AI Tech Stocks Portfolio Current State

Companies / Tech Stocks Oct 29, 2021 - 07:01 PM GMTBy: Nadeem_Walayat

Dear Reader

This is the third and final part of my extensive analysis - Stock Market FOMO Going into Crash Season, Chinese Stocks and Bitcoin Trend Update

This is Part 2 of my extensive analysis

Part 1 - Stock Market FOMO Going into Crash Season

Part 2 - Chinese Tech Stocks CCP Paranoia and Best AI Tech Stocks ETF

Contents:

- FOMO Fumes on Negative Earnings

- Cathy Woods ARK Funds Performance Year to Date - Chinese Stocks Big Mistake

- INTEL The Two Steps Forward One Step Back Corporation

- AMD Ryzen 3D

- New Potential Addition to my AI Stocks Portfolio

- Why is Netflix a FAANG Stock?

- Stock Market CRASH / Correction

- How to Protect Your Self From a Stock Market CRASH / Bear Market?

- Chinese Tech Stocks CCP Paranoia

- VIES - Variable Interest Entities

- CCP Paranoid

- Best AI Tech Stocks ETF?

- Best UK Investment Trust

- AI Stocks Buying Pressure Evaluation

- AI Stocks Portfolio Current State

- AI Stocks Portfolio KEY

- What to Buy Today?

- INVEST AND FORGET HIGH RISK STOCKS!

- High Risk Stocks KEY

- Bitcoin Trend Forecast Current State

- Crypto Bear Market Accumulation Current State

- Crazy Crypto Exchanges - How to Buy Bitcoin for $42k, Sell for $59k when trading at $47k!

The whole of which was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Also gain access to my latest just published analysis highly timely analysis -

Bitcoin NEW All time High is TRIGGER for Future Alt Coins Price Explosion

Contents:

- Bitcoin & Ethereum 2021 Trend

- Crypto Portfolio Current State

- The BITCOIN NEW ALL TIME HIGH Changes EVERYTHING!

- Ravencoin to the MOON!

- What am I doing?

- How to Invest in Crypto's

- Bitcoin 2022 Price Target

- Ethereum 2022 Price Target

- Ravencoin 2022 Price Target

- Cardano (ADA) 2022 Price Target

- Chainlink 2022 Price Target

- Pokadot 2022 Price Target

- Solano 2022 Price Target

- Litecoin 2022 Price Target

- Arweave 2022 Price Target

- Stellar Lumens - XLM 2022 Price Target

- Eth Classic 2022 Price Target

- Vechain 2022 Price Target

- EOS 2022 Price Target

- Earnings Noise Delivers INTEL And IBM Buy Opps

- Facebook and Google Could CRASH 10% Post Earnings Day

- High Risk Stocks Swings and Roundabouts

As well as access to why inflation will be far from transitory, batton down the hatches for whats to come-

Protect Your Wealth From PERMANENT Transitory Inflation

- Best Real Terms Asset Price Growth Countries for the Next 10 Years

- Worst Real Terms Asset Price Growth Countries for the Next 10 Years

- The INFLATION MEGA-TREND

- Ripples of Deflation on an Ocean of Inflation!

- Stock Market Trend Forecast Current State

- US Dollar - Stocks Correlation

- US Dollar vs Yields vs Dow

- Stock Market Conclusion

- 34th Anniversary of the Greatest Crash in Stock Market History - 1987

- Key Lesson - How to REALLY Trade Markets

- AI Stocks Portfolio Current State

- October Investing Plan

- HIGH RISK STOCKS INVEST AND FORGET PORTFOLIO

- Can US Save Taiwan From China?

And my extensive analysis of Silver concluding in a trend forecast into Mid 2022.

