Inflation the bug-bear looking forward through 2021

Stock-Markets / Financial Markets 2021 Jan 07, 2021 - 04:00 PM GMTSince the Covid 19 crisis began in March 2020 just over 10 trillion dollars have been pumped into the World's economies. This is the reason why the stock markets are breaking into new highs despite the fact that most countries are in recession.

"Given the broad global impact of the COVID-19 crisis, few populations, businesses, sectors, or regions have been able to avoid the knock-on economic effects. That means government measures have had to support large parts of the economy in a very short time to maintain financial stability, maintain household economic welfare, and help companies survive the crisis. In addition, countries have tended to escalate their interventions as the crisis increases in severity and lockdowns persist. Nine of ten countries in our data set have already announced at least one additional financial-relief or -stimulus package. Two-thirds of countries have announced three or more packages, while a few countries have announced as many as six or seven packages".

However, in the long run these monies will find their way into the main economy and it is my belief that increasingly in 2021 we are going to hear the narrative of higher interest rates being needed to combat inflation.

As reported in GoldMoney last month:

"Publicly, the trigger for the Fed’s inflationary magnanimity was the covid-19 virus and the lockdowns it triggered in Europe, and then to a developing extent in America. But, reflecting on events, such as the repo crisis the previous September, when the banking system ran out of balance sheet capacity, and the economic consequences of an equity bear market loomed, one wonders. The Covid crisis provided cover for an unprecedented monetary expansion that was required to save the economy from the maelstrom of bank credit contraction. It worked like a charm".

"However, the most important event in the new year is likely to be the Fed losing control of its iron grip on markets. The dollar’s declining trend is already well established against other currencies and commodities, leading to this outcome".

"Events in 2021 will be the consequence of a developing hyperinflation of the dollar. Foreign holders of dollars and dollar assets — currently totalling $27.7 trillion — are sure to increase the pace of reducing their exposure. This is a primal threat to the Fed’s policy of using QE to continually inflate assets in the name of promoting a wealth effect and continuing to finance a rapidly increasing federal government deficit by supressing interest rates".

"Bubbles will then pop; leaving establishment investors exposed to a combined collapse of fiat currencies, bonds and equity markets, which could turn out to be very rapid".

Thus in the short term it is highly likely markets will continue to move higher but when the inflation narrative becomes mainstream given the extreme level of corporate and government borrowing market psychology could easily change, thus caution is warranted.

Market Note:

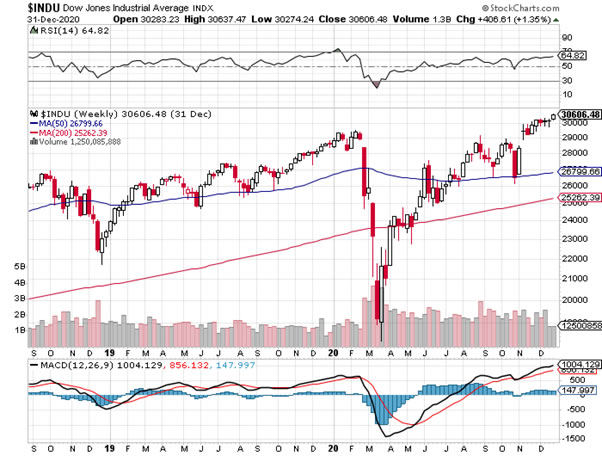

For 37 trading days approx., since the 9th of November, the Dow Industrials has been stuck in a minute trading range. This is called a "line" in Dow Theory technical parlance. I like lines. They longer they persist, on probability, the more technically relevant the direction of the eventual breakout. If it does break to the bull side it is quite possible the market could go parabolic as Tesla and Bitcoin have gone recently. Bull markets normally end in euphoric parabolic mode. It is hard to say how high the markets could go on a bull break but if you chose to chase any momentum be careful, the risks to the downside are enormous.

Chart: Dow Industrials Index: Daily.

Chart: Dow Industrials Index: Weekly

Chart: Tesla: Daily.

Chart: Tesla: Weekly.

Chart: Bitcoin Index: Weekly.

Charts: Courtesy of CtockCharts.Com

Ref: McKinsey & Company, Government Practice,

Ziyad Cassim, Borko Handjiski, Jörg Schubert, and Yassir Zouaoui.

Economic & Monetary Outlook,

GoldMoney, 30th December 2020.

Christopher Quiqley

B.Sc., M.M.I.I. Grad., M.A.

http://www.wealthbuilder.ie

Mr. Quigley was born in 1958 in Dublin, Ireland. He holds a Bachelor Degree in Accounting and Management from Trinity College Dublin and is a graduate of the Marketing Institute of Ireland. He commenced investing in the stock market in 1989 in Belmont, California where he lived for 6 years. He has developed the Wealthbuilder investment and trading course over the last two decades as a result of research, study and experience. This system marries fundamental analysis with technical analysis and focuses on momentum, value and pension strategies.

Since 2007 Mr. Quigley has written over 80 articles which have been published on popular web sites based in California, New York, London and Dublin.

Mr. Quigley is now lives in Dublin, Ireland and Tampa Bay, Florida.

© 2020 Copyright Christopher M. Quigley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Christopher M. Quigley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.