Make Bitcoin's Volatility Work for You

Currencies / Bitcoin Jan 24, 2024 - 10:15 PM GMTBy: EWI

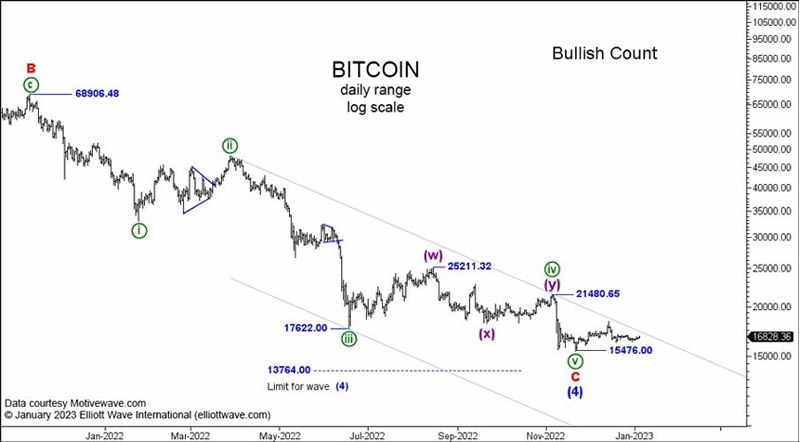

Here's a bullish forecast when a "crypto winter" was proclaimed

The price action of bitcoin has been the very epitome of volatility.

The good news for Elliott wave practitioners is that the greater the emotional swings in a financial market, the clearer the Elliott waves -- but not at every juncture along a market's price path.

In other words, Elliott wavers often have to exercise patience as the wave structure resolves itself. At these times, what is called an "alternate" wave count is usually considered. That is -- in addition to the preferred wave count, there's a second-best interpretation.

As Frost & Prechter notes in Elliott Wave Principle: Key to Market Behavior:

Because applying the Wave Principle is an exercise in probability, the ongoing maintenance of alternative wave counts is an essential part of using it correctly.

With that in mind, our January 2023 Global Market Perspective was considering both a bearish and bullish scenario for bitcoin -- with the bullish scenario being the preferred count. Here's the chart and brief commentary from that issue:

Under the bullish [scenario for bitcoin,] we're considering the Intermediate wave (4) correction to have ended at the 15,476 low of November 21.

Mind you, around the time the January 2023 Global Market Perspective published, bearish sentiment toward bitcoin was widespread. Here are some headlines:

- 'Crypto winter' has come. Will it become an ice age? (Washington Post, Dec. 18, 2022)

- Bitcoin's Price Targets for 2023 Are In -- and They Are Grim. Brace for a 50% Fall. (Barron's, Dec. 28, 2022)

However, bitcoin never breached that 15,476 level that was mentioned in our January 2023 Global Market Perspective.

That doesn't mean that Elliott wave analysis is always perfect, but it does offer context from which to forge a forecast.

Indeed, as of this writing, bitcoin is trading north of 40,000.

Is the rally over -- or is there a lot more upside to go?

You may want to check out our Global Market Perspective's latest analysis and wave count in our "Cryptocurrencies" section.

If you're unfamiliar with Elliott wave counts, read Frost & Prechter's Wall Street classic Elliott Wave Principle: Key to Market Behavior. Here's a quote from the book:

All waves are of a specific degree. Yet it may be impossible to identify precisely the degree of developing waves, particularly subwaves at the start of a new waves. Degree is not based upon specific price or time lengths but upon form, which is a function of both price and time. Fortunately, the precise degree is usually irrelevant to successful forecasting since it is relative degree that matters most.

Here's good news: You can read the entire book for free once you become a member of Club EWI, the world's largest Elliott wave educational community.

Club EWI is free to join and members enjoy complimentary access to a wealth of Elliott wave resources on investing and trading.

Just follow this link to become a Club EWI member: Elliott Wave Principle: Key to Market Behavior.

This article was syndicated by Elliott Wave International and was originally published under the headline Make Bitcoin's Volatility Work for You. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.