, an explosive increase in the national debt is being used to fund an array of emergency programs that are throwing hundreds of billions of dollars at corporations, smaller businesses and individuals. At the very same time, all of that money - and quite a bit more - is coming from the Federal Reserve creating the money, almost entirely through a process of reserves based monetary creation.

This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

An Unprecedented Increase In The National Debt

We have the fastest increase in the national debt coming up in 2020 that we have ever seen, and this is on top of a national debt that was already rising very rapidly with trillion dollar a year deficits. There is a great deal of weekly variation, but that works out to a round number average of about $20 billion a week or $80 billion every four weeks.

Even in late March, deficits were already running well above that range, as can be seen with the green bars in the graph. There was $67 billion in net new public debt issued in the week ending March 18th, 2020, and another $30 billion the next week, for a two week total of $97 billion, or about 4X the pace of a government running $1 trillion a year deficits.

Then another $299 billion was issued the week ending April 1, 2020, and another $276 billion the following week. That brought the four week total to $672 billion - which vastly exceeded any deficit run up over an entire year by the Federal government before 2009.

The previous annual record had been a $459 billion deficit in the year 2008 (fiscal years), and that total was exceeded in just four weeks by almost 50%. Indeed, if we just look at the latter two weeks, the deficit spending by the government in just those two weeks was equal to almost twice the highest annual deficit ever incurred by the government prior to 2003 (and yes, inflation plays a role, but the current rate of increase is off the charts).

The extraordinary, fantastic, almost incomprehensible increase in the national debt over four weeks is half the picture. The perhaps even more important event - though even less understood by the public - is the orange bars, which represent where the money came from to buy the newly issued debt.

The Federal Reserve effectively created the money to purchase $118 billion in Treasury debt in the week ending March 18th. This rose to a staggering $455 billion the next week, $818 billion the third week, and the Fed had cumulatively purchased over $1.1 trillion in federal debt in the four weeks ending April 8th, 2020.

Almost all of the new money spent by the United States government came from the Federal Reserve using a process of reserves based monetary creation (not money printing). Now, these were not direct payments from the Fed to the Treasury, but that is more or less the whole point. By purchasing the Treasuries through the markets, from participants who had just bought them from the government, the Fed not only funded the U.S. government but ensured that interest rates would remain at extreme lows.

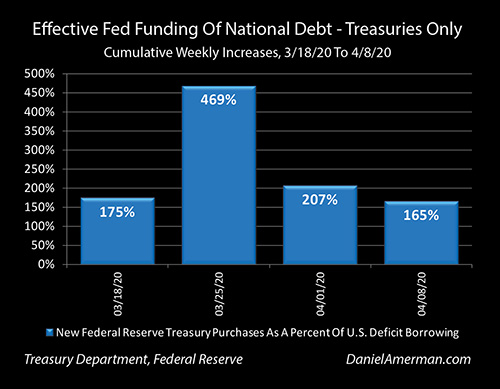

Indeed, as further explored below and in previous chapters, the Fed has been buying far more Treasuries than just those needed to fund deficit spending.

This can be seen in the graph above where we compare the amount of US treasuries that the Federal Reserve was buying each week on a cumulative basis with the increase in the public national debt.

The Fed created the money to buy 175% of the first week of new debt, and then 469% of the second week of new debt (on a cumulative basis). Over three weeks, Treasuries representing a little more than twice the issuance of new debt were purchased, and over four weeks, 165% of the increase in the national debt was funded with newly created money.

And we are still in the early stages.

If we look at every dollar of the amount of money that is going out to businesses from the U.S. government - it is coming from monetary creation by the Federal Reserve.

If we look at checks being sent to each family - every dollar is coming from monetary creation by the Fed.

If we look at the fantastic increase in unemployment compensation payments, and then add on the extra $600 a week to keep the ability to buy groceries and make rental or mortgage payments - every dollar is effectively coming from newly created money, courtesy of the Federal Reserve.

