THE STOCK MARKET BIG PICTURE

Stock-Markets / Stock Markets 2020 Nov 06, 2020 - 05:15 PM GMTBy: Nadeem_Walayat

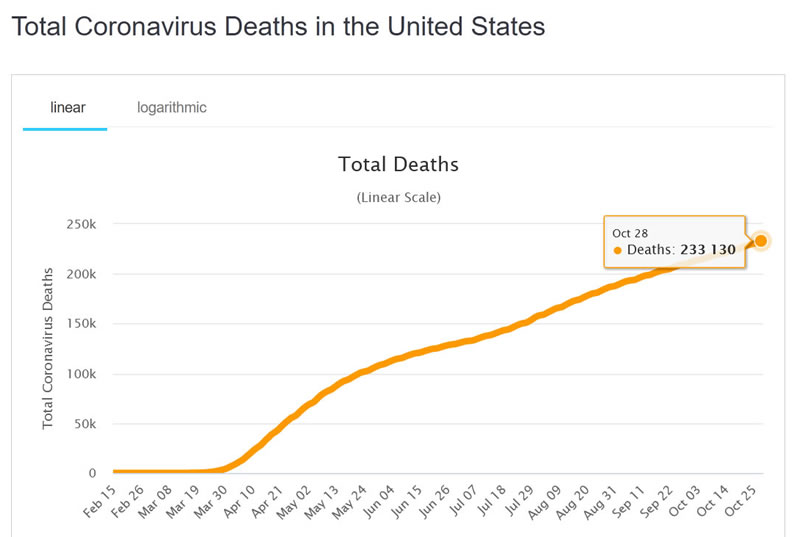

Will the November 3rd election earthquake trigger a stock market Tsunami or just a few inconsequential waves lapping on the market shore? Here we stand just a few days away from the US presidential election with the liberal MSM in a state of electoral fever as their preferred candidate is way ahead on the polls looking set to win, just as their favoured candidate Hillary Clinton in 2016 was way head of the polls so unlike 2016 there is an edge to the frenzy of their activity given the awareness that the polls tend to be wrong, skewed against conservative voters and opinions. However, 2020 is even more chaotic than 2016, as this year there is the backdrop of the chinese virus raging across the US and especially in many US swing states that is contributing towards new cases of infection soaring to new plandemic highs with deaths already having broken above 230,000! Near double all of the US lives lost in all of the wars since 194 that acts as a continuing noose around the US economy, though that has so far not been enough to full fill that which the perma stock market doom merchants have been proclaiming for a more than a decade, an end to the stocks bull market.

Will the November 3rd election earthquake trigger a stock market Tsunami or just a few inconsequential waves lapping on the market shore? Here we stand just a few days away from the US presidential election with the liberal MSM in a state of electoral fever as their preferred candidate is way ahead on the polls looking set to win, just as their favoured candidate Hillary Clinton in 2016 was way head of the polls so unlike 2016 there is an edge to the frenzy of their activity given the awareness that the polls tend to be wrong, skewed against conservative voters and opinions. However, 2020 is even more chaotic than 2016, as this year there is the backdrop of the chinese virus raging across the US and especially in many US swing states that is contributing towards new cases of infection soaring to new plandemic highs with deaths already having broken above 230,000! Near double all of the US lives lost in all of the wars since 194 that acts as a continuing noose around the US economy, though that has so far not been enough to full fill that which the perma stock market doom merchants have been proclaiming for a more than a decade, an end to the stocks bull market.

The stock has largely marked time in a tight trading range with all wondering if Trump being 10%+ behind in the polls can manage to pull off another election miracle as he did in 2016.

THE STOCK MARKET BIG PICTURE

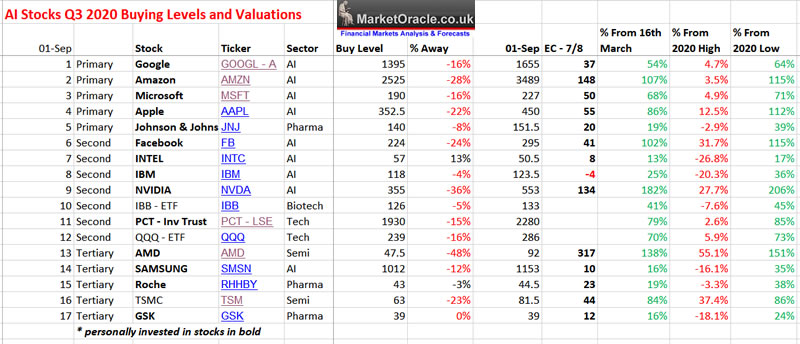

The starting point for this analysis is to remind my Patrons of the BIG PICTURE, the general trend trajectory for AI stocks as illustrated by my following concluding graph from June 2020. (Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!)

Which would roughly convert into the Dow trading at 100k by the Late 2030's.

THAT IS THE BIG PICTURE!

So the primary objective is to KEEP CALM AND REMAIN INVESTED IN AI STOCKS, a message I have been iterating since soon after the Dow bottomed in March 2009 (Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470)

"The greater the deviation from the bull market high then the greater the buying opportunity being presented"

At my last AI stocks update many stocks had run way ahead of valuations on my EC metric, for instance Amazon was trading at $3300 on an EC ratio of 148 (objective is to buy Amazon at levels below 100). Of course the revenues and profit bonanza from the lockdown's and the work from home demand surge should ensure that most AI stocks see their EC levels moderate as earnings reports come in, especially for the likes of Amazon and AMD which is literally on FIRE! KILLING Intel and now also giving Nvidia a run for its money! AMD is definitely NOT a stock that any investor should contemplate selling out of regardless of how high it trades because this stock is literally on FIRE!

I will update the AI stocks buying levels in due course, but just a reminder to be aware of the big picture and not get lost in short-term noise that is the the US presidential election is, and which ever way the stocks trend over the next couple of months which are unlikely to deviate much to the downside against the bull market highs given the fundamentals of the AI Mega-trend.

This analysis continues from Part 1 (US and UK Coronavirus Pandemic 2nd and 3rd Waves Trend Implications for the Stock Market). So I won't be repeating or presenting updates to to that analysis other than as expected the US has headed into a higher third peak, whilst the death rate is currently moderating, which confirms that the virus is diminishing in significance in advance of the appearance of the first vaccines that 'should' start to appear in volume early 2021.

Part 2 - Stock Market Trend Forecast into January 2021, Final Election Forecast Matrix

- Stock Market Big Picture

- Dow Short-term Analysis

- Dow Long-term Trend Analysis

- VIX Analysis

- 2020 vs 2016 and 2012

- ELLIOTT WAVES

- Seasonal Trend / Election Cycle

- Dow Stock Market Trend Forecast Conclusion

- US Presidential Election Forecast Matrix Final Update

- AI Stocks - AMD is Killing Intel

This analysis is an excerpt from my latest in-depth analysis that concludes in a detailed trend forecast for the stock market into January 2021.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.