Silver Price Is Trapped Below $30

Commodities / Gold & Silver 2020 Nov 09, 2020 - 01:24 PM GMTBy: Kelsey_Williams

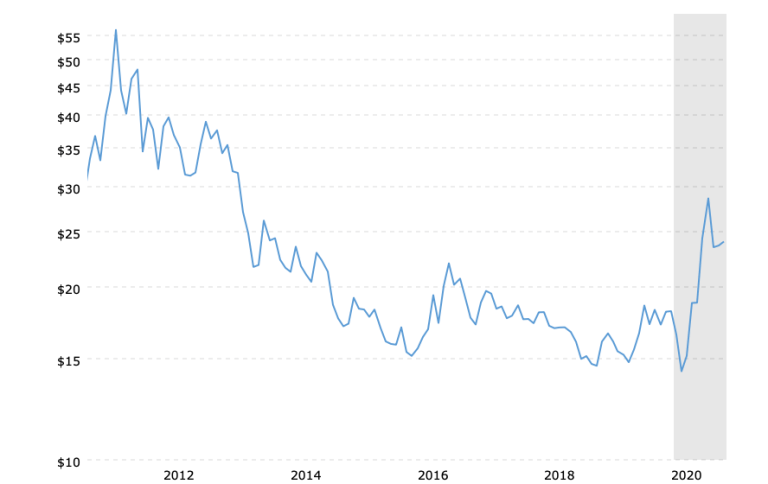

Below is a chart (source) showing a 10-year history of silver prices. The prices are adjusted for inflation…

![]()

![]() As you can see, the price of silver today is well below its peak price in 2011. At $24 per ounce, silver is down fifty-six percent since August 2011.

As you can see, the price of silver today is well below its peak price in 2011. At $24 per ounce, silver is down fifty-six percent since August 2011.

When the silver price collapsed almost forty percent in just a few weeks earlier this year, its price briefly broke below $12 per ounce. That was its lowest point since the August 2011 peak. Silver then rallied strongly to new recovery highs of just under $30 per ounce, at $29.26.

The $30 stopping point for silver was not random or arbitrary.

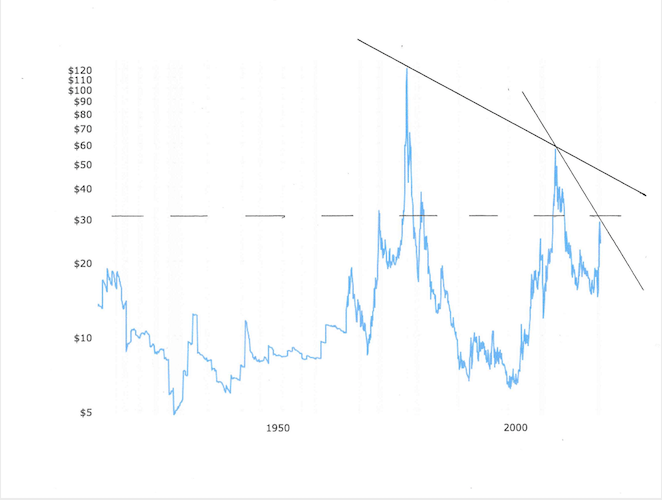

The chart (source) below is a 100-year history of silver prices. The prices date back to 1915 and, again, are adjusted for inflation…

The dashed line on the chart at $30 per ounce shows that nearly all of silver’s price action for the past century has been below that mark. Of the 105 years shown, the silver price only traded above $30 on two occasions totaling slightly more than four years.

In other words, for more than 100 of the past 105 years, silver’s inflation-adjusted price has stayed below $30 per ounce.

If you are bullish on silver, what is it that you expect to change so radically in the future that will wipe away the past century of consistently lower prices for the white metal?

We may very well have seen the lows for silver at $11.77 earlier this year. but consider this…

In February 1991, silver traded at $3.55. At that price, it had fallen ninety-three percent from its high of $49.45 in January 1980.

The $3.55 price proved to be the absolute low for silver at that time and it traded as high as $7.81 in 1998. Unfortunately, it also traded as as low as $4.07 in 2001, which is ninety-two percent less than its peak more than twenty years earlier.

The implication is worse when you look at the chart immediately above. The nominal price of $3.55 was the absolute low, but the $4.07 inflation-adjusted price in 2001 was cheaper by seventeen percent – nearly eleven years later.

When silver dropped to $11.77 in March this year, that price was silver’s lowest since its peak in 2011. If you bought at that price, congratulations! You have doubled your investment in six months time. But what do you do now?

Except for the two brief occasions noted above, silver has traded below $30 for more than 100 years. There is very little profit potential for silver at its current price and plenty of room on the downside.

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2020 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.