Outside of the Treasury purchases that are the subject of this analysis, if we look at the announced trillions of dollars of Federal Reserve lending programs and asset purchase programs - the Fed didn't have the money to do any of that, without creating the money.

Almost without discussion, or votes, or elections or constitutional processes, emergency powers were seized by the state governors to effectively force the immediate collapse of their state economies, in the name of a health emergency. The calamitous economic damage - even the ability to eat and stay in a residence for the tens of millions of newly unemployed whose jobs were deliberately destroyed by government order - is being dealt with by what could be called an unprecedented and seemingly unquestioned Federalization of the economy, where the Federal government pays for everything for everybody - under the rules and with the political and financial priorities that it establishes (thereby taking total control).

Except the U.S. government doesn't have the money to do any of that, not one bit. The government was already $23 trillion in debt, and unable to pay its preexisting promises without borrowing over $1 trillion a year. An effectively bankrupt government doesn't have the money to pay for any of that: not the rent payments or the grocery bills or the corporate bailouts.

So another branch of the government is creating the money to do so.

This is not literal "money printing" or "modern monetary theory" - or at least, not yet. Instead the money is being created in a very careful, very disciplined - and ultimately quite limited - manner, using reserves based monetary creation. Almost exactly $1 trillion of that $1.1 trillion in newly created and spent money came from an increase in excess reserves of depository institutions over the four weeks ending April 8th. If the current wild rate of spending and asset purchases by the government and the Fed exceed the limits of reserves based monetary creation - that is where "money printing" and high inflation risks come into the picture.

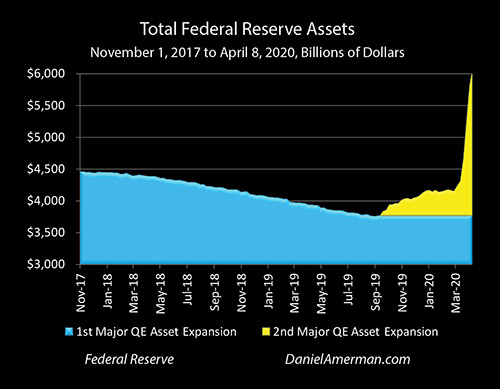

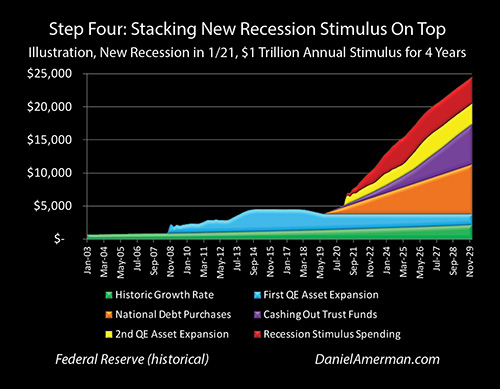

The extraordinary increase in Federal Reserve assets through April 8th - funded by reserves based monetary creation can be clearly seen in the yellow spike above, and we are still in the very early stages.

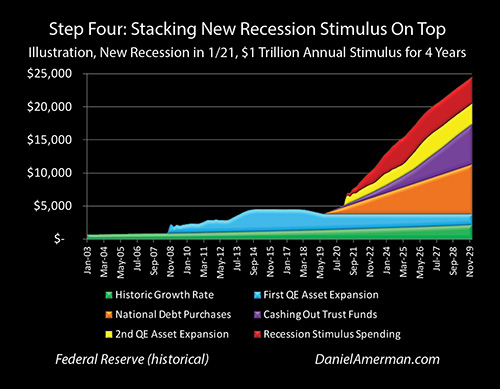

If the graph generally looks familiar to regular readers - it should, because it looks a lot like the graph above from Chapter 8 that was published about a year ago. That chapter did not (of course) predict the pandemic, and the illustration assumed a recession beginning in October of 2020, which is a bit later than the way things turned out.

