Stock Market 40 Year Cycle - 1980 Part 2?

Stock-Markets / Stock Markets 2020 Apr 24, 2020 - 05:00 PM GMTBy: Submissions

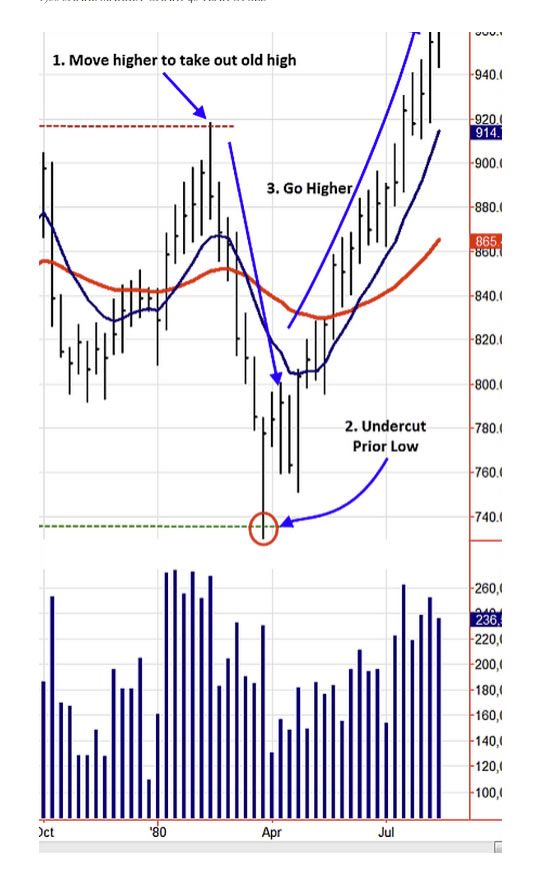

We are tracking the 1980 correction in relation to the ongoing correction today. Thus far, the two have been shockingly similar.

1980 SHARE MARKET CHART 40 YEAR CYCLE

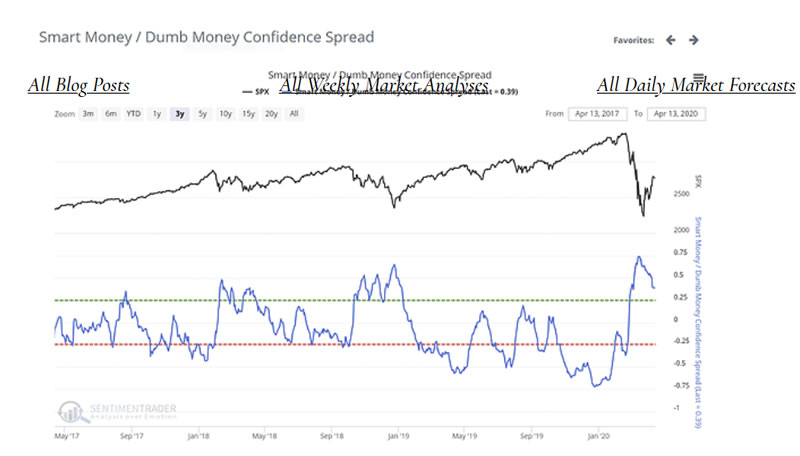

We are contrarians at HFZ and prefer to enter trades when sentiment is heavily bearish. We have that exact perfect storm right now! Virtually every newsletter, analyst, article, and YouTube expert has been predicting a continuation of the crash into the end of April or a re-test of the low into early June. We bought the share market on March 23rd, the low of this correction. We have never wavered in our analysis of this market. It was either a V shape rocket recovery or strong rebound into mid May, followed by a much higher low . We have leaned toward the V shape recovery for the simple fact the current markets movements have mirrored our 40 yr 1980 cycle since October.

There is a record amount of institutional cash on the sidelines not seen since the Great Depression. The market is like a slingshot. When it gets stretched too far above the 200 weekly moving average, price reverts. Then a equally violent reaction to the upside normally follows.. Our proprietary artificial intelligence models are telling us to expect a MASSIVE move in early May. We believe this will be to the upside. The only caveat would be certain governors refusing to follow President Trump's Reopen the USA order. We don’t think that will happen based on the people wanting to end the lockdown and governors hearing that cry and wanting another term in office. There is too much money on the sidelines and cash is indeed trash over long periods of time. It will be deployed. The FOMO, fear of missing out, trade will show back up with a vengeance . We will convert to leverage for our accounts once markets pass certain trigger points we have established. The profits should be fast and furious. Join and become a Gold Member at HFZ to follow our identical trades.

© 2020 Copyright hedgefund-z - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.