Chasing Value with Five More Biotech Stocks for the Long-run

Companies / BioTech Oct 04, 2021 - 10:43 PM GMTBy: Nadeem_Walayat

Five more biotech stocks to add to the strategy of invest and forget for a potential X10 return. a reminder of why I am engaging in this binge on biotech stocks after having been focused on AI stocks for the past 5 years.

1. Biotech stocks are an unloved stocks sector whilst tech stocks over valued, even the ultra safe stocks such as the Top 10, so I am reluctant to add at current valuations hence why I hit the SELL button for the first time in many years and reduced my exposure to AI stocks by about 40%.

2. That biotech is a derivative of AI, we'll most sectors will soon become a derivative of AI because it is the PRIMARY tech megatrend of our age that will continue to broaden its reach to encompass all sectors of the economy.

3. That one of my former biotech 12xers got taken over (GW Pharma) that flooded my account with cash early May and so that focused my attention on repopulating my portfolio with 10 more biotech stocks where I expect at least 3 to 10x, with most of the rest expected to survive to varying extent. Though this is the stock market and so there are never any guarantees especially where such smallish cap stocks are concerned.

4. Our beloved AI stocks have been BID UP to high valuations, yes including Google, so they are not CHEAP, even after a 10% to 15% correction i.e. the likes of Microsoft and Amazon are discounting a lot of future earnings growth! Of course that does not necessarily mean that they are about to fall to what I would consider to be fair value let lone cheap levels as they did during March 2020 because at the end of the day they are GOOD stocks so usually command a healthy premium to invest in unless there is a market panic that marks everything lower regardless.

I had planned to have completed and posted this analysis shortly after my last biotech stocks analysis (Five More Small Cap Bio and Tech Stocks to Invest for 2021 and Beyond!), but focus shifted to crypto's on how to capitalise on the crypto bear market by investing in a select portfolio of crypto's at various buying levels, that and expectation of a correction would lower the price of these biotech stocks, which has happened even if the general market has held steady.

Contents

- RISK RATINGS

- HIGH RISK STOCK BUYING LEVELS\

- Blueprint Medicines - BPMC - $84.5 - Risk 3

- Cara Therapeutics - CARA - $11.94 - Risk 5

- Takeda - TAK - $16.86 - Risk 1

- BioDelivery Sciences International - BDSI - $3.65 - Risk 8

- Aptorum Group - APM - $2.64 - Risk 10

- High Risk Stocks Portfolio Buying Levels

- Netflix - FAANG a Buy, Sell or Hold?

- Trending towards Hyperinflation!

- Delta Variant!

- Solar CME MULTIPLE Black Swans

This analysis is Part 2 of 2 (Part 1) the whole of which was first been made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month now before the price hike. https://www.patreon.com/Nadeem_Walayat.

Chasing Value with Five More Biotech Stocks for the Long-run

Including access to my recent extensive analysis on the prospects for the stock market into Mid 2022 - Stock Market FOMO Hits September Brick Wall - Dow Trend Forecast Sept 2021 to May 2022

Contents:

- Stock Market Forecast 2021 Review

- Stock Market AI mega-trend Big Picture

- US Economy and Stock Market Addicted to Deficit Spending

- US Economy Has Been in an Economic Depression Since 2008

- Inflation and the Crazy Crypto Markets

- Inflation Consequences for the Stock Market

- FED Balance Sheet

- Weakening Stock Market Breadth

- Why Most Stocks May Go Nowhere for the Next 10 Years!

- FANG Stocks

- Margin Debt

- Dow Short-term Trend Analysis

- Dow Annual Percent Change

- Dow Long-term Trend Analysis

- ELLIOTT WAVES Analysis

- Stocks and 10 Year Bond Yields

- SEASONAL ANALYSIS

- Short-term Seasonal Trend

- US Presidential Cycle

- Best Time of Year to Invest in Stocks

- 2021 - 2022 Seasonal Investing Pattern

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Trend Forecast Sept 2021 to May 2022 Conclusion

- Investing fundamentals

- IBM Continuing to Revolutionise Computing

- AI Stocks Portfolio Current State

- My Late October Stocks Buying Plan

- HIGH RISK STOCKS - Invest and Forget!

