Silver Bulls Are the Walking Wounded

Commodities / Gold & Silver 2023 Oct 08, 2023 - 10:06 PM GMTBy: Submissions

Silver has been a major underperformer in recent months, as the white metal proved no match for higher real yields and a stronger USD Index.

With silver gunning for its 2023 lows, the recent sell-off has done severe technical damage. And while the weakness has been a boon for our GDXJ ETF short position, silver could enjoy a meaningful bounce in the weeks ahead. Yet, the technicals are much better than the fundamentals at uncovering support and resistance, and our premium Gold Trading Alert has all of those details.

As for the medium-term outlook, we remain bearish and will cover the fundamental metrics that keep us cautious. To begin, we’ve warned on numerous occasions that higher long-term interest rates (not the FFR) create recessions. And with the recent rate surge dominated by the long end, the chickens should come home to roost in the months ahead.

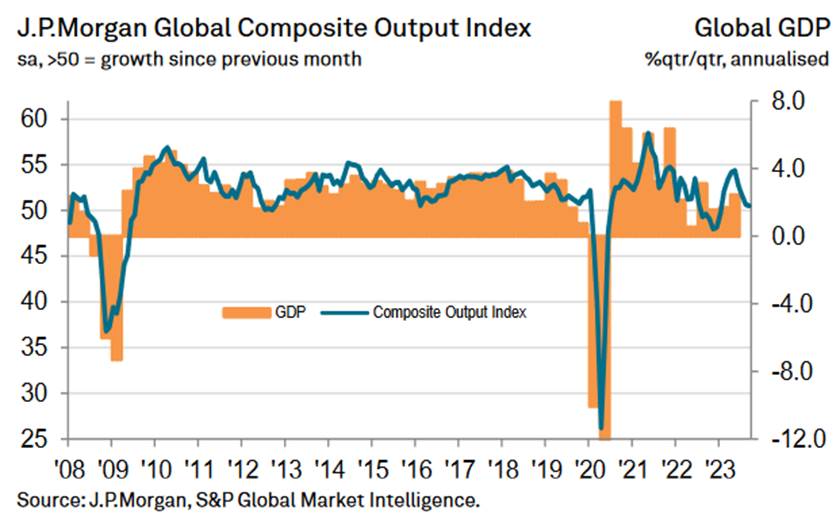

S&P Global and J.P. Morgan released their Global Composite PMI on Oct. 4. And with output already sputtering, the data should only worsen as higher long-term rates filter through the system. The report stated:

“Global economic growth remained lackluster at the end of the third quarter, as output edged higher and intakes of new work contracted for the first time in eight months. There were also signs of further weakness in the coming months, as backlogs of work fell sharply and business optimism dipped to a nine-month low.”

Please see below:

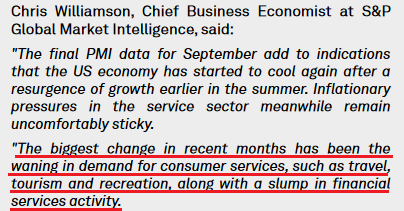

Similarly, while gold could realize a short-term bounce if rates decline due to economic weakness, the medium-term consequences are still bearish. S&P Global’s U.S. Services PMI report stated:

“September data indicated a continued decline in new business at service sector firms. The rate of contraction quickened to the sharpest since December 2022, albeit still modest overall. Lower new orders were reportedly linked to weak domestic and foreign client demand, with new export orders falling for the first time in five months. The decrease in new export sales was the steepest since February and was in stark contrast to the solid expansion seen in July.”

So, while the ISM’s report was much more optimistic, we prioritized S&P Global’s data in 2021 and 2022 and will continue to do so now.

Please see below:

Weak Data

The Mortgage Bankers Association (MBA) reported on Oct. 4 that its Market Composite Index declined by 6% week-over-week (WoW) as higher long-term rates make homes even more unaffordable. Moreover, the longer the gambit persists, the more it stresses the U.S. economy, and the more the USD Index should soar when an ominous event occurs. Joel Kan, MBA’s Vice President and Deputy Chief Economist, said:

“Mortgage rates continued to move higher last week as markets digested the recent upswing in Treasury yields. Rates for all mortgage products increased, with the 30-year fixed mortgage rate increasing for the fourth consecutive week to 7.53 percent – the highest rate since 2000.

“As a result, mortgage applications grounded to a halt, dropping to the lowest level since 1996. The purchase market slowed to the lowest level of activity since 1995, as the rapid rise in rates pushed an increasing number of potential homebuyers out of the market.”

On top of that, the recent JOLTS release rattled the bond market as job openings smashed expectations. Yet, the data is also more semblance than substance, as other metrics support weaker results in the months ahead. Indeed’s Economic Research Director for North America Nick Bunker wrote on Oct. 3:

“Don’t be fooled into thinking the longstanding cooldown in the labor market has suddenly reversed itself after an unexpectedly strong August. While the headline jump in openings was surprising, the large majority of the almost 700,000 increase in job openings came from just one industry – professional and business services – and is likely noisy.”

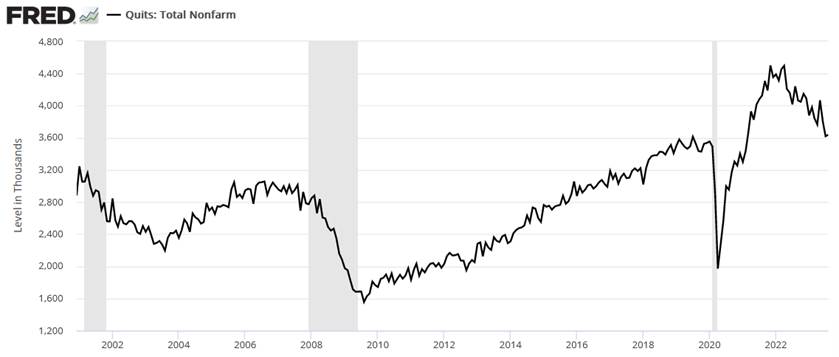

As further evidence, the quits data highlights how the 2023 labor market is nothing like 2021 and 2022, and oil prices seem to have gotten the memo recently.

Please see below:

To explain, more Americans quit their jobs when the labor market is hot and do the opposite when it’s cold. And if you analyze the right side of the chart, you can see that quits barely budged in August and remain firmly in a downtrend. Consequently, the metric continues to follow a path that aligns with the last three recessions.

Overall, silver has suffered mightily, as our warning about higher nominal and real yields has come to fruition. Furthermore, with a stronger USD Index also part of the thesis, the developments have rattled the S&P 500 too. So, while we may position for a short-term bounce, the medium-term trend remains down, in our opinion.

Again, subscribe to our premium Gold Trading Alert to stay ahead of the game. We’re on pace for an 11-trade winning streak, as the technicals have been an excellent timing tool. Remember, the fundamentals are great for risk-reward analysis, but they are not our go-to resource for when to enter and exit trades. Therefore, subscribing is the best way to analyze all of our indicators in one place.

By Alex Demolitor

Alex Demolitor hails from Canada, and is a cross-asset strategist who has extensive macroeconomic experience. He has completed the Chartered Financial Analyst (CFA) program and specializes in predicting the fundamental events that will impact assets in the stock, commodity, bond, and FX markets. His analyses are published at GoldPriceForecast.com.

Disclaimer

All essays, research and information found above represent analyses and opinions of Alex Demolitor and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Alex Demolitor and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Alex Demolitor reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Alex Demolitor Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.