Want To Invest In US Real Estate Market But Don’t Have The Down Payment?

Housing-Market / US Housing Apr 30, 2021 - 05:40 PM GMTBy: Chris_Vermeulen

As an asset class, real estate should be a part of every balanced investment portfolio. That’s because real estate investments generally have a low correlation to stocks, can offer lower risk, and provide greater diversification.

Today about 65% of Americans own a home, but that means that tens of millions of Americans have no exposure to real estate. Making matters worse, becoming a homeowner today is harder than in previous generations, with 1 in 5 millennials believing they will never be able to afford a home. Is there a way to get exposure to the real estate market for as little as $100?

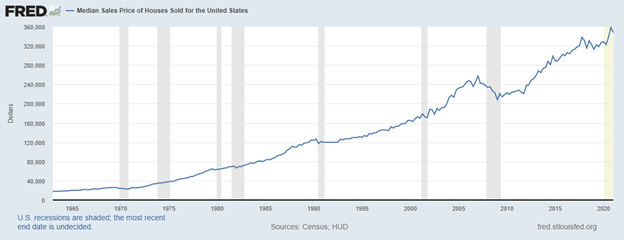

Residential real estate market trend

From the chart below, we can see that the residential real estate market continues to climb and the median price of houses sold in the US is near recent all-time highs of $347,500. Even though mortgage rates remain near all-time lows, the appreciation of prices in certain pockets of the country are making many cities and areas simply unaffordable for most. Things look much the same for industrial, commercial, agricultural, and most other specialized real estate subsectors.

how can you invest in real estate through the stock market

The stock markets offer three different ways you can invest in real estate, and today we will be looking at three of them: REITs, ETNs, and ETFs.

A REIT is a real estate investment trust and it generally owns, manages, and/or finances income-producing real estate assets. REITs are generally highly liquid (trading like stocks) and are known to produce steady income through dividends as opposed to focusing on capital appreciation.

There are hundreds of REITs, with the most popular focused on retail, residential, healthcare, office, and mortgages. Having REIT status enables those companies to avoid paying taxes at the corporate level as taxes are paid by the investors when they receive distributions of income in the form of dividends.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

A real estate ETN is unsecured debt of real estate assets, essentially a type of bond with a maturity date (but without interest payments). ETNs do not provide ownership of the underlying assets, but their performance is directly correlated to the performance of those assets.

Investors need to be wary that they can lose all of their ETN investment if the underlying debt goes into default. They also face closure risk if the issuer closes the ETN before maturity by paying the prevailing price in the market (potentially creating a loss for the investor). Despite these risks, some investors prefer ETNs because of the tax treatment for long-term ETN holdings.

A real estate ETF is the same as any ETF, being a basket of securities in the real estate sector that can be bought and sold on the stock market. Real estate ETFs often focus on a collection of REITs, offering investors a way to diversify their real estate bets without the torture of researching hundreds of REITs. REIT ETFs offer investors to earn dividend income like REITS while also benefiting from higher diversification and greater market liquidity, which are the hallmarks of all ETFs.

what makes a good reit etf?

First, you need to decide if you want a mortgage or equity REITs, as well as if you are looking for an objective-specific REIT (like storage facilities) or something more broad and big-picture (like residential real estate). Your REIT ETF should also have a good amount of assets under management in order to keep expense ratios down, and always check to see if the ETF you are interested in has sufficient liquidity.

The charts below show you the performance of the three largest real estate ETFs. Each of these ETFs have over $5 billion of assets, are highly liquid, and a slightly different focus in either the index they track or the real estate assets they are comprised of.

Vanguard focuses on US equity REITS with a small allocation to specialized REITS and real estate firms.

The iShares REIT, above, follows the Dow Jones U.S. Real Estate Index, whereas Schwab’s REIT ETF (below) follows the smaller Dow Jones U.S. Select REIT Index.

For those of you that get my daily BAN Hotlist, you will know that real estate triggered a signal more than a month ago indicating the sector to be in an uptrend. Real estate continues to be a top-performing sector, with all three of the biggest ETFs gaining more than 15% so far in 2021. In fact, more than 90% of all real estate ETFs have outperformed the S&P500 this year. When you add in the fact that some of the REIT ETFs are also producing annual dividend rates as high as 7-8%, it becomes clear that real estate ETFs should be part of your portfolio.

The strongest sectors are going to continue to be the best performers over time. Being able to identify and trade these sectors is key to being able to efficiently target profits. You can learn more about the BAN strategy and how to identify and trade better sector setups by registering for our FREE step-by-step guide.

For those who believe in the power of trading on relative strength, market cycles, and momentum but don’t have the time to do the research every day then my BAN Trader Pro newsletter service does all the work for you with daily market reports, research, and trade alerts. More frequent or experienced traders have been killing it trading options, ETFs, and stocks using my BAN Hotlist ranking the hottest ETFs, which is updated daily for my premium subscribers.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.