Powerful Deflationary Winds" Include a "Bust in Commodity Prices

Commodities / Commodities Trading Aug 30, 2020 - 05:27 PM GMTBy: EWI

Elliott Wave International's analysts have posited that the next big global monetary event will be deflation, not inflation.

The writer of an August 18 Telegraph article also sees "powerful deflationary winds."

Here's an excerpt:

Talk of resurgent global inflation is mostly noise. Powerful deflationary winds continue to blow through the world economy. ...

The great inflation hypothesis now in fashion rests on mechanical monetarism. It assumes that the fastest peacetime growth of the "broad" M3 money supply since the American Revolution lays a bed of inflammatory tinder that will catch fire once a match is lit: that is to say, when the velocity of money reverts to mean and collides with the enlarged stock of money.

Liquidity creation has been less extreme elsewhere (the Federal Reserve front-loaded $3 trillion in March and April) but there has still been an eye-watering jump in "narrow" M1 money across the OECD bloc -- ie, a surge in bank deposits due to hoarding of saved money through the lockdowns.

Monetarists say inflation did not take off when QE was first launched a decade ago because the western banking system was crippled. The stimulus offset the destruction of money by banks as they slashed lending in order to beef up capital buffers. This time banks are in better shape (in Europe, really?) and the transmission channel is intact. That at least is the argument.

The monetarist school has claimed victory already, quick to suggest that a V-shaped recovery in asset prices implies a V-shaped recovery in the real economy as well.

The Federal Reserve does not believe a word of it. Nor does the International Monetary Fund, nor the OECD, nor the global professoriate, nor the prophets of modern economic orthodoxy, loosely known as the New Neo-classical Synthesis. Their collective view is that central banks are low on usable ammo and will struggle to create any inflation, unless they escalate to the next stage of Weimar fiscal dominance.

It is now a pitched battle between two incompatible economic models. One side or the other is going to emerge looking bruised, and I suspect that it will be the monetarists. The velocity of money will indeed recover in the long-run but in the long-run -- pace Keynes -- we are all dead.

One thing that is not happening right now is a pre-inflationary surge in raw material prices, let alone an oil shock, though you might think otherwise after the wild moves in gold and silver. The Bloomberg all commodity index has recouped just half of its losses since the pandemic began and remains at near depression levels.

Speaking of raw material prices, Elliott Wave International's monthly publications have been keeping subscribers ahead of the trend.

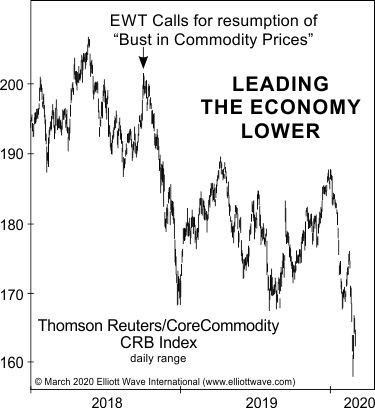

Here's a chart and commentary from the March 2020 Elliott Wave Financial Forecast:

This chart shows the Thomson Reuters/CoreCommodity Index; the high on the chart is the end of a bear market rally in May 2018. In February 2018, EWFF called for a "substantial decline" in the CRB, and The Elliott Wave Theorist reiterated with a forecast for a resumption of the "Bust in commodity prices" on October 1, 2018. Two days later, the CRB index made the countertrend high shown by the arrow on the chart.

Get more important insights by reading the free report: What You Need to Know Now About Protecting Yourself from Deflation.

This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.