Stocks Bear Market Bubble Trouble

Stock-Markets / Stocks Bear Market Jun 02, 2022 - 02:44 PM GMTBy: The_Gold_Report

As month five of this bear market comes to an end, expert Michael Ballanger goes over some bear market stories that left him with battle scars and provides some insight on what to expect in the months ahead.

Month five of the Great 2022-202? Bear Market is almost complete so I thought you all might wish to hear a few “war stories” from past bear markets, some of which I endured while none of which I even vaguely enjoyed. First, I offer the MJB “primer”…

“The key to long-term profits on Wall Street is not making big killings; it’s not getting killed.”

—Daniel Turov

At the bottom of bear markets (or at the start of bull markets), stocks are like moored boats at low tide, resting on the sand desperately in need of the resurgent surf.

As markets turn, it is analogous to the tide roaring in and when it does, it lifts all boats, big and small, and it doesn’t care whether a vessel is leaking or whether it is tight. Warren Buffett coined a phrase that perfectly describes how bear markets expose flawed business models in heavily-pumped companies when he said, “Bear markets are like the tide going out; you soon learn who is swimming without trunks.”

This year has been a classic case of the tide leaving quite suddenly but instead of seeing the normal flotsam and jetsam on the seafloor, what is being revealed is an unimaginable toxicity of an order “most foul.”

I listened to Grant Williams today interview two high-intellect dudes that know the crypto space infinitely better than I do but, more importantly, they did a “deep-dive” into the Terra-Luna disaster where a supposedly “pegged-to-the-buck” currency lookalike turned into a total wipeout of every single dime ever invested into a “stablecoin.”

Now, for the record, I have never trashed crypto because I know nothing about it. Unlike other prominent forecasters and commentators, I have refrained from casting judgment on cryptocurrencies largely because when one misses out on a phenomenally-profitable trade as in Bitcoin, one is wise to avoid the “sour grapes” moniker that ultimately arrives like an uninvited uncle.

The crash of the Terra stablecoin triggered a $200 billion drawdown in the crypto space and while it probably never belonged in the billions of dollars, it seems that many of the covenants that were marketed to investors were never really in place.

In raging bull market bubbles, there are two horsemen that usually ride into town: the first is greed the one right behind it is fraud. From 1982 to 1997, the mining industry had multiple world-class discoveries that began with Hemlo and included Eskay Creek (gold-silver), Lac-de-Gras (diamonds), Voisey’s Bay (nickel-copper-cobalt), and Arequipa (gold).

As the reports of lottery-type wins circulated around the global trading rooms, vast sums of new investments capital (also representing the first horseman) flooded the space, and right behind it came the opportunistic scam artists (the second horseman) that created a little entity in Indonesia called Bre-X that in April 1997 turned out to be the biggest fraud in Canadian mining history.

As we look back at that fraud, it paled in comparison to the one that surfaced four years later when the Enron scam vaporized $60 billion in what was then the largest corporate bankruptcy in U.S. history.

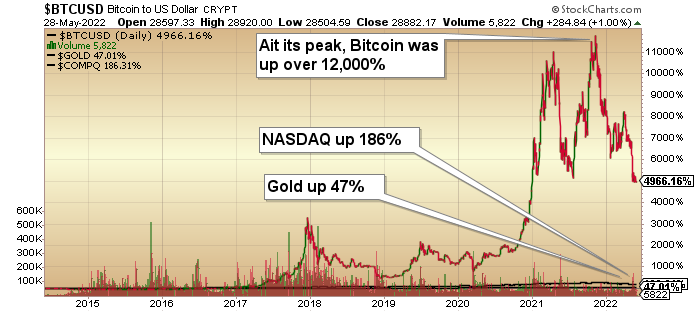

Ergo, with central bank printing presses engorging the financial world with phony credit and currency for most of the last 22 years, the most recent battle for investment superiority was won by Bitcoin, which turned paupers into billionaires. And thanks largely to the growth of information technology, Bitcoin lured entire generations into its “off-the-grid” appeal and unregulated maneuverability, which meant that the arrival of "scamsters" was only a matter of time.

What makes the Luna fraud so outrageous is the lack of transparency in its financial reporting.

It is bad enough to step into a penny mining stock at $1.00 and after disappointing drill results take it back down to $.25 but when one plunks down entire life savings into a deal like Luna that was advertised as “pegged to the buck” as if it were a money market fund and then has to watch it go to zero, this verges on the taking of the proverbial cake in the realm of financial fraud.

Alas, these are all the characteristics of what is revealed when the tide finally leaves the harbor and as I have seen over more than a few baby, mama, papa, and grandpapa bear markets, it is uncanny how greed and fraud always leave their stains on the landscape.

Humans are completely incapable of idly standing by while their neighbor celebrates a hard-earned (or unearned) windfall without trying to devise a way of capitalizing through repetition, imitation, or fraud.

