Why US Commercial Real Estate is Set to Get Slammed

Housing-Market / US Housing Jul 31, 2020 - 05:31 PM GMTBy: EWI

Commercial real estate investors are in an especially precarious position should another financial crisis unfold.

A July 18 Marketwatch article titled "The open secret in commercial real estate is that owners regularly take cash out of properties ..." says:

Borrowers, ahead of this [year's] downturn, pulled more equity out of U.S. commercial buildings than ever before. ...

Debt relief conversations already started in April ... between the hardest-hit commercial property borrowers and their lenders.

Since then, delinquent commercial mortgage-backed securities loans have climbed to nearly 10%, rivaling the worst levels of the global financial crisis [in 2007-2009].

The National Association of Real Estate Investment Trusts estimates that the value of U.S. commercial real estate is around $16 trillion (2018).

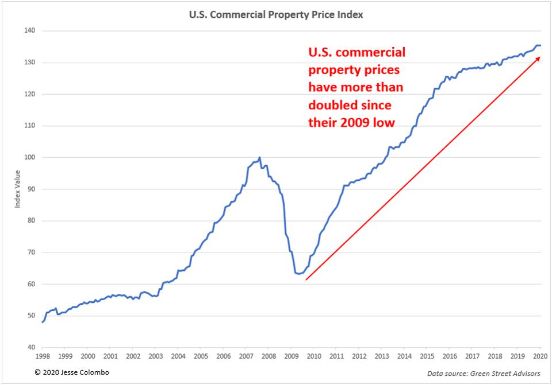

Indeed, as this April 2020 chart from Forbes shows, U.S commercial property prices have more than doubled since their 2009 low:

Moreover, commercial real estate loans at U.S. banks surged by $863 billion or 62% since 2012.

So, if commercial mortgage-backed securities loans delinquencies already exceed the levels of more than a decade ago, imagine the scenario if "another shoe drops."

Relatedly, trouble is also brewing in the residential real estate market.

In June, ABC News reported:

Existing home sales plunge 9.7% in 3rd straight monthly drop

Elliott Wave International's analysts have been discussing what this likely means for U.S. housing prices.

And, getting back to the phrase about "another shoe dropping" in the financial system, Robert Prechter's 2018 edition of Conquer the Crash discusses what happens when debt levels become unsustainable:

The ability of the financial system to sustain increasing levels of credit rests upon a vibrant economy. At some point, a rising debt level requires so much energy to sustain -- in terms of meeting interest payments, monitoring credit ratings, chasing delinquent borrowers and writing off bad loans -- that it slows overall economic performance. A high-debt situation becomes unsustainable when the rate of economic growth falls beneath the prevailing rate of interest on money owed and creditors refuse to underwrite the interest payments with more credit.

When the burden becomes too great for the economy to support and the trend reverses, reductions in lending, borrowing, investing, producing and spending cause debtors to earn less money with which to pay off their debts, so defaults rise. Default and fear of default prompt creditors to reduce lending further. The resulting cascade of debt liquidation is a deflationary crash. Debts are retired by paying them off, "restructuring" or default. In the first case, no value is lost; in the second, some value; in the third, all value. In desperately trying to raise cash to pay off loans, borrowers bring all kinds of assets to market, including stocks, bonds, commodities and real estate, causing their prices to plummet. The process ends only after the supply of credit falls to a level at which it is collateralized acceptably to the surviving creditors.

Indeed, deflation is one of the topics discussed in Elliott Wave International's free resource: 5 Global Insights You Need to Watch.

You see, we asked our top 5 global experts to share their latest forecasts for cryptocurrencies, crude oil, interest rates, deflation, and the future of the European Union.

The result is this short, 5-video series (plus, two quick reads). In just 13 minutes, you get insights into markets and factors that can have a major impact on your investments.

And -- you get it free with a fast Club EWI signup. Club EWI is the world's largest Elliott wave educational community and membership is also free.

Just follow this link for free access to 5 Global Insights You Need to Watch.

This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.