Beneficiaries of US Dollar Weakness

Currencies / Forex Trading Jul 24, 2023 - 07:54 AM GMTBy: Richard_Mills

On July 9 the US dollar index (DXY) slipped under 100 for the first time since April 3, 2022, with cooling US inflation data released on July 12 maintaining the trend of a weaker greenback against a basket of other trade partner currencies.

As of July 14, the dollar was down nearly 13% from last year’s two-decade high and was its lowest level in 15 months. According to Reuters, the softer-than-expected inflation print supports views that the Federal Reserve is nearing the end of its interest rate-hiking cycle.

Source: MarketWatch

At time of writing, on July 18, gold prices hit their highest level in six weeks as weakness in the USD and Treasury yields helped keep prices of precious metals and commodities elevated.

Gold has risen $22 over the last three days. Source: Kitco

A long-time currency analyst cited by MarketWatch said Tuesday that the dollar’s slide over the past eight months means that all of its gains in the wake of the coronavirus pandemic could soon be lost.

A weak US dollar has many implications, including strong upside potential in long-term bonds, currencies, American companies selling goods and services abroad, and commodities especially gold.

American exports

First we need to understand the relationship between interest rates and the US dollar, since the former has clearly been driving the latter, and is expected to continue doing so.

It’s fairly obvious that changes in the federal funds rate — the overnight lending rate controlled by the Federal Reserve — impacts the dollar. When the Fed hikes the FFR, it has a ripple effect throughout the economy, including on government bond yields. Higher yields on US Treasury bills attract investment capital from investors abroad seeking good returns on bonds. But first the investors need to use their home currencies to buy dollars. The result is a stronger exchange rate in favor of the US dollar.

What will happen if the Federal Reserve begins to lower interest rates, which the market consensus sees happening sometime in 2024? The result will be less demand for dollars, weakening the currency, along with a reduction in US bond yields.

Clearly, a weak dollar makes American goods priced in US dollars more competitive in overseas markets. It also makes it cheaper for multinationals to convert foreign profits into dollars. According to Reuters, an analysis of Russell 1000 companies by Bespoke Investment Group showed that the US technology sector generates just over 50% of its revenue abroad.

Currencies

In times of economic or political turmoil, domestic and foreign investors often buy dollars because they are a safe haven. When the dollar falls, other currencies that were previously weaker become stronger, and therefore more attractive as an investment.

“That sound you hear is the breaking of technical levels across the foreign exchange markets,” said Karl Schamotta, chief market strategist at Corpay, quoted in the Reuters piece. “The dollar is plunging toward levels that prevailed before the Fed started hiking, and we’re seeing risk-sensitive currencies melt up on a global basis.”

If the buck continues to fall, it could favor the dollar-funded carry trade, where dollars are sold to buy a higher-yielding currency, allowing the investor to pocket the difference. Corpay showed, for example, that selling dollars and buying the Colombian peso would have booked a 25% gain year to date, while the Polish zloty has yielded 13%.

In terms of monetary policy, the dollar’s decline is good for some countries as it removes the urgency to support their falling currencies. Among the best examples is Japan, which intervened last year to prop up the yen for the first time since 1998. Interventions typically consist of the central bank buying large amounts of yen using dollar reserves.

Yen weakness is a continuing problem for Japan, which relies heavily on imports, especially crude oil and natural gas — priced in US dollars. In fact, when adjusted for inflation, Japan’s currency is trading near its lowest level in decades.

However, last week the greenback tumbled 3% against the yen, setting up the biggest weekly fall against the Japanese currency since January.

Source: Xe

In fact every group-of-10 currency has strengthened against the greenback over the past month, as have emerging currencies, with a gauge of such assets up 2% this year after falling 4% in 2022.

Michael Cahill, a G-10 foreign exchange strategist with Goldman Sachs, expects any dollar downturn to be shallower than past cycles, but he says dollar support could crumble if the Fed ends its inflation fight before the European Central Bank, which could be compelled to keep rates higher for longer.

“The biggest risk that could lead to more dollar downside is that the inflation picture diverges,” said Cahill, via Bloomberg. The bank expects the dollar to weaken to $1.15 per euro in 2024 from about $1.12 now, and that the yen will strengthen to 125 per dollar from the current 139.