- Afghanistan The Next Chinese Province, Australia Living on Borrowed Time

- CHINA! CHINA! CHINA!

- Evergrande China's Lehman's Moment

- Aukus Ruckus

And my latest analysis published earlier today - Silver Price Trend Forecast October 2021 to May 2022, CHINOBLE! AI Stocks Buying Plan

DISCLAIMER - Investing in Smallish cap stocks is VERY HIGH RISK. The analysis in this article is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis derived from sources and utilising methods believed to be reliable, but I cannot accept responsibility for any trading or investing losses that may be incurred as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any investing or trading activities

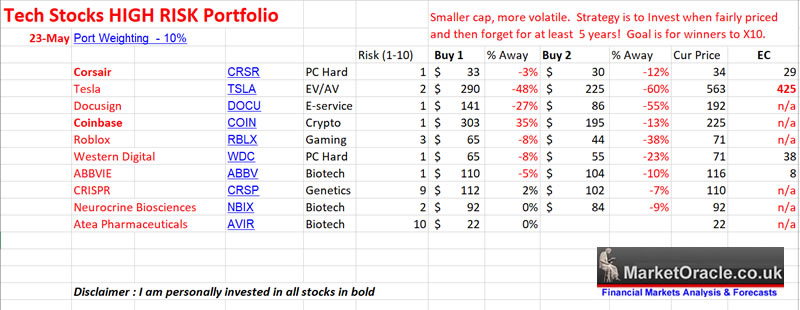

Firstly here's a reminder of the small cap bio-tech stocks state of play as per my last analysis of which I now personally hold positions in ALL 4 of the biotech stocks mentioned i.e. ABBV, CRSP, NBX, AVR, all of which are trending in the right direction. Though of course I am focused on many multiples towards 10x many years down the road.

RISK RATINGS

A rating of 1 is the lowest risk and 10 highest risk in terms of something going wrong and the stock effectively crashes and burns into becoming a penny stock or even going bust within the next 5 years! This is based on the sum of all my analysis of each stock and given my risk averse nature then most of the stocks will tend to have a low probability of actually going bust within the next 5 years. Still this rating gives an extra measure of risk vs reward when entertaining potential position sizes.

HIGH RISK STOCK BUYING LEVELS

As is the case with the main AI stocks portfolio I will be listing buying levels which are high probability levels that could be achieved during a correction. What I tend to do is put a price alert at the buying level so if triggered I can decide whether to buy, this means I don't need to waste time monitoring any of my stocks for if they fall I will get an alert, and all I need to do is update the buying levels every so often in response to price action. Of course one can also put in selling level alerts if one is looking to cash out or reduce exposure.

However, for high risk stocks I will be listing 2 buying levels, a near buying level and a more distant buying level. The reason being that I may be more inclined to buy some high risk stocks than others, so if I really want to invest in stock x then I would put the price alert at the near buying level, whilst if I am only interested at much lower prices i.e. as the case with Tesla trades, then I would set the alert to act on the more distant price alert level, of course one can set both price alerts and then make up ones mind at the time they are triggered,

Also I will be include the biotech sector IBB ETF to compare each stocks trend against.

Blueprint Medicines - BPMC - $84.5 - Risk 3

I'll start the ball rolling with a relatively large small cap stock with a market cap of $5 billion trading an a dirt cheap PE of 15 which illustrates the extent to which the biotech sector is unloved! If this was one of Cathy Woods tech stocks that PE would be well north of 100! Blueprint develops medicines for people with cancer and hematological disorders in the US and Europe and it is profitable. Peg ratio is also very low at 0.3, whilst Price to Book is a little high at 4. The company has NO debt and equity of $1.4 billion, so even if it returned to making losses for a few years would not impact much on future prospects. Black Rock and Vanguard each own about 10% of the company as the largest shareholders.

