The “Long COVID” Economy

Economics / US Economy Jun 30, 2021 - 02:02 PM GMTBy: Patrick_Watson

According to some analysts, higher inflation is on its way. Americans will spend like crazy and drive prices higher as the pandemic recedes.

According to some analysts, higher inflation is on its way. Americans will spend like crazy and drive prices higher as the pandemic recedes.

That’s the theory. It may be right, for a while, but we also have other problems. For one, the pandemic hasn’t ended; it’s simply become optional.

Most US adults can now “opt out” by getting vaccinated. The shots, while not perfect, are proving highly effective. Unfortunately, many are opting to stay vulnerable. We also can’t yet vaccinate children under 12.

This may be an economically significant problem soon. But even if the virus disappears, we are going to spend years repairing the economic damage already done… and more may be coming.

Excess Deaths

Confirmed US COVID-19 deaths now exceed 600,000. These are people with positive tests. Some question whether they all died “from” the virus or simply “with” it. But whatever the cause, they are dead.

In normal conditions, population-level mortality is highly predictable. That’s why the life insurance industry works. “Excess deaths” above the expected number mean something unusual happened.

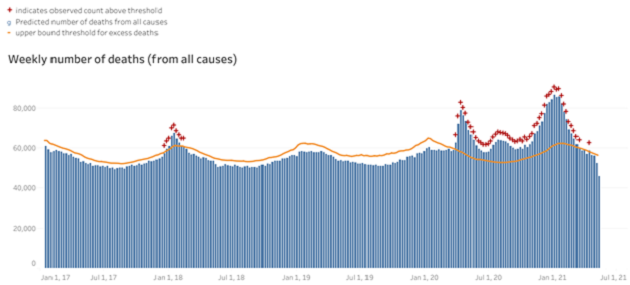

This chart from the CDC shows US deaths from all causes by week since 2017. When the blue bars go above the orange line, it means more people than expected died that week. It happened a few times in the unusually bad 2017─2018 flu season.

Source: CDC

But starting in March 2020, COVID-19 generated excess deaths every week for almost an entire year. (Note: The recent weeks may be incomplete, since recording deaths takes a while.)

Of those excess deaths, some died directly from COVID-19 and others indirectly because, for instance, they couldn’t get necessary healthcare. Add up the excess deaths and the US seems to have lost more like a million extra people, not the 600,000 we can pin on the virus.

Human lives are an economic resource. All are producers and/or consumers. Researchers estimate the average victim died about nine years before they otherwise “should” have. That’s many years of life lost (YLL).

David Kotok of Cumberland Advisors explained why this is important:

By the end of this calendar year, we project a COVID shock of about 10 million YLL in the United States. That is a huge reduction in projected aggregate demand, because consumption by those million people over their projected average 9 lost years disappears. That is an addition to the baseline projection from the mortality tables.

And I haven’t even touched on the issue of the skills lost. The 100-year-old person who died of COVID in a nursing home counts as a COVID death but makes only a small contribution to this economic estimate. The 30-year-old nurse who died of COVID while caring for COVID patients in a hospital, on the other hand, makes a large contribution to YLL and will be sorely missed, as will the 50-year-old engineer or computer scientist. So, too, the truck driver or teacher. COVID has killed many who are highly skilled, and it has killed many who had years yet to contribute to the labor force.

To be blunt, dead people stop being active participants in the economy. It’s no coincidence war-torn nations often face depressions afterward.

Pandemics have a similar effect. This one’s numbers are big enough to matter, and more so in certain industries that depend on the most-affected groups.

But that’s not the only problem.

Long-Haulers

Most people who get COVID-19 survive, but sometimes with persistent health consequences. Scientists are still trying to understand this “Long COVID” condition. It can be serious.

Estimates suggest COVID disabilities will far outnumber COVID deaths. Eventually we may have treatments to help them, but for now it looks like a big problem.

Here’s David Kotok again.

The evidence grows daily that there are something like six to eight long-haulers for each COVID death. That loss of health and capacity, too, is a demand shock. It also impacts the ability of the labor force to work since it leads to growing medical leaves of absence and disability. It also raises the demands on the healthcare sector. Millions more COVID long-haulers will need treatments and work accommodations if they are to be able to continue to contribute to the labor force.

Much more data needs to be gathered to enable us to quantify both the medical needs of COVID long-haulers and a figure capturing the weeks, months, or years of work lost to long COVID; but we do have enough input to know that the numbers will be significant.

A civilized society takes care of its disabled members, but doing so has costs.

Inflation Needs Fuel

All these effects are locked in based solely on what already happened. If the virus resurges, they may get worse.

Nor is this only a US problem. Excess deaths and long COVID are happening around the world. Countries without our advantages may experience even more harm, and take longer to recover from it.

So if your investment thesis assumes a sustained global boom as the virus fades, you might want to think again. Inflation needs fuel… and we already burned a lot of it.

COVID long-haulers will feel the effects for years. The economy will, too.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

By Patrick Watson

The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.