Reflation vs. Economic Stagflation

Stock-Markets / Financial Markets 2021 Sep 28, 2021 - 08:23 PM GMTBy: Monica_Kingsley

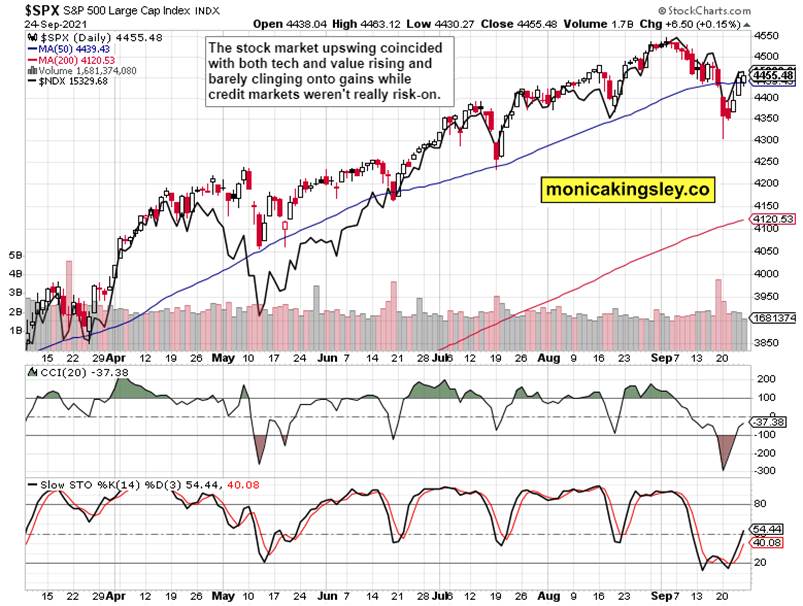

S&P 500 didn‘t give in to the opening weakness, and eked out minor gains. There was no selling into the close either – the table looks set for the muddle through to continue on Monday. Tech and value – uninspiring on the day, and the same could be said of the credit markets. Rising yields (the market believes in taper, it appears) across the board, with high yield corporate bonds holding up much better than quality debt instruments – I have seen stronger risk-on constellations really.

Importantly, the huge weekly jump in Treasury yields (the 10-year yield jumped over 20 basis points to 1.47%) failed to lift the dollar, which says a lot given the risk-off entry to the week. Meanwhile, the Fed jawboning continues, and the bigger picture leaves the ambitious Nov tapering suspect.

At the same time, the Fed‘s foot is to a large degree off the gas pedal, and even global liquidity is shrinking. New taxes are kicking in, job market woes are persisting, inflation isn‘t going away any time soon, challenged supply chains are forcing globalization into reverse, workforce is shrinking, GDP growth is decelerating, and no fresh fiscal initiatives are on the horizon – sounds like a recipe for stagflation.

As I wrote on Friday:

(…) The post-Fed relief simply took the bears for a little ride, and the Evergrande yuan bond repayment calmed the nerves. As if though the real estate sector was universally healthy – I think copper prices and the BHP stock price tell a different story. Things will still get interested in spite of PBOC moving in. The current macroeconomic environment will be very hard (economically and politically) to tighten into – have you noticed that the Turkish central bank unexpectedly cut rates?

Precious metals should love the ever more negative real rates, and the financial repression that does accompany them. Commodities and real assets are bound to do great long-term, and stocks would enjoy the most the reflationary stage, the early stage of inflation where everyone benefits and no one pays. In spite of all the real world inflation, we‘ve not yet entered its nasty, late phase.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

Friday brought a daily pause in the upswing – the bulls however didn‘t yield to the sellers through the day.

Credit Markets

High yield corporate bonds gave up less ground than quality debt instruments, whose downswing was arguably a bit too steep. The non-confirmation of the stock market advance though is barely visible.

Gold, Silver and Miners

Gold managed to hold ground in spite of the steep rise in yields, but miners keep on being more and more undervalued – if you‘re a long-term investor, these are very interesting prices throughout the PMs sector. Silver keeps trading at odds with copper, and both metals (including a couple more), are required for the green economy shift.

Crude Oil

Oil stocks paused on Friday, and so will the oil upswing likely too next. Energies though remain bullish, and dips are to be bought.

Copper

Copper closed at weekly highs, but hesitated still when compared to the CRB Index. All isn‘t well if you look at BHP (or FCX), which is a proxy for both copper and China.

Bitcoin and Ethereum

Bitcoin and Ethereum have recovered from the China crypto trading crackdown notice, and keep repelling the bears successfully.

Summary

Risk-on wasn‘t dethroned on Friday, but didn‘t convince either. Apart from select commodities, strong gains were absent. Wait and see on low volume day – one that is likely to carry over into Monday. Risk-on assets still haven‘t cut the corner (no recapturing of the 50-day moving average), and the VIX below 19 is slowly approaching the lower border of its recent range, meaning that volatility can surprise us shortly again.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.