Stock Market Uptrend Continues?

Stock-Markets / Stock Markets 2020 Aug 04, 2020 - 05:41 PM GMTBy: Andre_Gratian

Current Position of the Market

SPX Long-term trend: For now, the best guesstimate is that we are still in the bull market which started in 2009.

SPX Intermediate trend: We should be approaching an important high, with confirmation coming over the near term.

Analysis of the short-term trend is done daily with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discuss longer market trends.

Daily market analysis of the short-term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at anvi1962@cableone.net

Uptrend Continues?

Cycle cluster ahead

45-td cycle ~8/14 – 26-day ~8/25 – 36-td ~8-31

Market Analysis (Charts courtesy of QCharts)

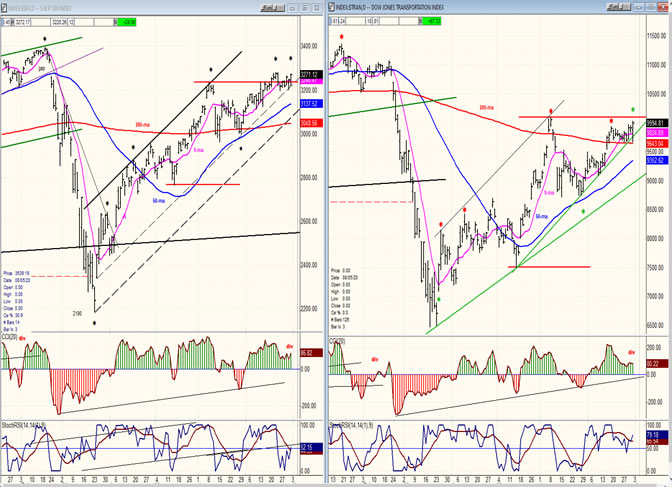

SPX- TRAN daily charts:

Both indexes continue in an uptrend from the March low with the TRAN still lagging but showing some minor relative strength (*) on Friday. This may mean that SPX could push higher next week. Note that since 6/29 both indexes have risen in a bullish structure which may be entering wave-5 from that date. When this 5th wave is complete, TRAN should signal it with a red asterisk a day or two ahead of SPX, followed by a reversal in both.

Also, the CCI of both indexes is showing negative divergence, hinting that a short-term high is near.

SPX daily chart

The 3200 SPX level is becoming important support which, after being tested several times, has held. Friday’s action suggests that we may be ready to move higher. After an important hold on Thursday in the light of a horrific economic report, on Friday the index closed strongly at the high of the trading range which was recently established above 3200. That, and the strong showing by the TRAN on Friday, can only suggest that higher prices lie directly ahead.

This is also suggested by the perception that both indexes are apparently starting their fifth and final wave from the 6/19 low. A minimum projection for this final wave is ~3320, but the index could rise as high as 3380 before completing the pattern. After this, a correction would be expected to take place into the end of the month and into the cycle cluster shown above.

The daily oscillators are confirming that we are approching the conclusion of an uptrend by exhibiting negative divergence in all three.

SPX hourly chart

When the index shot up in the last two hours of trading on Friday, it caused the momentum oscillators to rise sharply along with the price. This is another indication that SPX should continue higher on Monday. These oscillators display recognizable patterns at short-term highs and lows, whereby some deceleration is usually followed by negative (or positive) divergence before a reversal takes place. Since we have neither, we must assume that Friday’s move will be followed by additional appreciation next week.

The rising dashed trend line at the bottom of the chart is a parallel to the trend line connecting the tops. When this dashed line is decisively penetrated, it will be a confirmation that we have completed the wave pattern from 2984 and that we have started a correction into the cycle lows.

- UUP (dollar ETF)

- Last week, I mentioned that the dollar should reach 93 before UUP could find a low for this move. USD did indeed meet its projection of 93 last week, and this should mark a temporary low for UUP enabling it to start a consolidation phase. This also marks the completion of a 5-wave pattern from the high. A return move to about 26 is probable.

-

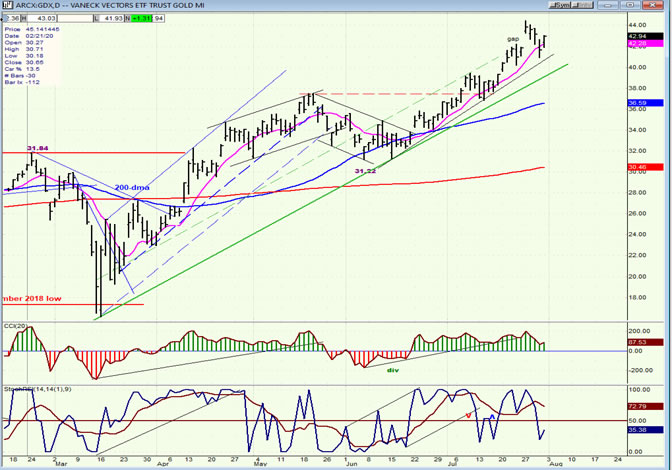

- GDX (gold miners)

- I had expected GDX to at least pause at about 40, which is what it did very briefly without generating a sell signal before moving on to 44.00 where it could linger slightly longer. There is no confirmed sell here either and, if none is created, the next target could be 47.

-

- PAAS (Pan American Silver Corp)

- PAAS and GDX have been moving in tandem and their price trends and oscillator patterns since 6/19 are identical, which means that PAAS has not given a confirmed sell signal either and could next move to about 44 if none is given.

-

- BNO (U.S. Brent Oil fund)

- Last week, BNO pulled back to its 50-dma, found support, and rallied. However, its oscillators have given a sell signal which could mark the start of a correction.

-

- Summary

Andre

FREE TRIAL SUBSCRIPTON

For a FREE 4-week trial, send an email to anvi1962@cableone.net, or go to www.marketurningpoints.com and click on "subscribe". There, you will also find subscription options, payment plans, weekly newsletters, and general information. By clicking on "Free Newsletter" you can get a preview of the latest newsletter which is normally posted on Sunday afternoon (unless it happens to be a 3-day weekend, in which case it could be posted on Monday).

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.