Silver Price Trend Forecast October 2021 to May 2022, CHINOBLE! AI Stocks Buying Plan

- UK Inflation Soaring into the Stratosphere, Real rate Probably 20% Per Annum

- The 2% Inflation SCAM, Millions of Workers take the Red Pill

- Silver Previous Forecast Recap

- Gold Price Trend Implications for Silver

- Silver Supply and Demand

- Silver vs US Dollar

- Gold / Silver Ratio

- SILVER Trend Analysis

- Long-term Trend Analysis

- Formulating a Trend Forecast

- Silver Price Trend Forecast October 2021 to May 2022

- Silver Investing Strategy

- SIL ETF - What About Silver Mining Stocks?

- Gold Price Trend Brief

- Why the CCP is Living on Borrowed Time and Needs a War

- Understanding the Chinese Regime and What it is Capable Of

- Guanxi

- Chinese People do NOT Eat Dogs Newspeak

- CHINOBLE! Evergrande Reality Exposes China Fiction!

- AI Stocks Portfolio Investing Strategy

- AI Stocks Portfolio Amendments

- AI Stocks Portfolio Current State

- October Investing Plan

- HIGH RISK STOCKS INVEST AND FORGET PORTFOLIO

- Why China Could Crash Bitcoin / Crypto's!

- My Next Analysis

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month,https://www.patreon.com/Nadeem_Walayat.