Source: Xe

At least one trader quoted by Reuters believes the Fed will wrap up its rate-hiking cycle before most other central banks, sapping the dollar’s long-term momentum.

While the dollar may pare some of its recent losses, “looking six months out it’s likely the dollar will be even weaker than it is today,” she said.

Commodities

A strong dollar may be in the national interest, because it makes imports cheaper, favoring American consumers. The same goes for US businesses that import manufactured goods and services. A high dollar helps to offset their costs and check domestic inflation.

Commodities are the obvious exception. Of 45 that are traded internationally, 42 are priced in dollars. They include crude oil and other hydrocarbons, corn, wheat, soybeans, base metals such as lead, zinc, copper and aluminum, and gold, platinum and silver.

A weak dollar usually means stronger commodities prices. Because the USD is the reserve currency and most commodities are traded in dollars, the value of the dollar is of crucial importance in determining the value of the commodity in question. Take the case of a low dollar. When the dollar drops it takes less of another currency to buy dollars needed to purchase the commodity, so the demand for that commodity will increase, leading to a price increase. The inverse happens when the dollar strengthens.

The case for commodities is bolstered by the fact that we are starting a new “commodity supercycle”.

All signs point to the early stages of a new “commodity supercycle”

While no two supercycles look the same, they all have three indicators in common: a surge in supply, a surge in demand and a surge in price.

The new commodity supercycle, however, could look a bit different from the previous ones for one simple reason — an increased focus on climate change.

According to S&P Global, a more aggressive commitment to the energy transition across G-20 nations could also create the conditions for a sustained surge in demand, supply and prices.

Like in the past, commodity supercycles are usually driven by strong demand for raw materials, manufactured materials and sources of energy. The energy transition serves as a major catalyst for all the key inputs to our renewable energy infrastructure, taking demand to levels never seen before.

Demand for copper — the cornerstone for all electricity-related technologies — is set to grow by 53% to 39 million metric tons by 2040, according to BloombergNEF. Battery metals like lithium, graphite, cobalt and nickel will see even faster growth, reaching more than three times the current demand levels by 2030, says BNEF, with lithium rising the fastest with a seven-fold increase.

Gold

The direction of a weakening dollar is clear, with the Federal Reserve last month pausing its tightening cycle after a series of interest rate hikes. If the Fed cuts rates in 2024, it will weigh on both US Treasury yields and the greenback — both positives for gold.

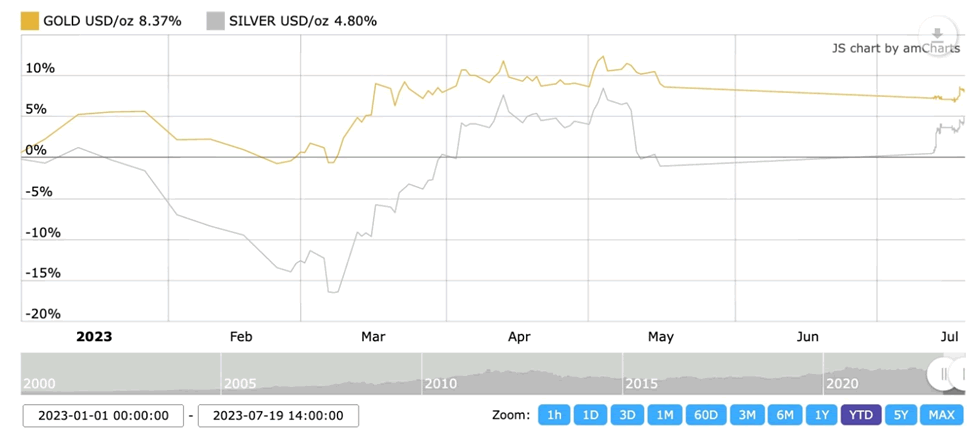

In fact, gold and silver prices have both seen impressive jumps this year, with gold coming within cents of an all-time high, and silver also flirting with price levels last seen a decade ago.

Gold and silver spot prices year to date. Source: Kitco

But the precious metals rally, according to some, has only just begun. One analyst believes it’s only a matter of time before gold surpasses double digits on its way to $12,000-15,000 an ounce.

In a recent interview, Adam Rozencwajg of Goehring & Rozencwajg (G&R), the Wall Street commodities investment firm, said “We think that gold has entered into a new phase of this bull market.”

