Surprising Consumer Activity May Suggest A Deeper Shift In The Markets

Stock-Markets / Financial Markets 2021 Aug 19, 2021 - 03:52 PM GMTBy: Chris_Vermeulen

Recent economic data suggests that US consumers are starting to pull away from the types of buying/spending activities we saw after the COVID virus event that shifted the US economy away from travel/office and towards work-from-home solutions. The deep decline in the US and global economic indicators, as a result of the COVID-19 shutdown, prompted an incredible recovery rally phase in the markets that had everyone chasing the uptrend in stocks, housing prices, and other assets. Now that we are beyond 15+ months after the March 2020 COVID lows, a new dynamic may be setting up in the markets.

Consumers & Trends May Shift Expectations Over The Next 6+ Months

Consumers & Services make up nearly 70% of GDP activity. Any shift in how consumers feel about the US/Global economy may translate into extended market trends and reflect in other economic data going forward. In recent research articles, we’ve highlighted how the extended rally phase in the markets continues to push higher in a “melt-up” type of trend – yet current data is starting to show a shift in how consumers are reacting to this extended trend. The US/Global markets may be setting up for a big shift away from this continued rally phase.

- August 4, 2021: WHEN THE RUSSELL 2000 ETF (IWM) REENTERS PRICE FLAG RANGE – WHAT’S NEXT FOR THE US MARKETS?

- August 3, 2021: US MARKETS STALL NEAR END OF JULY AS GLOBAL MARKETS RETREAT – ARE WE READY FOR AN AUGUST SURPRISE?

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

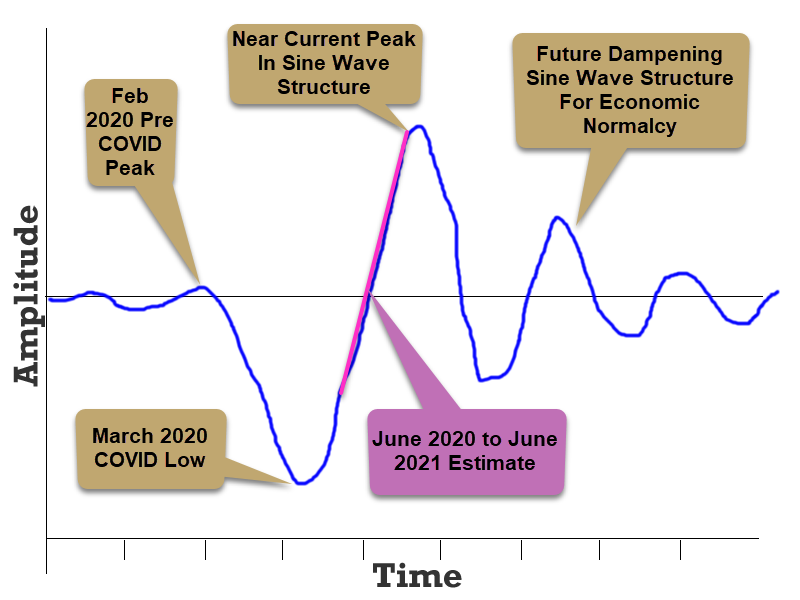

One concept I want to remind traders of is the continuing normalization of market trends/indicators as the post-COVID-19 recovery continues. The extreme rally phase that has taken place, after the extreme lows resulting from the COVID-19 global shutdowns, is likely to transition into more normalized trending through a process called a “Dampening Sine Wave”. This process may prompt a fairly big downward economic trend resulting from Month-over-Month and Year-over-Year data trending lower for the next 6 to 12+ months as the data shifts throughout the Sine Wave process.

As time progresses forward, we will see the trends roll over the June/July peak in this Sine Wave process and begin to move downward. This will shift how consumers perceive global market trends and will shift how economic data is being reported. What was very strong growth, inflation, and economic data will shift into weaker trends and an eventual downtrend as the Month-over-Month and Year-over-Year data shifts forward.

Consumers Have Already Started Reacting To These Extreme Highs

Consumers, and consumer activity, should always be one of the top economic indicators traders/investors follow. Additionally, the Transportation Index is another key indicator that leads the US/Global markets by 3 to 6+ months in most cases. Consumers and consumer activity make up nearly 70% of the US GDP and account for a very large portion of the US/Global economy. If consumers constrict spending and economic engagement activity over the next few months because of new COVID restrictions, perceptions that the economy has become super-heated, and/or any other issues related to US/World affairs, it is likely that the shifting Dampening Sine Wave process may see an accelerated Amplitude range related to the normal Dampening process compounded by the shifting Consumer sentiment.

