Cheers for the 2021 Stock Market and These "Great Expectations"

Stock-Markets / Stock Market 2021 Jan 09, 2021 - 06:42 PM GMTBy: EWI

Insights into "the most speculative of strategies ... among the most speculative of traders"

We're reminded during this time of year of the wonderful classic by Charles Dickens, "A Christmas Carol."

As you probably know, the Victorian-era British novelist also wrote several other books, including "Great Expectations."

That title is also a fitting description of the mindset of many stock market investors as they raise their glass to 2021: "Cheers to the market!"

One example of the positive expectations for the market is from a BMO Capital Markets' strategist (Yahoo News, Dec. 7):

"Expect another year of double-digit gains. We anticipate that 2021 has the potential to be one of the best years ever in terms of earnings growth."

Yet another is from a Goldman Sachs' strategist:

"We recommend overweights in Information Technology, Health Care, Industrials and Materials."

Several other professionals have expressed "great expectations" for stocks in 2021.

But novice speculators are also on board.

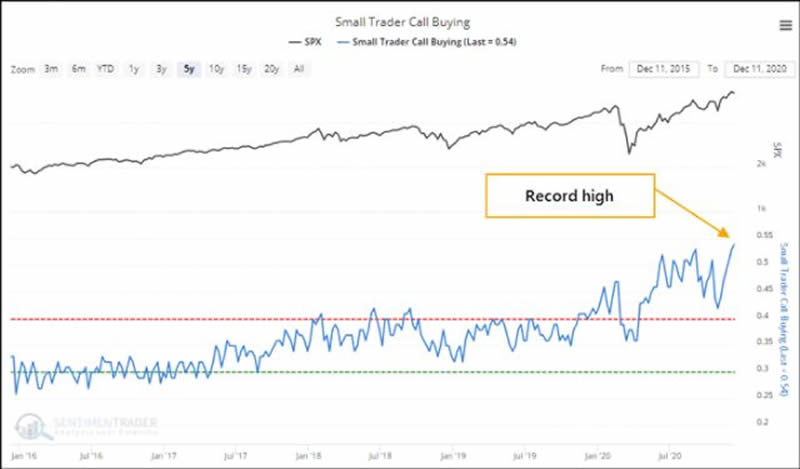

The December Elliott Wave Theorist, a monthly publication which provides analysis of financial markets and social trends, showed this chart from SentimenTrader and said:

The chart shows that traders with only $9000 to their names are aggressive to a record degree.

The Theorist goes on to quote SentimenTrader:

"Among the smallest of traders, 54% of volume flowed into buying call options to open over the past week. That's a record amount of focus among the most speculative of strategies and among the most speculative of traders. The 5-year chart shows just how much this behavior has ticked up." -- SentimenTrader

Great expectations, indeed!

Yet, we urge you to think independently about financial markets as we enter 2021.

The Elliott Wave Principle can help you do just that.

Here's a quote from Frost & Prechter's Wall Street classic, Elliott Wave Principle: Key to Market Behavior:

The practical goal of any analytical method is to identify market lows suitable for buying (or covering shorts) and market highs suitable for selling (or selling short). When developing a system of trading or investing, you should adopt certain patterns of thought that will help you remain both flexible and decisive, both defensive and aggressive, depending upon the demands of the situation. The Elliott Wave Principle is not such a system, but is unparalleled as a basis for creating one.

Despite the fact that many analysts do not treat it as such, the Wave Principle is by all means an objective study, or as Collins put it, "a disciplined form of technical analysis."

If you'd like to read the entire book, all that's required for free access to the online version is a Club EWI membership. Club EWI, which is free to join, is the world's largest Elliott wave educational community. Members enjoy a wealth of insights into financial markets, trading and investing.

Get started by following this link: Elliott Wave Principle: Key to Market Behavior -- free access.

This article was syndicated by Elliott Wave International and was originally published under the headline Cheers for the 2021 Stock Market and These "Great Expectations". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.