RAMPANT MONEY PRINTING INFLATION BIG PICTURE!

Economics / Inflation Jun 16, 2021 - 09:09 AM GMTBy: Nadeem_Walayat

I know it can get a bit tiring to hear me bang on with the mantra of rampant money printing inflation, BUT one can tend to get lost in the detail i.e. looking at individual stocks and assets and forget the BIG PICTURE which really is one of RAMPANT MONEY PRINTING INFLATION!

For instance the stimulus that all nations have implemented is far in excess of the temporary loss of GDP due to Covid i.e. the US suffered a 10% drop from peak to trough in GDP, about $2 trillion's worth but has printed $5 trillion in response to which is about 25% of GDP!

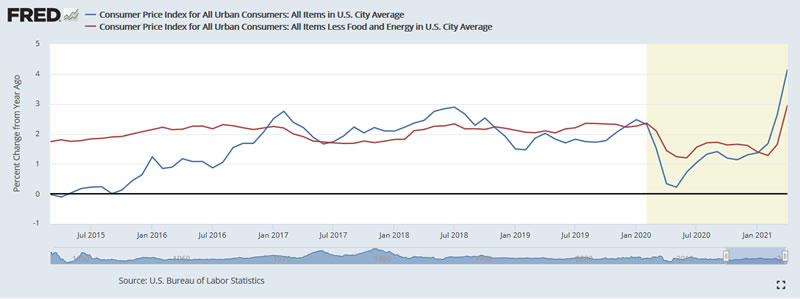

US official CPI inflation soared like a rocket in April to 4.2% up from 2.6% in March.

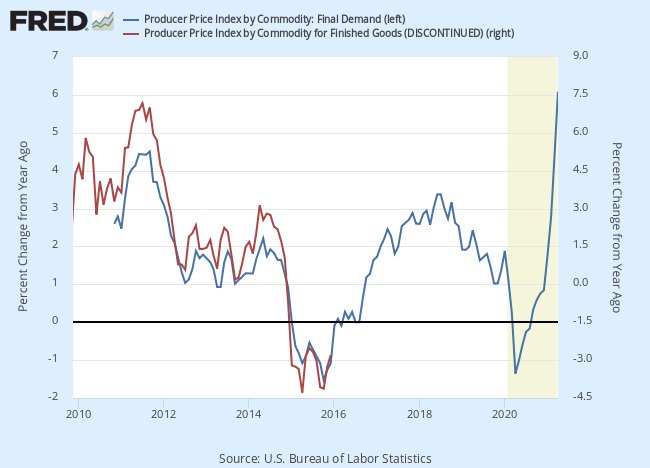

Whilst PPI soared to 6.2% up from 4.2% in March.

So forget Doge coin to the moon it's more like Inflation to the moon!

Good stocks tend to be leveraged to RAMPANT MONEY PRINTING INFLATION i.e. their revenues and profits INFLATE.

Another thing is that investors tend to get side tracked by currency fluctuations i.e. the sterling or dollar value of stocks, whilst yes it can matter in terms of timing buying and selling, as right now is a good time for a sterling investor to buy dollar assets. HOWEVER, all currencies are free falling together which means the value of GOOD STOCKS is INFLATING, so if the dollar falls 10%, that would mean the likes of Google will receive upwards pressure GREATER than 10% because the stock is leveraged to inflation because the drop in the dollar is not the full picture as ALL currencies are perpetually falling together. For instance Google is up about 32% year to date, so that means the dollar has fallen by 32% in value in Google terms, and similarly most other currencies have fallen between 15% and 30% year to date in Google terms which is why I don't focus on what the stocks do in say sterling as all currencies are falling together, other than giving a few percent discount or premium when one is actually buying or selling stocks.

So next time one wonders why or how stocks or any other asset can keep rising in price then remember the big picture which is one of RAMPANT MONEY PRINTING INFLATION!

And despite this there are still those who flog the deflation dead horse.

Of course there is a risk that the central banks lose control of the inflation monster they are busy feeding that results in economic chaos, so whilst AI stocks should protect us in such a scenario to some degree, however when chaos reigns it WILL be a question of that which can limit the damage done to our accumulated wealth in real terms.

At this point in time the most probable outcome is stagflation.

AI stocks have repeatedly demonstrated themselves to be robust means of protecting ones wealth in times of uncertainly, one only needs to look at the pandemic for proof of that. STILL it is wise to diversify and not have all one ones eggs in one basket such as having some exposure to crypto's.

The rest of this extensive analysis that concludes in my latest biotech stocks with the potential to X10 over the coming years Five More Small Cap Bio and Tech Stocks to Invest for 2021 and Beyond! has first been made available to Patrons who support my work.

Topics Include:

- Invest and Forget

- Stock Market Early Summer Correction Review

- AI Stocks Strength vs Weakness

- RAMPANT MONEY PRINTING INFLATION BIG PICTURE!

- HIGH RISK STOCK BUYING LEVELS

- RISK RATINGS

- WESTERN DIGITAL - WDC $71 - CHIA! - Risk 1

- Life Sciences Biotech Smaller Cap High Risk Stocks Investing Binge

- Biotech stock 1 - Cheap Low Risk Pharma - Risk 1

- Biotech stock 2 - HIGH RISK GENE EDITING - Risk 9

- Biotech stock 3 - Low Risk 2

- Biotech stock 4 - X10 for Max Risk 10

- High Risk Stocks Portfolio Buying Levels

- Covid India Black Mold Epidemic

- Bitcoin and Raven Coin Buying Levels

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Inlcuding access to my latest analysis -

Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

- Investing in the Tulip Crypto Mania

- Bitcoin Price Trend Forecast Review

- Lessons Learned

- Cathy Crypto Wood's View on Bitcoin

- BITCOIN HALVINGS TREND TRAJECTORY

- Stock to Flow Infinity and Beyond!

- Bitcoin, Crypto's and the Inflation Mega-trend

- Black Swan 1 - Will Crypto's Get Banned?

- Black Swan 2 - GOOGLE

- Black Swan 3 - USDT Tether Un-Stable Coin Ponzi Schemes!

- BLACK SWAN 4 - Bitcoin 51% Network Attack by China?

- Black Swan 5 - Bitcoin is Already Obsolete

- US Trending Towards Hyperinflation

- BITCOIN TREND ANALYSIS

- Bitcoin Bear markets analysis - How low could she blow?

- Bitcoin Trend Forecast

- Bitcoin Long-term probable Next bull market price target

- Alternative Scenarios

- My Crypto Bear Market Investing Strategy

- Crypto 1 - Ethereum (ETH) $2600

- Crypto 2 - Bitcoin $40,375

- Crypto 3 - Ravencoin $0.078

- Crypto 4 - Cardano $1.59

- Crypto 5 - Pokadot $25

- Crypto 6 - ChainLink $26

- Crypto's 7 to 10

- Creating The Perfect Crypto

- How to Invest in Crypto Without Getting SCAMMED

- CHIA SCAM COIN

- Binance vs Coinbase

- Have ARK Invest Funds Bottomed?

My analysis schedule includes:

- More X10 Biotech Tech Stocks - 50% done

- UK House Prices Trend Analysis - 10% done

- How to Get Rich! - 70% done

- US Dollar and British Pound analysis

- Gold and SIlver Price Analysis

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.\

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst investing in biotech stocks.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.