Economic Challenges face the Stocks Bull Market

Stock-Markets / Stock Market 2022 Nov 21, 2022 - 09:51 PM GMTBy: Donald_W_Dony

One of the biggest challenges that face the continuation of the 14-year economic expansion is inflation. Years of near-zero interest rates, an accommodating Fed, and low unemployment have resulted in the highest inflation rate in 40 years.

To counteract this rapid rise in inflation, the FOMC started increasing the Fed Funds Rate in May. First with small increments and then with four jumbo increases of 75 bps.

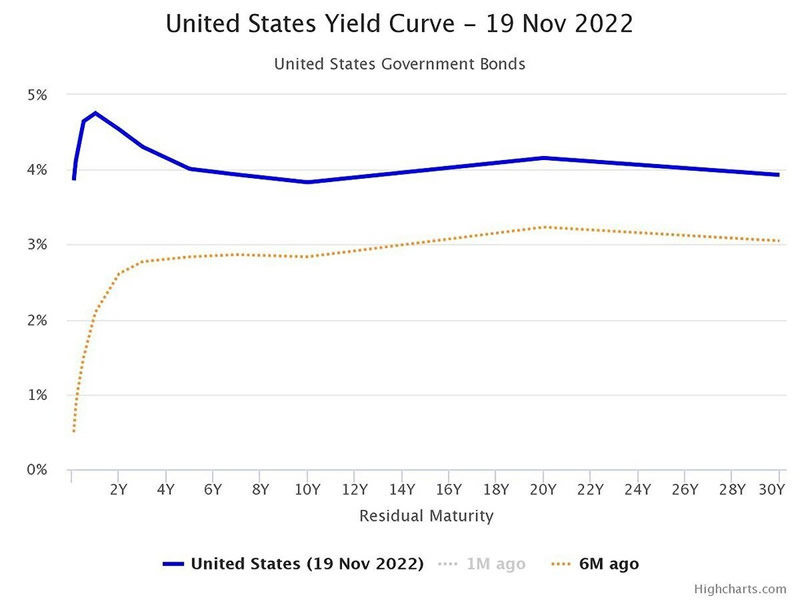

The effect on the US yield curve that these rate escalations have achieved is an inverted curve. A short-term inversion of up to 6 weeks is not problematic to the economy. But a prolonged inversion is a different story.

Currently, the US yield curve has been inverted for 21 weeks (Chart 1).

Since the 1960s, whenever the curve has been inverted for longer than 6 weeks, a recession and market correction develops.

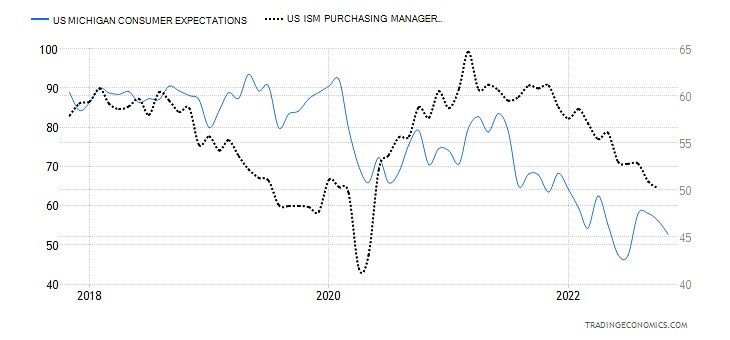

The signs of a weakening US economy are already present. Consumer expectations have been steadily declining and are now at a 10-year low. Business confidence (ISM Purchasing Manager) index, is also dropping (Chart 2). Existing home sales have plunged to an 11-year low and the steadily declining US Unemployment Rate, once the results of a decade of near-zero interest rates and an accommodating Fed, is now beginning to rise. The high-tech industry, in particular, is finding this environment challenging.

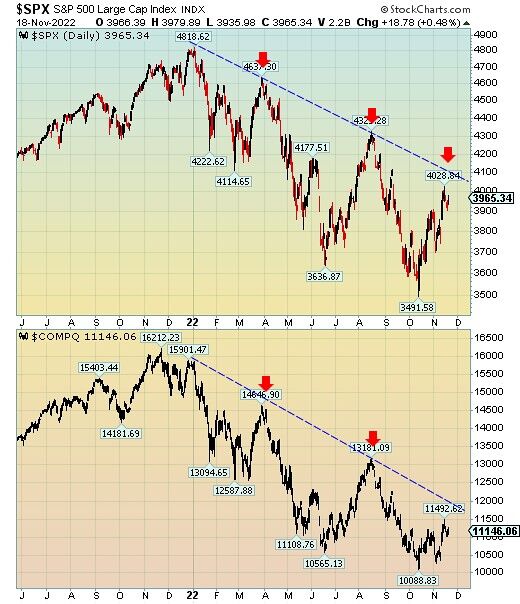

Nasdaq is down 31% from its high in January as compared to 18% for the S&P 500 (Chart 3).

But, both indexes have a very similar trading pattern.

The SPX and Nasdaq are locked in a formation of descending rallies. Every rebound this year has been met with increasing selling pressure. Models are pointing to a continuation of these trading patterns with new lows for both indexes in January.

Bottom line: The steady escalation of interest rates has created an inverted yield curve. The fallout of this prolonged inversion is being felt in the economy and the stock market.

We expect the recent rally in the S&P 500 and Nasdaq has reached their peak. Investors should expect to see lower levels for both indexes into Q1.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2022 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.