The stock price is volatile and range bound trading between about $110 and $45 though with an upward bias, currently coming off a high of $125 with significant support around $70, though could gyrate all the way down to $45. So we are catching this stock at slightly higher level given it's trend i.e. 1st Buying level would be $70, 2nd buying level would be $53, which given it's volatility should be achievable. A X10 target on $70 would imply $700. It's a case of buying towards the bottom of it's range or at least bellow the midway point and wait for the breakout higher.

Cara Therapeutics - CARA - $11.94 - Risk 5

Another downtrodden unloved small cap biotech stock with a market cap of $600 million, Cara Therapeutics focused on developing and commercialising chemical entities with a primary focus in pruritus and pain by targeting the opioid receptors. Current PE ratio is 51.2 on earnings of 0.23. Yes the PE is a high, but the PEG ratio is low at 0.5, and as is Price to book at 2.9. As is the case with most of these biotech stocks it's a case of investing and waiting several years for the payoffs to materialise, don't know when the breakthroughs will happen but sometime over the next few years. The company is awash with cash with ZERO debt and has had not debt for the past 5 years which means it has a good chance of having enough time and resources to make it to the breakthroughs.

The stock is trading near its historic low of $9 to $12, so not much down side which compares against the highs of its range of $27 to $30. The share price is very volatile, in fact I would be tempted to range trade it i.e. put a sell limit at $27 to try and capitalize on the volatility with a view to buying back in towards the bottom of the range again.. It does not track the biotech sector much as is the case with most of the small cap stocks they just do their own thing in response to own news events, a X10 target would be about $120, though I would be tempted to let it run to $200. Meanwhile shares were diluted by 7% over the past year. Largest shareholder is Black rock 15%.

Takeda - TAK - $16.86 - Risk 1

Takeda sounds a bit japanese that's because it is a Japanese corporation and the differences to the rest don't stop there! When we imagine pharma / biotech stocks we think about them usually being founded during the past 20 to 30 years, this stocks been around for over 200 YEARS! We'll at least that means the probability of this stock going to zero is going to be very, very low. Secondly like most of it's pharma brethren it trades on an unloved PE of just 14.8 on a market cap of $52 billion, AND pays a dividend of 4.35% with an average annual growth rate of 13%. Takeda is Japans equivalent of Pfizer or JnJ and like those has dozens of drugs under development but trading on half their valuations whilst selling a lot of it's drugs in the US market, in fact Takeda has just broken ground on a new large manufacturing facility in California a few days ago. Looking into who are the big share holders reveals Cathy Woods ARK fund is numero uno, digging deeper apparently she bought in the range $18 to $20 early in the year. Basically getting to buy a mini Johnson and Johnson at a 25% discount.

The stocks been stuck in trading range of between $21 and $16, so not much downside given it's last close of $16.86. Whilst it's wider longer term range is $28 to $20 which is where the stock has spent most of it's time during the past 20 years. So a price below $20 is cheap, which is obvious given the low PE ratio. Of course upside here appears limited unless it has a major drugs or genomics breakthroughs . Though a 5 year investment could see the stock price double with another 20% to 25% from dividends, so on face value is not a X10er but a stock that my screening threw up and well my risk averse nature prompted me to include given that it has a lot of potential upside with very little if any downside i.e. in a worst case scenario if this turns out to be a mistake i.e. no prospects of running to several multiples than I would just set a limit to exit at say $27 and in the meantime collect the dividends. In this market the bargains are few and far between, and to me this looks like a bargain cheap stock with potential to at least double with a 4.35% dividend yield on top. As for Buying level that would be where it is trading right now, so I will be buying some TAK today.