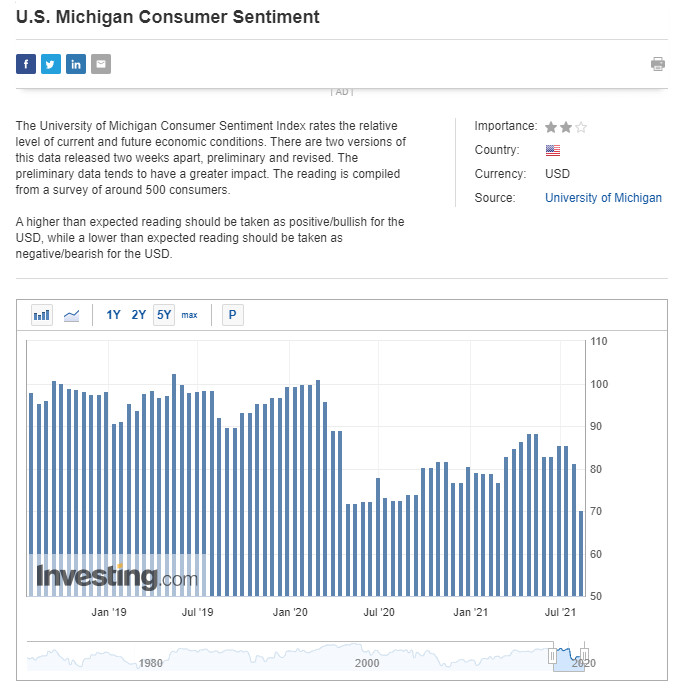

Currently, the Michigan Consumer Sentiment data has collapsed -13.55% based on the August 13, 2021 posting – from a level of 81.2 to 70.2. This comes after Consumer Sentiment has been above 71 since January 2012. This new low data point for Consumer Sentiment may represent a big shift in how consumers are reacting to the global market trends and the US Federal Reserve pushing the envelope related to interest rates and economic activities.

(Source: https://www.investing.com/economic-calendar/michigan-consumer-sentiment-320)

If we stop to consider how important the consumer is and the psychological aspects of a shifting economy as we have described above, one must stop and ask two simple questions – “what happened the last time consumers pulled away from economic activities and how long did it take them to re-engage in normal spending activities?”.

The answer to that question is that this type of consumer reaction has only happened once in the past 10 years, based on data sourced from Investing.com using the Michigan Consumer Sentiment data.

April 9, 2020 (-20.31%) and April 24, 2020 (-19.42%) – right at the peak of the COVID-19 global shutdown crisis.

Prior to those dates, we have to go all the way back to 2010 & 2011, just after the Housing Market crash where the markets were struggling to regain upward momentum, and the Consumer Sentiment levels bottomed out at 56.2.

In Part II of this research article, we’ll continue to explore the shifting tides of the US and global markets in relation to our belief that the Dampening Sine Wave process is continuing to unfold. This means traders and investors need to be prepared for extreme volatility events over the next 12 to 24+ months and be ever cautious of any new external economic crisis events. These external events may prompt an increase in the Amplitude and structure of the Dampening Sine wave process and could completely disrupt the global market recovery process taking place right now.

More than ever, right now, traders need to move away from risk functions and start using common sense. There will still be endless opportunities for profits from these extended price rotations, but the volatility and leverage factors will increase risk levels for traders that are not prepared or don’t have solid strategies. Don’t let yourself get caught in these next cycle phases unprepared.

Please take a minute to learn about my BAN Trader Pro newsletter service and how it can help you identify and trade better sector setups. My team and I have built this strategy to help us identify the strongest and best trade setups in any market sector. Every day, we deliver these setups to our subscribers along with the BAN Trader Pro system trades. You owe it to yourself to see how simple it is to trade 30% to 40% of the time to generate incredible results.

As something entirely new, check out my initiative URLYstart to learn more about the youth entrepreneurship program I am developing. This is an online program of gamified entrepreneurship designed to introduce and inspire kids to start their own businesses. Click-by-click, each student will be guided from their initial idea, through the startup process all the way to their first sale and beyond. Along the way, our students will learn life lessons such as communication, perseverance, goal setting, teamwork, and more. My team and I are passionate about this project and want to reach as many kids as possible!

Have a great day!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.