The Tragedy of More Missed COVID-19 Opportunities

Politics / Coronavirus Depression Aug 19, 2020 - 03:44 PM GMTBy: Dan_Steinbock

According to a new report, US states are the most virus-affected relative to major economies. As COVID-19 has proceeded in two phases, containment failures in the West continue to fuel the pandemic and economic damage.

In April, my first COVID-19 report focused on the progression of the pandemic from China to Western Europe and the United States, and the belated mobilization and containment failure in Washington and Brussels.

My new report The Tragedy of More Missed Opportunities , which is also released by Shanghai Institutes for International Studies [with Chinese introduction], focuses on the new missedCOVID-19 opportunities and the consequent human costs and economic damage in the largest world economies, particularly in emerging and developing countries.

At the current rate, the confirmed cases could exceed 25 million by the end of August. In the absence of deceleration, these cases could soar to 50-60 million and deaths to 1.5 to 1.7 million by the year-end. And as projected by the April report, the devastation would prove most significant in the United States.

Distressingly, the new report shows how even more opportunities have been missed in the past quarter, as a result of the old public-health debacles and premature exits, continued policy mistakes and the consequent collateral damage in all income groups of world economies (high-, middle-, and low-income).

Following standards-setting measures to contain the outbreak in January-February, Chinese economy is rebounding. In contrast, economies, which began COVID-19 mobilization belatedly, struggle with disastrous 2nd quarter results, as projected by the first report.

In the Americas, US failure of containment, poor crisis management and premature exits, coupled with poorer economies and weaker health systems, have resulted in the worst regional crisis worldwide. Yet, Canada’s track record suggests proper precautions can work, despite elevated risks in the region.

US states most virus-affected relative to world economies

In January, President Trump congratulated President Xi Jinping for China’s success in the containment of the COVID-19. But as the Trump administration’s delayed responses and poor crisis management failed to contain the pandemic in the US, Trump reversed his stance. To win re-election, the White House has blamed China for the pandemic and escalated the trade war diplomacy, technology, and finance.

Yet, contrary to the Trump White House’s narrative, the global pandemic actually evolved in two phases. The first involved mainly Chinese cases from Wuhan, Hubei, and it was contained rather quickly. The second phase involved especially Western Europe and the US, and it continues to fuel the global pandemic.

To understand the full magnitude of the adverse spillovers, let’s think of US states as independent economies. If these states were sovereign entities, then by August almost a fourth of the 25 most virus-affected economies were in the US, with California, Florida, Texas and New York in the top-10, right after the large economies of Brazil, India and Russia, even South Africa.

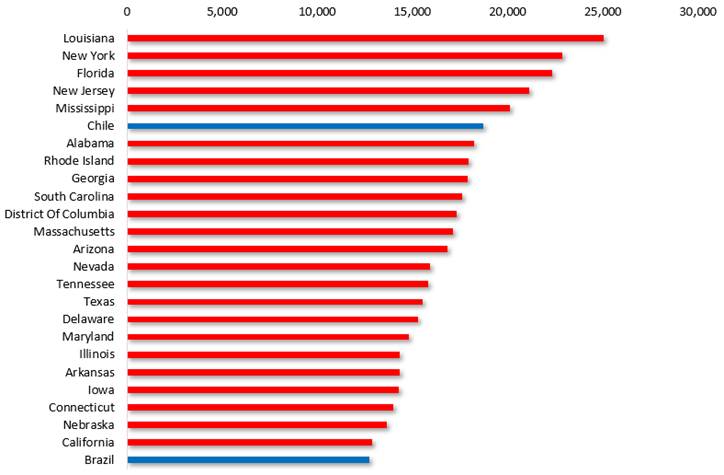

Nevertheless, aggregate data reflect poorly the actual realities unless adjusted to the size of population. To gain a more valid picture of the pandemic intensity, let’s focus on population-adjusted data (total cases/1 million population). In this view, US states accounted for a whopping 23 of the 25 most-virus affected large economies worldwide, as Louisiana, New York, Florida, New Jersey and Mississippi come before Chile. Even the populous and highly virus-affected Brazil fell behind many US states, including the tiny Iowa (3.2 million) and Connecticut (3.6 million) (Figure).

Figure COVID-19, World Economies and US States*

Accumulated confirmed cases by Aug 1, 2020

Sources: Worldometer; Difference Group

COVID-19 progression in two phases

In my new report, the progressive course of the COVID-19 was examined in all major economies in terms of the timing of the official first cases, accelerated spread, effective reproductive number (Rt), transmission classification, flattening of the curve, new accelerations, and potential susceptibility to new waves.

While the virus was first officially recorded in China, the global pandemic has been fueled by delayed responses, failed containment and premature exits in Europe and the US. While the outbreaks began in Wuhan, Hubei, the sources of the pandemic are more complicated.

In the high-income group (four major Western European economies, US and Canada, Japan and South Korea) the reported first cases in late January were associated with China. Yet, the confirmed spread has been linked with travelers from Western Europe and local transmissions, and to a lesser degree with travelers from US, Asia, the Middle East and China.

In the upper middle-income economies (Argentina and Brazil, China and Indonesia, Mexico, Russia, Thailand and Turkey) and lower middle-income economies (Bangladesh, Egypt, India, Kenya and Nigeria, Pakistan, Philippines and Vietnam) half of the first cases have been linked with China, another half with Western Europe, and to a lesser degree with Japan, the Middle East and the US. However, the confirmed spread has been associated with Western Europe and local transmissions, and to a lesser degree with the US, Midddle East and Japan.

In the low-income economies (Afghanistan, Congo DR and Ethiopia, Madagascar, Mozambique, Sudan, Uganda and Yemen) most of the first cases have been linked with Western Europe, and to a lesser degree with the Middle East, Japan and local transmissions, whereas the confirmed spread has been associated with local transmissions.

China’s rebound, US lost years

As measured by declines in expected gains of per capita incomes – a rough shorthand for living standards - the impact has been devastating in most economies and relatively worst in those that have been coping with pre-pandemic challenges.

Among high-income economies, most countries may face 5-7 years of lost progress, whereas in outliers prior challenges are contributing to far greater declines (e.g., Italy, Japan).

Among upper middle-income economies, China and possibly Indonesia may navigate through the crisis without negative contraction. But most countries have already lost 5-7 years of progress and in some economies in Latin America, such as Brazil and Argentina, the lost years may prove twice as many as among their peers.

Moreover, the economic devastation in poorer economies could be significantly higher than currently acknowledged. Due to minimal testing and underestimated COVID-19 case counts, everyday realities in Congo DR, Yemen and certain other countries differ dramatically from the official low number of cases.Instead of the pandemic, premature deaths could be attributed to “pre-existing conditions.”

Worse, the two phases of the COVID-19 progression may have been amplified by an adverse mutation. In Wuhan, China and Asia, the virus was initially dominated by the original ‘D’ variation. But in March, a new ‘G’ variation seems to have evolved in Western Europe and the US predominating infections in late spring.

If this transition has occurred, emerging and developing economies may soon face more virulent virus strains that the lockdowns and travel restrictions in the West have so far kept in check.

With the Spanish flu, it was not the first wave that proved fatal, but the second. If such painful lessons have not been learned by now, they will be learned over a major crisis that could result in a protracted pandemic and global depression.

Dr. Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Center (Singapore). For more, see http://www.differencegroup.net/

© 2020 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.