BioDelivery Sciences International

- BDSI - $3.65 - Risk 8

BDSI is another hated small cap ($361mln) biotech stock trading on a sub 15 PE (14.86), with forward PE dropping to 12, focused on developing pain management solutions. The company’s portfolio consists of Belbuca and Symproic (opioid induced constipation). Opioid! Hmm, that may explain the suppressed stock price down from a 2014 high of $18. ROIC is a healthy 36% (31st March), and so is the net margin of 16% with both revenue and earnings trending in the right direction for the past 3 years. Financials appear fine, what am I missing? Okay I see a lot of share dilution over the past 3 years of 5% (2020), 35% and 28%. That's a lot of shares being printed, no wonder the stock price is lower! Also the company has a lot of debt but also a lot more cash $116mln to $75mln (debt). Strong earnings growth vs shares dilution vs high debt vs cash surplus makes this a stock that's unlikely to imminently take off.

The stock price had been trending higher, even beating the IBB up until the end of 2020, so what happened in January to send the stock price into a tailspin? A lot of litigation both from and against. Something is weird about this stock it should be trading higher, they even bought back about $6 mln of shares earlier this year. For some reason this stock is very hated! Short interest? It must be uncertainty surrounding it's litigation concerning 3 of it's patents. This is a tough stock, it is cheap for litigation reasons if resolved in the companies favour then surely should send the stock price to new highs. Whilst downside risk appears limited to about $3. Strategy here could be to invest for a year then if it is still dead basically going nowhere then look to exit with a $5 limit order for a small profit. As there is a risk one could be stuck in a stock that for whatever reason fails to budge out of a trading a range. Anyway the price is near the lows, so downside risk is limited, with the price trending higher 1st Buy is now at $3.65, 2nd buy is at $3.35. So this stock is a case of invest when cheap and give it a year or so to prove itself, if it fails to perform then get out with a small profit.

Aptorum Group - APM - $2.64 - Risk 10

And lastly, can't get much high risk vs reward than Aptorum - This is probably the smallest small cap bio tech stock I have invested in for over a good decade! With only a market cap of $90 million. The stock trades on a dirt cheap PE of 13. Of course one of the reasons is because it is too small cap for institutions and most investors but conversely the more it grows it's revenues and profits the more investor interest will be generated sending the multiple far higher than where it trades today. Of course as is the case with most of the biotech sector we are waiting for the drug trails to come good, for what it's worth it's PEG ratio is 0.2 and Price to Book of 1.9 are good but how reliable?. Also 60% of the companies stock is owned by 1 person, the founder Mr Chung Yeun Huen. An additional investing risk is shareholder dilution that runs at about 12% per annum.

The stock price has collapsed from a Mid 2019 high of $34 into a trading range of $5 to $2 with the most recent price putting the stock near the bottom end of the range. As can be seen by the comparison against sector ETF IBB, the stock basically does it's own thing as it awaits news, it's basically a binary investment could easily more than X10 form there or go to zero, and either could happen a lot sooner than in 5 years time!. And I am not sure that spike to $14 on the chart was tradable but maybe it could be worth putting a sell limit at $14 to try and catch such one day spikes. Buying levels are where it is trading right now i.e. $2.64.

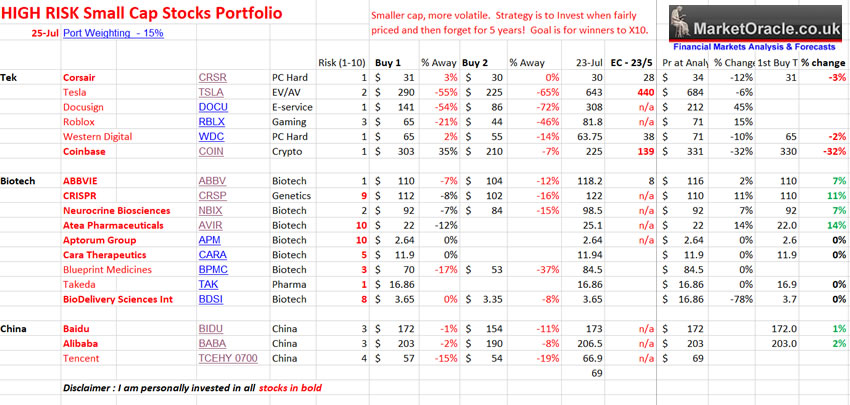

High Risk Stocks Portfolio Buying Levels

Here is my updated high risk stocks table with the new additions that for the time being complete my high risk stocks analysis / investing binge. I have already bought positions in Aptorum, Cara Therapeutic and BioDelivery Sciences International and and will likely be buying Takeda later today, whilst I will wait for the buying level for Blueprint Medicines to be triggered. The table also includes columns for % change since analysis and percent change since 1st buy trigger. For instance Takeda's buying level is the same as its last close therefore the 1st Buy is the last close. Whilst the 1st Buying level for Blueprint Medicines is $70 so when triggered that will be the 1st buy unless it is moved lower before it is triggered in a future update.

