Gold Junior Miners: A Bearish Push Is Coming to Move Them Lower

Commodities / Gold and Silver Stocks 2022 Jun 27, 2022 - 10:12 PM GMTBy: P_Radomski_CFA

Let's not be confused by the temporary USDX weakness. Junior miners are faint and we can expect them to decline again soon.

April and May Replay?

Although history doesn’t repeat itself to the letter, it rhymes. At least that’s what tends to happen in the financial markets.

In today’s analysis, I’ll explain why I think we’re about to see another example of the above in the case of junior mining stocks. There’s a technique that suggests one thing, but there’s also another that suggests that a 1-to-1 analogy wouldn’t be as good a fit, as a slight deviation from it.

So far, the situation in the GDXJ – a proxy for junior mining stocks – has been similar to what happened in the second half of April and early May.

I even marked those similar periods with orange rectangles. We saw a small consolidation right after the end of the smaller rectangle, so history had already proved to be repeating itself.

However, let’s see what happened differently. This time, the initial decline (so the smaller rectangle) was not as steep as it was in April, and the following consolidation was shorter and narrower, too.

What does it tell us? No, I don’t mean the obvious “well, it’s not identical” here. The price moves are smaller either because the entire current short-term downswing is smaller (so, a smaller initial part and then a smaller final part would together create a smaller version of what we saw in April and May), or because this time, the structure of the price move is going to be a bit different.

If the latter is the case, it means that the decline can actually be bigger than what we saw in April-May, not smaller.

Looking at the charts featuring gold and the general stock market, we can tell that the latter of the above scenarios is more likely being realized.

Why? Because junior miners are weak relative to both: gold and the stock market.

Did gold move to new 2022 lows recently? Or below its 2021 lows?

Nope, it’s not even particularly close to those levels. In fact, gold didn’t even move below its recent lows on Friday.

What about the general stock market – did it slide profoundly recently? If it did, it might have explained juniors’ weakness, as both juniors and the general stock market are relatively highly correlated (compared to how correlated is the general stock market is with other parts of the precious metals sector).

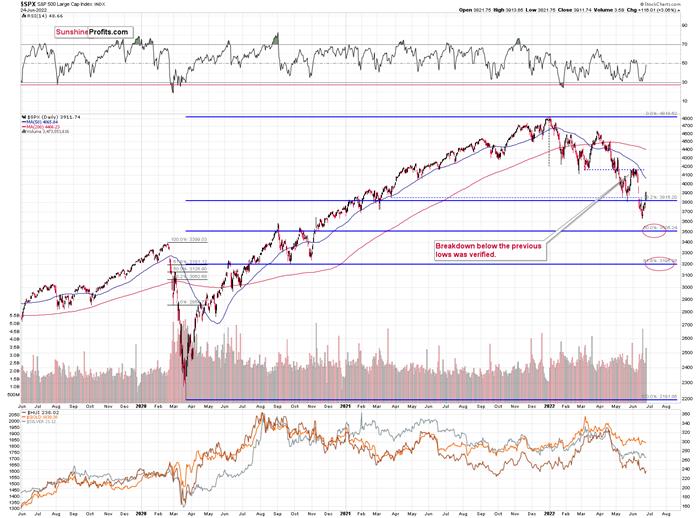

Actually, the general stock market rallied last week, and it invalidated its previous breakdown below the recent and 2021 lows. In fact, the S&P 500 Index was up by over 6% last week!

Was GDXJ up by over 6% too? No. It was down by over 3%, and profits on our short positions in juniors have increased once again.

The juniors are weak. Period.

This tells us that it’s more likely that the deviation from the history that is not repeating itself to the letter will be toward something more bearish than the 1:1 analogy would be.

Does it complicate the outlook or analysis right now? Actually, it’s the opposite, because the above perfectly fits what was visible on broader charts all along!

I previously explained that the next target for the GDXJ is likely around the $26-27 area.

That’s below the 1:1 analogy-based target that would be at “just” $28 as the blue, dotted lines would indicate.

Additionally, please note that the GDXJ is likely about to complete a head-and-shoulders pattern. Actually, it doesn’t matter if we use the late-2021 rally as the left shoulder or the late-2021 – early-2022 one, as the early-2022 rally is still the head, and the target based on the formation is the same in both cases. I marked the neck levels with green, solid lines, and I marked the downside target based on the potential formation with green, dashed lines – it’s slightly below $24.

The formation is only “potential” at this time, as we would need to see a confirmed breakdown below the neck level to say that the formation is complete. This would mean a breakdown below ~$34.

Given the kind of weakness that we saw in junior miners recently, it seems that we won’t have to wait too long for the above to take place.

Speaking of time, the month is ending, and this might ring some bells…

The USDX Tendency

The USD Index tends to turn around at the turn of the month, usually bottoming out at that time. For example, that happened about a month ago and three months ago.

The month ends this Thursday. This tendency works on a near-to basis, so the exact bottom might or might not form on Thursday, but it doesn’t seem that we’ll need to wait for this bottom for long.

Based on junior’s weakness, we see that they just “can’t wait” to move lower, and the above USD Index chart tells us that they are likely about to get a bearish push.

Let’s not forget about the forest while looking at trees. The recent brief decline in the USD Index is likely just a handle of a cup-and-handle pattern that – when completed – is likely to take the USD Index much higher.

Most importantly, the entire cup-and-handle pattern (so basically the May-now performance) is a big handle of a much bigger cup-and-handle pattern that you can see on the long-term USD Index chart.

This means that once the USD Index breaks and confirms the breakout above the previous highs (and it’s likely to do so in the near future), it’s likely to soar.

This is bearish for the precious metals market – extremely so. Gold’s back-and-forth movement is likely about to end, just like junior miners are indicating. Gold’s next important stop (not the final end of the entire medium-term decline, though) is likely to be at its 2021 lows or close to them.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.