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

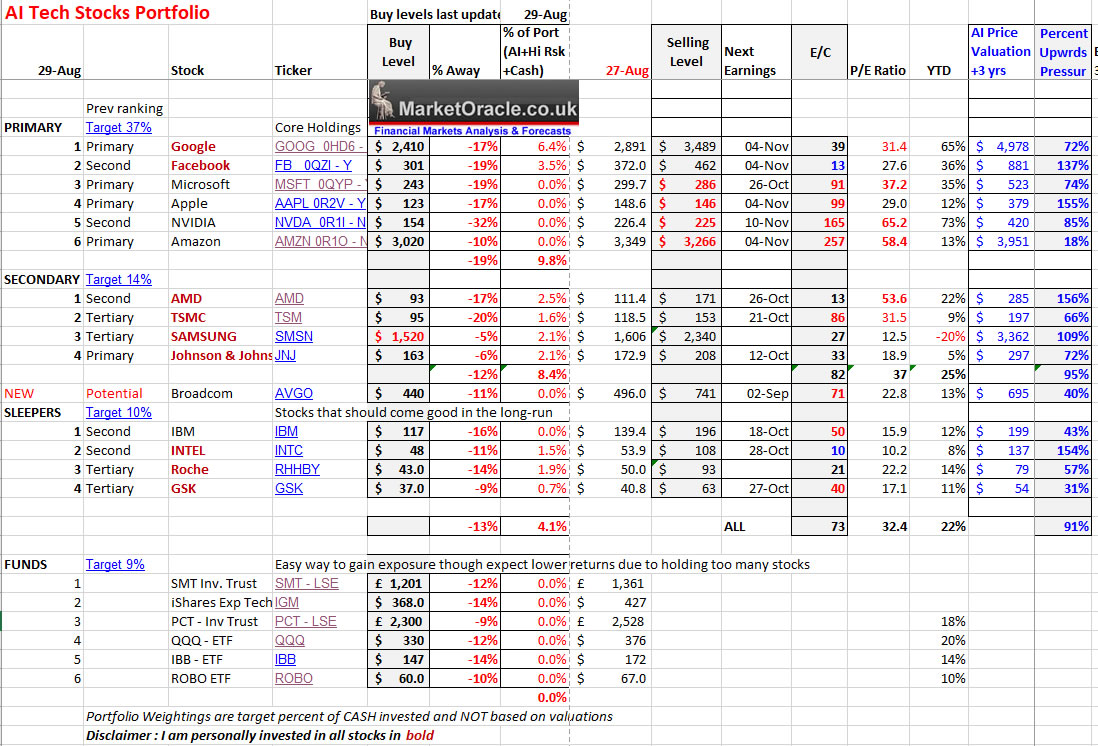

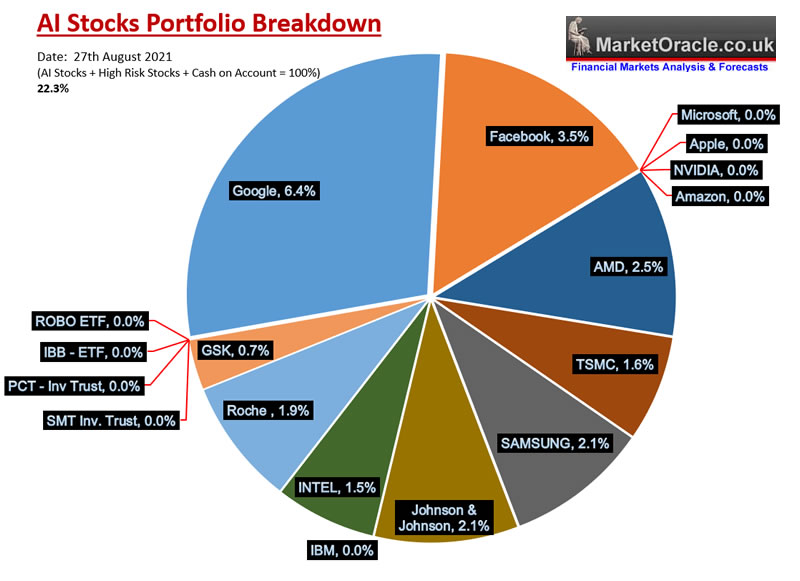

AI Stocks Portfolio Current State

Here's the updated current state of the Portfolio going into September that contains several new metrics as listed in the KEY, followed by a pie chart to further illustrate the current breakdown of my AI stocks holdings.

AI Stocks Portfolio KEY

Stock Name in maroon means I have a position in that stock, conversely a stock in black means I hold no position in that stock

Buying Level - Where I would consider buying, I buy most of the stocks at or very near their 1st Buy level, and some additionally at their 2nd Buy Level when achieved. The only exception so far is WDC since I have had my fill of high risk stocks for the time being.

Port % (AI +Hi Risk+C) - My holding in each stock as a percent of AI stocks + High Risk stocks + Cash on account. So basically my public portfolio. I do hold more that I call legacy stocks, that I have long since forgotten why I bought them decades ago, such as BHP, UU, BP, BAT, Bailie Gifford Japan and so on. Most of which I just let ride with limit orders to sell on a few such as BP.

Selling Level - An earnings derived level that I would consider selling holdings at or beyond due to over valuation, good until next earnings release.

E/C Ratio - A formulae encompassing 15 inputs such as Price to Book, Price to Sales, P/E etc.

P/E Ratio - Price divided by earnings.

Price valuation and Upwards Pressure - What the AI thinks about the future prospects for each stock updated at the time of each earnings report. Where the key metric is the Percent Upwards Pressure which indicates how strong the stock could be relative to others over the coming weeks and months. Whilst for sleepers indicates how good or bad of a buy the stock is relative to others.

What's cheap ?

Facebook, Intel and then Google.

What's expensive?

Microsoft, Apple, Nvidia, Amazon, AMD, TSMC and IBM.

Amazon stock price has been falling towards its buying level of $3020, which whilst better than paying $3700, is still not exactly cheap. Personally I have had a limit order to buy Amazon at $2933 since I sold it.

The bottom line is the best way to protect from bear markets and crashes is to PAY attention to the VALUATION! Selling over valuation and buying under valuations means that ones portfolio is some what PROTECTED from a valuation reset as happened to the chinese tech giants.

What to Buy Today?

The only AI stock that stands out is Intel as being cheap, so I am definitely looking to buy more Intel, perhaps double my position though holding off for the buying level of $48 or better probably during late October.

