US Real Estate Showing Signs Of Covid19 Collateral Damage

Housing-Market / US Housing May 19, 2020 - 05:56 PM GMTBy: Chris_Vermeulen

As we continue to digest economic and global data, our researchers have focused on Real Estate as we believe the contraction in the US economy, spanning corporate, main street, and millions of Americans, will quickly reflect in a slowing Real Estate market. Our researcher attempted to dive into the most recent data from Realtor.com (https://www.realtor.com/research/) to identify any trends or insights we could find to prepare for a broader contagion event.

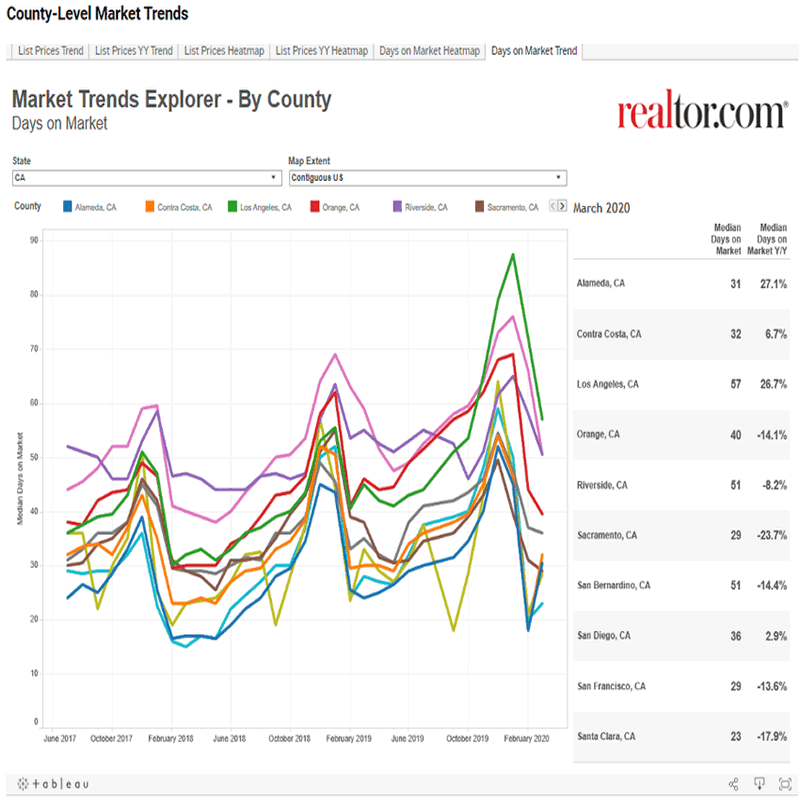

Current data suggests the US Real Estate market has begun a dramatic slowdown even though the listing and pricing data does not reflect this data yet. In short, more homes are being pulled from active listings and those that are still listed are sellers that can wait out their price or are under pressure to sell because of other factors. Historically, Summer months typically result in a moderate decrease in price levels as more homes get listed for sale and “Days On Market” (DOM) lengthens. Something big is starting to take place almost everywhere in the US as current data suggests inventory is shrinking, price levels are still moderately high and DOM level has increased dramatically.

News of recent delinquencies in the mortgage market shows an incredible increase in the number of mortgages under pressure. We believe many borrowers will attempt to cash out of the market over the next 90+ days while price levels are high. Many of these borrowers will be rolling the dice while they hold onto their homes hoping the economy/jobs come back before the end of 2020 while they watch the value of their homes decline.