And as always do, do your own research before investing and don' forget I consider ALL of these stocks to be HIGH RISK so my positions sizes are small so that I basically invest and forget / don't think about them because I understand they are going to be volatile as hell!

Again the whole of this extensive analysis was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month that is set to increase to $4 per month this week for new Patrons, so a short window of opportunity exists to lock in at $3 per month now before the price hike. https://www.patreon.com/Nadeem_Walayat.

Including access to my recent extensive analysis that maps out the stock markets trend into Mid 2022 which was first made available to Patrons who support my work - Stock Market FOMO Hits September Brick Wall - Dow Trend Forecast Sept 2021 to May 2022

Contents:

- Stock Market Forecast 2021 Review

- Stock Market AI mega-trend Big Picture

- US Economy and Stock Market Addicted to Deficit Spending

- US Economy Has Been in an Economic Depression Since 2008

- Inflation and the Crazy Crypto Markets

- Inflation Consequences for the Stock Market

- FED Balance Sheet

- Weakening Stock Market Breadth

- Why Most Stocks May Go Nowhere for the Next 10 Years!

- FANG Stocks

- Margin Debt

- Dow Short-term Trend Analysis

- Dow Annual Percent Change

- Dow Long-term Trend Analysis

- ELLIOTT WAVES Analysis

- Stocks and 10 Year Bond Yields

- SEASONAL ANALYSIS

- Short-term Seasonal Trend

- US Presidential Cycle

- Best Time of Year to Invest in Stocks

- 2021 - 2022 Seasonal Investing Pattern

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Trend Forecast Sept 2021 to May 2022 Conclusion

- Investing fundamentals

- IBM Continuing to Revolutionise Computing

- AI Stocks Portfolio Current State

- My Late October Stocks Buying Plan

- HIGH RISK STOCKS - Invest and Forget!

- Afghanistan The Next Chinese Province, Australia Living on Borrowed Time

- CHINA! CHINA! CHINA!

- Evergrande China's Lehman's Moment

- Aukus Ruckus

And my just published analysis earlier today - Silver Price Trend Forecast October 2021 to May 2022, CHINOBLE! AI Stocks Buying Plan

- UK Inflation Soaring into the Stratosphere, Real rate Probably 20% Per Annum

- The 2% Inflation SCAM, Millions of Workers take the Red Pill

- Silver Previous Forecast Recap

- Gold Price Trend Implications for Silver

- Silver Supply and Demand

- Silver vs US Dollar

- Gold / Silver Ratio

- SILVER Trend Analysis

- Long-term Trend Analysis

- Formulating a Trend Forecast

- Silver Price Trend Forecast October 2021 to May 2022

- Silver Investing Strategy

- SIL ETF - What About Silver Mining Stocks?

- Gold Price Trend Brief

- Why the CCP is Living on Borrowed Time and Needs a War

- Understanding the Chinese Regime and What it is Capable Of

- Guanxi

- Chinese People do NOT Eat Dogs Newspeak

- CHINOBLE! Evergrande Reality Exposes China Fiction!

- AI Stocks Portfolio Investing Strategy

- AI Stocks Portfolio Amendments

- AI Stocks Portfolio Current State

- October Investing Plan

- HIGH RISK STOCKS INVEST AND FORGET PORTFOLIO

- Why China Could Crash Bitcoin / Crypto's!

- My Next Analysis

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month now before the price hike. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 15% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Your de-risked along the highs analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.