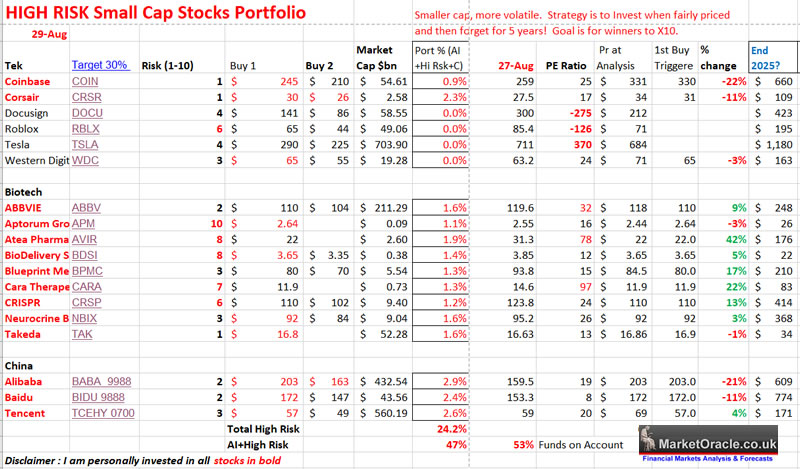

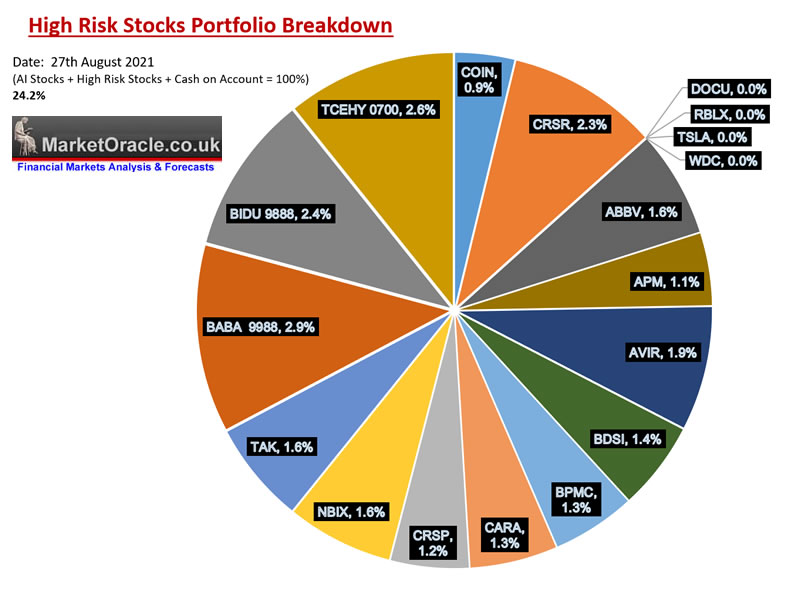

INVEST AND FORGET HIGH RISK STOCKS!

In recent months I de risked from AI tech stocks substantially cutting my holding in my Top 6 AI stocks by 80%. But then not happy with having so much cash sat on account being stealthily eroded away by the INFLATION STEALTH THEFT TAX, I went along and re risked by investing about 25% of my portfolio on first biotech stocks and then after turning a blind eye to chinese stocks decided jump in head first and start accumulating in the three Chinese stocks that I am most familiar with, Bidu, Alibaba and Tencent. However the key difference being that all of my investments over the past couple of months have been investing in high risk stocks for the long-run! That are EXPECTED from the outset to be VERY VOLATILE!, but given low valuations are expected to on average deliver between X3 to as high as X10 over the next 5 years, though a few will undoubtedly not make it to the other side, hence why one should not make the mistake of SELLING those that do well, i.e. if one sell after a 30%, 50% or even a 100% gain then it is NOT going to work as all one will be left is those few stocks that fail to perform whilst those that one sold for 50% gains, which I consider to be for peanuts will continue to soar!

INVEST and FORGET, else one will screw things up by getting out early on good stocks. All of the tech giants where once upon a time high risk stocks! Imagine if you thought Google was definitely going to be a big a winner, bought at $300ish in 2010 but then sold out a a year or so later at around $500, congratulating yourself for your wise investment decision in buying Google and pocketing a healthy 66% return and ever since waited for Google to fall back towards $300 so you can do the same again.