It is like sands through the hourglass and, yes, these indeed are the days of our lives.

It seems to me that every time I land upon a blog or podcast these days, some “expert” is rhyming off a dozen reasons why one should avoid the stock market. Shorting and put buying are now the new “flaveur de jour” for the Millennial and Gen-Ex crowd that have been weaned on Fed largesse and bubbly markets.

Additionally, the controlled demolition of the short sellers by way of the “Powell put” has removed a pool of nascent buying power that served as a parachute of sorts in past bears. When stocks appeared ready to crash late last week, there was a deafening crescendo of odd-lot put buying along with a record number of Google searches with “market crash” as the keyword.

As for the markets, the pessimism that marked the interim bottom for stocks last Friday has now evolved into a decent rally with the retail-dominated NASDAQ up over 10% from the lows of May 20.

I see the potential for a few more percentage points of advance before the bear returns to the dinner table but what I do not see is this much-vaunted “melt-up” scenario that is being floated around the blogosphere these days by more than a few “forecasters” that “never offer investment advice” (but who will gladly have you subscribe to their sponsored podcasts or newsletters).

After getting pummeled by my energy shorts this month, I was able to claw back a few shekels with the pick-off of Teck Resources Ltd. (TECK:TSX; TECK:NYSE) under $36 a couple of weeks back.

I have a 2022 target of $50 with a near-term target of $44 (22% ROI) and since it trades step for step with the XLE due largely to its coal and oil and gas operations, this trade relies on continued strength in energy stocks.

While I have been dead wrong on energy this year, it seems that everyone I know has become an energy bull and that is a circumstance that usually does not last. (Stop-losses under $40 are in place for Teck.)

These are the conditions under which stocks usually do the opposite of what the crowd expects so while it was an easy call to make, now comes the hard part.

Where does the rally run into a wall?

I see the 38.2% Fibonacci retracement level at around 13,000 for the NASDAQ and 4,191 for the S&P so those are two highly-optimistic targets for this bounce and since we get institutional money flow at the start of the month, by late next week we could get there.

I will be watching with great and morbid curiosity how quickly the “buy-the-dip” crowd comes charging back but you should all know this: Until those permabulls legions are nowhere to be found, the markets will continue to see new lows.

That is a characteristic of literally every bear market since they started swapping paper on a street curb in Manhattan.

With diesel prices into the stratosphere, one of the greatest arguments for owning mining issues is no longer a factor and that is what is weighing on the GDX and GDXJ ETFs these days.

Contrast that with gold bullion, whose chart looks not only fine, but it would also appear that the lows for 2022 are in.

With the U.S. dollar screaming through 105 recently, one might have expected even greater weakness than the $250/ounce thrashing it has taken since early March.

With the low of May 16 at $1,785 now well behind us, I see $1,885-1,890 as the next barrier.

Silver was added to the trading account on the recent break under $20.50.

So after taking a couple of body blows this month, we are poised for recovery.

Remember the immortal words of Richard Russell: “In bear markets, he who loses the least, wins!”

I save the best for last as the TSX Venture has lived up to its reputation as “NASDAQ North” where the TSXV is down 25.28% YTD while the NAZ is down 26.91% YTD.

Both of these exchanges carry speculative issues and are usually dominated by the retail trade.

I prefer resource issues over technology given that tech is coming off thirteen years of Fed protection while the same cannot be said for resource issues.

While I remain fearful of the deflationary impact of the pending Fed quantitative tightening (removing liquidity from all credit markets), many of the names I cover on the TSXV are actively exploring for gold, silver, copper, and uranium and since we are now in the seasonally-active period, positive drilling results should (in a perfect world) bring buyers to the table.

It was only a few months ago that the world was facing a massive copper shortfall due to undersized CAPEX commitments and dwindling mine reserves resulting in a $5.00/lb copper price.

We went out this week at $4.32 suggesting that either someone found a few billion pounds of the red metal sitting in a Shanghai warehouseor that the market has become dislocated.

I choose the latter since many of my portfolio picks are actively drilling copper prospects (Getchell, Norseman, Allied, Northisle, Max), a basket of these juniors, most of which trade on the deeply-oversold TSXV should (again, in a perfect world) yield potentially outsized returns once sentiment settles down.

Actor Matt Damon says in his recent crypto pump advertisement, “Fortune favors the brave” and while I totally agree with that type of attitude when waging war in the trading pits, I bet Matt would like to have that one back…

“Crypto.com this!”

Follow Michael Ballanger on Twitter ;@MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver Ltd., Great Bear Resources, Western Uranium, Stakeholder Gold, Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My firm no longer does consulting work for Stakeholder Gold.. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium and Aftermath. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Getchell Gold, Western Uranium and Stakeholder Gold and Aftermath, companies mentioned in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.