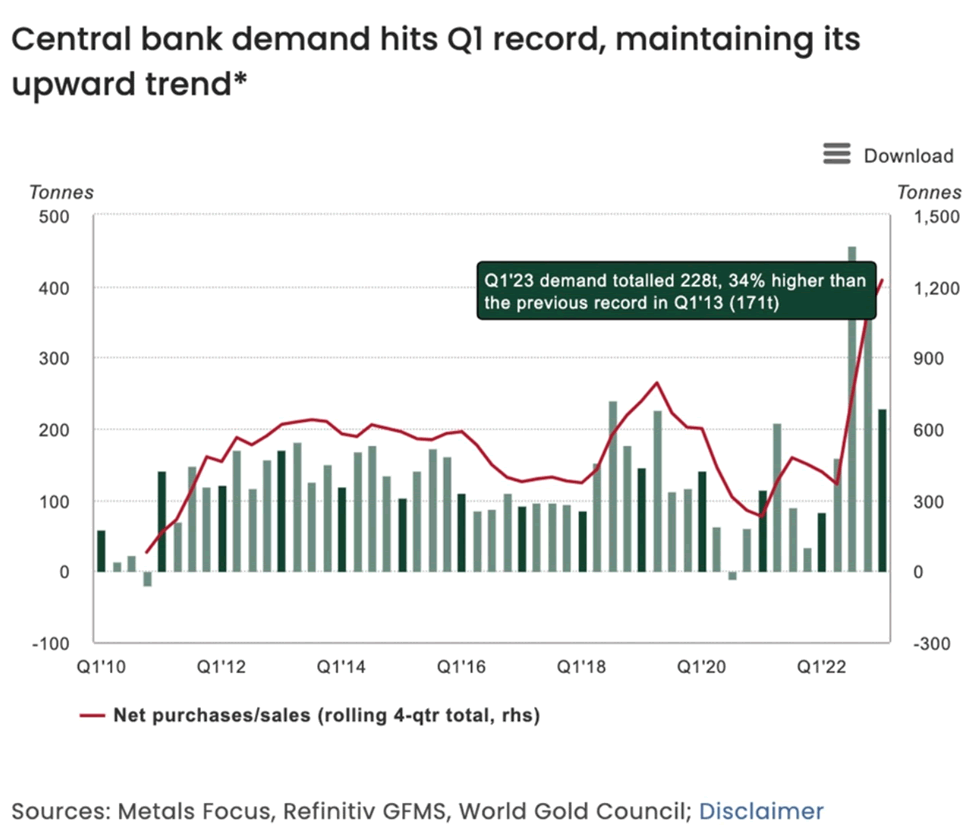

Rozencwajg says the new bull market phase began in the third and fourth quarters of 2022, “and it really revolves around central banks’ behavior as much as anything else. I think it’s going to propel gold much much higher in this leg of the bull market.”

Central banks actually stopping buying gold during covid, with some deciding to sell bullion to pay for social programs necessitated by virus-related economic slowdowns and business closures.

After economic recovery in 2021-22, this behavior changed, with central banks in the aggregate buying more gold in the fourth quarter of 2022 than they had since the world went off the gold standard in 1971. Individually, some countries bought more gold during this period than at any other time. The trend has carried forward into 2023.

In the first three months of the year, central banks bought a combined 228 tonnes, the most ever in a first quarter, World Gold Council data revealed.

“De-dollarization” is another factor driving the dollar lower and gold prices higher.

While there has been plenty of talk of this over the past few years, the fact is there has been scant evidence of countries using currencies other than the dollar for settling international trade transactions. Until now. Among recent examples, France announced it will sell LNG to China priced in renminbi, China will buy soy and iron ore from Brazil denominated in Chinese currency, and crude oil trades between Saudi Arabia and China will be settled outside the dollar.

“Any time you’re going to get a major monetary shock like that, like the end of a reserve currency system and bringing in a new system, I think that’s going to be really good for gold,” says Rozencwajg.

Bonds

A recent Bloomberg piece is titled, ‘History Says It’s Time to Buy Long-Term Bonds as Peak Rates Near’. The crux of the argument is that historically, US Treasuries maturing in 10+ years have outperformed shorter-dated Treasuries immediately following the last in a series of interest-rate increases. The Fed is expected to raise rates on July 26, but a poll suggests it will be the final rate hike.

