Silver vs Gold Trend

Commodities / Gold & Silver 2020 Jun 09, 2020 - 03:09 PM GMTBy: Nadeem_Walayat

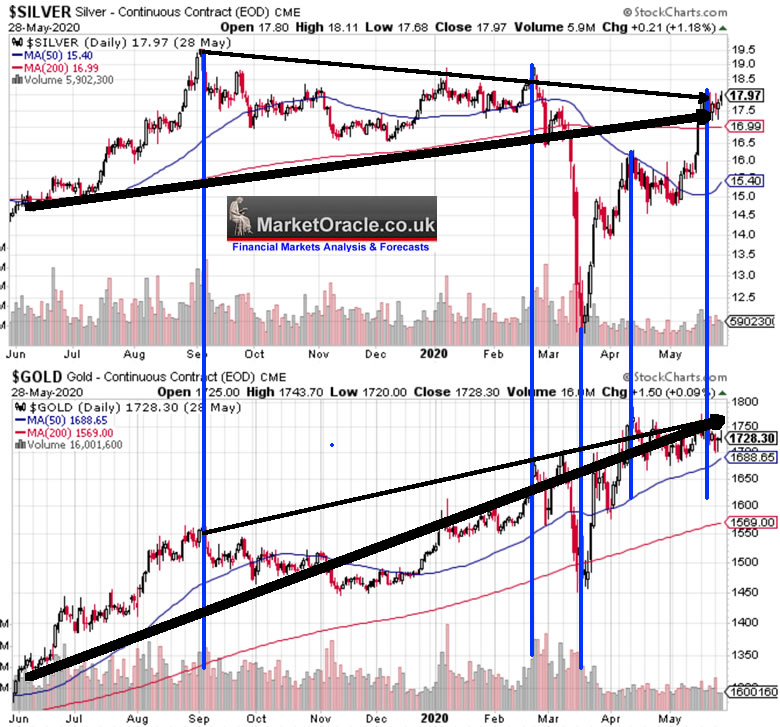

The silver price has managed to recover from the Corona crash of 2020 with the price back within it's trading range of $17 to $20. Though contrary to the Silver bugs perma expectations for the Silver price to track the Gold price higher, that's not what usually tends to happen as the below graph illustrates,, which if you have followed my previous Silver analysis articles than you would know this is the expected behaviour of Silver, Gold's volatile and unresponsive to events cheaper cousin.

Gold price rises to new bull market highs whilst the SIlver price just manages to recover to it's trading range.

My last look at the Gold price was in Mid January (Gold Price Trend Forecast 2020) that concluded in mild first few months of the year to give way to a strong Bull run from Mid April to target a trend towards $1800.

I will cover the prospects for Gold in a separate article because it's probably better to analyse Silver before Gold, else one can fall victim to the tendency to extrapolate Gold to Silver.

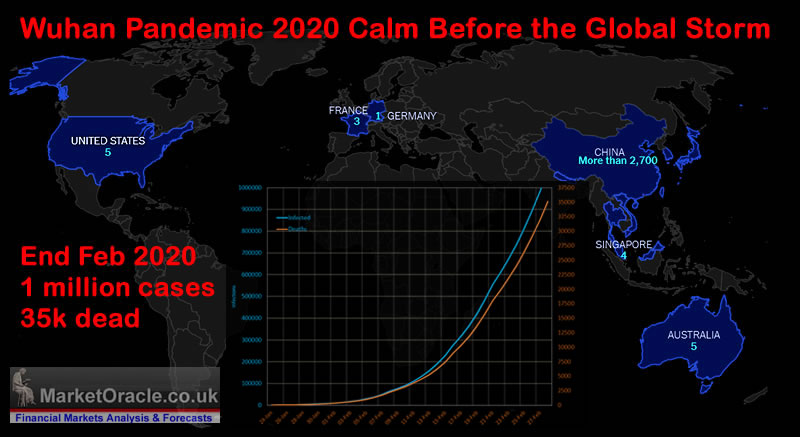

Whilst my last look at silver on the 29th of January at the very beginning of the coronavirus catastrophe when most of the world thought it uniquely as a Chinese problem and then continued to remain largely deaf, dumb and blind to it's apparent consequences for nearly another 2 months !

29th Jan 2020 - Silver Price Trend Forecast 2020

Given the exponential rate of spread of the virus, then by the end of February 2020 as many as 1 million people could be infected globally, that at a 3.5% fatality rate would result in 35,000 deaths. Though the true fatality rate will likely be significantly higher, and likely the virus has already spread to most nations (including Britain) given that approx 1 million Chinese students have traveled back to foreign Universities after the New year holidays.

So a potential AI mega-trend stocks buying opportunity. Though stock sectors likely hardest hit will be travel, tourism and retail.

Silver Price Trend Forecast 2020

Initially I am expecting a very volatile trading range between a low of $16.50 to a high of $19 for the next 3 months or so, following which the Silver price 'should' respond to a Gold price rally and follow the yellow metal higher. The trends not going to be pretty but I expect Silver to trade above $20, and likely reach a peak near $21 later in the year as the forecast graph illustrates.

The bottom line is that Silver is in a 6 year long trading range of between $21 and $14. And we are all waiting for the breakout higher. For which there is a low probability of happening during 2020. However, my long-term expectations remain of being invested for a spike to $35+, which on the current price would represent a gain of 100%.

So the strategy is to invest in Silver rather than to trade Silver, to accumulate when cheap and given the gold / silver ratio of 89, Silver is still cheap today relative to Gold. Just remember Silver tends to under perform Gold during most of the precious metal bull markets, and tends to outperform towards the end of powerful bull runs as retail investors start waking up and start jumping on board, hence expect a series of spikes higher through resistance levels over the coming years.

All things considered, and given that on 29th of Jan no one could have imagined our governments would be incompetent and negligent to the extent they have been in response to the Coronavirus then the forecast has managed to prove remarkably accurate given that the forecast was for SIlver to be currently trading at about $17.4 against actual last close of $18.4. Namely for the expectation for Silver price weakness into Mid 2020 ahead of an attempt at a break above $20 later in the year, set against the perma silver bugs who have seen every up day as the start of the silver gold rush towards $50 and beyond.

The whole of this extensive analysis that concludes in a detailed trend forecast for the Silver price was first made available to Patrons who support my work: UK and US Corona Catastrophe Trend Analysis, Stock Market State and Silver Price Trend Forecast Summer 2020

- UK Corona Catastrophe Trend Analysis

- FEEDING THE INFLATION MEGA-TREND

- US Corona Catastrophe Trend Analysis

- The Corona Riots of 2020 Have Begun!

- Stock Markets Failing to Give Another AI Mega-trend Buying Opportunity

- Silver vs Gold Trend

- Gold Silver Ratio

- Silver Long-term Trend Analysis

- Silver Trend Analysis

- Formulating a Trend Forecast

- Silver Price Trend Forecast Conclusion

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.