However, what was illustrated was always on the way, and should have always formed the foundation of retirement financial planning for most individuals. Oh, not the radical severity of the coronavirus pandemic and the economic shutdowns, but that a recession from any source hitting an effectively bankrupt U.S. government would require massive monetary injections from the Federal Reserve and massive stimulus spending from U.S. government, with each being funded by an unprecedented degree of monetary creation simply because of a lack of other alternatives.

Indeed, every aspect of what is now playing out in real time for the funding of the at least temporary Federalization of the U.S. economy could be seen advance in the graph above, which is from DVD #4 of my "Gold Out Of The Box, 2020s Edition" financial education materials (introductory analysis link here). Our current reality is just starting 8 months earlier than the illustration, and it is occurring faster and on a larger scale.

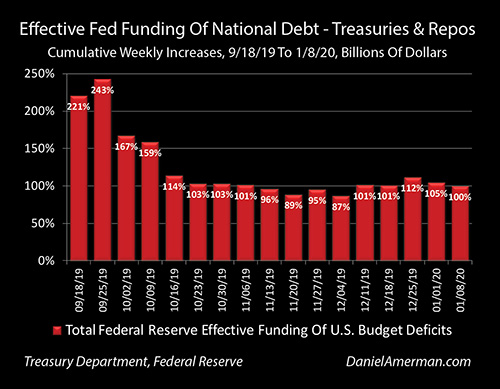

The Federal Reserve was already unable to unwind its monetary creation that was used to contain the damage from the Financial Crisis of 2008, as explored in Chapter 8 and as can be seen in the blue area. The Federal Reserve has since September of 2019 been effectively funding 100% of the growth in the U.S. national debt through monetary creation, as explored in Chapter 18 and shown in the orange area.

After knowing that slamming interest rates down to zero percent would prove inadequate, for the reasons explored in Chapter 4, the Fed would necessarily resort to massive Treasury purchases in the attempt to contain a new recession, funded by monetary creation for lack of alternatives, as shown in the yellow area above and explored in Chapters 8 and 13.

The funding of unprecedented government stimulus programs by monetary creation on a massive scale was always in the cards, as shown in the red area and covered in DVD #4 of the set. The only source of funding for the cashing out of the Social Security trust funds being that of monetary creation by the Fed was also always in the cards as shown in the purple area and as also explored in DVD #4 of the set. The eventual catastrophic conflict involved in using up the limited resource of reserves based monetary creation for fighting recessions, and thereby quite predictably depleting the money needed to cash out the Social Security trust funds and pay future Social Security payments in full, was also more or less inevitable. The cost of the shutdowns has just increased the size of the conflict while bringing it forward in time.

To be clear, the coronavirus pandemic and the economic shutdowns were each complete wild cards, with no possible way to predict them.

But it's not just the pandemic. The shutdowns and wild increases in the national debt are not hitting an ordinary economy, ordinary markets or ordinary government debt levels. The U.S. economy and financial markets were already based on the fragile and unprecedented foundation of a reliance on monetary creation, that has always been there in the aftermath of the Financial Crisis of 2008.

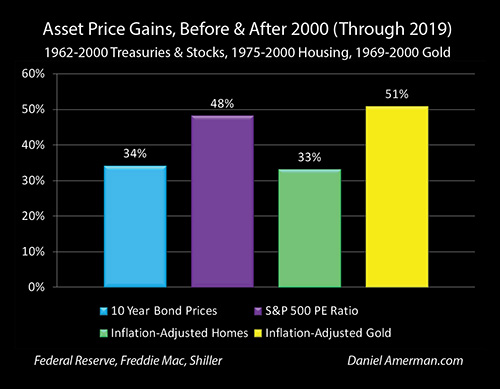

As explored in chapters including 1, 3, 5, 7, 9, 10, 11, 12, 13, 14 and 15, stock, bond and housing prices over the 2010s were being determined not by historical normality, but the rather we were experiencing soothing, elevated asset prices produced by very low interest rates that were maintained and enforced by a form of monetary creation never used in the U.S. before October of 2008.