California Days On Market YoY Chart

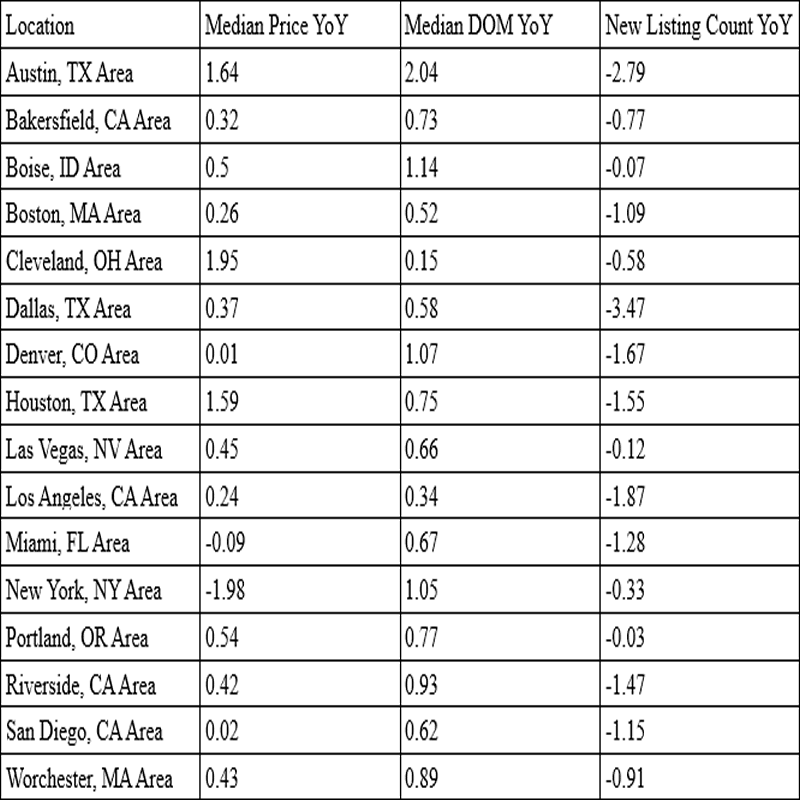

Overall, across the entire US, median listing price levels have increased 1% YoY while Days on Market has increased 6% YoY and Active Listings have decreased 15% YoY. Reading between the lines, this suggests to our researchers that sellers are trying to capture peak price levels while sales activity continues to decrease. This also suggests that buyers are shifting into a more conservative buying mode – waiting for the right deal, better prices, and more distressed sellers.

Locally, most of the major markets have seen an incredible change in listing price, DOM, and active listing data over the past 30+ days. This data represents the YoY data change related to data from April 11, 2020, to May 9, 2020. This data reflects how trends are changing and how total counts are changing – not total price level changes or total trend count changes on a YoY basis.

Our research team believes this data suggests sellers are still entering the market trying to take advantage of high price levels, yet they are not entering the market as quickly as they were 30+ days ago (hence the drop in new listing data). Additionally, the DOM increases suggest buyers are slowing their activities as well. Simple Supply and Demand theory suggests when prices are high and buyers begin to lose faith in future price increases – the cycle shifts from rising price levels to falling price levels as buyers begin to wait out the better deals and wait for the bottom in the markets to setup.

I was on TraderTV a few weeks back with Mr. Wonderful (Kevin O’Leary) and he talked about the issue with real estate and his way to deal with it in this video clip.

In Part II of this article, we’ll continue to explore more data that suggests the Real Estate sector may become a big part of the next phase of the global economic collapse. Early data suggests the market is shifting away from a seller’s market into a buyers market fairly quickly. If our research is correct, all segments of Real Estate will become a bigger problem for banks and the economy as the shutdown continues.

We suggest you read this article from March 2020, WE ARE CONCERNED ABOUT THE REAL ESTATE MARKET:

If our research is correct, this shift is taking place right now and will likely continue into Summer 2020 as Main Street and millions of businesses suffer from the COVID-19 virus shutdowns. Common sense would suggest an economic contraction reflecting millions in lost jobs, a major contraction in retail and other segments of the US economy and a severe issue with commercial real estate may lead to a broader contraction in residential real estate. Buyers slow their purchases as more homeowners come under increasing economic pressure, prices begin to decline, and the cycle shifts from a seller’s market to a buyers market.

Right now, we are advising our clients to wait for stronger confirmed trading setups as we believe the current US market is still in a no man’s land related to price levels and future trends. There is still a moderate change the US Fed buying will prompt a bit more upside price trend, but our modeling systems and technical indicators are suggesting a “double-dip” low will form as the collateral damage continues to become known. This is the time for skilled technical traders to play very conservatively with their capital and to target bigger trends when the setup.

The next 24+ months are certain to be full of incredible opportunities for skilled technical traders – yet also full of risks. We’ve already received emails from individuals who have been taking aggressive trades in certain sectors and gotten burned. Follow our research and please understand the markets will do what they are going to do. Our job is to find the right opportunities and to capitalize on them for profits.

I have to toot my own horn here a little because subscribers and I had our trading accounts close at a new high watermark for our accounts. We not only exited the equities market as it started to roll over, but we profited from the sell-off in a very controlled way. Also, we locked in more with this bounce in the markets, along with a move in natural gas and we are sitting with some gains in our new position in the next hot sector.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is going to be an incredible year for skilled traders. Don’t miss all the incredible moves and trade setups.

I hope you found this informative, and if you would like to get a pre-market video every day before the opening bell, along with my trade alerts. These simple to follow ETF swing trades have our trading accounts sitting at new high water marks yet again this week, not many traders can say that this year. Visit my Active ETF Trading Newsletter.

We all have trading accounts, and while our trading accounts are important, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during a time like this, you could lose 25-50% or more of your entire net worth. The good news is we can preserve and even grow our long term capital when things get ugly like they are now and ill show you how and one of the best trades is one your financial advisor will never let you do because they do not make money from the trade/position.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Long-Term Investing Signals which we issued a new signal for subscribers.

Ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.