And THAT is what IS going to happen when you SELL out of your BEST stocks for PEANUTS! Instead of nearly X10 on Google, you got out at $500!

INVEST AND FORGET ELSE YOU WILL BLOW IT! Think in terms of TIME rather than PRICE, and the TIME is at LEAST 5 YEARS! Yes, not all stocks are the same, and some are more speculative than others, but at LEAST forget about them for 3 years, and then consider where one stands at that time, it's a pretty bad investing mindset to already consider selling a stock that one bought barely a couple of months ago! 2 months is NOT 3 years! For instance I held Microsoft for well OVER 10 years before I sold and for a good 3-5 years for most of the rest.

So high risk stocks are 3 years minimum, 5 years optimum, and as long as 10 years to truly maximise returns. It's not rocket science it's allowing time to do it's compounding magic!

NOW, don't take the above to just go to sleep on ones holdings for decades as that's probably just as dangerous as selling out too early as my recent articles have illustrated, but a balancing act of giving stocks room to breath whilst keeping an eye on valuations, for as my recent article illustrates it's valuations that are the long-term performance killers such as Cisco and many other giants of 20 years ago having failed to break to new highs. Which is why ONE needs mechanisms to EXIT / SELL when valuations reach extreme levels especially if the stocks have crazy $1 trillion/+ or even $2 trillion+ market caps whilst trading on 30X, 40X even 50X earnings (Amazon)!

At this point in time I am fully loaded so personally not looking to buy more high risk stocks. Though I still consider CRSR to be dirt cheap, a coiled spring! And I may be tempted to take a nibble at Coinbase if it fell towards $220. I may also consider my first buy of WDC at around $55.

The Chinese tek giants remain dirt cheap, even cheaper today than when I first flagged them as buys, of the 3 probably Alibaba stands out as being the best bet, though all 3 should do well over the next 3 to 5 years, and much more if one has the staying power for a 10 year investment, Alibaba could easily X5 from current levels.

High Risk Stocks KEY

Stock Name in red means I have a position in that stock, conversely a stock in black means I hold no position in that stock

Risk 1 to 10 - 1 means basically I consider it a done deal, to just forget about the stock and light time do it's magic. Whilst 10 means this really is a high risk stock that could go bust, so definitely not a stock to get carried away with! With a spectrum of risk in between.

Buying Levels - Where I would consider buying, I buy most of the stocks at or very near their 1st Buy level, and some additionally at their 2nd Buy Level when achieved. The only exception so far is WDC since I have had my fill of high risk stocks for the time being.

Market Cap - The smaller the market cap the easier it will be for the stock to multiply its valuation i.e. it is relatively easy for CRSR to X2 than for instance ABBV. Though market caps under $1 billion carry increasing risks of going bust.

Port % (AI +Hi Risk+C) - My holding in each stock as a percent of AI stocks + High Risk stocks + Cash on account. So basically my public portfolio. I do hold more that I call legacy stocks, that I have long since forgotten why I bought them decades ago, such as BHP, UU, BP, BAT, Bailie Gifford Japan and so on. Most of which I just let ride with limit orders to sell on a few such as BP.

P/E Ratio - Price divided by earnings.

Price at Analysis - Where the stock was trading when I first added it to this list.

1st Buy Trigger - When the stock first got triggered which is usually around the price where I would have first bought the stock using limit orders to at least squeeze the trading and forex fees.

End 2025? - My rough target for the stocks trading high between now and the the end of 2025.

Price valuation and Upwards Pressure - What the AI thinks about the stocks prospects updated at each earnings. Though most high risk stocks lack data to generate this output.

Again for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Especially my highly timely analysis on the crypto markets and where they are likely to go next - Bitcoin NEW All time High is TRIGGER for Future Alt Coins Price Explosion

In advance of which I posted a video on why Ravencoin was on the cusps of breaking out higher that would mark the start of a trend to new all time highs i.e. from 0.11 to above 0.29.

My analysis schedule includes:

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 65% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Your cryptos accumulating analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.