Surveys by two major US banks found investors have increased their exposure to long-dated bonds, with bonds last week posting their biggest gains since March following a report showing consumer prices (inflation) increased at the slowest pace in two years.

While the biggest moves were in short-and intermediate-maturity tenors, investors can reap bigger rewards by purchasing long-dated bonds. According to Bloomberg data, On average, Treasuries maturing in 10 or more years have gained 10% in the six months after a Fed policy-rate peak, compared with 6.5% for bonds maturing between five and seven years and 3.7% for those due within three years. In 12 months, the longest-dated bonds returned 13%, outpacing the other sectors.

“There is finally income to be earned in the fixed-income market,” BlackRock President Rob Kapito told analysts Friday, calling the higher yields a “remarkable shift” and a “once-in-a-generation opportunity.

Hard or soft landing?

Of course, any discussion of the dollar’s movements would be incomplete without a mention of the state of the US economy. Many now believe the Fed can pull off what was until only recently viewed as impossible, that is, containing pricing pressures without tipping the economy into recession. This is know as “a soft landing”.

According to Bloomberg strategists, If you continue to believe, as we do, that the Fed rate will soon peak (though no 2023 cuts), in a softening (not hard landing) US growth story and in a continued risk-on market context, it makes sense to believe in a weaker dollar performance into 2H.

In other words, a soft landing appears to coincide with a weak dollar.

The Bank of International Settlements published a study last year that analyzed 70 tightening cycles between 1980 and 2019 across 19 advanced and six emerging economies.

The paper found that All else equal, larger rate hikes spread over a longer period are more likely to be associated with hard landings, and front-loaded tightening cycles tend to be followed more frequently by soft landings, the BIS found.

The Fed’s latest cycle falls under the second category.

(‘The Inverted Yield Curve and Next US Recession’, QTR’s Fringe Finance, July 11, 2023)

A third theory supporting the idea of a soft landing and a weak dollar is proposed by the director of currency strategy at Amundi Asset Management, Paresh Upadhyaya.

The thinking there is that the greenback typically gains when the US is either in a severe slump or a robust expansion — and falters in times of moderate growth.

“If the US engineers a soft landing, that is probably the best case for a weaker dollar you can ask for,” Upadhyaya said.

Conclusion

Current and future weakness in the dollar — the result of much better inflation readings and the subsequent expectation of the Fed putting an end to its interest rate-hiking cycle, potentially even lowering rates — bodes well for a number of asset classes discussed here. They include long-dated bonds, gold and other commodities that tend to gain value on a lower dollar, and of course, other currencies that are suddenly attractive compared to the mighty buck.

Beyond the simple fact of inflation getting closer to the Fed’s 2% target, which would mean “mission accomplished” for the central bank, there is another reason why the organization cannot continue to hike rates to quell inflation for much longer. Hint: it has to do with the debt.

Even when the Fed starts cutting rates, due to the delay of rolling over maturing debt, interest payments will keep going up for the foreseeable future. As Zero Hedge recently observed, if rates keep rising “higher for longer”, the current weighted average for total outstanding debt will go from 2.76% to 4% in one year:

That would be a complete disaster for the US, and it would mean that interest payments on total US debt of $32.3 trillion would hit $1.3 trillion within 12 months, potentially making interest on the debt the single biggest US government expenditure and surpassing social security!

This gells with a previous AOTH article highlighting the dangerously ballooning interest on the national debt.

Interest on the debt on track to exceed military expenditures

It concluded that budget cuts are inevitable; they are needed just to keep the government solvent. Where will the reductions occur? The answer is Social Security and Medicare/ Medicaid. Both programs are unsustainable the way they are currently structured.

Over the next decade, Medicare and Social Security spending are both expected to double. Yet the government has no money in the bank for future expenses and there is no serious proposal to change that.

How high will they have to raise the debt ceiling to afford these expensive, unfunded liabilities? How much interest will have to be paid on this higher debt?

With 17 cents out of every dollar now going to paying the interest on the debt, it won’t be long before debt servicing costs are the biggest line item, surpassing even the true, bloated defence/ war-making budget. And who is to blame? Both the GOP and Dems.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2023 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.