These elevated asset prices were already being endangered by the fast growth in the national debt, as explored in Chapter 18 (link here). The federal government could not get the money from banks and private investors to fund trillion dollar a year deficits without paying higher interest rates. Those higher interest rates would likely have collapsed the stock, bond and housing markets - the elevated asset prices were already in peril. In desperation and to keep markets high while keeping government spending going the Federal Reserve was already resorting to funding 100% of deficit spending through monetary creation - even before the pandemic hit - as shown in the graph above.

Decades of short term decisions by politicians to kick problems down the road were already coming together in the 2020s between the growth in the national debt, the dependence of the financial markets on artificially low interest rates maintained via monetary creation by the Fed, and the looming dependence of Social Security on empty "trust funds" where the money paid in had already been spent by politicians many years ago, and trillions in new borrowing would be the only way to get the money to pay retirees.

It was this already weak and heavily stressed situation that the pandemic slammed into like a tsunami. Even before the shutdowns, a cornered federal government could not get the a trillion a year (or at least not at very low interest rates) without getting the Fed to create it. So, when we look at these staggering additional trillions in government spending that the nation and economy are dependent upon because of the shutdown decisions - that money is simply not there, and is not even remotely available by any natural means.

This then means that the U.S. economy, investment markets and the future viability of such programs as Social Security have become utterly dependent on an ever more unnatural and extreme experiment with the nature of money itself. This is not remotely normal - and it won't go away either. The national debt usually only goes one direction - upwards.

If we start with the planned cumulative deficits for the 2020s from before the pandemic, and stack on what is now looking like a quite conservative projection for increased U.S. government spending, we are likely looking at adding $20+ trillion to the national debt in the 2020s, effectively doubling it. What is being spent at such a frantic pace in the space of a few months - is in no way free, but will be there for all of us, for the rest of our lives, in the form of a crushing level of debt to be serviced by the entire nation.

The Federal Reserve knew full well starting in 2008 that when it began its unprecedented experiment of using monetary creation to directly intervene in the markets, that one likely result would be unnaturally elevated asset prices. It didn't have an exit plan. It tried an exit anyway in 2017 and 2018, and nearly brought the markets down in 2018 before backing off.

So when we look at the fantastic rate of growth in what is funded in government deficit spending and in the markets by just creating the money - it too is a one way street, that is likely to be there and stronger every year for the rest of our lives (absent a reset event such as a high rate of inflation).

Part of the premise behind this book, started well before the pandemic, was to provide a framework, as shown below, and help people better understand why stock, bond, home and gold prices were all being profoundly changed by what the Federal Reserve was doing, and what was happening with the national debt.

(More information on the framework can be found in Chapter 1, link here.)

The way stock, bond, housing and gold prices work is changing for the rest of our lives, starting in 2020.

One path is market meltdown and monetary reset. This possibility is shown in Column A, and would include a secular bear market with major losses to retirement accounts, inflation destroying most of the value of money, and likely an economic depression to go along with it. That may sound a bit extreme, but we are living history right now in terms of both a pandemic and a record - government ordered - collapse of the economy and employment.

However, that is not the only possibility and the point behind the fantastic increase in the national debt and the even more fantastic increase in monetary creation is to keep the economic and market collapse from happening. But - the measures deployed won't be temporary events. If they work, they will be there for a very long time, and they are likely to dominate money, interest rates and investment prices for the rest of our lives, as well as the ability of the nation to pay for Social Security and medical care.

If the current crisis is successfully contained, stock prices will be dominated to an unprecedented extent by the distorting effects of how that containment is achieved, possibly for the rest of our lives.

The same will be true of bonds. The same will be true of home prices. The same will be true of gold prices (though in a quite different way).

As many of us sit in our homes and socially distance - the financial and economic world we had in December of 2019 is already long gone. We are in the midst of the fantastic and the unprecedented - and there is no reasonable path back to where we were in the 2010s, let alone the decades before which were not dominated by monetary creation.

There will still be opportunities and there will still be risks. But the specifics of where they are, why they exist and how to identify them are likely to be quite different.

Learn more about the free book.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2020 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.