I Stumbled Across a Massive Investing Opportunity in a Parking Lot

Companies / Investing 2021 Aug 20, 2021 - 09:05 PM GMTBy: Stephen_McBride

By Justin Spittler : One of the #1 ways to improve your investing returns is to simply:

Take notice of your immediate world.

Take the metaverse, for example—the new 3D, immersive internet that’s becoming more popular by the minute. If you have kids or grandkids, there’s a good chance they’re playing in the metaverse as I type. In fact, more than half of American children are taking part in the metaverse!

This is a powerful piece of information. It reminds me of the moneymaking opportunity in video game stocks in the ‘90s.

The video game boom started under the radar, with millions of kids playing Super Mario Brothers in their basements. Investors who saw this and put the pieces together made out like bandits. Video game maker Activision Blizzard (ATVI) has rocketed 8,634% since it IPO’d in 1993. Electronic Arts (EA) has soared 1,766% during the same timeframe.

As I’ve emphasized, I think the metaverse is going to be huge. Much bigger than video games.

But today, I want to tell you about a more imminent investing opportunity.

First...

- Think about your day-to-day life.

Which products do you buy over and over again? What services can’t you live without?

It might seem too simple…

But investors who use this information correctly often unearth incredible stocks before they take off.

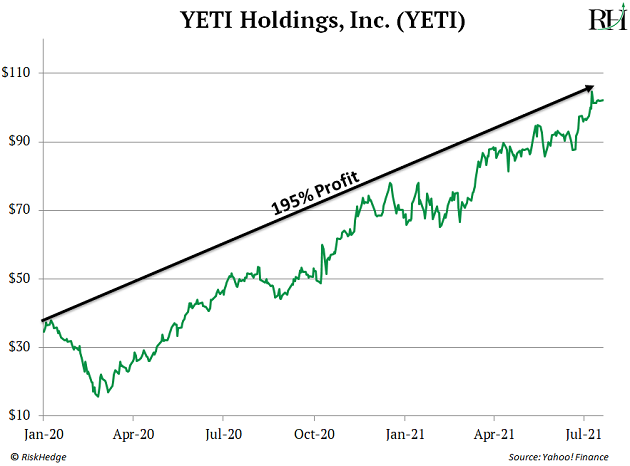

This simple strategy helped me recognize the massive potential of Yeti (YETI).

Yeti sells high-end coolers, drinkware, and other camping merchandise. It’s one of today’s hottest American brands.

I got excited about Yeti after a trip to the local hardware store in early 2020. As I explained at the time, I noticed tons of Yeti products right next to the checkout counter.

Now, I knew about Yeti before this trip to the hardware store. Everyone I know who owns a Yeti product loves it.

But this was the first time I saw a huge checkout display for its products.

So, I sparked up a conversation with the cashier. She said, “We’re selling tons.”

Later that day, I started digging into Yeti’s fundamentals.

And I discovered that it’s an incredible business. That led me to recommend Yeti to RiskHedge readers in January.

Since then, Yeti stock has nearly tripled.

But here’s the thing. I probably wouldn’t have dug deep into Yeti’s business if it weren’t for what I saw at my local hardware store.

Of course, that wasn’t the only time I uncovered a huge investing opportunity by taking in my surroundings.

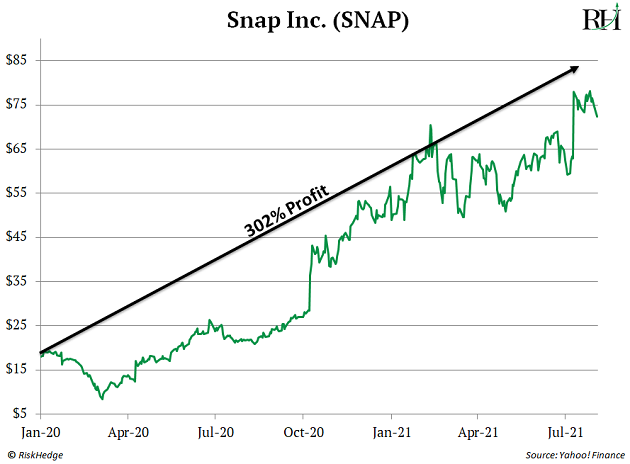

- A chance conversation with one of my younger friends turned me on to Snap (SNAP)…

Snap is the biggest US social media company after Facebook (FB). It owns the wildly popular app Snapchat. As I explained in this January 2020 RiskHedge Report, my younger friend Tyler tipped me off to the potential in SNAP.

In short, he basically laughed at me when I told him I wasn’t on the popular app.

I learned that Snapchat was incredibly popular with young people. In fact, 90% of 13- to 24-year-olds in the US use Snapchat. To put that in perspective, only 39% of young folks use Facebook (FB).

The stock went on to surge 302% after I encouraged RiskHedge readers to buy the stock.

In short, the best investing opportunities are often hiding in plain sight. You just need to be on the lookout for them.

So, I always have my eyes peeled for potential opportunities. And I recently discovered one during a trip to Chipotle (CMG).

- I couldn’t believe my eyes when I walked inside…

There was no one in line.

I thought that was odd. It was peak lunch hour.

By the time I had paid for my food, two takeout orders sitting along the wall had disappeared. In just three minutes, two people had swung by and picked them up.

Then, while I was walking to my car, I noticed a whole section of parking spots reserved for curbside pickup of online orders.

When I got home, I dug deeper into the industry. The data confirmed what I saw with my own two eyes.

Online food ordering is a massively underappreciated investing opportunity.

- See, Chipotle isn’t the only restaurant that’s transforming its business around online orders.

I don’t need to remind you that Delta variant cases are soaring. Many cities and states have responded by requiring masks in bars and restaurants. Some ordinances are even requiring proof of vaccination to enter public places.

You don’t have to work on Wall Street to understand how this bodes well for restaurant businesses with an established digital presence.

The data confirms that this is a big and fast-growing opportunity:

- According to restaurant management platform Upserve, 60% of US consumers order delivery or takeout once a week.

- A recent survey by the National Restaurant Association found that 64% of adults would rather order directly through the restaurant for delivery versus 18% who prefer ordering through a third-party delivery service app.

- It’s also worth noting that 48% of customers are ordering delivery more from restaurant websites than they were prior to the pandemic.

So how do you play it?

DoorDash (DASH) is one of my top ways to profit off the online food ordering megatrend. The company operates America’s #1 food delivery app.

DoorDash went public at a steep valuation. So, it didn’t soar out the gate.

But it’s spent the past nine months growing into its valuation, and now appears poised for a major rally. In fact, its sales surged 84% last quarter.

I also just recommended a food tech pioneer in my IPO Insider advisory. This company is flying under the radar of most investors, but I don’t expect it to stay a secret much longer. This little company has even more upside than DoorDash.

I’ll have more to say about this hidden gem soon.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2021 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.